Pantograph Charger Market Size, Share & Industry Analysis, Charging Type (Level 1 Charging, Level 2 Charging, and Direct Current Fast Charging (DCFC)), Component Type (Hardware and Software), Charging Infrastructure Type (Off-Board Top-Down Pantograph and On-Board Bottom-Up Pantograph), and Regional Forecast, 2025-2032

Pantograph Charger Market Size and Future Outlook

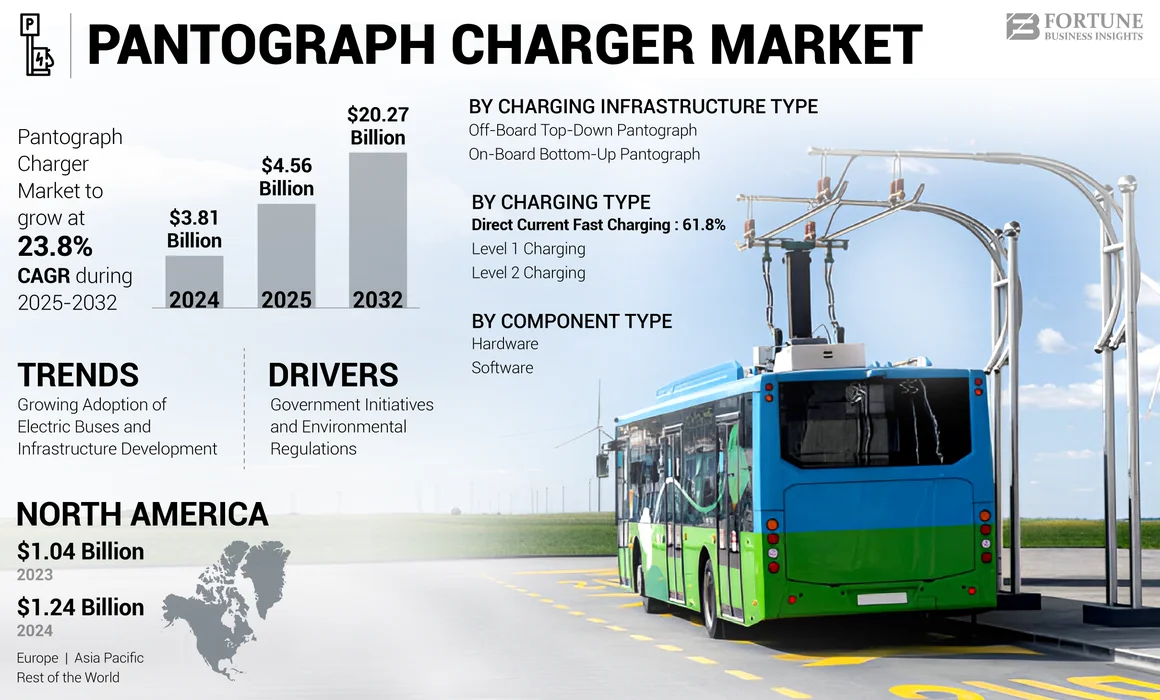

The global pantograph charger market size was valued at USD 3.81 billion in 2024. The market is expected to grow from USD 4.56 billion in 2025 to USD 20.27 billion by 2032, exhibiting a CAGR of 23.80% during the forecast period. North America dominated the global market with a share of 32.55% in 2024.

Pantograph chargers are advanced Electric Vehicle (EV) charging systems that utilize an overhead structure to deliver electricity to vehicles, primarily buses. This system features a movable arm that connects to the vehicle’s roof, allowing for efficient and rapid charging without the need for manual plugging. Pantograph chargers can deliver high power levels, typically ranging from 150 kW to 600 kW, thereby enabling quick recharging while vehicles are stationary or in motion.

The global pantograph charger market has witnessed significant growth driven by the increasing adoption of electric vehicles and demand for efficient charging solutions. Key applications include public transportation systems, fleet operations, and dynamic wireless charging for electric buses and trucks. The market is characterized by technological advancements in 30 electric buses and charging infrastructure and the development of standardized protocols, such as ISO 15118 and OppCharge. Major players are investing in research and development to enhance charging efficiency and safety, aiming to cater to the growing demand for sustainable transportation solutions.

The COVID-19 pandemic had a mixed impact on the global pantograph charger market. Initially, lockdowns and restrictions led to delays in infrastructure projects and reduced usage of public transportation, negatively affecting the demand for bus pantographs. However, as countries began to prioritize green recovery initiatives, there has been renewed interest in electric mobility solutions, including pantograph chargers. Increased focus on sustainable transport post-pandemic is expected to drive the market’s growth as cities seek to modernize their public transport systems and reduce emissions.

