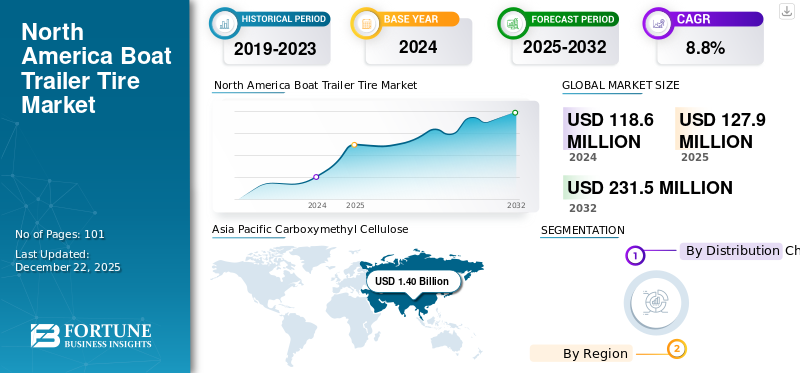

North America Boat Trailer Tire Market Size, Share & Industry Analysis, By Distribution Channel (OEM and Aftermarket), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America boat trailer tire market size was valued at USD 118.6 million in 2024. The market is projected to grow from USD 127.9 million in 2025 to USD 231.5 million by 2032, exhibiting a CAGR of 8.8% during the forecast period.

The boat trailer tire market includes the manufacturing, distribution, and sales of tires designed particularly for boat trailers transporting boats over land. These tires are built to resist exposure to water, corrosion, and changing stack capacities. The market incorporates various tire types, sizes, and brands, catering to recreational and commercial boat trailers. As a basic component of vessel transportation, this market is affected by boating activity levels, trailer manufacturing trends, and technological progressions in tire durability and performance.

The North America boat trailer tire market is experiencing development due to the increasing popularity of recreational boating, fueled by rising disposable incomes and a strong culture of outdoor leisure activities. The region's extensive network of lakes, streams, and coastal areas empowers boating tourism and individual boat ownership, boosting demand for reliable trailer tires. Additionally, advancements in tire innovation, such as corrosion-resistant materials and enhanced durability, attract consumers seeking safer, long-lasting options. The growth of the aftermarket service industry and boat manufacturing contribute to sustained demand for specialized trailer tires in North America. Kenda Americana Tire & Wheel, Richards Tire, and The Carlstar Group LLC are some major companies operating in the market.

North America Boat Trailer Tire Market Trends

Technological Advancements in Infrastructure Act as a Major Technological Trend

North America is witnessing growth in infrastructure development investments. Technological advancements are transforming the market, with focus on durability, safety, and performance.

One striking trend is the advancement of tubeless radial tires, which offer better puncture resistance and lower maintenance compared to traditional bias tires. For instance, brands such as Goodyear and Maxxis introduced tubeless models specifically tailored for trailer applications, improving safety and longevity. Integration of smart technologies, such as Tire Pressure Monitoring Systems (TPMS), is progressively being embraced to prevent blowouts caused by underinflation, a common issue in trailer tires subjected to varying loads and terrains. These systems give real-time data to boat owners, enabling timely maintenance and decreasing accidents.

Furthermore, advancements in rubber compounds utilizing silica and other manufactured raw materials enhance UV resistance and saltwater erosion durability, which are critical for marine environments. Certain manufacturers are exploring eco-friendly materials that reduce the natural impact without compromising performance. The drift toward lightweight, high-strength tires that improve fuel efficiency and ease of towing is also gaining momentum. For instance, innovative tread designs with optimized patterns improve traction on slippery or uneven surfaces, enhancing safety and handling.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rise in Ownership of Boats and Recreational Boating Bolsters Market Expansion

The primary drivers propelling the North America boat trailer tire market growth are the surging demand for recreational boating and the growing number of boat owners globally. As leisure activities gain popularity, particularly in North America and Europe, the need for reliable trailer tires capable of withstanding long-distance travel and assorted terrains intensifies.

