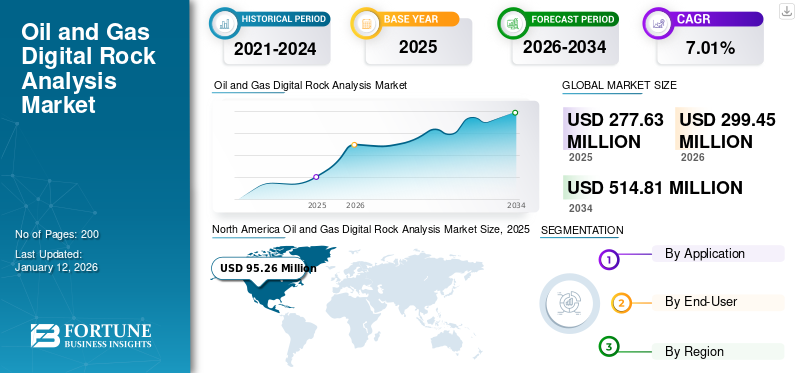

Oil and Gas Digital Rock Analysis Market Size, Share & Industry Analysis, By Application (Exploration & Production, Research & Development, and Enhanced Oil Recovery (EOR)), By End-User (Oil & Gas Companies, and Research Institutes), and Regional Forecast, 2026-2034

Oil and Gas Digital Rock Analysis Market Size and Future Outlook

The global oil and gas digital rock analysis market size was valued at USD 277.63 million in 2025. The market is projected to grow from USD 299.45 million in 2026 to USD 514.81 million by 2034, exhibiting a CAGR of 7.01% during the forecast period. North America dominated the global market with a share of 34.31% in 2025.

Digital rock analysis refers to the study of rock samples using imagery data with the goal of understanding rock properties. Digital rock analysis encompasses a multi-disciplinary approach that helps to understand the pore-scale microstructure of reservoir rock. By enabling operators to collect deeper petrophysical and geological insights, it facilitates more cost-effective drilling decisions. The market is expected to grow in the coming years owing to the rising investments in oil and gas exploration and production activities.

Halliburton is one of the leading players in the oil and gas digital rock analysis market. The company offers FastSCAL™ service, a digital special core analysis solution that supports predicting original oil or gas in-place, production forecasting, risk assessment analysis, EOR completions, and risk assessment analysis.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Investment in Oil And Gas Exploration and Production Activities To Support Market Growth

With growing energy needs, the demand for oil & gas is increasing to fulfill market demand, which has propelled investments and focus on oil and gas exploration & production activities. These operations require the support of a wide range of technologies in order to ensure efficiency. Digital rock analysis is one of the advanced methods that could help companies evaluate fluid transport and petrophysical properties at the pore scale. This approach is quicker than the conventional rock analysis process, which can take even months to complete.

Growing Focus on Environmental Sustainability to Drive Market Growth

The oil and gas industry is directing its efforts toward environmental sustainability, which is anticipated to encourage the adoption of digital rock analysis solutions. The environmental impact of drilling and production operations can be reduced by utilizing digital rock analysis. Additionally, adopting such sustainable practices aligns with regulatory requirements and enhances consumer perception of companies. This shift toward eco-friendly operations is driving demand for technologies that provide advanced insights while reducing waste and emissions, thereby fueling the oil and gas digital rock analysis market growth.

MARKET RESTRAINTS

High Initial Investment Cost And Requirement Of Skilled Professionals to Limit Market Growth

Significant upfront investment is required for the implementation of digital rock analysis technologies in equipment and software. Small to medium-sized enterprises may find it difficult to allocate necessary resources, thereby hindering widespread adoption of the technology.

Understanding rock analysis by using advanced software requires a special understanding and knowledge of rock physics. This technology generates vast amount of technical and complex data, necessitating skilled professionals for accurate interpretation. However, the lack of qualified personnel with expertise in advanced imaging and data analytics poses a challenge for the oil & gas digital rock analysis market.

MARKET OPPORTUNITIES

Growing Adoption of Cloud-Based Solutions Anticipated to Encourage Market Growth

In digital rock analysis, cloud technology assists in the storage and processing of data obtained during the study of different properties of rocks. The utilization of cloud technology enables enhanced collaboration, scalability, and accessibility, which makes it simple for teams to analyze and share data in real time.

Furthermore, the integration of IoT-based devices in the oil and gas sector is enhancing digital rock analysis by offering real-time data from various sensors. This incorporation enhances the precision and timeliness of analysis, leading to better decision-making.

MARKET CHALLENGES

Regulatory Concerns to Hinder Market Growth

The oil and gas sector is heavily regulated and adhering to environmental and safety standards can make it challenging to implement new technologies. Organizations must navigate these regulatory requirement, which can hinder the incorporation of digital rock analysis into their processes.

