Oscilloscope Market Size, Share & Industry Analysis, By Product Type (Digital {Digital Storage Oscilloscopes (DSO), Digital Phosphor Oscilloscopes (DPO), Mixed-Signal Oscilloscopes (MSO), Mixed-Domain Oscilloscopes (MDO), and Sampling Oscilloscopes} and Analog), By Form Factor (Benchtop, Portable, and PC-based), By Bandwidth (Less than 500 MHz, 500 MHz - 1 GHz, 1 GHz - 4 GHz, and More than 4 GHz), By Industry (Automotive and Transportation, IT and Telecommunications, Consumer Electronics, Aerospace and Defense, Medical and Life Sciences, and Others), and Regional Forecast, 2026-2034

OSCILLOSCOPE MARKET SIZE AND FUTURE OUTLOOK

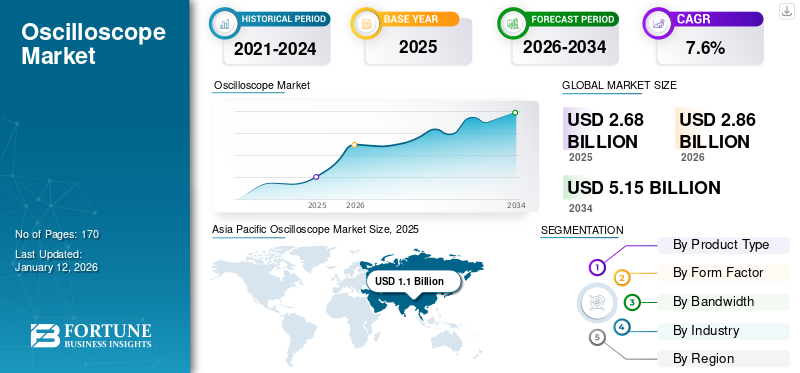

The global oscilloscope market size was valued at USD 2.68 billion in 2025. The market is projected to grow from USD 2.86 billion in 2026 to USD 5.15 billion by 2034, exhibiting a CAGR of 7.6% during the forecast period. Asia Pacific dominated the oscilloscope market with a market share of 41.2% in 2025.

An oscilloscope is an electronic test instrument that graphically displays varying voltages of one or more signals as a function of time. It is primarily used to visualize and analyze electrical signals for properties such as amplitude, frequency, and waveform shape, facilitating the diagnosis and troubleshooting of electronic circuits.

The market is experiencing growth driven by increasing demand from the expanding electronics industry, technological advancements in digital oscilloscopes, rising complexity of electronic systems, growth in the Internet of Things (IoT), and developments in automotive electronics including electric vehicles and driver-assistance technologies. These factors collectively fuel the need for precise and sophisticated testing instruments across various sectors.

The main participants in the market include Tektronix Inc., Yokogawa Test & Measurement Corporation, Pico Technology Ltd., Rohde & Schwarz GmbH & CoKG, Keysight Technologies, and Teledyne LeCroy.

MARKET DYNAMICS

Market Drivers

5G Rollouts, Telecom Infrastructure, and High-Speed Digital Design Driving Market Growth

5G deployments, telecommunications infrastructure expansion, and high-speed digital design are the key drivers supporting the oscilloscope market growth. According to 5G Americas, as of Q1 2025, there were 2.4 billion global 5G connections and the statistics may grow to 8 billion by 2029, with service for over 94% of the forecasted population. Rapid 5G adoption necessitates advanced oscilloscopes for rigorous validation, signal testing, and compliance with performance standards. Also, governments are committed to investing in telecommunications wireless infrastructure with continued construction of telecom towers, especially in remote areas with stimulus funding such as Universal Service Obligation Fund (USOF), driving demand for precise network optimization tools. High-bandwidth oscilloscopes (> 1 GHz) are required to effectively test complex high frequency signals for both 5G and digital design use cases to ensure superior performance and reliability in networks amid accelerating data consumption and next-generation wireless technologies.

Market Restraints

Supply-chain & Components Volatility Hinder Growth and Limit Market Scalability

The growth of the market is challenged by supply-chain and component volatility, which inhibits the ability to scale to meet demand. High-performance components most important for oscilloscopes, including analog-to-digital converters (ADCs), memory modules, and RF front-end components, are often limited in terms of availability or pricing. This limited availability affects manufacturing lead time and pricing, thereby restricting the growth of the market. In addition, the constant volatility of raw material pricing and geopolitical disturbances is contributing to supply instability. All these factors create significant constraints on growth by increasing the production costs and limiting the ability to react quickly to increased demand, both limiting the potential for growth of the overall market.

Market Opportunities

Rising Integrated Measurement Ecosystems Drive Growth, Creating Opportunities for Innovation

The growing usage of integrated measurement ecosystems is expected to create more significant market prospects. By bundling oscilloscopes with additional capabilities such as spectrum analysis, protocol decoding, power analysis, and automated test scripts, vendors can address specialized verticals such as automotive, telecommunications, and aerospace more comprehensively. This integration supports complex system testing and accelerates innovation, increasing instrument utility. The trend toward multifunctional instruments open avenues for differentiation and value addition, driving higher adoption rates and facilitating entry into new application domains that demand advanced and customized test solutions.

