Packaging Waste Management Market Size, Share & Industry Analysis, By Waste Type (Plastic, Paper & Paperboard, Metal, Glass, and Wood), By Service Type (Collection, Transportation, Disposal, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

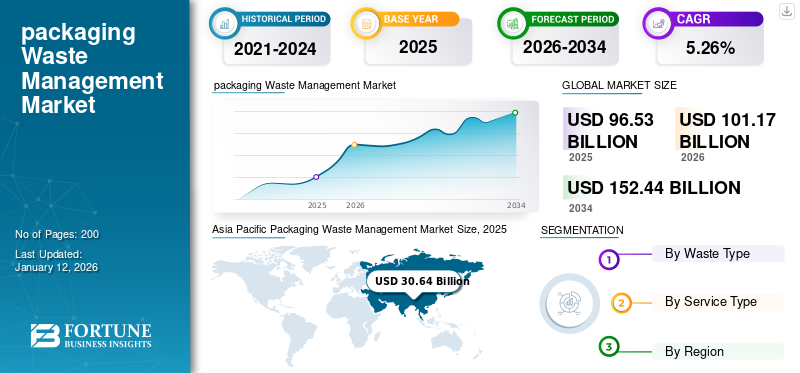

The global packaging waste management market size was valued at USD 96.53 billion in 2025 and is projected to be worth USD 101.17 billion in 2026 and reach USD 152.44 billion by 2034, exhibiting a CAGR of 5.26% during the forecast period. Asia Pacific dominated the packaging waste management market with a market share of 31.74% in 2025.

Packaging waste management is the process of reducing, reusing, and recycling packaging waste. It helps to reduce environmental impact and conserve resources. According to the Organization for Economic Co-operation and Development, global plastic waste production doubled from 2000 to 2019, reaching 353 million tonnes. Almost two-thirds of plastic waste originates from plastics production that lasts less than five years, with 40% arising from packaging, 12% from consumer products, and 11% from apparel and textiles.

The management of packaging waste is a dynamic field, influenced by shifts in environmental regulations, technological innovations, and movement toward a circular economy. Companies that keep up with these trends and adopt sustainable waste management practices are strategically positioned for long-term success, thus driving the market growth.

Waste Mission and BEWI are the leading manufacturers, accounting for the largest global market share.

Global Packaging Waste Management Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 96.53 billion

- 2026 Market Size: USD 101.17 billion

- 2034 Forecast Market Size: USD 152.44 billion

- CAGR: 5.26% during the forecast period (2026–2034)

Market Share:

- Asia Pacific dominated the packaging waste management market with a 31.74% market share in 2025.

Regional Insights

- Asia Pacific: Largest market; India and China major plastic waste contributors, fueling demand for waste management.

- North America: Strong recycling initiatives and government investments boost market growth.

- Europe: Increasing recycled packaging waste and policies like the Plastic Packaging Tax drive market expansion.

- Latin America: Growth fueled by rising single-use plastic waste and increasing awareness.

- Middle East & Africa: Increasing solid waste and growing consumer environmental awareness create market demand.

MARKET DYNAMICS

MARKET DRIVERS

Rising Environmental Awareness and Sustainability Initiative Drives Market Growth

Growing awareness about the environmental impact of packaging waste is one of the main drivers, propelling market growth. Packaging waste contributes significantly to pollution, especially plastics, which take centuries to decompose. As consumers and businesses become more environmentally conscious, there's increasing pressure to reduce packaging waste. Public concern regarding climate change and resource depletion is pushing governments, industries, and NGOs to seek more sustainable alternatives.

Governments worldwide are implementing stringent regulations to reduce packaging waste, including plastic ban, extended producer responsibility (EPR) policies, and the implementation of recycling targets. The European Union, for instance, has set ambitious recycling goals, with many countries introducing legislation to curb single use plastics and promote reusable and recyclable packaging. Henceforth, increasing environmental awareness and sustainability initiatives are studied to drive the global packaging waste management market growth.

Growing E-commerce Demand & Focus on Corporate Social Responsibility (CSR) & Brand Image Propels Market Growth

The surge in online shopping has led to a significant increase in packaging waste, as products need to be packaged and shipped. E-commerce companies are finding ways to reduce waste generation through packaging, and this is fueling the demand for sustainable and efficient packaging waste management solutions. Companies are under pressure to meet sustainability goals set by their stakeholders, which includes reducing waste, adopting circular economy models, and using eco-friendly materials. This trend is leading many companies to adopt more sustainable packaging practices, such as using recyclable, compostable, or biodegradable materials. Major brands are incorporating waste reduction initiatives into their sustainability strategies to enhance their reputation and attract eco-conscious consumers.

