Packaging Automation Market Size, Share & Industry Analysis, By Type (Packaging Robots, Secondary Packaging Automation, Automated Conveyor and Sorting Systems, and Tertiary and Palletizing Automation), By Function (Filling, Labelling, Bagging, Palletizing, Capping, and Others), By End-use Industry (Food & Beverage, Healthcare, Personal Care & Cosmetics, Electrical & Electronics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

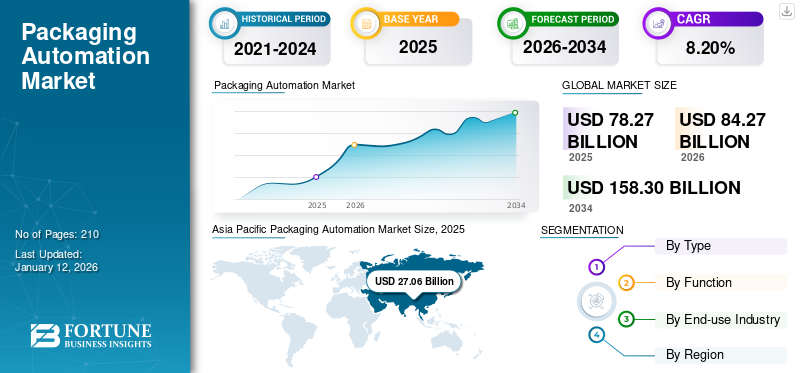

The global packaging automation market size was valued at USD 78.26 billion in 2025. It is projected to be worth USD 84.27 billion in 2026 and reach USD 158.30 billion by 2034, exhibiting a CAGR of 8.20% during the forecast period. Asia Pacific dominated the packaging automation market with a market share of 31.81% in 2025.

Packaging automation refers to employing machinery and technology to mechanize the packaging process. It may encompass various activities, including filling, sealing, labeling, and palletizing. The market is witnessing a shift toward more flexible, efficient, and sustainable solutions. The growing use of robotics, AI, and IoT is enabling smarter packaging lines, while the increasing demand for eco-friendly and personalized packaging drives the market growth.

BEUMER Group GmbH & Co. and Rockwell Automation are the leading manufacturers, accounting for the largest share.

GLOBAL PACKAGING AUTOMATION MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 78.26 billion

- 2026 Market Size: USD 84.27 billion

- 2034 Forecast Market Size: USD 158.30 billion

- CAGR: 8.20% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 31.81% share, rising from USD 24.89 billion in 2025 to USD 27.06 billion in 2026.

- By type, packaging robots dominated due to their accuracy, speed, and ability to handle complex packaging tasks.

- By function, filling was the largest segment as automated fillers ensured uniformity and eliminated discrepancies.

- By end-use, food & beverage led the market with a 32.95% share in 2024, driven by hygiene and sustainability demands.

- Leading manufacturers included BEUMER Group GmbH & Co. and Rockwell Automation.

Key Country Highlights:

- China: Highest robot deployment in Asia Pacific; over 1 million robots across Asia, with China holding 33.7% in 2022, boosting automation in packaging.

- United States: Strong demand from non-automotive sectors (56% of robotic orders in 2024), especially life sciences and food sectors.

- Germany: Major installations of industrial robots in automotive, plastics, and chemical sectors support market growth.

- Brazil: Government-led “AI for the Good of All” plan projects USD 4 billion investment by 2028, fueling automation integration.

- South Africa: Retail food sales at USD 39 billion in 2023 increase demand for automated packaging, especially in the food sector.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Expansion of E-commerce Sector Drives Market Growth

The rapid expansion of e-commerce has created a need for faster and more efficient packaging solutions. Automated packaging solutions can improve packing speeds and reduce labor costs, making them an attractive investment for e-commerce companies. The growth of e-commerce is a driving force behind the adoption of automation packaging. Companies are increasingly seeking automated solutions to handle high volumes of small, variable packages.

Automated systems that can quickly adapt to different sizes, shapes, and packaging materials are essential for meeting the diverse needs of e-commerce orders. There is also a growing focus on packaging systems that reduce the need for excessive materials, streamline order fulfillment, and minimize packaging waste for online shipments.

Significant Benefits Offered by the Automated Packaging Systems Enhances Market Growth

Automation guarantees that every packaged product meets set specifications, significantly decreasing inconsistencies such as misalignments or labeling problems. This results in fewer recalls and decreased waste from packaging mistakes. Digital integration provides stakeholders with a comprehensive perspective of the packaging process. By using real-time monitoring, bottlenecks can be detected, foresee issues can be detected, and workflows can be optimized. This results in faster adaptations and more flexible responses to any issues that may emerge.

