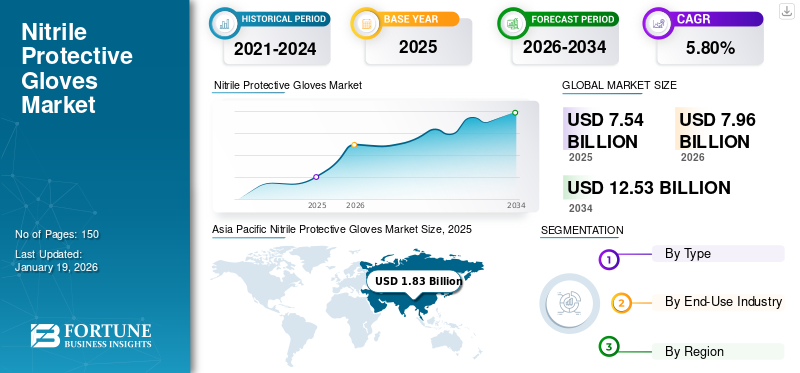

Nitrile Protective Gloves Market Size, Share & Industry Analysis, By Type (Powder-Free Gloves and Powdered Gloves), By End-Use Industry (Medical & Healthcare, Automotive, Food & Beverages, Chemical Industry, Oil & Gas, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global nitrile protective gloves market size was valued at USD 7.54 billion in 2025. The market is projected to grow from USD 7.96 billion in 2026 to USD 12.53 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. Asia Pacific dominated the Nitrile Protective Gloves Market with a market share of 24% in 2025.

The nitrile protective gloves market has witnessed significant growth due to rising awareness about hygiene, safety, and infection control across various industries, including healthcare and chemical sectors. Nitrile gloves, made from synthetic rubber, offer superior puncture resistance, chemical resistance, and strength compared to latex and vinyl alternatives. Their allergy-free properties make them suitable for individuals with latex allergies, further boosting their demand in medical and food-handling applications. Additionally, growing regulatory standards for workplace safety across developed and developing economies continue to support market expansion. Rising demand from the medical & healthcare, chemical, and automotive industries will significantly drive the market growth. The main players working in the market include Top Glove Corporation Bhd, Hartalega Holdings Berhad, INTCOMEDICAL, Unigloves (UK) Limited, and Kossan Rubber Industries Bhd.

NITRILE PROTECTIVE GLOVES MARKET TRENDS:

Increased Preference for Powder-Free Gloves in Healthcare Sector to Lead Market Growth

One of the clear trends in the market for nitrile protective gloves is the growing shift toward powder-free variants, particularly in the medical and healthcare sectors. Powdered nitrile gloves have a risk of allergic reactions, skin irritation, and contamination issues in sensitive environments. Healthcare professionals are increasingly opting for powder-free nitrile gloves as they offer the same level of protection without the associated health risks. Powder-free gloves are also more suitable for surgical and sterile procedures. This shift is further supported by growing awareness of workplace safety and hygiene standards.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS:

Rising Healthcare Awareness and Infection Control Fuel Market Growth

The rising awareness of sanitation and infection control across the globe has significantly boosted the demand for nitrile protective gloves. With increasing public health campaigns and stricter government regulations, healthcare professionals and general consumers are more conscious of the importance of using protective equipment. Hospitals, clinics, and diagnostic centers rely heavily on nitrile gloves to prevent cross-contamination and safeguard patients and staff from viruses. The COVID-19 pandemic further boosted the market, highlighting the necessity of protective gloves in preventing disease spread. Hence, growing health awareness is expected to drive the nitrile protective gloves market growth.

MARKET RESTRAINTS:

High Production Costs Limit Market Growth

The comparatively high production cost of nitrile protection gloves poses a major restraint on their global adoption, especially in price-sensitive markets. Nitrile gloves are prepared from synthetic rubber derived from petroleum-based raw materials, subject to fluctuating global oil prices. Additionally, the manufacturing process is more complex than latex or vinyl gloves, requiring advanced equipment and higher energy consumption. These factors contribute to the overall cost of production, making nitrile protective gloves more expensive for end users.