Pantograph Charger Market Trends

Growing Adoption of Electric Buses and Infrastructure Development to Emerge as Key Market Trend

One of the significant global pantograph charger market trends is the growing adoption of electric buses, driven by environmental concerns and government initiatives promoting sustainable and efficient public transportation. This trend is particularly evident in regions, such as Europe and Asia Pacific, where municipalities are transitioning from diesel to electric buses to reduce emissions. For example, in 2024, the city of London announced plans to invest heavily in its electric bus infrastructure, including pantograph charging systems, to enhance its green transport initiatives.

Major players, such as ABB and Siemens are actively developing advanced pantograph charging solutions to meet this demand, focusing on efficiency and integration with smart city frameworks. This shift not only supports environmental goals, but also addresses the operational challenges faced by transport agencies, making pantograph chargers a vital component of future urban mobility strategies.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Government Initiatives and Environmental Regulations to Drive Market Growth

One of the primary drivers of the global pantograph charger market growth is the increased government initiatives and stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable transportation. Governments worldwide are investing heavily in electric public transport systems, recognizing the need to transition from fossil fuel-powered vehicles to electric ones. For instance, in 2023, the European Union announced a substantial funding package for cities to enhance their electric bus fleets, which includes the installation of the pantograph charging infrastructure.

China is leading the market, with Shenzhen converting its entire fleet of over 16,000 buses to electric, supported by extensive pantograph charging networks. Additionally, in the U.S., initiatives such as California’s Clean Transportation Program provide financial incentives for transport agencies to encourage them to adopt electric buses and associated charging technologies. These efforts will not only facilitate the deployment of pantograph chargers, but also align with the broader goals of reducing pollution in urban areas, achieving corporate average fuel economy, and decreasing greenhouse gas emissions. As governments continue to prioritize green transportation solutions, the demand for efficient electric bus charging systems like pantographs is expected to grow significantly.

Market Restraints

High Initial Infrastructure Costs to Restrain Market Growth

A significant restraint of the market is the high initial infrastructure costs associated with the installation and maintenance of pantograph charging systems. Developing a comprehensive charging network requires substantial financial investment in both hardware and installation, which can be a barrier for many municipalities and transport agencies. For example, cities transitioning to electric bus fleets may face challenges in securing funding for the necessary infrastructure upgrades, which include not only the chargers themselves, but also grid enhancements and site preparations.

In 2024, the city of Los Angeles announced plans to expand its electric bus fleet but highlighted that the costs of installing pantograph chargers at bus depots were a major hurdle. The city is exploring public-private partnerships to offset these expenses, demonstrating how financial constraints can impede the growth of the market. Additionally, compatibility issues with existing vehicles further complicate the situation, requiring additional investments to ensure that new charging systems can accommodate various models. As cities strive for greener transport solutions, addressing these financial barriers will be crucial for the wider adoption of the pantograph charging technology.

Segmentation Analysis

By Charging Type

DCFC’s Quick Charging Ability Has led to its Market Dominance

Based on charging type, the market is segmented into level 1 charging, level 2 charging, and Direct Current Fast Charging (DCFC).

Direct Current Fast Charging (DCFC) is the dominating segment within this category. DCFC can recharge electric buses in approximately 30 minutes, making it ideal for public transport systems that require quick turnaround times. Major players such as ABB have been expanding their DCFC offerings to meet the growing demand for rapid charging solutions. For example, in 2024, ABB announced new installations of DCFC systems across various European cities to support their electric bus fleets. The DCFC segment is currently the dominant segment in the market due to its essential role in enabling the widespread adoption of electric vehicles. The segment held 62% of the market share in 2024.

Level 2 charging is the fastest-growing segment in the market as it offers a more robust solution with a voltage of 240V, thereby offering much lesser charging time as compared to that of Level 1. This type of charging is commonly used in public charging stations and commercial fleets. For instance, many cities are installing Level 2 chargers in bus depots to enhance the efficiency of their electric bus operations.

Level 1 charging utilizes a standard 120V outlet, providing a slow charging option that is primarily for residential use. While it is the most basic form of charging, its low power output makes it less suitable for commercial applications, such as electric buses, limiting its market share.

To know how our report can help streamline your business, Speak to Analyst

By Component Type

Crucial Role in Charging Infrastructure Development Helps Hardware Dominate Market

Based on component type, the market is divided into hardware and software.

