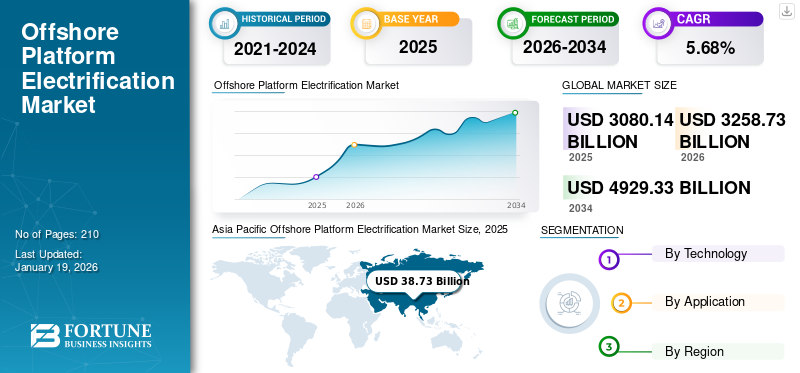

Offshore Platform Electrification Market Size, Share & Industry Analysis, By Technology (Offshore Wind, Subsea Cable/Onshore Transmission Line, and On-Site Generation), By Application (Fixed Platforms and Movable Platforms), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global offshore platform electrification market size was valued at USD 3080.14 billion in 2025 and is projected to be worth USD 3258.73 in 2026 and reach USD 4929.33 billion by 2034, exhibiting a CAGR of 5.31% during the forecast period. Asia pacific dominated the offshore platform electrification market with a market share of 38.73% in 2025. Moreover, Asia Pacific accounts for the largest market revenue share owing to the combination of regulatory, economic, and technological factors that are accelerating decarbonization and energy transition in the region.

Offshore platform electrification is the process of powering offshore industrial operations, particularly oil and gas extraction and production, using electricity instead of traditional, fossil fuel-based generators. This is achieved by connecting offshore platforms to electricity grids or renewable sources such as offshore wind turbines via subsea cables, allowing for reduced greenhouse gas emissions and a more sustainable operational model. It also involves converting on-platform systems, such as hydraulic components, to more efficient electric alternatives.

The major drivers for the market growth are environmental regulations and the demand for sustainability, which push companies to reduce carbon emissions by replacing traditional on-platform power sources with renewable energy and grid-connected electricity. Technological advancements in offshore wind, energy storage, high-voltage subsea cables, and power management systems facilitate this transition.

- In January 2025, Equinor announced plans for the electrification of its offshore oil and gas installations on the Norwegian Continental Shelf (NCS) by awarding a contract for early-stage engineering services to Multiconsult Norge, in collaboration with Aker Solutions and subsidiary LINK Arkitektur. This development aligns with Equinor's conviction that electrification is key to the energy transition

ADNOC holds significant prominence in offshore platform electrification. The company aims to decarbonize its operations by connecting offshore platforms to onshore clean power sources such as nuclear and solar energy, reducing its carbon footprint by up to 50%.

MARKET DYNAMICS

MARKET DRIVERS

Integration of Digitalization and Energy Storage Solutions with Offshore Platforms Driving Market Growth

The integration of digitalization and energy storage solutions is a key driver for the offshore platform electrification market growth. As digital technologies enable efficient management and optimization of energy production, storage, and distribution on offshore platforms, particularly when combined with renewable energy sources, leading to increased sustainability and operational efficiency.

- In December 2021, ADNOC launched an electrification plan for offshore oil and gas fields in the Middle East region with an investment of USD 3.5 million.

The growing demand for sustainable energy solutions is driving the adoption of offshore platform electrification projects, fueled by the integration of digitalization and energy storage technologies. Companies are developing innovative digital energy storage solutions specifically tailored for offshore platforms, including advanced battery technologies and energy management systems.

Expansion of Offshore Wind and Hybrid Renewable Integration to Boost Market Growth

The expansion of offshore wind and the integration of hybrid renewable systems are key drivers for growth in the market, which aims to reduce carbon emissions and costs by replacing fossil fuels with clean energy sources. Advancements in technology and economies of scale are lowering the cost of offshore wind power, making it a viable and increasingly competitive alternative for electrifying offshore operations.

- For instance, Hywind Tampen is the world's largest floating offshore wind project and is a pioneering facility that powers Norway’s Snorre and Gullfaks oil and gas fields in the North Sea through renewable energy. It consists of 11 floating wind turbines with a system capacity of 88 megawatts (MW).

Hybrid systems combining wind, solar, and energy storage further enhance reliability and efficiency, providing a stable and consistent power supply for offshore platforms and supporting the global energy transition to a sustainable future.