MARKET RESTRAINTS

Inadequate Recycling Infrastructure & Economic and Cost Barriers Obstructs Market Growth

One of the major factors hampering the packaging waste management industry is the absence of adequate recycling infrastructure, particularly for the effective sorting of waste. Packaging waste often consists of multiple materials (plastics, metals, paper, etc.), and if not sorted correctly, it can lead to contamination. Contaminated waste is much harder to recycle, which reduces the overall efficiency of recycling programs. Sustainable packaging alternatives, such as biodegradable or recyclable materials, often cost more than traditional plastic packaging. For manufacturers, the higher upfront cost can be deterrent, especially when they are trying to remain competitive in price-sensitive markets. Thus, the inadequate recycling infrastructure & economic and cost barriers are analyzed to hamper the market growth.

MARKET OPPORTUNITIES

Shift Towards a Circular Economy Will Generate Growth Opportunities

The shift towards a circular economy offers significant opportunities for packaging waste management. Reusing materials, designing for recyclability, and creating closed-loop systems for packaging materials can reduce the overall waste generated. Companies that invest in sustainable design, recycling infrastructure, and packaging innovation can gain a competitive edge in the market. In addition, innovations in recycling technologies provide new opportunities for managing packaging waste. For instance, the development of advanced recycling technologies like chemical recycling and biodegradable polymers is allowing packaging materials to be recycled more efficiently. Investment in recycling infrastructure, including improved sorting, processing, and recycling capabilities, is creating growth potential for waste management companies.

MARKET CHALLENGES

Regulatory and Compliance Issues & Environmental Impact of Waste-to-Energy (WTE) System Challenges to the Market Growth

Different regions and countries have their own regulatory frameworks for managing packaging waste. The lack of a unified global approach to packaging waste management complicates the recycling processes, especially for multinational companies trying to comply with diverse regulations. For instance, packaging waste policies may differ significantly between Europe, U.S , and emerging markets. While WTE systems that convert packaging waste into energy can reduce landfill use, they also contribute to emissions and air pollution. The combustion of packaging materials can release harmful gases and particulate matter into the atmosphere, which undermines some of the environmental benefits of waste-to-energy technologies. Such factors challenge the market growth.

Download Free sample to learn more about this report.

PACKAGING WASTE MANAGEMENT MARKET TRENDS

Shift Toward Zero-Waste & Closed-Loop Packaging Systems Emerges as a Key Trend

A significant trend is the move towards closed-loop packaging systems, where packaging materials are reused, recycled, and kept within a circular supply chain. This reduces the need for virgin raw materials and decreases packaging waste. Companies like Coca-Cola and Unilever are exploring ways to incorporate reusable packaging or deposit-return systems to make packaging waste management more sustainable. The zero-waste movement is gaining momentum in the packaging industry. Companies are increasingly working to eliminate packaging waste, focusing on reducing, reusing, and recycling materials in an incorporated manner. Zero-waste stores and businesses that offer refills and reusable packaging are becoming more popular.

IMPACT OF COVID-19

The COVID-19 pandemic significantly affected waste management systems due to a sharp increase in waste, predominantly, medical waste. This rise in waste was challenging for existing waste management systems to manage. Although proper waste management is essential for health and safety, it became even more crucial during pandemics to ensure that potentially infectious materials are disposed of securely to avoid further virus transmission.

SEGMENTATION ANALYSIS

By Waste Type

Paper & paperboard Segment’s Dominance is Due to Its Usage in Various End-Use Industries

Based on the waste type, the market is segmented into plastic, paper & paperboard, metal, glass, and wood.

Paper & paperboard is the dominant waste type segment and has been analyzed to witness massive growth during the forecast period. Paper and paperboard waste is a noteworthy source of secondary raw materials such as glass, wood, and plastics. The material is used as a secondary source by various end-use industries, owing to which waste is generated on a large scale. The segment held 33.50% of the market share in 2026.

- According to the European Union, paper and cardboard were the main packaging waste materials in Europe (34.0 million tonnes in 2022), followed by plastic (16.1 million tonnes).

Plastic is the second-dominating waste type segment and is expected to grow rapidly in the coming years. Plastic packaging is extremely wasteful and impacts the earth's ecosystems, on which everyone is dependent, leading to waste disposal. According to the European Union, plastic is the second packaging waste material (16.1 million tonnes).

To know how our report can help streamline your business, Speak to Analyst

By Service Type

Collection Segment is a Major Step for Waste Management, Which Further Drives its Growth

Based on service type, the market is segmented into collection, transportation, disposal, and others.

Collection held the largest packaging waste management market share in the service type segment. Collecting waste through source separation collection systems is an essential part of increasing resource efficiency, meeting recycling goals, and fostering a circular economy. Waste collection reduces the need for new raw materials, which can lead to deforestation and mining. Enhancing the effectiveness of waste collection systems (WCS) to redirect more recyclable materials to the correct material recovery facility (MRF) instead of disposal is a key sustainability challenge and the obvious first step toward achieving recycling targets. Waste collection reduces the amount of waste that ends up in landfills and incinerators. The segment is set to capture 41.63% of the market share in 2026.