Global supply chains are becoming increasingly complex, creating a growing need for packaging systems that can optimize both production and shipping processes. Automation improves packaging consistency, reduces human errors, and speeds up the overall production process, thus improving supply chain efficiency. The packaging automation market offers a wealth of opportunities across industries, driven by the need for efficiency, cost reduction, sustainability, and technological advancements. Henceforth, the potential benefits offered by the automated packaging systems drives global packaging automation market growth.

MARKET RESTRAINTS

High Initial Investment Costs and Integration with Existing Systems to Hinder Market Growth

One of the primary restraining factors for businesses, especially small and medium-sized enterprises (SMEs), is the significant initial capital investment required for implementing packaging automation systems. The costs associated with purchasing automated machinery, software, installation, and training can be prohibitive for some companies. Integrating new automated packaging systems into existing production lines can be complex, especially in industries with legacy systems. Ensuring that the new automation technology works seamlessly with current machinery, software, and workflows requires significant planning and potential customization.

MARKET OPPORTUNITIES

Introduction of End-of-Line Automation, Smart Packaging, and Tracking Technologies to Offer Growth Opportunities

The automation of end-of-line packaging processes, such as carton erecting, filling, sealing, and palletizing, is gaining momentum. These processes benefit significantly from automation, as they are often labor-intensive and time-consuming. Automated end-of-line solutions can improve throughput, reduce errors, and enhance safety, making them a key focus for companies looking to optimize their production lines. Smart packaging technologies are integrating sensors, RFID tags, and QR codes into packaging systems, enabling real-time tracking of products throughout the supply chain. It enhances product traceability, improves inventory management, and allows for better consumer engagement through product information and authenticity checks, creating additional offering growth opportunities.

MARKET CHALLENGES

Regulatory and Compliance Issues Challenges Market Growth

The packaging automation market, despite its growth and potential, faces several challenges that companies must navigate to fully realize the benefits of automation. Different industries, such as food, pharmaceuticals, and chemicals, have stringent packaging regulations. As these regulations evolve, automated packaging systems must be adapted to comply with new requirements, which can incur additional costs and delays. Automation systems must meet strict quality control standards, particularly in industries such as pharmaceuticals, where product safety and traceability are paramount. Ensuring that automated systems consistently maintain these standards can be challenging, thus impacting market growth.

Download Free sample to learn more about this report.

PACKAGING AUTOMATION MARKET TRENDS

Increased Use of Robotics, AI, and IoT Integration Emerges as a Key Trend

The use of robotics in packaging is expanding, particularly in tasks such as pick-and-place, palletizing, and sorting. Robots offer precision, speed, and the ability to handle complex packaging tasks efficiently. AI-driven systems are becoming more common in packaging lines, enabling predictive maintenance, quality control, and intelligent decision-making. These systems can optimize the packaging process in real time monitoring, adjusting based on variables such as product type and packaging size.

- Asia Pacific witnessed a packaging automation market growth from USD 24.89 billion in 2025 to USD 27.06 billion in 2026.

The integration of Internet of Things (IoT) technology into packaging automation systems is facilitating real-time monitoring, data analysis, and predictive maintenance. It thus enhances efficiency and reduces downtime by providing insights into machinery performance, inventory levels, and packaging operations, and emerges as a major market trend.

IMPACT OF COVID-19 ON THE MARKET

The COVID-19 pandmeic affected several end-use sectors globally. The automation industries faced several challenges, such as extended/ longer lead times from manufacturers, shortages of raw materials, a lack of engineers to meet demand, canceled orders due to the inability to keep up with demand, and difficulties in the transportation of parts, all of which hampered market growth.

SEGMENTATION ANALYSIS

By Type

Packaging Robots Segment Leads due to its Benefits

Based on the type, the market is segmented into packaging robots, secondary packaging automation, automated conveyor and sorting systems, and tertiary and palletizing automation.

Packaging robots are the dominant type segment in the global packaging automation market share. Automated packaging systems can help alleviate these challenges by replacing manual labor with more efficient, cost-effective robotic solutions. Packaging robots provide accuracy, speed, and the capability to handle difficult packaging tasks efficiently, thus contributing to the growth of the segment. The segment led the market with a share of 48% in 2024.

Secondary packaging automation is the second-dominating segment and will experience steady growth in the coming years. It assists companies in enhancing productivity, lowering expenses, and boosting quality. It can also assist companies in fulfilling the requirements of a competitive market, further enhancing the segment’s growth.