MARKET OPPORTUNITIES:

Rising Demand from Emerging Economies is Boosting Market Expansion

Developing economies present a significant growing opportunity for the market due to increasing industrialization, expanding healthcare infrastructure, and rising awareness of hygiene and safety. Countries in Asia Pacific, Latin America, and parts of Africa are witnessing strong economic development, leading to improved access to healthcare and higher demand for personal protective equipment (PPE). Governments in these regions are investing in public health programs and promoting workplace safety regulations that mandate the use of protective gloves across multiple industries.

- As per the India Brand Equity Foundation (IBEF), India’s hospital sector was valued at USD 98.98 billion in 2023 and expected to grow at a CAGR of 8.0% to reach USD 193.59 billion by 2032, showcasing a major opportunity for the nitrile protective gloves market, as these are used majorly in the healthcare industry.

MARKET CHALLENGES:

Inconsistent Raw Material Prices are a Major Challenge to Market

The prices of raw materials used to manufacture nitrile gloves, mainly acrylonitrile and butadiene, are highly sensitive to ups and downs in the market. Any fluctuation in crude oil prices, geopolitical tensions, or trade restrictions can disturb supply chains and increase raw material costs dramatically. These price fluctuations pose a serious challenge for manufacturers of nitrile protective gloves. Additionally, unpredictable pricing affects forecasting and budgeting, making it difficult for businesses to plan effectively.

Segmentation Analysis

By Type

Powder-Free Gloves Lead MarketDue to Their Safety and Comfort

Based on type, the market is classified into powder-free gloves and powdered gloves.

The powder-free gloves segment holds the highest share of the market. These gloves have become the preferred choice in various sectors due to their safety and comfort. Unlike powdered gloves, powder-free variants eliminate the risk of allergic reactions, contamination, and respiratory issues caused by glove powder particles. They are especially used in the medical, pharmaceutical, and food industries, where sterility and cleanliness are important. As global awareness around workplace safety and infection control increases, the demand for powder-free gloves continues to rise.

Powdered nitrile gloves, once widely used for their ease of application and cost-effectiveness, are now experiencing a decline in demand due to rising health and regulatory concerns. These gloves contain cornstarch powder that helps users wear them more easily, but the powder can become airborne, leading to allergic reactions, skin irritation, and contamination in sterile environments. In healthcare and laboratory settings, such issues have driven strict rules, with several countries restricting or banning powdered gloves altogether.

By End-Use Industry

Medical & Healthcare Segment Dominates Market Owing to High Demand for Hygiene and Infection Control

Based on the end-use industry, the market is classified into medical & healthcare, automotive, food & beverages, chemical industry, oil & gas, and others.

The medical & healthcare sector is the leading segment in the market due to the critical need for hygiene, infection control, and personal safety. These gloves are widely used by doctors, nurses, laboratory technicians, and other healthcare professionals during examinations, surgeries, and diagnostic procedures. The COVID-19 pandemic significantly boosted demand in this sector, driving increased glove consumption in hospitals, clinics, and testing centers. With growing global healthcare expenditure and aging populations, the use of nitrile gloves in healthcare continues to rise.

The food & beverages industry depends heavily on nitrile safety gloves to maintain hygiene, prevent infection, and comply with safety regulations. Food handlers, chefs, and processing workers use these gloves during preparation, packaging, and quality control. Nitrile is preferred over latex or vinyl in this sector as it is stronger, puncture-resistant, and free from allergens that can transfer to food products.

The chemical industry extensively uses nitrile safety gloves to safeguard workers from exposure to hazardous and acidic substances. Nitrile gloves are known for their sturdy chemical resistance, ideal for handling acids, bases, solvents, and other reactive compounds. Workers in chemical manufacturing, laboratories, and research facilities rely on these gloves during mixing, sampling, and equipment maintenance tasks.

Nitrile Protective Gloves Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific:

Asia Pacific Nitrile Protective Gloves Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market due to its strong manufacturing base and growing healthcare needs. Countries such as China, India, and Malaysia are key producers and exporters of nitrile gloves, benefiting from lower labor costs and well-established production facilities. The healthcare sector in Asia Pacific has witnessed rapid growth, driving significant demand for personal protective equipment.

