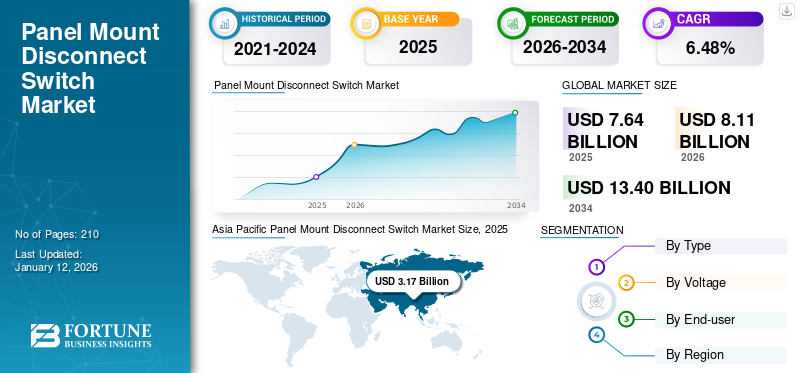

Panel Mount Disconnect Switch Market Size, Share & Industry Analysis, By Type (Fused Disconnect Switch, Non-Fused Disconnect Switch, Rotary Disconnect Switch, and Others), By Voltage (Upto 150 V, 150-300 V, and Above 300 V), By End-user (Utility, Industrial, Commercial, and Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global panel mount disconnect switch market size was valued at USD 7.64 billion in 2025 and market is projected to grow from USD 8.11 billion in 2026 to USD 13.4 billion by 2034, exhibiting a CAGR of 6.48% during the forecast period. Asia Pacific dominated the global market with a share of 41.52% in 2025.

A panel-mounted disconnect switch is a crucial safety device used for quickly disconnecting power to machinery during maintenance or emergencies. Its market spans across various sectors, such as manufacturing, industrial automation, HVAC, and renewable energy systems. The market is driven by an increasing focus on workplace safety regulations, a rising need for dependable and efficient power control solutions, the growth of industrial automation, and the rising adoption of renewable energy sources that necessitate safe disconnection methods.

ABB is the leading player in the market, offering a wide range of panel mount disconnect switches designed to emphasize safety and reliability for industrial applications requiring secure power isolation.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Strict Safety Standards and Increasing Focus on Occupational Safety Drive Market Growth

The increasing focus on workplace safety and the implementation of strict safety regulations in numerous sectors are gaining traction in industrial workplaces. Regulatory voltage agencies, such as OSHA (Occupational Safety and Health Administration) in the U.S. and comparable organizations worldwide, are advocating for improved safety protocols, especially in settings with high-voltage machinery. Disconnect switches are essential for implementing a lockout or tag-out process, guaranteeing that machinery and equipment are powered down prior to any maintenance or repair, thereby avoiding unintended start-ups and electrical component dangers.

- For instance, in September 2023, the European Agency for Safety and Health at Work (EU-OSHA) initiated its "Safe and Healthy Work in the Digital Voltage Campaign." It emphasized the importance of electrical infrastructure safety protocols in workplaces that rely significantly on machinery.

Due to the rising instances of workplace accidents, the need for panel-mount disconnect switches is driving the global panel mount disconnect switch market growth, especially in workplaces.

MARKET RESTRAINTS

High Price of Product and Technology is Expected to Hamper Market Growth

The high cost of panel mount disconnect switches limits market expansion, especially in industries and applications that are sensitive to pricing. Although these switches provide essential safety and operational advantages, the initial cost is a hindrance in comparison to less durable options, postponing or hindering upgrades, particularly for smaller enterprises.

Moreover, the complex installation of current control panels further increases the overall cost. The market is experiencing technological growth; for instance, ABB introduced its compact OZXS series disconnect switches in May 2024, aimed at reducing panel space and installation duration, providing a more economical option. Similarly, in March 2024, Eaton broadened its range of disconnect switches, emphasizing improved features while not explicitly tackling the fundamental cost problem. These advancements indicate that the industry is prioritizing performance and space efficiency over cost-cutting, potentially continuing the cost-related limitation on market expansion.

MARKET OPPORTUNITIES

Integration with Intelligent Manufacturing and IoT Systems Provide Opportunity for Market Growth

As industries are advancing and implementing automation and data-centric methods, the demand for disconnect switches that can offer real-time information on their condition, usage trends, and possible maintenance requirements is escalating. Intelligent disconnect switches with sensors and communication features can be incorporated into a larger IIoT ecosystem, allowing for remote monitoring, predictive maintenance, and enhanced Overall Equipment Effectiveness (OEE). This integration results in considerable cost reductions, decreased downtime, and improved safety performance.

