Organic Coconut Oil Market Size, Share & Industry Analysis, By Type (Virgin Coconut Oil, Refined Coconut Oil, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

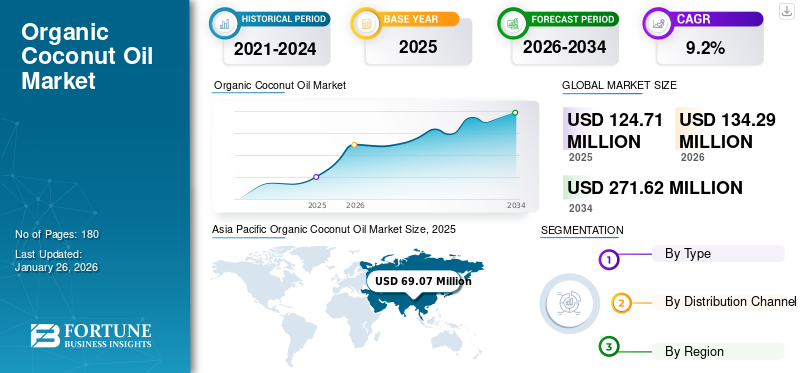

The global organic coconut oil market size was valued at USD 124.71 million in 2025 and is projected to grow from USD 134.29 million in 2026 to USD 271.62 million by 2034, exhibiting a CAGR of 9.2% during the forecast period. Asia Pacific dominated the organic coconut oil market with a market share of 55.38% in 2025.

Organic coconut oil is extracted from coconuts, especially fresh coconut meat is grown utilizing organic farming methods. This oil is typically derived by using wet milling or cold pressing, which aids in maintaining the natural components and natural flavor. Predominantly, Indonesia, Sri Lanka, and Philippines are the main producing countries of organic oil. With respect to benefits, this finished product is valued for its natural aroma, flavor, and several nutritional advantages. Moreover, this item is utilized in a range of industries, including cosmetics, food, beverages, and pharmaceuticals. The surging trend of health consciousness and increasing shift toward certified organic products are boosting organic coconut oil demand.

A few of the key players in the global industry include Dabur, The Hain Celestial Group, Inc., and Nutiva, Inc., among others.

Organic Coconut Oil Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 124.71 million

- 2026 Market Size: USD 134.29 million

- 2034 Forecast Market Size: USD 271.62 million

- CAGR: 9.2% from 2026–2034

Market Share & Segmentation:

- Asia Pacific dominated the organic coconut oil market with a 55.38% share in 2025, driven by a shift toward plant-based diets, evolving culinary preferences, and a growing number of local organic oil producers.

- By type, the virgin coconut oil segment held the largest market share, valued for its health benefits like reducing inflammation and strengthening good cholesterol, as well as its superior flavor and aroma.

- By distribution channel, supermarkets/hypermarkets led the market in 2024, thanks to their diverse product portfolios, effective inventory management, and in-store promotions.

Key Regional Highlights:

- Asia Pacific: Leads the global market. China is a key driver, with growing coconut plantations and increasing availability of organic oil products.

- North America: Ranks second, with growth fueled by high demand for plant-based organic products and its use in the packaged food industry as a healthier alternative to other oils.

- Europe: The third-largest market, driven by the strong veganism trend, demand for transparent and minimally processed products, and supportive policies like the European Green Deal.

- South America: A developing market with strong growth potential, fueled by increasing consumer preference for organic products and rising disposable income.

MARKET DYNAMICS

Market Drivers

Increasing Adoption of Organic Coconut Oil in Food Industry Escalates Its Sales

The rising use of organic coconut oil in the food processing sector is the main driver contributing to market growth. For a few years, individuals have been looking for clean-label items and are willing to pay an additional amount for certified organic products, including oil. The majority of consumers are aware of the harsh impacts of conventionally produced items on both the environment and their health. By witnessing such a shift toward responsibly sourced ingredients, food operators are focusing on using organic edible oil in the preparation of numerous food products. Such versatility of organic oil, especially coconut-sourced, makes it a popular ingredient in food preparation.

