Oral Antibiotics Market Size, Share & Industry Analysis, By Drug Class (Penicillin, Cephalosporin, Tetracycline, Macrolides, Fluoroquinolones, Sulfonamides, and Others), By Application (Skin Infections, Respiratory Infections, Urinary Tract Infections, Ear Infection, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

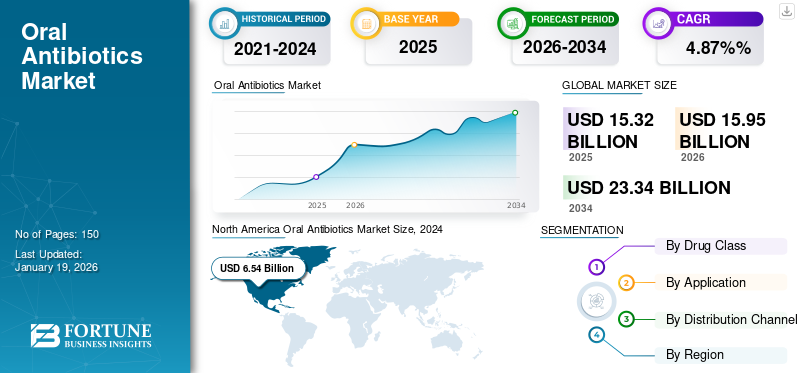

The global oral antibiotics market size was valued at USD 15.32 billion in 2025. The market is expected to grow from USD 15.95 billion in 2025 to USD 23.34 billion by 2034, exhibiting a CAGR of 4.87% during the forecast period. North america dominated the oral antibiotics market with a market share of 34.90% in 2024.

Oral antibiotics are drugs prescribed to treat infections using common method of drug administration, which is oral route. These antibiotics are absorbed through the digestive system and enter the bloodstream to fight infections.

The market growth is fueled by the rise in cases of infectious diseases across the world. While the elderly population is more susceptible to infectious diseases, the increasing geriatric population also boosts the demand for antibiotics. Additionally, strong clinical pipeline is anticipated to further support the market growth.

- For instance, in April 2023, GSK plc., announced positive phase 3 result of gepotidacin, an investigational, oral antibiotic for the treatment of uncomplicated urinary tract infections (uUTI).

Some of the key operating players in the market include GSK plc., Cipla, and AdvaCare Pharma. The robust pipeline and frequent product launches by these key players are also expected to support the market growth during the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Incidence of Infectious Diseases is Driving the Demand for These Antibiotics

The rise in incidence of infectious diseases, such as respiratory tract infections, urinary tract infections, and skin and soft tissue infections, are major factors contributing to the increase in demand for antibiotics that are administered orally. Additionally, environmental factors, such as water, sanitation, and air quality influence the spread of infectious diseases. Moreover, the chronic conditions, such as diabetes and cancer compromises the immune system, and increases the risk of infections and subsequently driving the need for antibiotics. These offer significant advantages in treating infections, such as high patient compliance, ease of administration, and lower drug cost, which supports the market growth.

- For instance, according to the data published by the National Center for Biotechnology Information in January 2023, half of the population across the globe is at risk of emerging and re-emerging infectious diseases. The rise in infectious disease incidence increases the adoption rate of these products, as it is a common route of drug administration.

MARKET RESTRAINTS

Antimicrobial Resistance May Hinder the Market Growth

Antimicrobial resistance (AMR) is a significant restraint for the oral antibiotics market growth. This resistance arises from the overuse and misuse of these antibiotics, leading to bacteria developing mechanisms to withstand effects of antibiotics. These mechanisms include genetic mutations, horizontal gene transfer, and the development of protective structures including biofilms. These results in infections are becoming challenging to treat, which leads to increased healthcare costs, prolonged hospital stays, and even higher mortality rates. The lack of effective treatment options also increases the risk of complications and the spread of resistant infections.

- For instance, according to the data published by the World Health Organization, in September 2023, antibiotic resistance poses a serious threat to the world since common antibiotics are becoming less effective against bacterial infections.

MARKET OPPORTUNITIES

Expansion of Indication of Oral Antibiotics Offers Lucrative Growth Opportunities

The expansion of indications treated by oral antibiotic presents significant growth opportunities for the market. Traditional oral antibiotics were used to treat infections, such as skin and respiratory infections. The rise in oral antibiotic applications, especially for bone and joint infections, offers significant opportunity in the future. This shift toward antibiotics that are administered orally is driven by clinical evidence, which demonstrates its safety and efficacy as an alternative to intravenous antibiotics, leading to reduced costs and improved patient outcomes.

- For instance, according to the data published by the National Center for Biotechnology Information, in November 2024, studies such as the Oral Versus Intravenous Antibiotics for Bone and Joint Infection (OVIVA) trial have shown that oral antibiotics can be as effective as intravenous antibiotics for treating bone and joint infections.