- In December 2023, ABB launched a new line of smart disconnect switches featuring built-in communication options. The switches are built to seamlessly connect with ABB's Ability platform, offering users real-time information on switch conditions, functionality, and maintenance needs. This introduction indicates an increasing advancement toward smart disconnect switches within the industrial domain.

PANEL MOUNT DISCONNECT SWITCH MARKET TRENDS

Expansion of Energy Sector to Support Market Growth

The ongoing growth of the energy sector, propelled by the transition to renewable energy sources, is promoting market growth. Further, the increasing demand to modernize and enhance the current power generation, transmission, and distribution infrastructure is contributing to the global market growth. Moreover, the integration of various renewable energy sources, such as solar, wind, and hydroelectric power, into the grid requires the creation of new infrastructure capable of managing variable energy inputs while ensuring dependable energy distribution, supporting market growth.

Segmentation Analysis

By Type

Durable and Easy-to-Use Disconnecting Option Drives Rotary Disconnect Switch Segment

Based on type, the market is classified into fused disconnect switch, non-fused disconnect switch, rotary disconnect switch, and others.

Rotary disconnect switches lead the market as they provide a durable and easy-to-use disconnecting option. These switches are widely used for their distinct on/off signal and reliable switching mechanism, making them ideal for situations where intuitive operation is essential.

Fused disconnect switches fuse into the disconnect system, providing circuit isolation along with overcurrent protection. They are especially used for situations with restricted space that require a compact solution for both circuit disconnection and protection.

Non-fused disconnect switches are one of the leading segments, as they offer a cost-effective solution for simple isolation. Non-fused disconnect switches are widely used in applications where overcurrent protection is provided separately, such as a breaker panel. Lower prices make them demand applications where cost is a significant growth factor.

By Voltage

Low Cost and Small Size of Upto 150 Voltage Makes it a Dominant Segment

Based on voltage, the market is divided into upto 150 V, 150-300 V, and above 300 V.

The upto 150V segment dominates as it serves applications with reduced voltage needs, commonly observed in small machines, control panels, and low-power distribution networks. It is widely used for HVAC management and lighting systems due to its low cost and comparatively small size.

150-300V is the second leading segment as this category addresses general industrial uses, power tools, and advanced control systems. Safety certifications and regulatory adherence, including UL and CE, hold significant importance in this sector.

The above 300V segment encompasses more robust applications and the highest voltage ratings, including large-scale industrial machinery, renewable energy solutions such as solar inverters, and high-capacity power distribution. These voltage segments focus on dependability, arc flash protection, and robust construction to withstand high voltage spikes and fault currents.

By End-user

Utilities is the Leading End-User Owing to Rising Demand for Grid Reliability and Resilience

Based on end-user, the market is segmented into utility, industrial, commercial, and residential.

Utilities are the leading end-users in the market, as they depend significantly on panel-mounted disconnect switches to isolate parts of power grids during maintenance, upgrades, or fault scenarios. The rising demand for grid reliability and resilience, the expansion of renewable energy projects with decentralized generation, and the necessity for remote operation and monitoring features in smart grid systems also contribute to the segmental growth.

- According to the International Energy Agency (IEA), electricity consumption is projected to rise by approximately 4% each year until 2027, fueled by increased demand from residential, industrial use, air conditioning, electrification, and data centers.

Industrial end-users are the second leading segment in the market as industries widely use panel mount disconnect switches to ensure the safe servicing and upkeep of equipment such as motors, pumps, and automated systems. The key influencing factors include workplace safety rules, the necessity to avoid arc flash events during maintenance, and the growing use of automated manufacturing techniques that demand regular power isolation for modifications and repairs.

Commercial end-users, including offices, retail spaces, and data centers, require disconnect switches for HVAC systems, lighting circuits, and backup power generators. Compliance with building codes, energy efficiency initiatives that involve isolating specific circuits, and the need for reliable power interruption during emergencies drive the demand in the commercial sector.

The residential sector uses the fewest panel mount disconnect switches compared to other industries. However, the rising use of solar power systems and energy storage technologies, which require disconnect switches for safe separation during installation and maintenance, is driving the product demand in the residential sector.

Panel Mount Disconnect Switch Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America and the Middle East & Africa.

North America

Asia Pacific Panel Mount Disconnect Switch Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounts for almost 28.50% of the global panel mount disconnect switch market share and generated a revenue of USD 1.90 billion in 2024. The demand for panel mount disconnect switches in North America is driven by stringent safety regulations, particularly within the industrial and manufacturing sectors. The increasing adoption of automation, renewable energy systems, and electric vehicles, all requiring robust safety mechanisms for power interruption, is driving market growth.

The U.S. market accounted for a major share of the North American market. The continual infrastructure improvement efforts, featuring enhancements to the power grid and investments in renewable energy ventures, are generating significant demand for panel mount disconnect switches.