For instance, the U.S. alone has over 11 million registered boats since 2020, with a significant portion being trailered, which directly fills the demand for specialized trailer tires. Innovations in tire design, such as spiral tires with reinforced sidewalls, enhance load capacity and durability, making them more appealing to boat owners seeking longevity and security.

Advancements in tire materials, including the use of durable rubber compounds resistant to UV degradation and saltwater corrosion, further drive market growth. The rise of e-commerce platforms has also expanded access to a broader range of trailer tires, encouraging consumers to upgrade or replace worn-out tires more easily.

The surge in luxury and performance boats requires higher-quality tires that can handle increased speeds and weights, pushing tire manufacturers to produce specialized, high-performance trailer tires.

Market Restraints

High Cost and Regulatory Issues Restrain Market Growth

Despite development in the market, a few restraints prevent the region from achieving its maximum growth potential. A noteworthy challenge is the high cost related to premium trailer tires made for boats, particularly those with reinforced sidewalls and specialized tread designs. These tires often come with a cost premium, making them less open to budget-conscious consumers. Also, the limited lifespan of boat trailer tires, particularly when subjected to harsh environmental conditions such as saltwater exposure and UV rays, necessitates frequent replacements, increasing ownership costs.

This can deter some boat owners from investing in high-quality tires, leading them to choose cheaper, lower-quality alternatives that may compromise safety. Another restraint is the regional disparity in boating activities; areas with limited access to boating facilities or adverse climatic conditions, such as extreme cold or high humidity, experience lower requests for specialized trailer tires. Moreover, improper tire maintenance, such as under-inflation or overloading, can lead to tire blowouts or premature wear, posing safety concerns and increasing risk for manufacturers.

Market Opportunities

Development of Specialized Tires for Electric and Hybrid Boats to Offer Market Expansion Opportunities

The boat trailer tire market presents numerous development opportunities driven by emerging trends and unmet needs. One critical opportunity lies in the development of specialized tires for electric and hybrid boats, which are gaining popularity due to environmental concerns. These boats frequently require tires that can handle increased weight and specific performance characteristics, opening avenues for innovation.

Another promising area is the expansion into emerging markets in Asia Pacific and Latin America, where rising expendable livelihoods and increased boating activities make demand for reliable trailer tires. Manufacturers can tailor products to regional climatic and road conditions, such as salt-resistant tires for coastal areas or rugged tires for off-road drifting adventures. The increasing adoption of electric trailer boats requires tires with lower rolling resistance and higher durability, giving a niche for R&D investments. Collaboration with boat manufacturers for OEM (original equipment manufacturer) supply agreements can accelerate market penetration.

Market Challenges

Environmental Exposure and Corrosion May Hamper Market Growth

Environmental exposure and corrosion pose noteworthy challenges in North America’s boat trailer tire market. These tires are regularly subjected to water, salt, and harsh climate conditions, which can accelerate wear and deterioration. Saltwater, in particular, is exceedingly corrosive and can harm the metal components of the trailer, leading to rust and structural issues. Continuous exposure to dampness can also debilitate tire materials over time, reducing their lifespan and safety. This requires frequent maintenance, inspections, and replacements, increasing costs for customers and manufacturers alike. Creating more corrosion-resistant materials and protective coatings is essential for overcoming these challenges, but they can add to production complexity and costs.

Segmentation Analysis

By Distribution Channel

To know how our report can help streamline your business, Speak to Analyst

Consumer Demand for Performance, Safety, and Reliability to Dominant Aftermarket Segment’s Growth

Based on distribution channel, the market is segmented into OEM and aftermarket.

The aftermarket segment accounted for a dominating North America boat trailer tire market share in 2024 fueled by the replacement demand for trailer tires due to wear and tear. These tires degrade over time due to UV exposure, saltwater, corrosion, heavy loads, and long storage periods, necessitating frequent replacement.

- In March 2024, EZ Loader Boat Trailers Inc. entered a strategic partnership with a leading boat manufacturer to produce custom-fit trailers designed specifically for electric boats. This collaboration focuses on integrating innovative features such as automated launch and retrieval systems, allowing owners of electric watercraft to efficiently transport and dock their boats while minimizing energy consumption.