The transportation service type is the second most dominant segment and will grow rapidly soon. By efficiently transporting waste to appropriate facilities, it minimizes the risk of pollution from improper disposal, including land and water contamination. The segment is likely to grow with a considerable CAGR of 3.48% during the forecast period (2025-2032).

PACKAGING WASTE MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Packaging Waste Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rising Plastic Waste in Major Countries Propels the Market Growth in Asia Pacific

Asia Pacific is the dominated the global packaging waste management market with a valuation of USD 30.64 billion in 2025 and USD 32.41 billion in 2026. Major countries in the Asia Pacific region, like India and China, generate plastic waste on a large scale. India is one of the world's largest contributors to plastic pollution. The rising plastic waste in the countries thus boosts the need for proper waste management, thus boosting the market growth. China is estimated to be valued at USD 10.55 billion in 2026.

- According to the Plastic for Change Organization, India has emerged as the leading contributor to plastic pollution globally, responsible for almost 20% of the worldwide plastic waste. India produces 9.3 million tonnes of plastic waste each year, making its share of this environmental disaster greater than that of whole regions.

India is set to grow wit a valuation of USD 8.73 billion in 2026, while Japan is expected to be valued at USD 6.06 billion in the same year.

North America

Rising Recycling Initiatives and Investments Drive the North American Market Growth

North America is the second-dominating region of the packaging waste management market, expected to hold USD 25.07 billion in 2026, exhibiting a CAGR of 5.26% during the forecast period (2026-2034). Many agencies, organizations, and businesses have increased their focus on recycling initiatives and investments, whichis enhancing the market growth in the North American region. The U.S. market is predicted to grow with a valuation of USD 19.76 billion in 2026.

- In 2021, the U.S. Environmental Protection Agency rolled out the National Recycling Strategy, aimed at enhancing recycling infrastructure and minimizing contamination in recycled items. This program advocates for advancements in waste separation and recycling technology, with a goal of recycling 50 million tons of waste each year by 2025. In 2023, the EPA invested more than USD 400 million in grants to local governments to enhance recycling rates processes and waste collection efficiency.

Europe

Increase in Recycled Packaging Waste Boosts Market Growth in Europe

Europe is the third-largest contributor to the packaging waste management market anticipated to be valued at USD 20.26 billion in 2026. Recycled packaging waste is being reprocessed and reused from materials like paper, plastic, glass, and metal, and increasing rapidly in European countries. The U.K. market is likely to reach a market value of USD 3.91 billion in 2026. Recycled packaging utilizes reusable materials but isn't recyclable itself, owing to which the waste management process is becoming essential in the region. The initiatives to reduce the use of recycled plastic also add to the market growth.

- According to the European Union, the volume of packaging waste produced per person in 2022 fell by 1.9%. The recovered packaging waste also fell by 1.4%, while the recycling of packaging waste saw a small rise of 0.3%. From 2011 to 2022, the quantity of packaging waste produced per person rose significantly by 18.7%. The volumes of packaging waste that were recovered and recycled increased even more significantly, by 20.1% and 20.7%, respectively.

- The Plastic Packaging Tax, introduced in April 2022, continues to affect companies that utilize plastic packaging. The tax targets packaging with under 30% recycled plastic, encouraging companies to reconsider their packaging materials and approaches.

Germany is projected to be worth USD 4.47 billion in 2026, while France is expected to reach USD 2.99 billion in 2025.

Latin America

Rise in Single-use Plastic Wastage Enhances Market Growth in Latin America

Latin America is the fourth largest market set to reach a value of USD 14.55 billion in 2026. The region will experience steady growth in the projected period. This region is experiencing a rapid rise in single-use wastage. The augmenting demand for packaging waste managing systems from major countries thus boosts the market growth.

- According to the Green Initiative Organization, Brazil generates approximately 11.3 million tonnes of plastic waste annually, making it the fourth-largest producer of plastic waste globally. The country produces about 500 billion single-use plastic items each year, with 87% being packaging material.

Middle East & Africa

Increasing Solid Waste and Consumer Awareness Fosters Market Growth in the Middle East & Africa

The Middle East & African market is expected to grow significantly. There is an urgent need for enhanced recycling initiatives, improved waste management infrastructure, and stricter regulations to address packaging waste in the Middle East & Africa. The region faces significant challenges in managing packaging waste, particularly plastics, due to the increase in solid waste. The consumers are highly concerned about the waste, thus boosting the need for proper waste management. Saudi Arabia is anticipated to reach USD 3.07 billion in 2025.