MARKET RESTRAINTS

Technical Challenges in Long-Distance Power Transmission are Restraining Market Growth

Technical challenges in long-distance power transmission and the harsh offshore environment are significant restraints on the growth of the market. As a result they significantly increase the cost and complexity of implementing these projects, impacting the adoption of this technology despite rising demand for cleaner energy solutions. Building and maintaining long-distance transmission grids, especially across challenging terrains including oceans or mountainous regions, involves high investment costs and logistical complexities.

MARKET OPPORTUNITIES

Growing Adoption of Offshore Wind-to-Platform Power Supply to Create Market Opportunities

The adoption of offshore wind-to-platform power supply is a key driver in the expanding market, creating significant market opportunities. This is due to the growing need for decarbonization and the benefits of replacing traditional generators with clean and reliable renewable energy. This trend is fueled by technological advancements, supportive government policies, and increased demand for greener energy solutions, particularly for offshore oil and gas platforms.

- In August 2024, Serica Energy signed a memorandum of understanding (MoU) with Swedish floating wind turbine developer SeaTwirl to assess the potential for electrifying its offshore oil and gas assets using floating wind technology and, where suitable, subsea energy storage. This initiative aims to identify and evaluate opportunities to decarbonize offshore oil and gas production with renewable power solutions.

MARKET CHALLENGES

High Upfront CAPEX and Financing Barriers Challenging Market Growth

High upfront costs (CAPEX) for offshore platform electrification are a significant barrier to market growth, coupled with challenges in securing adequate financing, which creates a funding gap for these large-scale, technically complex projects. These financial hurdles, alongside the long lead times and capital-intensive nature of the technology, are slowing the adoption of renewable energy sources offshore.

GLOBAL OFFSHORE PLATFORM ELECTRIFICATION MARKET TRENDS

Adoption of Offshore Wind-to-Platform Power Supply is Emerging as a Key Trend.

The adoption of offshore wind-to-platform power supply is a significant and growing trend within the market, driven by a global push for reduced carbon emissions and greater sustainability in offshore oil and gas operations. This trend is enabled by advancements in offshore wind technology, particularly floating turbines and high voltage direct current (HVDC) subsea cables, which facilitate the transmission of clean energy to offshore platforms. Key drivers include stringent environmental regulations, the economic advantages of reducing fuel use, and national commitments to renewable energy targets.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

U.S. tariffs significantly impact the global market by increasing costs for critical components, which leads to higher energy prices for consumers and slows down the transition to renewable energy. They disrupt supply chains, forcing companies to seek alternative suppliers or diversify their production locations to mitigate increased costs and potential disruptions. This uncertainty can delay large-scale electrification projects, deter foreign investment, and reduce margins for companies, ultimately impacting project viability and overall market growth.

SEGMENTATION ANALYSIS

By Technology

On-site Generation to Dominate Market Due to Increasing Demand for Reliable and Efficient Power

Based on the technology, the market is segmented into offshore wind, subsea cable/onshore transmission line, and on-site generation.

In 2026, the on-site generation is expected to dominate with a market share of 64.12%. Demand for on-site generation and overall offshore platform electrification is strong and growing, driven by stringent environmental regulations, a global push for decarbonization, and the need for more reliable and efficient power in offshore oil and gas operations.

- In April 2023, N-Sea acquired a major contract by ONE-Dyas to install a subsea power cable linking the Riffgat offshore wind farm in the German North Sea to the new N05-A gas production platform on the Dutch Continental Shelf.

Moreover, offshore wind emerged as the fastest-growing technology with a CAGR of 7.58%. The offshore wind electrification segment demand is anticipated to grow significantly, driven by government policies, stringent environmental regulations, and the industry's global push toward decarbonization. This necessitates replacing traditional, carbon-intensive power generation on offshore platforms with renewable sources such as offshore wind and subsea cables.

By Application

To know how our report can help streamline your business, Speak to Analyst

Fixed Platform Segment to Dominate Market Owing to Presence of a Large Number of Offshore Platforms Globally

Based on the application, the market is broadly categorized into fixed platforms and movable platforms.

Fixed platforms accounted for the largest market of 63.45% in 2026. Owing to the increasing regulatory pressure globally as governments enact stricter environmental standards for offshore energy operations, with decarbonization targets pushing operators to modernize older, permanently anchored (fixed) platforms.

- In June 2025, Perenco Congo announced the deployment of the upcycled Mobile Offshore Production Unit (MOPU) named Tchendo 2, converted from a former drilling rig. It uses three gas turbines generating 27 MW to power operations offshore Congo, providing energy independence to multiple fields and enabling sustainable production growth.

Moreover, the movable platform sector emerged as the fastest-growing segment with a CAGR of 6.01%. Demand for electrification of movable offshore platforms such as floating platforms, FPSOs (Floating Production Storage and Offloading units), and remote installations is rising steadily as the sector transitions toward decarbonization, energy efficiency, and compliance with stricter environmental regulations.

OFFSHORE PLATFORM ELECTRIFICATION MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market and the Middle East & Africa is expected to grow at a considerable growth rate during the forecast period.