OSCILLOSCOPE MARKET TRENDS

Edge/Compact and Lower-Cost Digital Alternatives as a Major Market Trend

An emerging trend is the development of edge, small and more affordable digital oscilloscopes. Portable, benchtop and PC-based digital oscilloscopes are gaining popularity due to their affordability and convenience. These alternatives reduce entry barriers for educational institutions, startups, and small labs, effectively increasing the user pool. Furthermore, the move to compact and mobile instruments only supports effective field diagnostics and quick deployment. Also, developments in the digital space have only increased the scope's functionality, while lowering costs, making oscilloscopes more accessible and adaptable to diverse user needs and environments.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Broad Adoption Across Industries Boosts Digital Segment Growth

Based on the product type, the market is segmented into digital and analog.

In 2025, the digital segment accounted for the largest revenue share of 76.37% in the overall global market. The revenue growth can be attributed to the product's versatility, advanced functionality, and cost-savings, making digital oscilloscopes a well-accepted form of measurement in industries such as electronics, automotive and telecommunication. In addition, its ability to provide accurate, real-time waveform analysis, has encouraged acceptance across diverse industries.

Of all the segments, analog oscilloscope holds the highest CAGR of 10.97% in the global market. The growth of analog segment is mainly due to the rising demand in niche industrial maintenance applications and the increasing adoption in developing markets, where affordability and ease of use make analog models a practical choice for basic signal testing and educational purposes.

By Form Factor

Benchtop Segment Dominates Market Owing to It Being a Standard for Labs, R&D, and Industrial Testing

Based on form factor, the market is divided into benchtop, portable, and PC-based.

The benchtop segment dominates with a market share of 40.02% in 2026. The segment continues to generate the major revenue as it being the standard choice for laboratories, research and development centers, and industrial testing environments. Benchtop models offer superior performance, extensive measurement capabilities, and high precision, making them indispensable in professional and high-end testing applications.

PC-based equipment has the highest CAGR of 10.30% in the global market. The growth of the segment is mainly due to cost-effectiveness, compact design, and advanced software-centered functions. Its designs make the remote access to equipment easy and portable for a modern testing environment, which gives the user advanced analytics and less reliance on physical equipment, thus promoting working efficiency and flexibility for diverse applications.

By Bandwidth

Broad Adoption in Mainstream Electronics Augments the 500 MHz - 1 GHz Segment Growth

Based on the bandwidth, the market is divided into less than 500 MHz, 500 MHz - 1 GHz, 1 GHz - 4 GHz, and more than 4 GHz.

The bandwidth ranges of 500 MHz-1 GHz accounted for the largest oscilloscope market share at 34.85% in 2026. This range continue to generate the highest revenues due to its suitability for a broad spectrum of mainstream electronics and communications testing, offering optimal performance for common R&D, troubleshooting, and signal analysis applications.

More than 4 GHz represent the largest CAGR at 11.72% in the global market. This segment is growing faster primarily due to the increasing adoption of advanced applications in 5G technology, aerospace testing, and high-speed computing systems, which demand superior signal analysis, higher accuracy, and enhanced measurement capabilities for complex electronic environments.

By Industry

Heavy Use in EV, ADAS, and Embedded System Testing Augments Automotive and Transportation Segment Growth

Based on the industry, the market is divided into automotive and transportation, IT and telecommunications, consumer electronics, aerospace and defense, medical and life sciences, and others (education and research, etc.)).

The automotive and transportation sector holds a dominant share in the market due to its extensive use in advanced testing applications. Oscilloscopes play a crucial role in electric vehicle (EV) development, advanced driver-assistance systems (ADAS), and embedded system testing. Their precise signal analysis capabilities ensure performance optimization, safety validation, and reliability across complex automotive electronics.

The aerospace and defense segment of the market is experiencing significant growth, driven by the rising need for precise signal analysis in advanced radar, satellite, and communication systems. High-performance oscilloscopes enable accurate testing, monitoring, and troubleshooting of complex electronic systems, ensuring superior reliability, security, and operational efficiency across critical aerospace and defense applications.

To know how our report can help streamline your business, Speak to Analyst

OSCILLOSCOPE MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

The value of North America market was of USD 0.78 billion in 2025 and USD 0.85 billion in 2026. The North America region demonstrates the highest CAGR at 8.97%, due to increase demand for high-performance oscilloscopes of above 4 GHz for applications of advanced communication, radar and semiconductor testing. The U.S. leads the North America market, reporting expected revenue at USD 91.56 billion in 2025.This growth is attributable to the growing demand for high-precision measurement tools in rapidly expanding sectors such as EVs and 5G network infrastructure, as well as in medical technology and the semiconductor industry. The U.S. market is projected to reach USD 0.62 billion by 2026.