Market Restraints

Lack of Standardization in Certification and Deforestation are Key Concerns Hampering Market Growth

The high risk of deforestation is a main challenge affecting the oil industry. Tropical rainforests, where coconut trees mainly grow, are considered the most diverse ecosystems globally. However, the growing demand for oil derived from coconut has resulted in considerable deforestation, owing to the conversion of land into coconut monocultures.

Another challenge in the global industry is the lack of standardization in certification. In several countries, producers face challenges with respect to a lack of consistency in organic certification. Thus, such hindrances create difficulties for individuals to trust the product’s credibility and hinder the global organic coconut oil market growth.

Market Opportunities

Growing Demand for Sustainable Oil Creates Growth Possibilities

The increasing need for sustainably produced oil among global consumers unlocks various growth opportunities for the industry. In today’s health-centric era, most consumers are prioritizing responsibly produced items, and organic oils associate well with this trend. In comparison to conventional oils, organic oils are considered safe and environmental-friendly substitutes. Moreover, the adverse impact of traditional oil on the environment has further necessitated consumers to shift toward organic edible oils. Thus, the oil businesses are adopting sustainable practices, which can pave the way toward the growth of the organic coconut oil industry.

Organic Coconut Oil Market Trends

Surging Home Cooking Trend Bolsters Usage of Oil

The rising trend of home cooking is a key factor boosting the utilization of oil. This growth is mainly augmented due to its versatility in cooking and its health advantages. Owing to such factors, most home cooks use organic oil. Also, this oil is known to have a high smoke point, which makes it appropriate for sautéing and frying. Moreover, it can be utilized as a vegan alternative for butter, especially in baking, and can be added to shakes and smoothies for a boost of healthy flavors and fats. As a result, such factors enhance organic oil usage in home kitchens.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Virgin Coconut Oil Segment Leads Due to Reduction in Inflammation Rate along with Strengthening Good Cholesterol

Depending on the type, the market is segmented into virgin coconut oil, refined coconut oil, and others.

The virgin coconut oil segment leads the global market and holds the maximum market share. This oil is primarily produced from fresh coconut meat, without bleaching or refining processes. This method is known to improve the aroma and flavor of the derived oil. Moreover, the utilization of this oil helps in strengthening good cholesterol and reducing the inflammation rate. Thus, these advantages propel the segment’s growth.

The refined coconut oil is anticipated to be the fastest-growing segment and is predicted to grow at the same pace in the near term. This type of oil is rich in medium-chain triglycerides (MCTs) and is extracted from dried coconut meat, which undergoes deodorization, refining, and bleaching processes.

By Distribution Channel

Supermarkets/Hypermarkets Led Due to Effective Inventory Management

Based on the distribution channel, the market is segmented into convenience stores, supermarkets/hypermarkets, specialty stores, online retail, and others.

The supermarkets/hypermarkets segment led the global market in 2024. The diverse product portfolio, in-store promotions, and multiple outlets at prime locations are pivotal aspects boosting the growth. Moreover, the large-scale purchasing option and effective inventory management appeal to a wide consumer base.

The online retail segment has a high CAGR and is expected to grow at the same pace in the coming years. The ease of ordering and discount coupons are contributing to the strong growth.

Organic Coconut Oil Market Regional Outlook

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Organic Coconut Oil Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 41.16 million in 2025 and USD 44.89 million in 2026. Asia Pacific dominated the organic coconut oil market share. Several components fueling the growth include a switch toward plant-sourced diets, evolving culinary preferences, and rising organic oil players. With the influence of other regions, such as North America and Europe, Asians are also experimenting with new, healthier cooking oils. Thus, these key factors escalate the region’s momentum.

Among Asian countries, China led the regional market and is anticipated to soar in the coming years. The growing coconut plantations and rising availability of organic oils stimulate the market’s growth.

North America

North America ranked second in the organic coconut oil industry and generated a considerable share in 2024. This growth is attained by the increasing demand for plant-sourced organic items, coupled with the expanding use of organic coconut oil in the food processing sector. In this region, consumers are known for their reliance on packaged food items to add convenience to their diet. These ready-to-eat products contain high levels of palm oil, which is considered unsafe for humans. As a result, food manufacturers are turning toward organic oil made from coconuts. The high smoking point and antimicrobial properties are factors that appeal to producers and fuel their utilization rate.