By Function

Automatic Filling Segment Leads due to its Ability to Eliminate Discrepancies

Based on function, the market is categorized into filling, labelling, bagging, palletizing, capping, and others.

Filling is the dominant function segment and is likely to grow massively during the projected years. Automatic filling machines enable a dependable, repeatable, and uniform filling process, regardless of whether a film is determined by produce level, volume, weight, or another similar metric. Automated fillers eliminate discrepancies and reduce ambiguity in the filling process. The segment led the market with a share of 32% in 2025.

Bagging is the second-leading function segment and is estimated to witness significant growth during the forecasted period. Automatic bagging machines are designed to manage rapid packaging with limited human involvement. By automating the bagging process, producers can witness a substantial decrease in manufacturing time. This segment is likely to grow with a substantial CAGR of 8.31% during the forecast period (2025-2032).

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Food and Beverage Segment Dominates due to Rising Need for Packaging Systems

Based on end-use industry, the market is classified into food & beverage, healthcare, personal care & cosmetics, electrical & electronics, and others.

The food and beverage is the dominating end-use industry segment. Automation solutions that ensure hygiene, minimize human contact, and maintain high-speed production lines are critical in this industry. Additionally, there is a growing need for packaging systems that cater to portion control, preservation, and eco-friendly packaging. Robotics used in the packaging industry helps remove numerous safety hazards linked to manual food packaging, thus contributing to segment growth. The segment is likely to capture 33% of the market share in 2025.

The healthcare segment is a rapidly growing in the market. Automated packaging machines that manufacture unit-dose or multi-dose pharmaceutical packs allow touch-free service, social distancing capabilities, efficiency, and improved patient adherence, thus driving the segment’s growth. This segment is anticipated to register a considerable CAGR of 8.29% during the forecast period. (2025-2032).

PACKAGING AUTOMATION MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific

Asia Pacific Packaging Automation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Introduction of Robotisation Boosts Market Growth in Asia Pacific

Asia Pacific held the dominant share of the global packaging automation market with a valuation of USD 24.89 billion in 2025 and USD 27.06 billion in 2026. China is estimated to acquire USD 8.45 billion in 2026. The robotization of the Chinese industries peaked in the previous decade, with a mass introduction of robots in production.

- According to the Bruegel Organization, in 2022, more than 1 million robots are located in the Asian markets (including China), with China having 33.7% of them. Moreover, the annual growth rate in the number of industrial robots is particularly high in China.

India is predicted to be valued at USD 7.34 billion in 2026, while Japan is projected to be worth USD 5.12 billion in the same year.

North America

Increasing Demand for Automation Systems in Varied Industries Drives Market Growth

North America is the second-dominating region and is expected to be valued at USD 30.92 billion in 2026, exhibiting a CAGR of 8.14% during the forecast period (2026-2034). Rapidly growing demand for automation systems from varied end-use sectors contributes to market growth in the region.

- According to the Association for Advancing Automation, in 2024, major demand was driven by non-automotive industries, which made up 56% of orders, while automotive customers represented 44%. The automotive-specific sector exhibited varied outcomes, with automotive component orders rising by 61%, whereas automotive OEM orders declined by 15%. A robust performance was demonstrated earlier in the same year in emerging robotics sectors, which included Life Sciences/Pharma/Biomed (+35%) and Food & Consumer Goods (+13%).

In the U.S., trends in packaging automation are influenced by the demand for greater efficiency, lower costs, and enhanced quality, with robotics, AI, and Industry 4.0 technologies being essential contributors. The U.S. market is set to expand with a valuation of USD 16.49 billion in 2026.

Europe

Rising Installation of Automated Robots Enhances Market Growth

Europe region is the third-largest contributor to the market expected to hit USD 17.55 billion in 2026. The increasing annual installations of industrial robots by several end-use industries is driving the growth of the automated packaging industry in Europe. The U.K. market is estimated to be worth USD 3.23 billion in 2026. Germany is analyzed to record a major installation of automated robots, thus favoring market growth.

- According to The International Federation of Robotics, in 2022, Germany majorly installed industrial robots in the automotive sector, followed by metal, machinery, plastic, and chemical products.

Germany is predicted to reach USD 3.23 billion in 2026, while France is set to grow with a valuation of USD 2.59 billion in the same year.

Latin America

Advances in Automation and Robotics Research Drives Market Growth

Latin Americ is set to reach a market value of USD 11.18 billion in 2026. The region will experience steady growth in the projected period. Several industrial associations are investigating ways to incorporate AI into logistics, predictive maintenance, and process automation. Innovations powered by AI can eliminate inefficiencies in intricate supply chains, alleviate traffic congestion in large megacities, and improve competitiveness in manufacturing.