Europe

The Europe market is substantially growing with a market value of USD 0.5 billion due to the focus on automotive innovation and industrial automation. The growth of electric vehicles, along with strict regulatory standards, warrants high-precision testing tools. Together with an established drive for manufacturing, these factors play a part in the region becoming progressively important in the market. U.K., Germany, and France are some of the leading contributors to the growth in the market, with the required revenue stake of USD 0.09 billion USD 0.13 billion, and USD 0.06 billion respectively by 2025. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

Asia Pacific

Asia Pacific Oscilloscope Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is currently at the forefront of the global market. The market size was valued at USD 1.1 billion in 2025. This leadership is attributed to the rapid scaling of electronics manufacturing, widespread 5G deployment, and increasing adoption of EV and ADAS testing applications. India and China are major contributors to the market growth with an expected revenue share of USD 0.16 billion, and USD 0.43 billion respectively by 2026. The Japan market is projected to reach USD 0.26 billion by 2026

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 0.19 billion and USD 0.2 billion respectively in 2026 due to growing adoption in industrial automation, electronics testing, and education sectors. GCC countries are predicted to have a market share of USD 0.08 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Players Focus On Partnerships and Acquisitions to Lead the Industry

The global market is highly competitive with major players providing the system to the national and international markets. The leading players in the market involve major electronics, test and measurement equipment manufacturers which serve globally and offer a wider array of products. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in oscilloscope market. Key players in the oscilloscope industry include Tektronix Inc., Yokogawa Test & Measurement Corporation, Pico Technology Ltd., Rohde & Schwarz GmbH & CoKG, Keysight Technologies, and Teledyne LeCroy.

LIST OF KEY OSCILLOSCOPE COMPANIES PROFILED:

- Tektronix Inc. (U.S.)

- Yokogawa Test & Measurement Corporation (Japan)

- Pico Technology Ltd. (U.K.)

- Rohde & Schwarz GmbH & CoKG (Germany)

- Keysight Technologies (U.S.)

- Teledyne LeCroy (U.S.)

- National Instruments Corporation (U.S.)

- Good Will Instrument Co. Ltd (Taiwan)

- Digimess Instruments (Brazil)

- Fluke Corporation (U.S.)

- Gratten Technologies (China)

- Scientech Technologies Pvt. Ltd. (India)

- B&K Precision Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2025- Tektronix announced its new 7 Series digital phosphor oscilloscope (DPO), the company’s first fresh high-performance platform. The 7 Series offers bandwidths ranging from 8 GHz to 25 GHz, with a 10-bit ADC sampling at 125 GS/s across all four channels.

- November 2024- Rohde & Schwarz has updated its portfolio with an entry level oscilloscope, the R&S RTB 2. It replaces the popular R&S RTB2000 oscilloscope and offers additional features and enhanced performance in a new color scheme.

- June 2023- Keysight Technologies jointly alongside Infiniium 9000 Series oscilloscopes introduced a software update that aims to enhance the performance of the scope completely, as well as signal integrity and usability-friendly GUIs that will help achieve objectives for quick and accurate data. Aligning this product with its vision of delivering the best precision tests by improving measurement functionalities requires all challenges to be overcome with professional support while including all updates for performance.

- May 2023- Acute Technology showcased TravelScope 3000 as a 4-channel DSO. Coming with a bandwidth of 200 MHz, and a sampling rate of 1 GS/s, this portable scope looks forward to meeting maintenance engineers' and technicians' requirements for high-performance diagnostics in a challenging environment.

- May 2023- The release of a new firmware for the 6 Series B MSO mixed signal oscilloscope by Tektronix. Recognizing that significant upgrades to measurement accuracy and increased test coverage would be necessary for such features to be employed effectively, this firmware upgrade marks Tektronix’s continuing concern for constant product enhancement.

- April 2021- Teledyne LeCroy has launched its next generation of oscilloscope, integrating a waveform generator and spectrum analyser. The HDO6000B Series follows the trend of instrument integration with larger interfaces for IoT, embedded and mobile computing. The oscilloscope is based around the HD4096 ASIC that combines 12bit ADCs, high Signal to Noise amplifiers and low noise system architecture.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the oscilloscope market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTES | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 7.6% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

| By Product Type |

|

| By Form Factor |

|

| By Bandwidth |

|

| By Industry |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.68 billion in 2025 and is projected to reach USD 5.15 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 7.6% during the forecast period.

5G rollouts, telecom infrastructure expansion, and high-speed digital design is speeding up the market growth.

Tektronix Inc., Yokogawa Test & Measurement Corporation, Pico Technology Ltd., Rohde & Schwarz GmbH & CoKG, Keysight Technologies, and Teledyne LeCroy are some of the top players in the market.

The Asia Pacific region held the largest market share.

Asia Pacific was valued at USD 1.1 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us