MARKET CHALLENGES

Adverse Drug Reactions Associated with Antibiotics May Restrict Market Growth

The adverse drug reactions (ADRs) associated with antibiotics can restrict the oral antibiotic market's growth. This is due to the rise in ADR concern reports associated with this type of antibiotics. The common ADRs associated with antibiotics include allergic reactions, gastrointestinal disturbances, kidney damage, and development of Clostridium difficile infections.

- For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in April 2024, approximately 10.0% of the U.S. patients report having a penicillin allergy.

ORAL ANTIBIOTICS MARKET TRENDS

Development of Novel Antibiotics is a Prominent Trend in the Market

The development of novel antibiotics is a prominent trend in the market. This is due to the bacteria that are constantly evolving, developing resistance to existing antibiotics, making infections more difficult and costly to treat. This rise in cases of antibiotic resistance needs more effective treatment options, which has boosted the development of novel antibiotics in recent years. The pharmaceutical companies invest heavily in the research and development to discover and manufacture new antibiotics. These research activities focus on developing antibiotics with novel mechanisms of action, targeting different bacterial pathways than existing drugs.

- For instance, in March 2025, GSK plc. received approval for Blujepa (gepotidacin) from the U.S. FDA to treat uncomplicated urinary tract infections (uUTIs). Blujepa is a first-in-class oral antibiotic with a novel mechanism of action.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug Class

Broad Spectrum of Activity Drives Growth of Penicillin Segment Growth

On the basis of drug class, the market is segmented into penicillin, cephalosporin, tetracycline, macrolides, fluoroquinolones, sulfonamides, and others.

The penicillin segment held the highest oral antibiotics market share in 2024. This dominance is due to several factors, such as a broad spectrum of activity and relatively low cost as compared to other antibiotics. Additionally, penicillin’s historical prominence as a first effective treatment for many previously untreatable infections makes it a trusted option for healthcare professionals. Moreover, new product launches, and manufacturing facility development also support the segmental growth.

- For instance, in March 2024, Sandoz opened a new manufacturing site in Kundl, Australia. With this production facility, Sandoz can produce additional one billion penicillin tablets and serve more patients with affordable and life-saving drugs.

The cephalosporin segment held a substantial share in the market and is expected to grow with a significant CAGR during the forecast period. This growth is due to its ability to target various bacteria, such as gram positive and gram negative bacteria. Additionally, pipeline products and new product launches also support the market growth.

- For instance, in September 2021, Lincoln Pharma planned to launch a product portfolio for cephalosporin products.

By Application

High Incidence Rate to Boost Growth of the Respiratory Infections Segment

Based on application, the market is segmented into skin infections, respiratory infections, urinary tract infections, ear infections, and others.

The respiratory infections segment accounts for the largest share in 2024. The rise in incidence of respiratory infections, such as pneumonia, leads to an increase in the demand for effective products for treatment, which is expected to drive the segment growth during the forecast period. Additionally, initiatives promoting early treatment of respiratory symptoms also propel the demand for such antibiotics and contribute to the market growth.

- For instance, according to the data published by the UNICEF, in November 2024, the incidence of pneumonia was over 1,400 cases per 100,000 children across the globe. The high number of respiratory infection cases is propelling the segment’s growth.

The urinary tract infections segment held a significant share of the market. The UTI is the most common bacterial infection across the globe, especially in women, which increases the preference for orally administered antibiotics due to their ease of administration and better patient compliance.

- For instance, according to the data published by the National Center for Biotechnology Information, in April 2021, the recurring urinary tract infection prevalence in women is estimated at 25–50% of all infections.

By Distribution Channel

Rise in Patient Flow Drives Hospital Pharmacy Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

The hospital pharmacy segment held a prominent share in the global market in 2024. Hospitals are the primary point of care for patients with severe and complex infections that require oral antibiotics with specific characteristics. The centralized distribution system and stringent quality control measures also support the segment's growth.

- For instance, according to the data published by the English Surveillance Programme for Antimicrobial Utilization and Resistance (ESPAUR) 2023-2024 report, in England, most antibiotics are prescribed in general practice, approximately 71.7% of overall consumption.

The retail pharmacy segment is expected to be the second-fastest-growing segment of the market during the forecast period. This is due to a rise in the number of retail pharmacies, which ensures the availability and convenience for the customers.

Oral Antibiotics Market Regional Outlook

By geography, the market is fragmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Oral Antibiotics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market and generated USD 6.54 billion in 2024. The rising incidence of infectious diseases, including respiratory infections, urinary tract infections, and skin infections, fuels the demand for these antibiotics and drives the market growth in this region.

U.S.

The U.S. dominated the North America market with the highest share in 2024. The regulatory bodies in the U.S., such as the FDA, have implemented initiatives including the GAIN Act, which promote the development and approval of new antibiotics. Furthermore, the funding programs from agencies, such as the Biomedical Advanced Research and Development Authority (BARDA), further accelerate the development and approval of critical oral antibiotics.