OIL AND GAS DIGITAL ROCK ANALYSIS MARKET TRENDS

Technological Advancements To Fuel Market Growth

The development of advanced imaging techniques, including X-ray computed tomography (CT) and magnetic resonance imaging (MRI), is significantly propelling the market for digital rock analysis in the oil and gas sector. These technologies help in producing high resolution rock data that allows comprehensive visualization and precise modeling of underground formations. Additionally, the implementation of artificial intelligence and machine learning techniques further improves data processing abilities, resulting in quicker and more reliable analyses.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic presented several challenges to the oil and gas digital rock analysis market. The oil & gas industry, in general, was highly impacted owing to reduced demand, leading to financial losses, and delayed project development. The pandemic further hindered the global oil and gas digital rock analysis market as oil and gas companies directed their focus to maintaining business continuity, resulting in reduced emphasis on the implementation of new technologies.

SEGMENTATION ANALYSIS

By Application

Exploration & Production Segment Led due to Growing Exploration Activities

By application, the market is segregated into exploration & production, research & development, and Enhanced Oil Recovery (EOR).

Exploration & production segment is anticipated to dominate the oil and gas digital rock analysis market share in the coming years. In the oil & gas industry, exploration & production activities are of utmost importance for discovering new reserves in order to address growing energy demand. Digital rock analysis plays a crucial role in assisting companies conduct these activities efficiently by providing detailed analysis of feasible hydrocarbon extraction from challenging environments. This segment dominated the revenue share of 79% in 2024.

Digital rock analysis also plays a crucial role in enhanced oil recovery. Market players such as Synopsys, Dassault Systèmes, and others offer solutions for enhanced oil recovery. For instance, DigitalROCK by Dassault offers digital simulation for relative permeability, including enhanced oil recovery (EOR) conditions. The solution enables the characterization of rock samples, pore space analysis, and investigative studies.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Investments in Advanced Technologies From Oil & Gas Companies to Propel The Market

By end-user, the market is divided into oil & gas companies and research institutions.

The oil & gas companies segment is anticipated to hold 94.29% of the market share in 2025 and to grow with fastest CAGR. The demand for digital rock analysis is largely driven by the need for improved efficiency in exploration and production and increasing demand for advanced reservoir characterization. Oil and gas operators play a pivotal role due to their considerable investments in technologies that optimizes resource extraction methods.

Research institutions contribute to the market by driving innovation and technological progress, enhancing the understanding of geological formations. This segment is anticipated to exhibit a CAGR of 5.70% during the forecast period.

OIL AND GAS DIGITAL ROCK ANALYSIS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Oil and Gas Digital Rock Analysis Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Rapid Adoption Of Advanced Technologies to Foster Market Growth

The North America region is anticipated to dominate the global oil & gas digital rock analysis market share. The regional market value in 2026 was USD 104.72 million, and in 2025, the market value led the region by USD 95.26 million. In the North America region, the market is driven by growing oil & gas exploration projects, technological advancements, and the region’s early adoption of new solutions. The region is also home to major industry players, which further fuels the research and development in the field. Furthermore, government support in the development of the oil & gas industry is anticipated to support oil & gas digital rock analysis market growth.

U.S.

Rise of Shale Gas Production to Propel Market Growth

The U.S. market size is anticipated to hit USD 91.20 million in 2026. Shale oil and gas production has made the U.S. the world’s top oil producer. According to the U.S. Energy Information Administration, in 2023, about 78% (37.87 trillion cubic feet) of total U.S. dry natural gas production came from shale formations. Digital rock analysis highly supports oil & gas exploration & production activities, which helps in the identification of shale oil and gas reserves. Thus, this technology is anticipated to benefit and support the oil & gas industry in the region.

Europe

Growing Emphasis On Digital Solutions To Support Market Growth

North America is anticipated to account for the second-highest market size of USD 55.12 million in 2026, exhibiting the second-fastest growing CAGR of 5.61% during the forecast period. In Europe, the market is anticipated to grow gradually owing to the region’s focus on adopting digital technologies and solutions to improve resource extraction efficiency. Businesses in the region are directing their investments in digital solutions to optimize production while meeting stringent environmental regulations. The region’s focus on sustainable practices within the oil & gas industry is anticipated to drive market growth. The market value in U.K. is expected to be USD 6.07 million in 2026.

On the other hand, Russia is projecting to hit USD 36.13 million and Norway is likely to hold USD 5.87 million in 2025.

Asia Pacific

Growing Energy Demand to Drive Market Growth

Asia Pacific region is to be anticipated as the third-largest market with USD 55.66 million in 2026.

The Asia Pacific region is experiencing significant growth driven by increasing energy demand across China, India, and other countries. Additionally, rising investments in digital technologies for the oil & gas sector coupled with the need for optimum utilization of resources is anticipated to drive demand for digital rock analysis solutions. The market value in China is expected to be USD 35.12 million in 2026.

