Organic Electronics Market Size, Share & Industry Analysis, By Material (Organic Semiconductor, Conductive, Dielectric, and Substrate), By Application (Display, System Components, Lighting, Solar Cells, and Others (Organic Transistors, etc.)), By Industry (Consumer Electronics, Automotive, Energy/Renewable Power, Healthcare, and Others (Aerospace & Defense, etc.)), and Regional Forecast, 2026-2034

ORGANIC ELECTRONICS MARKET SIZE AND FUTURE OUTLOOK

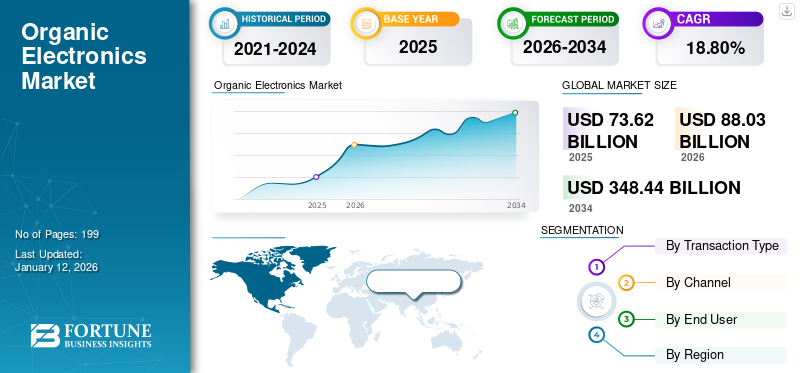

The global organic electronics market size was valued at USD 73.62 billion in 2025. The market is projected to grow from USD 88.03 billion in 2026 to USD 348.44 billion by 2034, exhibiting a CAGR of 18.80% during the forecast period. Asia Pacific dominated the organic electronics market with a market share of 52.40% in 2025.

The organic electronics industry involves the usage of organic materials, primarily carbon-based compounds, to create electronic devices such as organic light-emitting diodes (OLEDs), organic photovoltaics (OPVs), and organic field-effect transistors (OFETs). These materials offer several advantages over traditional inorganic electronics, including flexibility, lower cost, and the potential for innovative applications such as flexible displays and biodegradable electronics.

Applications such as smartphone displays, colored light sources, portable solar cells, and curved HD TV will have a high impact on the global market during the forecast period. Organic electronics are predicted to provide more functionality as it tries to resolve the power consumption concerns. This makes them a very promising technology. Applications of organic electronics might be found in many areas such as IT, biological research, environmental health, and national security. They will probably appear as a low-cost variant for traditional inorganic electronic applications because their production techniques are simple, and the material consumption is limited. There are several factors that are stimulating the market in the coming years, including a rapidly expanding consumer electronics market, significantly increasing application areas, favorable government initiatives, and better performance.

The main participants in the market include MercK KGaA, BASF SE, Convestro AG, DuPont, Universal Display Corporation, Samsung Display, and LG Display Co., Ltd.

Impact of Gen AI

Generative AI Streamlines the Innovation Process in Material Discovery and Device Design

Generative AI is transforming the global marketplace by streamlining the innovation process of material discovery and device design. In particular, advanced AI-driven simulations allow researchers to predict molecular properties, optimize the structures of organic semiconductors, and discover new materials with better performance and stability. This approach allows research and development (R&D) cycles to be shorter, prototype costs to be less, and more probability of commercial success. As Gen AI is integrated into design workflows, manufacturers can respond quicker to the needs of the market, develop the next generation of OLED lighting and flexible electronics, and sustain a competitive advantage in a rapidly changing space.

Impact of Reciprocal Tariff

Reciprocal Tariffs Can Impact Product Pricing and The Stability of Supply Chains

Reciprocal tariffs in global markets can have a large impact on product pricing and the stability of supply chains. Increased tariffs on imported OLED panels and organic materials could raise production costs and limit sources for cross- border sourcing opportunities, impacting especially APAC-based suppliers that dominate manufacturing. Tariff changes could result in longer shipping times, limited in-stock inventories and lower competitiveness for exporters in foreign markets.

MARKET DYNAMICS

Market Drivers

Rising Adoption of OLED Displays Driving Market Growth

The global market is witnessing strong growth driven by rising adoption of OLEDs (Organic Light-Emitting Diodes) across multiple consumer electronics segments. OLED technology offers superior image quality, thinner designs, and energy efficiency, making it highly attractive for smartphones, televisions, laptops, tablets, and wearable devices.

