Offshore Helicopter Services Market Size, Share & Industry Analysis, By Type (Light, Medium and Heavy), By Application (Inspection, Monitoring and Surveying, Passenger Transport, Goods Transport, Search & Rescue, and Others), By End User (Oil and Gas Industry, Offshore Wind Industry, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

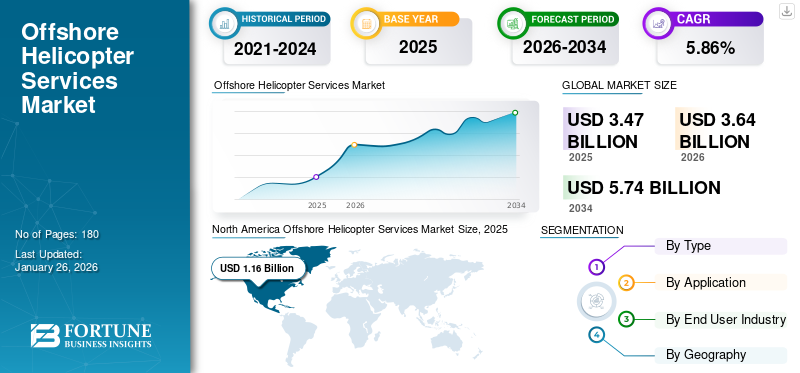

The global offshore helicopter services market size was valued at USD 3.47 billion in 2025. The market is projected to grow from USD 3.64 billion in 2026 to USD 5.74 billion by 2034, exhibiting a CAGR of 5.86%. North America dominated the offshore helicopter services market with a market share of 32.37% in 2025. Moreover, the offshore helicopter services market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1,141.5 million by 2032, driven by increase in air & passenger traffic and cargo transportation to drive market size & growth.

Offshore helicopter services refer to the use of helicopters for transportation, logistics, search and rescue, and other activities to support operations in the offshore oil and gas industry, as well as other offshore industries such as wind energy, marine research, and emergency services.

These services are crucial for the effective functioning of offshore operations. They provide fast, efficient, and safe transportation of personnel and equipment to and from offshore installations, vessels, and platforms. These services include a range of activities, including flight planning, pre-flight checks, safety briefings, loading and unloading of passengers and cargo, and others. The increasing demand for offshore operations is expected to drive the growth of the global market size from 2023 to 2030. The market was significantly affected by the COVID-19 pandemic as global travel restrictions, lockdowns, and reduced economic activity decreased the demand for offshore activities across various sectors. These included the global offshore helicopter services, search & rescue services, and others.

GLOBAL OFFSHORE HELICOPTER SERVICES MARKET OVERVIEW

Market Size & Forecast

- 2025 Market Size: USD 3.47 billion

- 2026 Market Size: USD 3.64 billion

- 2034 Forecast Market Size: USD 5.74 billion

- CAGR: 5.86% from 2026–2034

Market Share

- North America led the offshore helicopter services market with a 32.37% share in 2025. Growth in this region is driven by the presence of large offshore oil and gas rigs and increasing demand for deepwater operations and offshore wind development.

- By service type, the search and rescue segment is expected to dominate, supported by growing emergency service needs across offshore operations. Medium-weight helicopters hold the largest share by type due to their versatility and suitability for a wide range of offshore activities.

Key Country Highlights

- United States: Projected to reach USD 1,141.5 million by 2032, driven by increasing offshore exploration, rising air and passenger transport, and cargo logistics in support of offshore infrastructure.

- United Kingdom: Europe’s offshore helicopter service market is strengthened by SAR contracts and ongoing investments in offshore wind farm operations, particularly in the North Sea.

- Norway: Leading advancements in drone integration and digitization in offshore logistics, with Equinor pioneering UAV-based delivery services for offshore platforms.

- China: With over USD 80 billion in upstream energy investments by major oil companies, China is expanding offshore drilling, creating significant demand for helicopter transport.

- Brazil: Offshore growth is fueled by new oil discoveries in pre-salt basins and increasing relocation and decommissioning activities. Petrobras remains a key market driver.

- UAE: Key regional operators such as Abu Dhabi Aviation and Gulf International Services continue to expand capacity to serve offshore platforms across the Middle East.