On the other hand, India is projecting to hit USD 7.07 million in 2026 and Indonesia is likely to hold USD 4.20 million in 2025.

China

Growing Oil & Gas exploration Activities to Support the Region’s Growth

In China, growing urbanization and industrialization are leading to increasing energy demand. To meet the demand, the government and businesses in the region are focusing on exploring new oil & gas reserves, which has led to increasing activities in offshore locations. Digital rock analysis is beneficial in increasing exploration and production activities and helps save time compared to conventional analysis methods.

Latin America

Growing Oil Production In The Region To Aid Market Expansion

Brazil is the largest oil producer in Latin America. According to the U.S. Energy Information Administration (EIA) more than 95% of Brazil's oil production is extracted from deep-water oil fields offshore. Thus, the market has significant growth potential in the Latin America region. Financial constraints and lack of effort could limit market growth; however, increasing foreign investments is anticipated to support market growth.

Middle East & Africa

High Prevalence of Oil & Gas industry in the region to Boost Market Growth

The Middle East & Africa region is to be anticipated as the fourth-largest market with USD 46.19 million in 2026. The Middle East, home to the major oil-producing countries such as Saudi Arabia, UAE, and Iraq remains the top oil-producing region in the world. The region’s dependency on the oil & gas industry is anticipated to propel the growth of oil & gas digital analysis market. Digital rock analysis solutions could help the region maintain its position by assisting in oil & gas exploration and production activities. Saudi Arabia is expected to hit the market size USD 15.60 million in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Advance Solutions Offering By Market Players To Support Market Expansion

Globally, Schlumberger Limited (SLB), Halliburton, and Baker Hughes, are some of the dominating players in the market. Baker Hughes’ Digital Core Analysis (DCA) services assist oil & gas operators to optimize the well planning. When paired with advanced imaging technology, DCA provides detailed formation evaluations, helps assess reservoir storage, map out flow paths between the reservoir and wellbore, and improves reserve estimates.

Schlumberger Limited (SLB) also offers digital rock analysis services for reservoir characterization, special core analysis, petrophysical analysis, and many other applications. Digital special core analysis (digital SCAL) by SLB offers rock and fluid analytics for integration of digital rock analysis, physical analysis, and fluid analysis and develop 3D reservoir model for further studying.

List of the Key Oil & Gas Digital Rock Analysis Companies Profiled

- SLB (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Halliburton (U.S.)

- ESSS (U.S.)

- Petricore (U.K.)

- Dassault Systèmes (France)

- Math2Market GmbH (Germany)

- Synopsys (U.S.)

- Baker Hughes (U.S.)

- Core Laboratories (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024 - Petricore, a global rock and fluid analyses services provider, and GeoMark Research, a geochemistry and PVT Service provider, collaborated to offer an integrated suite of Carbon Capture and Sequestration (CCS) services.

- October 2023 - Halliburton and Core Laboratories Inc. announced a collaboration in the U.S. aimed at compressing the delivery time of cutting-edge, comprehensive digital rock data solutions from months to weeks. This collaboration combines Core’s latter’s industry-leading expertise in reservoir characterization and optimization technologies with Halliburton’s specialization in pore-scale digital rock analysis.

- September 2023 - GeologicAI, a provider of digital rock analysis solutions using AI technology, secured over USD 10 million in funding from Export Development Canada as part of its extended Series A financing round, led by Breakthrough Energy Ventures. This funding support the worldwide rollout of GeologicAI’s fleet of AI-driven robot geologists, advancing the exploration and extraction of essential minerals.

- August 2022 - ADNOC deployed an AI-based solution for geomodelling hydrocarbon reservoirs. The company uses IBM’s artificial intelligence engine to effectively constructs reservoirs digitally and simulate various decision-making factors.

- June 2021 - CGG S.A., a French-based seismic data and technology firm, launched version 11.0 of GeoSoftware, its portfolio of reservoir characterization and petrophysical interpretation software solutions. This version includes enhanced cloud and machine learning capabilities and optimized computing performance.

REPORT COVERAGE

The global market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies coupled with market trends, latest technologies and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.01% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application, By End-User, and By Region |

|

Segmentation |

By Application

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market stood at USD 277.63 million in 2025.

The oil and gas digital rock analysis market is likely to grow at a CAGR of 7.10% over the forecast period.

The exploration & production segment dominates the market.

The market size of North America stood at USD 104.72 million in 2026.

Increasing investment in oil and gas exploration and production activities are key factors supporting oil and gas market growth.

Some of the top players in the oil and gas digital rock analysis market are SLB, Halliburton, Baker Hughes, and others.

The global oil and gas digital rock analysis market is expected to reach USD 514.81 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us