North America Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (ML, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

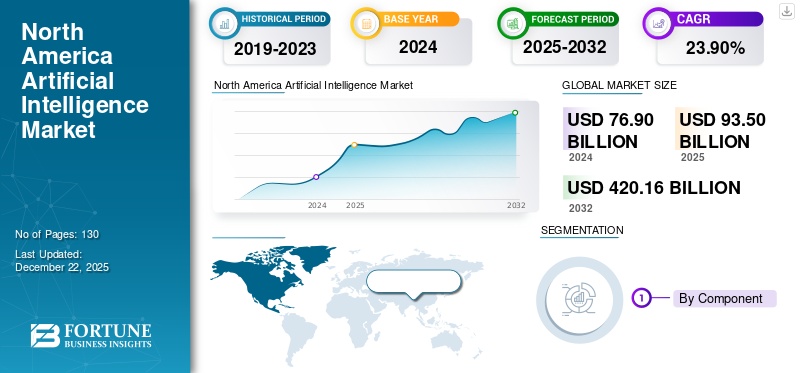

The North America Artificial Intelligence market size was worth USD 76.90 billion in 2024. The market is projected to grow to USD 93.50 billion in 2025 to USD 420.16 billion by 2032, exhibiting a CAGR of 23.90% during the forecast period.

With the rapid integration of emerging technologies and a strong focus on automation, North America has become a central hub for artificial intelligence (AI) market. The region continues to witness accelerated adoption of AI across sectors such as healthcare, finance, and manufacturing, driven by a tech-savvy business environment and robust digital infrastructure. In 2025, North America remained at the forefront of AI innovation, with the U.S. leading in AI research, enterprise deployment, and ecosystem expansion.

Impact of Generative AI

Generative AI profoundly impacts the artificial intelligence market by accelerating innovation and enhancing productivity across industries. This enables businesses to automate content creation and embed AI capabilities into everyday applications. This widespread adoption enables companies to improve efficiency and shorten time-to-market. For instance,

- According to AmplifAI, North America is at the forefront of generative AI adoption, with an adoption rate of 40%, highlighting its leading position in embracing this transformative technology.

Overall, generative AI is accelerating growth in the AI market but requires careful deployment and responsible practices to ensure long-term success.

Impact of Reciprocal Tariffs

Reciprocal tariffs can significantly impact the North American AI market by increasing the cost of essential components such as semiconductors, servers, and specialized hardware that are often imported from global suppliers.

Higher import costs might delay AI development and deployment, particularly for startups and smaller companies operating on tight budgets. For instance,

- If a 20% tariff is placed on imported advanced chips from East Asia, a U.S.-based AI startup focused on computer vision might have to delay product launches or scale back operations due to the rising costs of hardware.

North America Artificial Intelligence Market Trends

Government Initiatives and Policy Support to be the Key Market Trend

Government initiatives and policy support also help the AI market grow in North America. They aim to enhance the business environment by lowering regulatory barriers and increasing cooperation between governmental and private organizations. For instance,

- In July 2025, the U.S. National Science Foundation (NSF), in partnership with Capital One and Intel, announced a USD 100 million investment to support five National Artificial Intelligence Research Institutes and a central community hub. These institutes focus on advancing AI in areas such as mental health, materials science, STEM education, human-AI collaboration, and drug development.

Key takeaways· By component segmentation, software for around 49.7% of the market in 2024. · By deployment segmentation, cloud is projected to grow at a CAGR of 25.0% in the forecast period. · In enterprise type segmentation, large enterprises accounted for around 62.9% of the market in 2024. · In the function segmentation, Risk is projected to grow at a CAGR of 26.5% in the forecast period. · In the technology, machine learning accounted for around 35.5% of the market in 2024. · In the by industry segmentation, Healthcare is projected to grow at a CAGR of 31.1% in the forecast period. · The artificial intelligence market in the U.S. was worth USD 54.09 billion in 2024. · In the region, U.S. is projected to grow at a CAGR of 25.1% in the forecast period. |

North America Artificial Intelligence Growth Factors

Massive Investment in R&D and Infrastructure to Boost Market Growth

The North American AI market is experiencing strong growth due to major investments carried out in research and infrastructure by several powerful tech companies, including Google, Microsoft, IBM, and Amazon. For instance,

- In August 2025, Meta signed a partnership with Midjourney to improve AI image generation and a USD 10 billion cloud deal with Google to support its AI infrastructure, boosting its AI capabilities and innovation.