Offshore Helicopter Services Market Trends

Rising Use of Unmanned Aerial Vehicles (UAVs) and the Adoption of Digitalization is Prominent Market Trends

An unmanned aerial vehicle is an aircraft or drone that comprises various sensors and can be guided autonomously. They are more efficient and provide greater range and endurance than manned aircraft. The use of unmanned aerial vehicles is increasing in the offshore operations industry as they can be used for various tasks such as surveying, inspection, and monitoring of oil & gas pipelines and wind turbines. This helps in significant cost reduction and improves safety. Major players such as Bristow Group, CHC Helicopter, and PHI Group are investing in drone technology to support their existing services. For Instance,

- In June 2022, Nordic Unmanned was selected for the second phase of the Equinor Drone Offshore Logistics contract in Norway. The offshore activities began on August 15 2022, from the Gullfaks C offshore site in the North Sea. The operation represents a significant milestone for the UAV industry and Equinor, since the company is the first operator to incorporate UAV for offshore logistical services.

Furthermore, adopting digital technologies is a key trend gaining popularity in the market to improve safety, efficiency, and cost-effectiveness. Operators are utilizing these technologies to leverage data analytics and predictive maintenance to enhance the safety and reliability of their services. Digital technologies also help in remote monitoring systems to improve operational performance. Furthermore, advancements in avionics systems, contracts from the government and other various end-user industries, strategic partnerships, and collaborations are also key trends in the market.

Download Free sample to learn more about this report.

Offshore Helicopter Services Market Growth Factors

Rising Offshore Oil & Gas Production and Exploration Activities are Expected to Propel Market Growth

Offshore production and exploration activities require reliable and safe transportation services to transport crew and cargo to and from offshore rigs. Helicopters are the preferred mode of transportation for offshore exploration and production activities due to their ability to reach remote locations and operate in adverse weather conditions. For instance, in June 2022, according to the U.S. Energy Information Administration’s Short-Term Energy Outlook (STEO) forecast, there will be new fields discovered and coming online in 2022. By the end of 2023, the newly discovered fields are expected to account for 5% of natural gas production and 14% of crude oil production in the U.S. Federal Offshore Gulf of Mexico (GOM).

It is also expected that the average natural gas production will increase from 0.1 billion cubic feet per day (Bcf/d) in 2022 to 2.1 Bcf/d in 2023. These newly discovered oil fields all around the globe will require ferry personnel and other equipment between the mainland and offshore oil rigs which, in turn, propel the market’s growth. Additionally, the growth of deepwater exploration and development has expanded to discover new oil fields and marine research, which is expected to drive market growth in the forecast period.

Expansion of the Offshore Wind Industry is Projected to Boost Market Growth

The offshore wind industry is experiencing rapid growth, which is expected to drive the demand for helicopter services from offshore. Offshore wind projects require a new installation, frequent monitoring, inspection, and other resource requirements from offshore locations which increases the demand for helicopter services in that sector. For instance, in September 2022, the International Renewable Energy Agency (IRENA), the Global Wind Energy Council (GWEC) and the offshore wind industry, and the governments of the U.S. and Denmark formed an alliance and launched the Global Offshore Wind Alliance to drive installed global offshore wind capacity up 670% from 57 GW in 2021 to 380 GW in 2030.

Several companies in offshore helicopter operators have reported growth in their business due to the expansion of the offshore wind industry. For instance, Babcock International Group has won contracts to provide transportation services for offshore wind projects in the UK, including the Hornsea Two and Triton Knoll offshore wind farms. Furthermore, rising demand for energy and government initiatives to promote the growth of the offshore wind industry are expected to boost the growth of the market.

RESTRAINING FACTORS

Safety Concerns, Stringent Regulatory Framework, and High Operating Costs Hamper Market Growth

The safety record is a important concern for helicopter as several accidents reported in the past. The safety concerns associated with offshore helicopter services can impact the growth of the industry and reduce the demand for services. For instance, in 2020, according to a report by the U.S. National Transportation Safety Board (NTSB), the helicopter accident rate in the U.S. was 3.38 accidents per 100,000 flight hours, higher than the accident rate for fixed-wing aircraft. Such factors are expected to restrain the growth of the market.