Europe

Europe is the third-largest market for panel mount disconnect switches. Strict European Union rules concerning machinery safety and energy efficiency are major factors driving the market in the region.

- For instance, according to Eurostat, in 2022, the EU experienced close to 2.97 million non-fatal workplace accidents, reflecting a 3% rise from 2.88 million in 2021.

Moreover, the rise of renewable energy sources such as solar and wind power, along with the growing use of electric vehicles, is also generating significant demand for disconnect switches in these areas.

Asia Pacific

Asia Pacific dominated the market, with the market size reaching USD 3.17 billion in 2025 and increasing to USD 3.38 billion in 2026. The area showcases considerable growth opportunities driven by rapid industrialization, growth, and increasing investments in infrastructure advancement. China and India are witnessing an increase in manufacturing operations, resulting in a greater need for safety gear, which includes panel mount disconnect switches.

- According to the National Bureau of Statistics (NBS), China's industrial output, a key economic metric, increased by 5.8% year on year in 2024, up from the 4.6% in 2023.

Latin America

The Latin America is expected to witness significant growth in the near future owing to the presence of leading oil & gas producing countries as well as growth in the mining sector. These industries demand the use of safety devices such as panel mount disconnect switch which are integral part of industrial & manufacturing settings.

Middle East & Africa

The market in the Middle East & Africa is expected to witness considerable growth in the near future. Saudi Arabia, UAE, South Africa, and other countries undergoing industrial advancement and infrastructure upgrades are expected to grow over the forecast period. Increasing recognition of workplace safety and the slow implementation of global safety standards are boosting demand.

COMPETITIVE LANDSCAPE

Key Industry Players

Players Focus on Continuous Development and Launch of New Products for Market Domination

The global panel mount disconnect switch market is concentrated with companies such as ABB, Eaton, and Schneider Electric, among others, accounting for a significant market share. ABB provides streamlined switch designs and advanced motor control solutions. They offer a broad selection of switches with different enclosure choices, handles, and accessories to meet customer-specific requirements. Moreover, the global presence of ABB and its wide distribution network guarantee product accessibility and assistance in various areas.

Eaton holds a significant share of the global market with its wide range of disconnect switches, prioritizing safety and simple installation. Eaton's product portfolio meets industry benchmarks, guaranteeing dependable operation in challenging settings. The company focuses on a strong distribution network, which enhances its market dominance and capacity to provide customized solutions for diverse industrial applications.

Additionally, Rockwell Automation, Legrand, Socomec, Littelfuse, Mitsubishi Electric, Omron, and Fuji Electric are among other major players. Focus on significant investments in the research & development of innovative products has supported their share in the market.

LIST OF KEY PANEL MOUNT DISCONNECT SWITCH COMPANIES PROFILED

- ABB (Switzerland)

- Eaton (Ireland)

- Schneider Electric (France)

- Rockwell Automation (U.S.)

- Legrand (France)

- Socomec (France)

- Littelfuse (U.S.)

- Mitsubishi Electric (Japan)

- Omron (Japan)

- Fuji Electric (Japan)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Rockwell Automation launched a panel-mount, high-power VFD Option. The PowerFlex 755TS frame 7A low-voltage drive increases the power capacity to 500 HP (355 kW) and offers a new panel-mounted option for high horsepower uses. It is 75% smaller than floor-mounted options and facilitates installation.

- November 2024: Socomec India, a provider of power management solutions, achieved the milestone of supplying photovoltaic (PV) disconnect switches for more than 50 GW of solar installations, within the total 90 GW installed in India.

- November 2024: LOVATO Electric widened its portfolio of switch disconnectors by introducing the new switch disconnector type GEF, in both three-pole and four-pole versions, with rated currents from 50 to 250 A AC23A. Its compact and modular design allows the installation in panels with limited space.

- February 2024: LOVATO Electric introduced GLD switch disconnectors series specific for photovoltaic applications up to 1500VDC. These switches enable to perform maintenance operations on the photovoltaic systems upto 1500VDC safely.

- June 2023: Schneider Electric introduced a new version of its flagship Square D safety switch offer, VisiPacT heavy duty safety switch, with new features and design. It features long-term durability for enabling enhanced safety and productivity.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.48% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Voltage

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.64 billion in 2025 and is projected to reach USD 13.4 billion by 2034.

In 2025, Asia Pacific’s market value stood at USD 3.17 billion.

The market is expected to exhibit a CAGR of 6.48% during the forecast period of 2026-2034.

The utility segment led the market by end-users.

ABB, Eaton, Schneider Electric, and Rockwell Automation are the top players in the market.

Asia Pacific held the largest share and dominated the market in 2025.

Strict safety standards and increasing focus on occupational safety products are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us