These firms advance AI capabilities with better algorithms and scalable platforms, while cloud providers-AWS, Azure, and Google Cloud-are ensuring distribution of AI tools through numerous industries. Whereas the infrastructural development is fast being enhanced with time, data centers of Amazon and the Stargate supercomputer projects strengthen the computing ability of this region.

North America Artificial Intelligence Market Restraints

High Capital Requirements Hinders the Market Growth

The large initial investments required for AI technology implementation in the region cause significant financial pressure on the players. This covers expenses associated with advanced hardware and software, as well as hiring skilled professionals. Small and medium-sized enterprises (SMEs) find such expenses prohibitive, limiting their ability to integrate AI technologies into business processes. For instance,

- A recent study by the Massachusetts Institute of Technology found that 95% of the companies surveyed reported no significant benefits from implementing AI.

Additionally, the cost of maintaining and upgrading AI systems poses a continuous financial burden. This creates a gap between big companies that can afford it and smaller ones, which slows down North America Artificial Intelligence market growth.

North America Artificial Intelligence Market Segmentation Analysis

By Component

Based on component analysis, the market is divided into hardware, software, and services.

In North America, the software segment holds the largest share of the AI market. This popularity is due to the fact that AI-based platforms and products, as well as machine learning and data analytics tools, are widely used in various industries such as healthcare, banking, and others. Additionally, recent product launches in the region also support this trend. For instance,

- In August 2025, Elon Musk launched Macrohard, an AI-driven software company under his xAI initiative, designed to rival Microsoft by simulating the functions of an entire software company through multi-agent AI systems.

The hardware segment is expected to grow at the highest rate in the coming years. This is due to the growing demand for specialized AI hardware components such as GPUs, TPUs, and edge computing devices, which are necessary for sophisticated and rapid processing

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

Cloud deployment is the leading segment in North America’s AI market and is anticipated to grow at the fastest rate in the upcoming years. The rise is predominantly due to the growing need for scalable and accessible AI solutions across industries. For instance,

- According to Amazon, by 2030, cloud adoption across the U.S. and Canada is projected to contribute over USD 5.8 trillion to GDP, with more than USD 857 billion of that growth driven specifically by cloud-powered AI technologies.

Businesses are increasingly adopting cloud platforms due to easier integration and reduced infrastructure costs. As AI-powered solutions and remote operations emerge, organizations increasingly rely on cloud deployment to support their digital transformation initiatives.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises are expected to hold the majority share due to their strong financial capabilities, established infrastructure, and strategic focus on innovation. These companies are actively implementing artificial intelligence across departments such as customer support, operations, and decision-making to improve efficiency and maintain a competitive edge.

Small and medium-sized enterprises are projected to grow at the fastest rate as they increasingly explore artificial intelligence to streamline processes, improve customer engagement, and reduce operational costs.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management and others.

The risk function is projected to register the highest CAGR. As AI is used to identify fraud, monitor compliance, and enhance cybersecurity, firms employ it to comprehend and manage risks better.

In the North America artificial intelligence market share, the service operation function is anticipated to hold a significant share. Organizations increasingly use AI to automate customer support and other processes, making service operations one of the implementation domains. For instance,

- According to Deloitte, 15% of contact centers are now using generative artificial intelligence technologies to speed up customer authentication, simplify the process of offering solution options, and automatically create call summaries and follow-up recommendations.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning is expected to hold the majority share in the North American AI market and holds the largest market share. Its ability to analyze complex datasets and continuously evolve has made it a preferred strategy for businesses looking for smarter solutions.

- According to Demandsage, North America is projected to experience a transformative 45% shift in the business supply chain sector driven by the integration of machine learning technologies.

Additionally, as the technology advances and integrates with other novel technologies, it is expected to experience the highest growth rate. Machine learning is the key enabler of AI growth and expansion in the region.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities and education.