Additionally, the high operating costs are also expected to hinder the offshore helicopter services industry. Factors such as fuel, maintenance, and insurance, acts a significant challenge to the to the growth of the market. Moreover, operators must comply with various safety and operational regulations as the regulatory framework varies from country to country. This makes it difficult for service providers to operate in different regions.

Offshore Helicopter Services Market Segmentation Analysis

By Type Analysis

Medium Weight Segment Dominates Market Owing to the Increased Demand for Versatile Helicopters

By type, the market is trifurcated into light, medium, and heavy. The medium weight segment dominated the market share of 55.32% in 2026. Medium helicopters are larger than light helicopters, with a maximum takeoff weight of between 6,000 and 18,000 pounds. They are used for applications such as search and rescue, law enforcement, firefighting, and others. Medium-weight segments are expected to witness steady growth due to increased demand for versatile helicopters from the offshore industry.

A lightweight helicopter is designed to be small, agile, and easy to operate, with a maximum takeoff weight of fewer than 6,000 pounds. Lightweight helicopters are estimated to be the fastest-growing segment globally due to the increasing demand for inspection and monitoring applications.

By Application Analysis

Owing to the Rising Demand for Emergency Services from Various Sectors, Search and Rescue Segment Dominates the Market

The application segment is categorized into inspection, monitoring and surveying, passenger transport, goods transport, search and rescue, and others. The search and rescue segment dominates the market share of 30.31% in 2026 and is estimated to be the fastest growing segment during the forecast period owing to rising demand and the high cost of emergency services.

The passenger segment is expected to witness significant growth in the segment. The increasing requirements for personnel for various offshore activities are anticipated to boost the market for the passenger segment.

To know how our report can help streamline your business, Speak to Analyst

By End User Industry Analysis

Oil and Gas Industry Dominates the Segment Owing to the Increased Demand for Helicopter Services for Crew and Cargo Transport

By end user industry, the market is segmented oil and gas industry, offshore wind industry, and others. The oil and gas industry segment dominates the market share of 70.71% in 2026, due to the rising demand for helicopter services for crew and cargo transport. The oil & gas industry is heavily dependent on helicopters. This industry either owns its independent fleet or gives contracts to helicopter service providers. For instance,

- In June 2023, Ecocopter announced that it had been awarded the tender to provide helicopter services to Enap in the southern part of Chile. The contract aims to provide transfer services for the crew and cargo for Enap’s oil platforms located in the Magallanes region.

The offshore wind industry segment is predicted to witness significant growth during the forecast period. The segment's growth is due to the expansion of the offshore wind industry globally. Additionally, the rising demand for renewable energy is also expected the drive the growth of the segment.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Offshore Helicopter Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.12 billion in 2025 and USD 1.16 billion in 2026. This region's high market growth is attributed to the presence of major offshore oil & gas rigs and growing demand for deep-water offshore development activity. Furthermore, the offshore wind industry's expansion, which requires helicopter transportation services for various applications from inspection to cargo transportation, also boosts the market's growth. The U.S. market is projected to reach USD 0.89 billion by 2026.

Europe

Europe holds the second-largest share of the market in the base year. Several European countries have invested heavily in Search and Rescue (SAR) operations to improve their response capabilities. For instance, in September 2022, Equinor, a Norway-based petroleum refining company awarded a SAR contract to Bristow Norway A/S for a tenure of four years which is expected to start from 1st September 2023. The contract also comes with options for a potential total of seven years. The UK market is projected to reach USD 0.19 billion by 2026, and the Germany market is projected to reach USD 0.07 billion by 2026.

Asia Pacific

Asia Pacific is the fastest-growing region in the helicopter market. This growth rate is attributed to the growing investments from governments in oil & gas industry. For instance, in April 2022, China National Petroleum Corp. (CNPC), China Petroleum & Chemical, and China National Offshore Oil Corp. are set to spend more than USD 80 billion on capital works which is an increase of up to 6.3% from the year 2021. The China market is projected to reach USD 0.14 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Latin America

Latin America is anticipated to witness significant growth in during the forecast period due to the rising relocation and decommissioning operations in countries such as Brazil. For instance, in 2022, Petrobras, the Brazilian state-owned corporation, found oil in a wildcat well situated in the pre-salt Campos Basin off the coast of Brazil. The company intends to continue drilling operations until it reaches the final depth to assess the new discovery's quality.