As per the Paulson Institute, OLED smartphone shipments are projected to surge from 390.6 million units in 2016 to 812.4 million units in 2021, with the share of OLED displays rising dramatically from 17% in 2015 to 43% by 2024. The considerable increase in shipments represents a growing consumer preference for quality visual experiences, and the ongoing shift of manufacturers toward to premium displays.

Revolutionary innovation, decreasing production costs and expanding use cases in flexible and foldable displays enhances prospects for the market. Moreover, the strong penetration in emerging markets, along with growth in disposable incomes is likely to impel the organic electronics market growth over the forthcoming years.

Market Restraints

High Manufacturing Costs Hinder Growth and Limit Market Scalability

One of the key factors that hinder the advancement of the global market is the high cost of manufacturing. The manufacturing of OLED panels and other organic components involves intricate deposition processes, vacuum equipment, and expensive organic materials like emissive polymers and small molecules. Additionally, the need for advanced encapsulation layers to ensure durability raises overall costs. These capital-intensive processes limit scalability and make organic electronics less competitive against traditional technologies. As a result, wider adoption depends on innovations that reduce costs through improved processes, material efficiency, and economies of scale.

Market Opportunities

Emergence of Organic Photovoltaics (OPV) Drive Growth, Creating Opportunities for Innovation

The swift emergence of Organic Photovoltaics (OPVs) brings great opportunities for innovation for the global market. OPVs are lightweight, semi-transparent, and highly flexible which brings unique advantages for specific applications such as building integrated photovoltaics (BIPV), automotive mobility and off-grid renewable energy. OPVs can be completely integrated into surfaces that are irregular or curved, which opens design possibilities for architects and manufacturers. Ongoing research focused on improving efficiency, lifespan, and stability further enhances OPV’s commercial potential, opening new revenue streams for companies and fostering sustainable energy solutions within the organic electronics ecosystem.

ORGANIC ELECTRONICS MARKET TRENDS

Shift Toward Flexible & Foldable Devices as a Major Market Trend

One of the key trends propelling the global market is the increasing shift toward flexible and foldable device technology. OLED smartphones, rollable TVs, and foldable laptops are progressing from premium innovations to mainstream consumer products. The flexibility of organic materials has unlocked new design possibilities, enabling thinner, lighter, and more durable devices. The continued development of substrate materials, transparent electrodes, and encapsulation methods is facilitating this transformation. Furthermore, as major electronics brands adopt foldable forms and flexible display structures, the growth of high performance organic materials and components is anticipated across multiple end-users.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Material

Crucial Role of Organic Semiconductor as Active Emissive and Charge-Transport Layers in OLED Displays Boosts Segment Growth

Based on the material, the market is segmented into organic semiconductor, conductive, dielectric, and substrate.

The organic semiconductor material segment is projected to dominate the market with a share of 44.00% in 2026. The increase in revenue is attributed to their crucial role as active emissive and charge-transport layers in OLED displays, which form the primary revenue source for the industry. The widespread adoption of OLED technology significantly fueled the segment’s growth and market share.

Of all the segments, conductive holds the highest CAGR of 21.63%% in the global market. The segment is predicted to grow significantly because there has been a huge demand for transparent and flexible applications.

By Application

Display Segment Dominates Market Owing to Its Widespread Adoption

Based on application, the market is divided into display, system components, lighting, solar cells, and others (organic transistors, etc.).

The display application segment is expected to lead the market, accounting for 78.51% of the total market share in 2026. The segment continues to generate the major revenue due to widespread adoption of OLED panels in smartphones, televisions, laptops, and wearable devices. Displays remain the largest and most commercially established application of organic electronic technology.

The solar cells segment holds the highest CAGR of 21.99% in the global market. The segment’s growth is mainly due the increasing adoption of organic photovoltaics (OPV), which offer lightweight, flexible, and cost-effective solar solutions.

By Industry

Extensive Use of OLED Displays Augments the Consumer Electronics Segment Growth

Based on the industry, the market is divided into consumer electronics, automotive, energy/renewable power, healthcare, and others (aerospace & defense, etc.)).

The consumer electronics industry segment is anticipated to hold a dominant market share of 67.81% in 2026. The consumer electronics industry continues to generate the highest revenue driven by the extensive use of OLED displays in smartphones, televisions, laptops, and wearable devices, establishing consumer electronics as the core application area for organic electronic technologies.

Automotive represent the largest CAGR at 22.36% in the global market. Automotive are growing faster primarily due to the growing integration of OLED displays and lighting in electric vehicle dashboards, infotainment systems, and premium car interiors, where advanced design, energy efficiency, and aesthetic appeal drive the increasing adoption of organic electronic components.

