Non-Fused Disconnect Switches Market Size, Share & Industry Analysis, By Type (Panel Mounted and DIN Rail Mounted), By Phase (Single Phase and Three Phase), By Voltage (High Voltage, Medium Voltage, and Low Voltage), By Application (Utility, Commercial, Industrial, Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

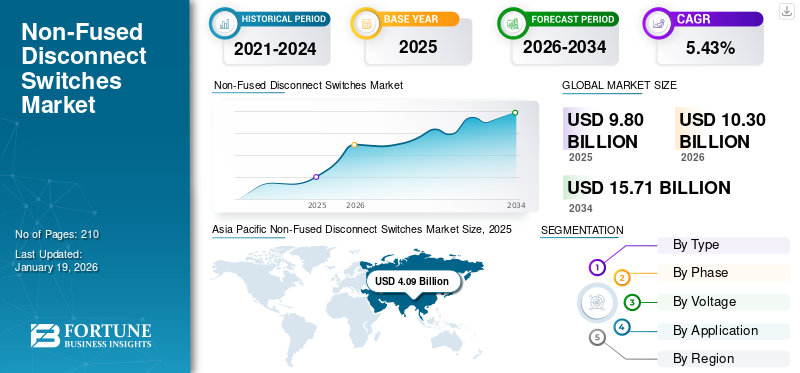

The global non-fused disconnect switches market size was valued at USD 9.80 billion in 2025. The market is projected to grow from USD 10.30 billion in 2026 to USD 15.71 billion by 2034, exhibiting a CAGR of 5.43% during the forecast period. Asia Pacific dominated the non-fused disconnect switches market with a market share of 41.77% in 2025.

The market for non-fused disconnect switches is driven by their ease of use, versatility, and safety features, particularly in applications such as renewable energy, industrial automation, and infrastructure development, as well as the growing emphasis on safety and compliance with regulations.

- In October 2024, Schneider Electric launched smart grid solutions at Europe 2024 to enhance grid flexibility resiliency and cater renewable energy demand.

The need for reliable electrical isolation and circuit protection, especially in industrial settings with renewable energy sources, drives product demand. The trend toward smart grids and digital substations is driving the demand for sophisticated disconnect switches with enhanced monitoring and control features. Non-fused disconnect switches are increasingly adopted across industries for their reliable circuit isolation and cost-effective operation without integrated overcurrent protection. The market is growing because safety and reliability in electrical systems are becoming top priorities for utilities, industries, and commercial users. Non-fused disconnect switches in the industrial sectors provide reliable equipment isolation without integrated overcurrent protection, ensuring safe maintenance and operation. Non-fused disconnect switches in distribution networks enable safe isolation and switching of electrical circuits without built-in overcurrent protection.

Schneider Electric is a major player in the global market, offering a range of products and solutions, including TeSys LK4 non-fusible disconnect switches and safety switches, for various applications.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Reliable Electrical Infrastructure Drive Market Growth

The increasing demand for reliable and uninterrupted power supply is driving demand for non-fused disconnectors. Industrial facilities, commercial buildings, and utilities require high-quality electrical infrastructure to minimize downtime and ensure system safety. These switches play a critical role by enabling the isolation of electrical circuits during maintenance or emergencies without relying on fuses. Non-fused disconnect switches are increasingly integrated with smart grid technologies to enhance reliable circuit isolation, monitoring, and grid efficiency.

- In January 2025, the government of India announced plans to invest USD 107 billion to develop more transmission lines with the target to triple the country’s renewable energy capacity by 2032, catering to the increasing demand for energy.

As industrialization and urbanization grow in emerging economies, the need for effective power management and safety systems boosts the adoption of non-fused disconnectors sectors, ensuring operational efficiency and enhanced protection.

MARKET RESTRAINTS

Complexity in Retrofitting Existing Electrical Systems May Lower Product Adoption

Retrofitting existing electrical infrastructure with non-fused disconnect switches can be a complex and time-consuming process, often requiring significant modifications. Many older industrial facilities and commercial establishments use legacy systems that are not easily compatible with modern non-fused disconnect switches. Integrating these devices may necessitate changes to wiring, control panels, and switchgear systems, adding to the overall cost. The complexity acts as a deterrent for organizations considering upgrades, thereby limiting the adoption of non-fused disconnectors, especially in facilities with outdated electrical infrastructure.

MARKET OPPORTUNITIES

Rising Industrial Automation and Smart Manufacturing Trends Create Lucrative Opportunities

The growing adoption of automation and smart manufacturing technologies is contributing to the increasing demand for non-fused disconnectors. Automated production facilities require high-performance electrical components to ensure seamless operations and protect sensitive machinery from electrical faults.