The U.S. is recognized as the biggest organic oil-consuming country in the region. The surging awareness of ethical production and the augmented popularity of organic coconut oil in numerous end-use industries enhance the chances of growth.

Europe

Europe is the third leading region in the world. This region is known for following the trend of veganism and is seeking products/ingredients that align with this trend. This demand for natural label items that emphasize minimal processing and transparency is fueling the intake of organic edible oil. Moreover, the promotion of organic farming through the Farm to Fork strategy and the European Green Deal further propels the extraction of organic oil. Thus, the companies should focus on strengthening their production of sustainable oil rather than regular oil, which will assist in driving the market’s potential.

Middle East & Africa

The Middle East & Africa region is also at its nascent stage and is projected to soar at the same pace in the future. The augmented urbanization and the rising number of private players in the organic oil industry propel the momentum.

South America

South America is at its developing stage and is predicted to grow at a strong pace over the forecast period. The growing consumer preferences toward organic oil usage and increasing disposable income collectively fuel market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Concentrate on New Product Offerings to Facilitate Brand’s Awareness

The active players in the global industry include Dabur, Nutiva Inc., and The Hain Celestial Group Inc., among others. The companies operating in the market are concentrating on new launches, which strengthen their product offering range. Apart from firms, well-known supermarket chains are also trying to introduce private-label certified organic oil, which assists in fulfilling the increased consumer demands.

List of Key Organic Coconut Oil Companies Profiled

- Dabur (India)

- Nutiva Inc. (U.S.)

- Marico (India)

- THE COCONUT COMPANY (U.K.)

- Bo International (India)

- The Hain Celestial Group, Inc. (U.S.)

- Kovai Agro Foods (India)

- Aadhunik Ayurveda (India)

- Connoils LLC (U.S.)

- Laurico Nutraceuticals (India)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Waitrose, a supermarket chain in the U.K., introduced its first-ever organic and own-label fair-trade coconut oil. This item launch supports the farmers of Sri Lanka who manufacture such oils to protect their environment and invest in their communities.

- October 2022: Natural Grocers, a health food chain in the U.S., launched an Organic Extra Virgin Unrefined coconut oil. The finished product is available in three sizes across the U.S.-based retailers and caters to the rising consumer demands.

- June 2020: Dabur, a consumer goods enterprise in India, announced the launch of organic virgin coconut oil, which is unrefined, vegan, and free from artificial preservatives. Moreover, the item is composed of 100% natural ingredients and can be purchased by Indian consumers.

- April 2020: Nutiva, a U.S.-based producer of organic foods, released its new line of organic liquid coconut oil. The oil launched is a non-GMO project verified and USDA certified organic, and is available for U.S. consumers.

- April 2019: Marico Limited, a prominent Indian FMCG, unveiled a line of gourmet products through its brand, Coco Soul. The range includes spreads, chips, and organic virgin oil produced from coconut and can be availed from modern trade stores such as Big Bazaar, D-Mart, and others across India.

REPORT COVERAGE

The global market report includes quantitative and qualitative insights into the market. It also offers a detailed market analysis of the market sizing and growth rates for all possible market segments. Key insights presented in the report include an overview of related markets, a competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory environment in critical countries, and current global organic coconut oil market trends.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 9.2% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 124.71 million in 2025.

The market is projected to grow at a CAGR of 9.2% during the forecast period (2026-2034).

By type, the virgin coconut oil segment leads the market.

Increasing adoption of organic coconut oil in the food industry boosts market expansion.

Dabur, The Hain Celestial Group, Inc., and Nutiva, Inc. are a few of the top players in the market.

Asia Pacific held the highest share of the market.

The growing demand for sustainable oil creates growth possibilities.

Customize This Report

Add Regions/Countries

Add Segments

Additional Company Profiles

Deeper Competitive Landscape

Tailored End-user or Application Splits

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us