The OEM segment accounted for a significant market share and is expected to grow at a stagnant CAGR in the forthcoming years driven by the increasing launches of boat trailers by OEMs.

NORTH AMERICA BOAT TRAILER TIRE MARKET REGIONAL OUTLOOK

The market covers three major countries, namely the U.S., Canada, and Mexico.

U.S.

Asia Pacific Carboxymethyl Cellulose (CMC) Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The boat trailer tire market in the U.S. is leading, with a value of USD 81.6 million in 2024. The presence of major OEMs and market players drives significant growth in the boat trailer tire market. Additionally, there is a growing demand in the market for industrial tires and budding competition from preexisting companies.

Canada

The region holds a significant market share due to the growing logistics and transportation industry in Canada and major changes in preference for recreational boating.

Mexico

Mexico’s market is primarily driven by increased industrialization and the growth of the commercial vehicle sector, particularly heavy vehicles used for transportation and infrastructure development.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Innovation and Development of Key Companies Helps them to Maintain Edge Over Competition

The boat trailer tire market in North America is highly competitive, with several key players vying for market share and prominence. Companies are continuously investing in research and development to develop advanced tire technologies, improve performance, and meet the evolving needs of customers.

The top 5 players in the industry are The Carlstar Group LLC, Kenda Americana Tire & Wheel, Richards Tire, American Pacific Industries, Inc., and Transeagle Tires.

Carlstar has invested in designing and manufacturing boat trailer tires, specifically tailored for the unique demands of marine environments. These tires offer enhanced durability, corrosion resistance, and load capacity, making them more attractive to boat owners and trailer manufacturers. Carlstar's extensive distribution channels and strategic partnerships with OEMs and aftermarket retailers have facilitated wider availability and visibility of their boat trailer tires.

LIST OF KEY BOAT TRAILER TIRE COMPANIES IN NORTH AMERICA

- Kenda Americana Tire & Wheel (U.S.)

- Richards Tire (U.S.)

- The Carlstar Group LLC (U.S.)

- Deestone Tires (U.S.)

- Thunderer Tire (U.S.)

- American Pacific Industries, Inc. (U.S.)

- Trailer King Tires (U.S.)

- Transeagle Tires (U.S.)

- Sailun Tyres (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Sailun reported that the first semi-steel radial tire was launched from the production line of its Mexican tire factory.

- July 2024: Sailun Tyres, a pioneer in boat trailer tires, unveiled next-generation truck tires. The company presented new passenger car tires from its EcoPoint3 ecosystem at The Tire Cologne as well as provided an overview of its current truck tire range.

- March 2024: EZ Loader Boat Trailers Inc. partnered with a leading boat manufacturer to produce custom-fit trailers designed specifically for electric boats. This collaboration focuses on integrating innovative features such as automated launch and retrieval systems, allowing owners of electric watercraft to efficiently transport and dock their boats while minimizing energy consumption during the process.

- November 2023: The Carlstar Group, a leading provider of specialty tires and wheels, debuted its brand move from Carlisle-branded tires to Carlstar-branded tires at the Agritechnica Expo 2023 in Hanover, Germany. Building on a legacy spanning over a century, the company is embarking on a brand evolution.

- January 2022: Kenda Americana Tire and Wheel recently unveiled its select modern AM03 and AM04 aluminum wheels planned for the RV and marine trailer markets.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.8% over 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

|

By Distribution Channel · OEM · Aftermarket |

|

By Region North America (By Distribution Channel and Country) · U.S. · Canada · Mexico |

Frequently Asked Questions

Fortune Business Insights says that North America’s market size was USD 118.6 million in 2024 and is projected to reach USD 231.5 million by 2032.

In 2024, the U.S. market size stood at USD 81.6 million.

The market is projected to grow at a CAGR of 8.8% and exhibit steady growth during the forecast period.

Increasing demand for recreational boating and the growing number of boat owners worldwide lead to a substantial growth in the market.

The top players are The Carlstar Group LLC, Kenda Americana Tire & Wheel, Richards Tire, American Pacific Industries, Inc., and Transeagle Tires, among others.

The U.S. dominated the market share of North America in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us