- In February 2025, KUKA and Dassault Systèmes announced a partnership to increase automation efficiency for manufacturers with the development of comprehensive solutions to meet the growing demand for automation in robotics.

Non-fused disconnectors provide safe and efficient circuit isolations, preventing equipment damage and minimizing downtime in automated systems. Moreover, the need for advanced electrical disconnect solutions is anticipated to grow. Non-fused disconnect switches play a key role in energy management by enabling safe circuit isolation and improving operational efficiency in power systems.

Non-Fused Disconnect Switches Market Trends

Retrofit and Upgrade of Legacy Installations is Emerging as a Key Trend

Retrofit and upgrade of legacy electrical installations are emerging as a major trend in the non-fused disconnect switches market. Aging industrial infrastructure and commercial facilities require modern, safer, and more efficient switchgear solutions to meet updated regulatory standards. Retrofitting provides cost-effective improvements without full system replacement, making it attractive for budget-conscious industries. This trend is further fueled by the growing emphasis on operational safety, energy efficiency, and minimizing downtime during maintenance activities which are expected to foster the non-fused disconnect switches market growth over the forecast period.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Rising Safety Concerns in High Voltage Electrical Equipment Boost Adoption of Panel-mounted Equipment

Based on type, the market is classified into panel mounted and DIN rail mounted. Panel-mounted segment currently dominates, with a significant share as panel-mounted disconnect switches are highly versatile and can be easily integrated into various control panels and electrical enclosures, making them suitable for a wide range of applications across different industries.

The demand for DIN rail-mounted is also experiencing substantial growth owing to the increasing demand for compact, efficient, and easy-to-install electrical safety solutions in industrial facilities. These switches are used in various applications, including motor control centers, switchboards, and main switches in various equipment and machines.

By Phase

Increasing Development of Industrial and Commercial Facilities Create Demand for Three Phase Disconnect Switches

Based on phase, the market is classified into single phase and three phase. The three-phase segment is expected to dominate due to its widespread use in industrial and commercial applications that require high power and reliable electrical systems.

Single-phase switches are used in systems where power is delivered through a single phase and neutral, common in residential and smaller commercial settings.

By Voltage

Low-Voltage Segment Leads Due to Widespread Use and is Preferred for Equipment Protection

Based on voltage, the market is classified into high voltage, medium voltage, and low voltage. The low voltage segment dominates the non-fused disconnect switches market share due to its widespread use in photovoltaic, commercial applications, and power distribution. They are used to protect sensitive electronic equipment, computers, servers, and telecommunications devices from voltage fluctuations, surges, or brownouts.

High-voltage switches are used in electrical substations to isolate circuit breakers, transformers, and transmission lines for maintenance. Medium voltage non-fused disconnect switches are used in commercial facilities, industrial services, and utility substations for electrical system maintenance, managing frequency and current fluctuations.

By Application

Power Management and Safety Requirements Boost Product Use in Industrial Applications

Based on application, the market is sub-segmented into utility, commercial, industrial, and others.

Industrial emerged as the dominating segment, driven by robust demand for reliable power management and safety in various industrial applications. The rise of renewable energy sources such as solar and wind power necessitates the use of non-fused disconnect switches for safe and efficient management of electrical circuits in these systems.

- In November 2023, POWERGRID announced an investment of USD 44.05 million for two utility-scale transmission projects located in Telangana and Gujarat. Moreover, POWERGRID also announced plans to invest USD 34.2 billion by 2030 to set up an interstate transmission network to cater to renewable energy in India. Such utility-scale developments are expected to grow demand for non-fused disconnect switches in the coming years.

Non-Fused Disconnect Switches Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Non-Fused Disconnect Switches Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the dominating position in the global market. In Asia Pacific, the demand for non-fused disconnect switches is driven by rapid industrialization, urbanization, increasing safety awareness, and the growing adoption of renewable energy sources, particularly solar and wind power. China and India are witnessing rising adoption of non-fused disconnect switches driven by rapid industrialization and expanding power infrastructure.

- In January 2025, the Government of China announced an investment of USD 88.7 billion in the enhancement of the power grid of the country. Such development in the electric grid in the region is expected to foster demand for disconnect switches.

As economies in Asia Pacific continue to grow, there is a surge in industrial activity and urbanization, leading to increased demand for reliable and safe power distribution systems, which necessitate the use of disconnect switches.

North America

In North America, the market for non-fused disconnect switches is driven by safety regulations mandating circuit isolation during maintenance and repair, coupled with the growing adoption of renewable energy sources and investments in electrical infrastructure.

- In August 2024, the government of the U.S. announced an investment of USD 2.2 billion in the maintenance of the national electrical grid against extreme weather and to cater to growing demand.