To know how our report can help streamline your business, Speak to Analyst

ORGANIC ELECTRONICS MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America is witnessing rapid growth owing to strong technology innovations and substantial research and development investments. The market shows strength through its extensive key industry presence together with effective channels for technology commercialization. The U.S. market is projected to reach USD 12.42 billion by 2026.

Europe

The European market is substantially growing and is likely to contribute to a revenue share of USD 12.25 billion in 2025. Europe operates as an excellence hub for organic electronics research and technology creation which specifically focuses on sustainable technologies together with environmental applications. Organic electronics development received extensive support from the European Union as it funded 12 printed organic electronics pilot lines throughout member states in 2023. Organic displays appear across 42% of European automotive displays in 2023 according to ACEA data demonstrating the importance of the automotive industry to organic electronic applications within this market. U.K., Germany, and France are some of the leading contributors to the growth in the market, with the required revenue stake of USD 2.37 billion USD 2.27 billion and USD 1.99 billion respectively by 2025. The UK market is projected to reach USD 2.72 billion by 2026, while the Germany market is projected to reach USD 2.64 billion by 2026.

Asia Pacific

The Asia Pacific is currently leading the global market as of 2024, with an estimated organic electronics market share of USD 31.64 billion. The region is a home to the largest OLED manufacturers with base in South Korea, China, and Japan, driving mass production for smartphones, TVs, and IT displays.

Asia Pacific is simultaneously predicted to have the high CAGR of 22.63%, sustaining their position as the fastest growing. Strong demand for consumer electronics, investments in capacity for flexible OLED devices, and the rapid adoption of EV's accelerate market growth. The Japan market is projected to reach USD 9.2 billion by 2026, the China market is projected to reach USD 9.56 billion by 2026, and the India market is projected to reach USD 6.72 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 3.31 billion and USD 4.35 billion respectively in 2025 due to sectors such as automotive, healthcare, and consumer electronics, with strong growth in flexible displays and organic sensors as well as increasing investments in technology development and consumer electronics applications. GCC countries are predicted to have a market share of USD 1.35 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus On Partnerships and Acquisitions to Lead the Industry

Leading market players are investing heavily in R&D in order to expand their product lines, which will help the organic electronics market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, organic electronics industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global organic electronics industry to benefit clients and increase the market sector.

LIST OF KEY ORGANIC ELECTRONICS COMPANIES PROFILED:

- MercK KGaA (Germany)

- BASF SE (Germany)

- Convestro AG (Germany)

- DuPont (U.S.)

- Universal Display Corporation (U.S.)

- Samsung Display (South Korea)

- LG Display Co., Ltd. (South Korea)

- Sony Corporation (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- AUO Corporation (Taiwan)

- Tianma Microelectronics (China)

- BOE Technology Group (China)

- Visionox (China)

- Japan Display Inc. (Japan)

- Idemitsu Kosan (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2025: BASF is proud to announce a major performance upgrade to its QDYESTM, a cutting-edge quantum dot level (QD-level) solution designed for LCD backlight applications. Implemented in 2025, the upgrade pioneers a greener and highly efficient path for manufacturers aiming to produce wide color gamut displays.

- July 2025: Samsung Display announced its latest foldable organic light-emitting diode (OLED) panel has successfully passed a 500,000-fold durability test, demonstrating the company’s advances in flexible display technology.

- April 2024: The German multinational company Merck KGaA made a large financial commitment to enhance its OLED material manufacturing capacities in Germany to fulfill worldwide requirements for cutting-edge display products.

- March 2024: Through the successful acquisition of Novaled GmbH Samsung SDI improved its market position within the OLED sector.

- February 2024: LG Display formed a long-term partnership with Universal Display Corporation for obtaining phosphorescent OLED materials.Ø

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the organic electronics market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021–2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 18.80% from 2026-2034 |

| Historical Period | 2021–2024 |

| Unit | Value (USD Billion) |

| Segmentation | By Material, Application,Industry, and Region |

| By Material |

|

| By Application |

|

| By Industry |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 73.62 billion in 2025 and is projected to reach USD 348.44 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 18.80% during the forecast period.

Strong demand from smartphones, TVs, laptops, tablets, and wearables is speeding up the market growth.

MercK KGaA, BASF SE, Convestro AG, DuPont, Universal Display Corporation, Samsung Display, and LG Display Co., Ltd. are some of the top players in the market.

The Asia Pacific region held the largest market share.

Asia Pacific region was valued at USD 38.57 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us