- For instance, in October 2023, Venatorx Pharmaceuticals, Inc. received a contract from the Biomedical Advanced Research and Development Authority (BARDA) to support the development of novel oral antibiotic ceftibuten-ledaborbactam etzadroxil for the treatment of complicated urinary tract infection (cUTI).

Europe

Europe is the second-dominating region in the global market. The European countries are highly investing in the research and development sector, which drives the market growth in this region. Additionally, the rise in product approval rate also supports the market growth.

- For instance, in April 2024, UTILITY Therapeutics Ltd. received the U.S. FDA approval for the Pivya tablets for the treatment of female adults with uncomplicated urinary tract infections (UTIs).

Asia Pacific

Asia Pacific is the fastest-growing region of the market. The regional growth is attributed to the high patient pool and the availability of affordable generic antibiotics. Additionally, increasing approvals and new product launches are expected to boost the regional market growth during the forecast period.

- For instance, in January 2025, Wockhardt received approval from the Central Drugs Standard Control Organization (CDSCO) for the Miqnaf (nafithromycin), a new generation oral ultra-short course, 3-day treatment for the community-acquired bacterial pneumonia (CABP) in adults.

Latin America and Middle East & Africa

The market in the Latin America and Middle East & Africa regions are expected to grow moderately in the near future. The rise in awareness about the infectious diseases such as respiratory infections, tuberculosis, urinary tract infections, and gastrointestinal disorders drives the market growth in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches and High R&D Investment by Key Companies Resulted in Their Dominating Position in the Market

The global market is concentrated with companies such as GSK plc., Pfizer Inc., and AdvaCare Pharma accounting for a significant share.

GSK plc. is a major player in the global market. This is due to the company's broad portfolio of innovative and established medicines in respiratory and urinary tract infections. The company's presence in the global market is strong, with significant presence in the U.S. and emerging regions including Asia. Furthermore, collaborations with other global organizations drive the company's market growth.

- For instance, in September 2022, GSK plc., and Spero Therapeutics entered into a license agreement to develop tebipenem HBr, a late-stage oral antibiotic, which is being evaluated to treat complicated urinary tract infections.

AdvaCare Pharma is anticipated to capture a significant share of the market. The company emphasizes on the production of orally administered antibiotics, at competitive prices. This approach makes their products reachable to a wider range of patients and healthcare providers, supporting the company’s market growth.

Cipla, Taj Life Sciences Pvt. Ltd., Sandoz Group AG, Bayer AG, and Shionogi & Co., Ltd. are among other prominent players in the market. These market players are focusing on the development of new antibiotics.

LIST OF KEY ORAL ANTIBIOTICS COMPANIES PROFILED

- GSK plc. (U.K.)

- Cipla (India)

- AdvaCare Pharma (India)

- Taj Life Sciences Pvt. Ltd. (India)

- Sandoz Group AG (Switzerland)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- Shionogi & Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Iterum Therapeutics plc received approval from the U.S. Food and Drug Administration (FDA) for ORLYNVAH, the first oral sulopenem to treat uncomplicated urinary tract infections (uUTIs).

- August 2024: RedHill Biopharma Ltd. announced the commercial launch of Talicia, a novel, all-in-one oral capsule combination of two antibiotics in the United Arab Emirates (UAE) for the treatment of adults with Helicobacter pylori (H. pylori) infection.

- March 2024: ANI Pharmaceuticals, Inc., launched levofloxacin oral solution, a generic version of the Reference Listed Drug (RLD) Levaquin, in the U.S.

- June 2023: Innoviva Specialty Therapeutics, Inc., and the Global Antibiotic Research & Development Partnership (GARDP) announced that the U.S. FDA has accepted their New Drug Application (NDA) for zoliflodacin, a first-in-class oral antibiotic for the treatment of uncomplicated gonorrhea in adults

- May 2021: Teva Pharmaceuticals Inc. launched generic Erythromycin tablets in 250 mg and 500 mg strengths to treat various bacterial infections in patients allergic to penicillin.

REPORT COVERAGE

The global oral antibiotics market report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of infectious disease in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. It covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.87% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 15.32 billion in 2025 and is projected to record a valuation of USD 23.34 billion by 2034.

In 2025, the market value stood at USD 6.8 billion.

The market is expected to exhibit a CAGR of 4.87% during the forecast period.

Penicillin segment led the market, by drug class.

The key factors driving the market are rise in the incidence of infectious diseases and increasing government initiatives, such as public awareness campaigns and antibiotic stewardship programs.

GSK plc. and AdvaCare Pharma are the top players in the market.

North America dominated the market with a share of 34.9% in 2025.

New product launches and a rise in demand for oral antibiotics are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us