- According to the KAPSARC Organization, Saudi Arabia generates over 110 million tons of waste annually, with nearly half originating from major cities like Riyadh (21%), Jeddah (14%), and Dammam (8%). Between early 2020 and mid-2021, Saudi Arabia's recycling capacity covered only 5% of its total waste, including plastics, metals, and paper. 64% of Saudi consumers are concerned about environmental pollution and food waste.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global packaging waste management market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Waste Mission, BEWI, Frigorifico Allana Pvt. Ltd., Bayer AG, ITENE, Merivaara Corporation, and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

List of the Key Companies Profiled in the Report:

- Waste Mission (U.K.)

- BEWI (Austria)

- Frigorifico Allana Pvt. Ltd. (Austria)

- Bayer AG (Austria)

- ITENE (Austria)

- Merivaara Corporation (Austria)

- Greenbank Recycling Solutions (U.K.)

- Stevcon Packaging & Logistics Ltd (Austria)

- JBS (Austria)

- WM Intellectual Property Holdings, L.L.C. (U.S.)

- PreZero International (Austria)

- Affordable Waste Management Ltd. (Austria)

- Biffa (U.K.)

- Materials Recovery (U.K.)

- Wanless Waste Management (Australia)

KEY INDUSTRY DEVELOPMENTS

- In December 2024, Bisleri International Pvt. Ltd, in collaboration with Sampurn(e)arth Environment Solutions Pvt. Ltd. and the Mineral Foundation of Goa, launches a Material Recovery Facility (MRF) Center in Harvalem, Goa. The facility is designed to handle 360 MT of plastic waste each year. Bisleri's 'Bottles for Change' program seeks to reduce plastic waste in landfills and foster a cleaner, more sustainable ecosystem in the area. The facility will mostly focus on promoting 100% plastic waste separation at the source, beginning with the Curchorem-Cacora area.

- In October 2024, At the PPMA Show, Waste Mission, a prominent UK waste management firm, introduced its tailor-made Waste Management Portal. This cutting-edge platform is tailored exclusively for contracted clients, allowing them to handle their waste more efficiently and sustainably than ever while keeping them informed about waste streams, compliance, and ESG goals.

- In June 2024, Waste Management, Inc. and Stericycle declared that they had reached a definitive agreement whereby WM purchases the remaining shares of Stericycle for USD 62.00 per share in cash, signifying a total enterprise value of about USD 7.2 billion, accounting for around USD 1.4 billion of Stericycle's net debt. The acquisition of Stericycle represents an important move in furthering this commitment as it expands our range of services, uniting the top player in solid waste with a leading firm in regulated medical waste management.

- In November 2023, In line with America Recycles Day, the U.S. Environmental Protection Agency (EPA) revealed 59 recipients set to receive more than USD 60 million in Solid Waste Infrastructure for Recycling (SWIFR) grants for Tribes and Intertribal Consortia, along with 25 recipients to obtain over USD 33 million in Recycling Education and Outreach (REO) grants. These funds, part of President Biden's Investing in America initiative, a fundamental aspect of Bidenomics, will enhance recycling infrastructure and education for waste management systems nationwide.

- In November 2021, Waste Management announced an investment of USD 200 million in recycling infrastructure in 2022, which will raise the company's total investment in new and improved recycling facilities to over USD 700 million since 2018. As the demand for products containing recycled materials grows, the investment will allow WM to collect more recyclables and enhance recycling accessibility for its clients. In the last two years, WM has launched new materials recovery facilities (MRFs) in Chicago, Salt Lake City, Raleigh, North Carolina, and Sun Valley, California.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In March 2024, Nestlé declared a GBP 7 million investment into a new recycling facility that processes flexible plastics. This initiative offers job training, encourages consumer recycling education, and implements waste collection infrastructure in 11 Brazilian states. Waste collection partnership projects supported by Nestlé in Brazil also empower more than 8,000 recycling professionals.

REPORT COVERAGE

The market research report provides a detailed market analysis. The packaging waste management market overview also focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter's five forces analysis, and leading segments of the product. Besides, the report offers insights into the packaging waste management market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.26% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Waste Type

|

|

By Service Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 101.17 billion in 2026.

The market will likely grow at a CAGR of 5.26% over the forecast period.

The paper and paperboard waste type segment was leading in the market.

The Asia Pacific market size stood at USD 30.64 billion in 2025.

The key market drivers are rising environmental awareness and sustainability initiatives, and growing e-commerce demand & focus on corporate social responsibility (CSR) & brand image.

Some of the top players in the market are Waste Mission, BEWI, Frigorifico Allana Pvt. Ltd., Bayer AG, ITENE, Merivaara Corporation, and others.

The global market size is expected to reach USD 152.44 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us