The BFSI (Banking, Financial Services, and Insurance) sector holds the largest share of the North American AI industry. This is due to the banking sector widely using AI to enhance fraud detection, risk management, customer service automation, and other operational processes. The industry will continue to invest in AI technology, given the critical nature of financial services and their need to be safe and efficient.

The healthcare industry is projected to be the fastest-growing sector in AI use in the region. Thanks to the advancements in AI-driven diagnostics, personalized medicine, and patient care management, healthcare providers widely use AI to enhance treatment quality and improve patient outcomes. The increasing implementation of AI technologies in healthcare will significantly contribute to the AI market’s growth.

By Country

Based on country, the market is segmented into the U.S., Canada, and Mexico.

The United States is expected to dominate the North American market due to its advanced technology and the presence of key AI innovators. The country’s extensive investments in technology and the swift implementation of AI solutions further bolster this position. As a result, the U.S. is not only expected to retain the largest market share but also to grow at the fastest CAGR rate through ongoing product innovation and high governmental support, which creates a suitable environment for AI expansion.

- The United States currently has approximately 133.80 million users of AI tools, reflecting increasing adoption of ai across various sectors

List of Key Companies in the North America Artificial Intelligence Market

The North America artificial intelligence (AI) market is led by major technology players such as IBM, Microsoft, Google, Amazon, and Meta, each driving innovation through advanced AI models, platforms, and tools. These companies are investing heavily in AI research, expanding data infrastructure, and launching specialized AI services tailored for sectors like healthcare, finance, and retail. IBM is recognized for its enterprise-grade AI solutions, Microsoft continues to integrate AI into its cloud and productivity platforms, while Google and Amazon are leveraging AI to enhance cloud capabilities and consumer experiences.

Meta, meanwhile, is making significant strides in generative AI and multimodal systems. Alongside these giants, numerous startups and mid-sized firms are contributing to a dynamic ecosystem through niche applications and industry-specific solutions. This competitive environment fosters continuous innovation and positions North America as a global hub for AI advancement.

LIST OF KEY COMPANIES PROFILED

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Alphabet Inc. (U.S.)

- OpenAI, Inc. (U.S.)

- Anthropic PBC (U.S.)

- 1QB Information Technology Inc. (Canada)

- AMC AI Solutions Inc. (Canada)

- Ada Support Inc. (Canada)

- Advanced Symbolics (Canada)

- Algo8 Inc. (Canada)

- Softeq (Mexico)

- AgileEngine (Mexico)

- TXM (Mexico)

KEY INDUSTRY DEVELOPMENTS

- August 2025: SoundHound AI has launched its advanced Chat AI Automotive voice assistant in vehicles from three major global automotive brands across North America. The system integrates generative AI to enable natural, conversational interactions for tasks like navigation, weather updates, restaurant and charging station searches, and even trip planning or vehicle manual guidance.

- December 2024: Philips launched its CT 5300 system in North America at RSNA 2024, featuring in-house AI-powered Smart Workflow to improve CT imaging speed, accuracy, and diagnostic confidence. It includes tools like Precise Position, Precise Cardiac, and Precise Brain, offering faster, low-dose imaging and enhanced workflow efficiency.

REPORT COVERAGE

The North America artificial intelligence (AI) market report delivers an in-depth evaluation of the industry landscape, highlighting key trends, drivers, and strategic developments such as partnerships, investments, and technology advancements. It explores the increasing integration of AI across diverse sectors like finance, healthcare, and manufacturing, alongside a rising focus on AI-driven automation and decision-making tools. The report also examines the growing momentum behind generative AI, the expansion of AI research hubs, and the surge in demand for AI-powered analytics and personalized solutions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 23.90% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

|

|

By Country · U.S. · Canada · Mexico |

Frequently Asked Questions

Fortune Business Insights says that the North America Artificial Intelligence market was worth USD 76.90 billion in 2024.

The market is expected to exhibit a CAGR of 23.90% during the forecast period.

By industry, the BFSI industry is set to lead the market.

OpenAI, Microsoft Corporation, IBM Corporation, and Alphabet Inc. are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us