- As per the Observatory of Economic Complexity (OEC), in 2023, Malaysia was a top exporter of rubber surgical gloves, with an export value of USD 1.78 billion, with a market share of 40.1%.

North America:

North America holds a significant nitrile protective gloves market share, driven by the large-scale demand in the U.S. across various industries. The medical and healthcare sectors are the primary drivers, particularly due to the increased need for PPE following the COVID-19 pandemic. The U.S. has stringent regulatory standards and a high demand for high-quality gloves to ensure worker safety and prevent cross-contamination.

- As per the U.S. Department of Labor, the U.S. government has finalized that personal protective equipment should be used in the construction industry to protect construction workers from hazardous conditions.

Europe:

Europe is a key market for nitrile safety gloves, with significant demand across healthcare, industrial, and food sectors. The region’s stringent health and safety regulations drive the use of high-quality gloves in various applications. Moreover, the growing focus on hygiene and safety in food processing and the chemical industry further boosts nitrile glove consumption.

- In October 2024, the European Union published a new and updated regulation regarding PPE. As per the new regulation, the PPE sold in the EU must meet essential health and safety requirements and carry the CE marking, which proves compliance with EU law.

Latin America:

Latin America is experiencing a growing demand for nitrile protective gloves. Rising industrialization, healthcare improvements, and regulatory developments are driving the need for gloves in the region.

- As per the Observatory of Economic Complexity (OEC), in 2023, Brazil imported USD 126 million worth of medical vulcanized rubber gloves.

Middle East & Africa:

Greater awareness of worker safety, especially in the building and infrastructure industries, and higher hygiene standards in the healthcare and food handling sectors, is driving the demand for nitrile gloves in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Top Players Emphasize Constant Progress and New Product Launches to Maintain Their Dominance

The market for nitrile protective gloves is highly competitive, where leading companies are ramping up production capacity, pursuing eco-friendly initiatives, and driving mergers and acquisitions to secure an edge. Global giants such as Top Glove Corporation Bhd, Hartalega Holdings Berhad, INTCOMEDICAL, Unigloves (UK) Limited, and Kossan Rubber Industries Bhd are at the forefront, leveraging innovation, cost leadership, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY NITRILE PROTECTIVE GLOVE COMPANIES PROFILED:

- Top Glove Corporation Bhd (Malaysia)

- Hartalega Holdings Berhad (Malaysia)

- INTCOMEDICAL (China)

- Unigloves (UK) Limited (U.K.)

- Medline Industries, LP. (U.S.)

- Kossan Rubber Industries Bhd (Malaysia)

- MCR Safety (U.S.)

- Superior Glove. (Canada)

- AMMEX Corporation (U.S.)

- Globus (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Unigloves (UK) Limited and KluraLabs collaborated to launch CrossGuard antimicrobial nitrile gloves. The specialty of the gloves is that they can eliminate 99.99% of selected bacteria in just 60 seconds.

- June 2024: Unigloves (UK) Limited announced that it acquired 50% equity in a company name Nitrex, a Spain-based PPE manufacturer, with future options to acquire the remaining interest.

- January 2020: Top Glove Corporation Bhd announced that it has plans to double nitrile glove production, and by the end of 2020, it will have more nitrile gloves than natural rubber gloves. This increase in production is due to increased demand for gloves during the COVID-19 pandemic.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information about the key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and many manufacturers of nitrile protective gloves in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, End-Use Industry, and Region |

|

By Type |

|

|

By End-Use Industry |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.96 billion in 2026 and is projected to reach USD 12.53 billion by 2034.

In 2025, the market value stood at USD 2.56 billion.

The market is expected to exhibit a CAGR of 5.80% during the forecast period of 2026-2034.

By type, the powder-free gloves segment leads the market.

Rising awareness about healthcare and hygiene is expected to boost market expansion.

Top Glove Corporation Bhd, Hartalega Holdings Berhad, INTCOMEDICAL, Unigloves (UK) Limited, and Kossan Rubber Industries Bhd are some of the leading players in the market.

Asia Pacific holds the largest the market share of 24% in 2025.

The increase in healthcare infrastructure is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us