The North American market emphasizes safety, with regulations requiring the use of disconnect switches for electric circuit isolation during maintenance and repairs, leading to a strong demand for these devices.

Europe

In Europe, the demand for non-fused disconnect switches is driven by increasing investments in power infrastructure, growing adoption of renewable energy, rising industrial automation, and stringent safety regulations, all requiring reliable electrical isolation and circuit protection solutions. The increasing reliance on renewable sources such as solar and wind requires robust and efficient modern electrical systems, including disconnect switches, for safe maintenance and operation.

Latin America

In Latin America, the market for non-fused disconnect switches is experiencing growth, driven by increasing industrialization, urbanization, and a focus on energy efficiency and electrical safety, as well as investments in power generation and infrastructure. Rising energy needs in the region are fueling the need for robust and safe power distribution systems, which rely on disconnect switches for safe operation and maintenance. The market in this region is expanding, supported by their open design and reliability in electrical systems.

Middle East & Africa

In the Middle East and Africa (MEA), the market is experiencing increased demand driven by increasing industrialization, grid modernization, and the need for reliable and safe electrical systems, particularly in the utilities, manufacturing, and commercial sectors. Countries in the region are investing in modernizing their electrical grids and promoting sustainable energy solutions, making reliable disconnect switches crucial for ensuring safe isolation during maintenance and emergency operations, especially with the integration of renewable energy sources.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are focused on Expansion of Product Portfolio to Cater Robust Demand

The global non-fused disconnect switches market is moderately concentrated with companies such as Schneider Electric, MK Electric, Littelfuse Inc., Eaton Corporation, and others, which account for a significant market share. For instance, in November 2021, Littelfuse launched the DC disconnect switch product line Littelfuse LS6 and the LS6R, available in 1000 and 500V variants. Focusing on significant technological advancement and expansion of product portfolio to match competitor’s offerings has supported the companies’ share in the market.

LIST OF KEY NON-FUSED DISCONNECT SWITCHES COMPANIES PROFILED

- Schneider Electric (France)

- MK Electric (U.K.)

- Littelfuse Inc. (U.S.)

- Eaton Corporation (U.S.)

- Mitsubishi Electric (Japan)

- ABB Ltd. (Switzerland)

- Legrand (France)

- General Electric Company (U.S.)

- Altech (U.K.)

- Delixi Electric Co. Ltd. (China)

- Socomec (France)

- Siemens AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Socomec India launched ATyS, a M pre-programmed Automatic Transfer Switching Equipment, which is designed for application in commercial buildings, luxury residences, and sectors such as hospitality & healthcare to enhance fire safety and emergency lighting.

- August 2024: Advantech introduced EKI-8528 Modularized IEC 61850-3 switches which enhances the network management and connectivity in digital substations and utility power distribution to cater customized requirements of medium to large scale industrial electric networks.

- November 2023: Solar Manufacturing Inc. announced the integration of a disconnect switch into the production car bottom vacuum furnace at Solar Atmospheres in Souderton, Pennsylvania, U.S. The switch has a rate of 50V AC per pole, 1000 amps. The integration of these switches has eliminated the labor-intensive process of providing efficient operations.

- June 2022: Eaton introduced battery disconnect units for EVs with different driving modes such driving and charging utilizing Eaton’s Breaktor circuit protection technology which provides current switching and resettable bidirectional short-circuit protection.

- September 2021: Orient Electric launched a new modular switch range which includes plates, hospitality range, switches, sockets, and other electronic accessories to cater commercial end users.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.43% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Panel Mounted · DIN Rail Mounted |

|

By Phase · Single Phase · Three Phase |

|

|

By Voltage · High Voltage · Medium Voltage · Low Voltage |

|

|

By Application · Utility · Commercial · Industrial · Others |

|

|

By Geography · North America (By Type, Phase, Voltage, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Phase, Voltage, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Spain (By Application) o Russia (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Phase, Voltage, Application, and Country) o China (By Application) o India (By Application) o Japan (By Application) o Australia (By Application) o Southeast Asia (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Phase, Voltage, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Phase, Voltage, Application, and Country) o GCC (By Application) o South Africa (By Application) · Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 10.30 billion in 2026 and is projected to reach USD 15.71 billion by 2034.

In 2025, the market value stood at USD 4.09 billion.

The market is expected to exhibit a CAGR of 5.43% during the forecast period of 2026-2034.

The industrial segment leads the market by application.

The key factors driving the market are the increasing demand for reliable electrical infrastructure and energy demand.

Schneider Electric, MK Electric, Littelfuse Inc., Eaton Corporation, and others are the top players in the market.

Asia Pacific dominated the non-fused disconnect switches market with a market share of 41.77% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us