The hardware segment dominates the market due to its critical role in establishing the charging infrastructure. Hardware includes pantographs, power electronics, and other physical components necessary for creating effective charging solutions. Major companies such as Siemens are investing heavily in advanced hardware technologies that improve charging efficiency and reliability. For instance, Siemens recently launched a new line of pantograph chargers designed specifically for high-capacity electric bus fleets across Europe. The segment is expected to hold 70% of the market share in 2025.

The software segment is also gaining traction as cities are increasingly adopting smart technologies that optimize charging operations. Software solutions enable real-time monitoring and management of charging stations, which enhance operational efficiency and reduce downtime. Collaborations between software developers and hardware manufacturers are becoming more common; for example, ABB has partnered with technology firms to integrate software solutions that facilitate seamless interactions between different charging systems. This segment is likely to grow with a considerable CAGR of 26.40% during the forecast period (2025-2032).

While hardware remains the dominant component segment due to its foundational role in infrastructure development, the growing emphasis on smart city initiatives indicates that software will be a rapidly expanding segment in the future.

By Charging Infrastructure Type Analysis

High-Power Delivery Availability and Lower Downtime Help Off-Board Top-Down Pantographs Segment Dominate Market

Based on charging infrastructure type, the market is segmented into off-board top-down pantograph and on-board bottom-up pantograph.

The off-board top-down pantographs is currently the dominating and fastest-growing segment in the market. This type of charging infrastructure allows for high-power delivery by utilizing overhead structures to connect with electric vehicles quickly. Shenzhen has implemented extensive off-board pantograph networks to support their large fleets of electric buses, demonstrating their effectiveness in reducing downtime during operations.

The dominance of off-board top-down pantographs can also be attributed to their ability to deliver rapid charging while minimizing vehicle downtime—an essential factor for public transportation systems that operate on tight schedules. As municipalities continue to prioritize efficient public transport solutions that meet sustainability goals, off-board pantographs will likely maintain their leading position in this market. This segment is foreseen to grow with a substantial CAGR of 25.90% during the forecast period (2025-2032).

Conversely, on-board bottom-up pantographs are less common but offer unique advantages in specific applications where space constraints or design preferences dictate their use. While they provide flexibility in vehicle design, their complexity and higher costs limit their widespread adoption. The segment is estimated to attain 51% of the market share in 2025.

Pantograph Charger Market Regional Outlook

North America Dominates Market Owing to Increasing Infrastructure Investment

Based on region, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Pantograph Charger Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share with a valuation of USD 1.04 billion in 2023 and USD 1.24 billion in 2024. In North America, the pantograph charger market share has witnessed dominant growth, primarily fueled by increased investments in electric vehicle infrastructure. Governments and transport agencies are recognizing the need for sustainable transportation solutions, leading to significant funding for electric bus fleets and charging systems. For instance, in 2024, Electrify America announced a USD 44 million investment to support the rising emphasis on electric buses and charging infrastructure in Sacramento, California.

This initiative aims to enhance the operational efficiency of public transport while reducing greenhouse gas emissions. However, challenges, such as high infrastructure costs and limited compatibility with existing vehicles may hinder the faster adoption of these chargers. Despite these obstacles, the commitment to electrification and government incentives are expected to sustain the market’s growth in North America, making the region a key player in the global pantograph charger market. The U.S. market is poised to be valued at USD 1.01 billion in 2025.

Europe is the third largest market estimated to gain USD 1.19 billion in 2025. Europe stands out as the fastest-growing region in the global market, driven by stringent environmental regulations and ambitious sustainability goals. The U.K. market is estimated to grow with a value of USD 0.28 billion in 2025. Germany and France are leading the regional market’s growth by heavily investing in electric public transport systems. In 2024, Berlin announced plans to expand its electric bus fleet significantly by integrating advanced pantograph charging solutions to improve efficiency.

The European Union’s Green Deal further supports this trend by providing funding for clean transportation initiatives. Germany is anticipated to grow with a valuation of USD 0.40 billion in 2025, while France is expected to reach USD 0.21 billion in the same year.

Asia Pacific is the second largest market expected to be worth USD 1.30 billion in 2025, documenting a CAGR of 24.80% during the forecast period (2025-2032). Asia Pacific is witnessing rapid growth in the global market, primarily driven by aggressive electrification initiatives in China and India. The Chinese market is estimated to acquire USD 0.21 billion in 2025. China has emerged as a global leader in electric bus adoption, with Shenzhen converting its entire fleet to electric vehicles supported by extensive pantograph charging networks. In 2024, Beijing announced plans to expand its electric bus fleet further, emphasizing the need for efficient charging solutions.