- According to the International Trade Administration, In July 2024, Brazil initiated the “AI for the Good of All” National AI Plan (PBIA), which anticipates investments around USD 4 billion by 2028. The strategy outlines a framework for upcoming public policies regarding AI and will direct efforts on technology regulation, aimed at fostering inclusive and sustainable growth.

Middle East & Africa

Growing Food Sales Propels Market Growth in Middle East & Africa

Middle East region will foresee significant growth during the projected period. Rapidly growing retail food sales in major countries of the region drive the demand for automated systems for food packaging.

- According to the USDA Foreign Agricultural Service, Retail food sales in South Africa reached a total of USD 39 billion in 2023. In 2023, South Africa imported consumer-oriented agricultural goods to the tune of USD 3.2 billion. In South Africa, retail trade sales account for over 20% of the country's GDP.

Saudi Arabia is likely to attain USD 2.44 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global packaging automation market report is highly fragmented and competitive, with significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The key developments by the manufacturers will offer growth opportunities.

Major players in the industry include BEUMER Group GmbH & Co., Rockwell Automation, Mitsubishi Electric Corp., Sealed Air, WestRock, Siemens AG, and others. Other companies operating in the market are focused on analyzing market trends and delivering advanced packaging solutions.

List of the Key Companies Profiled in the Report

- BEUMER Group GmbH & Co. (Germany)

- Rockwell Automation (U.S.)

- Mitsubishi Electric Corp. (Japan)

- Sealed Air (U.S.)

- WestRock (U.S.)

- Siemens AG (Germany)

- Swisslog Holding AG (Switzerland)

- SATO Holdings (Japan)

- Kollmorgen Corporation (U.S.)

- Ranpack (U.S.)

- ABB Ltd (Switzerland)

- Schneider Packaging Equipment (U.S.)

- Emerson Electric Co. (U.S.)

- Multivac Group (Germany)

- ULMA Packaging (Spain)

KEY INDUSTRY DEVELOPMENTS

- September 2022- A U.S.-based paper packaging firm, Ranpak, introduced its latest automated packaging solution, Cut’it! Evo. The device increases packaging production, lowers operational expenses, and improves sustainability for clients’ processes.

- September 2022- Mondi, a worldwide leader in packaging and paper, partnered with Heiber + Schröder to introduce a rapid automated packaging machine. The machine satisfies all the efficiency, process, and safety standards of e-commerce activities. It is capable of handling as many as 500 parcels per hour due to its automated erecting, filling, and sealing functions.

- July 2022- Ranpak Holdings Corporation, a global leader in environmentally sustainable, paper-based packaging solutions for e-commerce and industrial supply chains, announced the global launch of the Flap’it! Solution: a highly efficient machine that automates the packing of a variety of small products.

- June 2022- MULTIVAC introduced the W 500, a versatile flow packaging solution that the offers enhanced flexibility and production for packing food items in pillow packs while accommodating the use of eco-friendly film and paper materials. The company states that bakery items such as baguettes, croissants, and pizzas, along with various types of fruits and vegetables, can also be securely packaged in pillow packs using the flow packer.

- May 2022- ULMA Packaging revealed the TSA 400, a newly designed compact tray sealer, during IFFA 2022. The TSA 400 is engineered to be a multifunctional machine capable of operating efficiently in SKIN, MAP, LEAFSKINTM, and LEAFMAPTM uses. The tray sealer features a compact design and a rapid output of only 2.3 meters, which is important for confined spaces.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The packaging automation market will witness astonishing growth with the growing collaborations, mergers, and investments. These initiatives helps in increasing the importance of automation in packaging sector. In January 2023, Emerson revealed a definitive agreement in which Emerson will purchase NI for USD 60 per share in cash, totaling an equity value of USD 8.2 billion. The acquisition delivers improved automation features and growth opportunities across various high-growth discrete end markets.

REPORT COVERAGE

The packaging automation market research report provides detailed market insights, providing key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Function

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 84.27 billion in 2026.

The market is likely to grow at a CAGR of 8.20% over the forecast period.

By end-use industry, the food and beverages segment leads the market.

The market size of Asia Pacific stood at USD 27.06 billion in 2026.

The key market drivers are the increasing expansion of the e-commerce sector and the significant benefits offered by automated packaging systems.

Some of the top players in the market are BEUMER Group GmbH & Co., Rockwell Automation, Mitsubishi Electric Corp., Sealed Air, WestRock, Siemens AG, and others.

The global market size is expected to reach USD 158.30 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us