Asia Pacific

Asia Pacific Offshore Platform Electrification Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market emerged as the largest market with a valuation of USD 1192.82 billion in 2025, driven by a combination of regulatory, economic, and technological factors that are accelerating decarbonization and energy transition in the region. The China market is estimated to reach USD 596.78 billion in 2026. The Japan market is valued at USD 164.09 billion by 2026 and the India market is valued at USD 296.16 billion by 2026.

- In August 2024, China Offshore Oil Engineering Co. Ltd. announced the development of China's heaviest offshore oil and gas platform. Installed in the Bohai Sea at the Kenli 10-2 oilfield, it represents a breakthrough in offshore construction technology.

Middle East & Africa

The Middle East & Africa market was valued at USD 670.36 billion in 2025 and is driven by the increasing demand for cleaner energy solutions, stringent environmental regulations, and the region's ongoing offshore oil and gas development activities. The region is focused on enhancing energy security by diversifying power sources and improving energy efficiency in offshore operations.

Europe

After Middle East & Africa, the Europe industry was valued at USD 524.39 billion in 2025 and is estimated to reach USD 552.89 billion in 2026. Europe, especially countries such as the U.K., Germany, Denmark, and France, leads in offshore wind farm development. Offshore wind power is a major driver for electrifying platforms as it provides reliable, clean electricity. The UK market is valued at USD 76.39 billion by 2026, while the Germany market is valued at USD 152.05 billion by 2026.

North America

The market for offshore platform electrification in North America is driven by increasing demand for cleaner energy solutions, regulatory pressure to reduce carbon emissions, and the region’s investment in offshore wind power infrastructure. The U.S. market is valued at USD 241.63 billion by 2026.

Latin America

Furthermore, the Latin America market is experiencing a significant CAGR of 3.56%. Brazil is beginning to implement environmental and sustainability regulations that encourage the electrification of offshore platforms to reduce emissions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Engaged in Strategic Collaboration and Acquisitions to Increase Market Share in Future

The competitive landscape is moderately concentrated, with major players in the market in ADNOC, BP PLC, Aker Solutions, Equinor, and others investing heavily in renewable energy and strategic partnerships to gain offshore platform electrification market share, while Hitachi Energy and other power transmission system companies provide critical infrastructure. For instance, in December 2024, Equinor and Shell announced plans to form the U.K.’s largest independent oil and gas company, combining assets such as Mariner, Rosebank, Buzzard, Shearwater, Gannet, and Schiehallion. The joint venture, based in Aberdeen, aims to extend field lifespans and secure U.K. energy. The market is shaped by a drive to reduce emissions and operational costs, leading to a competition of innovative electrification solutions, including renewable integration, hybrid systems, and grid connectivity.

List of the Key Offshore Platform Electrification Companies Profiled

- ADNOC (UAE)

- BP PLC (U.K.)

- Aker Solutions (Norway)

- Equinor (Norway)

- Cerulean Winds (U.K.)

- GE Vernova (U.S.)

- Nexans (France)

- Siemens Energy (Germany)

- ZTT (China)

- SLB (U.S.)

- NKT (Denmark)

KEY INDUSTRY DEVELOPMENTS

- In February 2025, Baker Hughes launched three new electrification technologies for onshore and offshore operations. Moreover, the company has also launched a fully all-electric subsea production system, enabling a fully electric topside-to-downhole solution for offshore oil and gas operations.

- In December 2024, GE Vernova Inc. was awarded a contract for the development of an offshore grid connection with a power capacity of 2 GW in the German Baltic Sea.

- In September 2024, Equinor announced partial electrification of the North Sea Troll B platforms and C platforms. The project is expected to reduce carbon emissions by approximately 250,000 tons per annum (tpa) and nitrogen oxides by 850 tpa.

- In August 2024, TotalEnergies launched a floating offshore wind energy pilot project, which will supply electricity to an offshore oil & gas platform in the North Sea.

- In November 2023, the North Sea Transition Authority announced plans for electrification for North Sea oil and gas platforms, prioritizing sustainable power systems with extra support of shore-based power cables.

REPORT COVERAGE

The global offshore platform electrification market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.31% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology · Offshore Wind · Subsea Cable/Onshore Transmission Line · On-Site Generation |

|

By Application · Fixed Platforms · Movable Platforms |

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3080.14 billion in 2025.

The market is likely to grow at a CAGR of 5.31% over the forecast period.

The fixed platform segment is expected to lead the market over the forecast period.

The market size of the Asia Pacific stood at USD 1192.82 billion in 2025.

Integration of digitalization and energy storage solutions with offshore platforms is driving the market growth.

Some of the top players in the market are ADNOC, BP PLC, Aker Solutions, and Equinor, among others.

The global market size is expected to reach USD 4929.33 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us