Middle East and Africa

The market in the Middle East and Africa will witness major growth in the near future. The growth is contributed to increased offshore oil production and rising demand for pipeline inspection and monitoring are expected to boost the market growth during the forecast period.

List of Key Companies in Offshore Helicopter Services Market

Mergers & Acquisitions, Diversification of Services, Expansion into Emerging Markets, and Sustainable Operations are Key Focuses of Leading Players

The global offshore helicopter services market is relatively fragmented with key players, such as Bristow Group Inc., Petroleum Helicopters International Inc., CHC Helicopter Group, Omni Helicopters International (OHI) SA, NHV Group, and others. Major players are focusing on the diversification of services, expansion into emerging markets, and sustainable operations. For instance, in October 2022, NHV Group, a Belgium-based helicopter operator partnered with TotalEnergies and completed the first flight using sustainable aviation fuel (SAF) in the offshore wind industry. This helps in the reduction of carbon dioxide (CO2) emissions by 27% which was produced by TotalEnergies. TotalEnergies is a French-based integrated energy and petroleum company.

LIST OF KEY COMPANIES PROFILED:

- Bristow Group Inc. (U.S.)

- Petroleum Helicopters International Inc. (U.S.)

- CHC Helicopter Group (U.S.)

- Omni Helicopters International (OHI) SA (Portugal)

- NHV Group (Belgium)

- Abu Dhabi Aviation Co. (UAE)

- Gulf International Services QPSC (UAE)

- Erickson Incorporated (U.S.)

- CITIC Offshore Helicopter Co. Ltd. (China)

- Cougar Helicopters (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 – Ultimate Aviation Group, a South Africa-based aviation operator, completed the acquisition of Offshore Helicopter Services U.K. from CHC Helicopter for an undisclosed amount. This acquisition strengthens the capabilities of Ultimate Aviation Group and expands its presence in Europe. Offshore Helicopter Services U.K. is a subsidiary of Babcock International Group plc which was acquired by CHC in 2021.

- October 2022 – Neptune Energy, a U.K.-based oil & gas company awarded a contract for offshore transport in the Dutch North Sea for a deal amount of USD 53 Million. As a part of the contract, CHC is expected to provide transport services to and from the 29 offshore platforms it operating bases in the Netherlands.

- October 2022 – PHI Aviation, a U.S. based helicopter operator, has extended its contract with BP p.l.c. to provide helicopter transportation services in the Gulf of Mexico for an undisclosed amount. The multi-aircraft agreement with a tenure of 10 years is an amendment to the existing contract to provide a support of full-time Sikorsky S-92 from PHI’s Houma base.

- October 2022 – NHV Group, a Belgium-based offshore helicopter operator, won a helicopter services contract from oil and gas company INEOS FPS for a tenure of 5 years. As part of the undisclosed contract NHV will provide helicopter flights to the Forties Unity from NHV Aberdeen.

- April 2022 – Orsted A/S and Eversource Energy awarded a contract together to HeliService International for helicopter crew change operations. As a part of the contract Heliservice will provide crew transport for the two companies’ joint venture offshore wind industry projects in the Northeast U.S.

REPORT COVERAGE

The offshore helicopter services market report provides a detailed market analysis. It comprises all major aspects, such as R&D capabilities and optimization of the operating services. Moreover, the market report includes insights into offshore helicopter services market trends, analysis, Impact of COVID-19 and primarily highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the global market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.86% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 5.74 billion in 2026.

The market is likely to record a CAGR of 5.86% over the forecast period of 2026-2034.

The Search and Rescue segment is expected to lead the market due to the rising demand for emergency services globally.

The market size in North America was valued at USD 1.12 billion in 2025.

Rising offshore oil & gas production and exploration activities expansion of the offshore wind industry are the key factors driving the market.

Some of the top players in the market are Bristow Group Inc., Petroleum Helicopters International Inc., CHC Helicopter Group, Omni Helicopters International (OHI) SA, NHV Group, and others.

The U.S. dominated the market in 2025.

Safety concerns, stringent regulatory framework and high operating costs are expected to restrain the deployment of the service.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us