Government policies promoting green transportation and significant investments in infrastructure are propelling this growth. India is foreseen to hold USD 0.23 billion in 2025, while Japan is predicted to reach a market value of USD 0.30 billion in the same year.

The rest of the world is the fourth leading region set to acquire USD 0.57 billion in 2025. In the rest of the world, including regions, such as South America and Africa, the global pantograph charger market is gradually growing as governments seek sustainable transportation solutions. For example, Brazil has initiated projects to integrate electric buses into its public transport systems, supported by funding from both governmental and non-governmental organizations. Thus, the regions in the rest of the world are poised for gradual expansion within the global market.

Competitive Landscape

Key Industry Players

ABB’s Innovative Technologies and Extensive Experience in Electric Mobility Solutions make it a Leading Market Player

ABB is the leading market player and a company renowned for its innovative technologies and extensive experience in electric mobility solutions. The company has established itself as a market leader due to its commitment to developing efficient and reliable pantograph chargers that cater to the growing demand for electric public transportation. Its pantograph charger products, such as the ABB Terra series, are designed for high-performance charging of electric buses and other heavy vehicles.

These chargers utilize advanced technology to ensure rapid and safe charging, significantly reducing downtime for transport operators. For instance, in 2024, ABB announced the installation of its pantograph chargers in several European cities, thereby enhancing the operational efficiency of electric bus fleets and supporting local governments’ sustainability goals.

Siemens Mobility is also among the leading players in the global market. It offers a range of innovative charging solutions, including its Siemens SICHARGE series, which is designed for both depot and opportunity charging of electric buses. Its advanced technologies ensure seamless integration with the existing transport infrastructure, while providing high charging efficiency. In 2023, Siemens partnered with various municipalities across Europe to expand electric bus networks, demonstrating its commitment to sustainable urban mobility. This collaboration highlights the company’s significant impact on the pantograph charger market and its dedication to advancing electric transportation solutions.

LIST OF KEY COMPANIES PROFILED:

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- Wabtec Corporation (U.S.)

- Schunk Transit Systems GmbH (Germany)

- Vector Informatik GmbH (Germany)

- SETEC Power (China)

- Valmont Industries, Inc. (U.S.)

- Comeca Group (France)

- Hangzhou Aoneng Power Supply Equipment Co., Ltd. (China)

- ChargePoint, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

December 2024: Kempower introduced a new model of its pantograph charger designed for high-capacity electric buses, emphasizing quick charging capabilities and user-friendly operation. This product aims to meet the growing demand for efficient public transport solutions.

November 2024: Multinational electronics company Toshiba partnered with Japanese bus operator Rinko Bus and Swiss electric bus equipment manufacturer Drive ElectroTechnology on a demonstration project. The project was to test the effectiveness of a rapid-charging battery powered by a pantograph in charging an electric bus in 10 minutes.

November 2024: Custom Denning unveiled the manufacturing of Australia’s inaugural electric bus featuring the pantograph fast-charging technology. The company effectively showcased consecutive rapid-charging sessions with a single bus pantograph charger, highlighting the bus’ capability to recharge its 462 kWh battery in under one hour. This accomplishment underscored Custom Denning’s dedication to promoting sustainable transportation options in Australia.

April 2024: EMT Madrid inaugurated a new inverted pantograph electric charging station at its Carabanchel operations center. This enhancement includes an additional 118 chargers, allowing a total of 260 electric buses to be charged simultaneously. With the fourth phase of the station’s conversion still underway, the center is projected to have 320 operational charging points by early next year - 230 from the inverted pantograph system and 90 from plug-in chargers. This significant upgrade underscored Madrid’s commitment to electrifying its public transport system and reducing emissions.

April 2023: The Toronto Transit Commission (TTC) and PowerON Energy Solutions unveiled 10 newly commissioned, battery-electric bus charging pantographs at Birchmount Garage. This system was the first phase of a 20-year agreement between the TTC and PowerON Energy Solutions, a subsidiary of Ontario Power Generation, to support the electrification of Toronto’s bus fleet.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on crucial aspects, such as leading companies, vehicle types, and leading product applications. Besides this, it offers insights into the market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market’s growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 23.80% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Charging Type

|

|

By Component Type

|

|

|

By Charging Infrastructure Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3.81 billion in 2024 and is projected to reach USD 20.27 billion by 2032.

In 2024, the North America market value stood at USD 1.24 billion.

The market is projected to record a CAGR of 23.80% over the forecast period of 2025-2032.

By charging type, the Direct Current Fast Charging (DCFC) type segment is leading the market.

Government initiatives and environmental regulations are driving the market.

ABB is a major player in the global market.

North America dominated the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us