Parenteral Antibiotics Market Size, Share & Industry Analysis, By Drug Class (Penicillin, Cephalosporin, Aminoglycosides, Tetracycline, Macrolides, Fluoroquinolones, Sulfonamides, and Others), By Application (Skin Infections, Respiratory Infections, Urinary Tract Infections, Septicemia, Gastrointestinal Infections, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

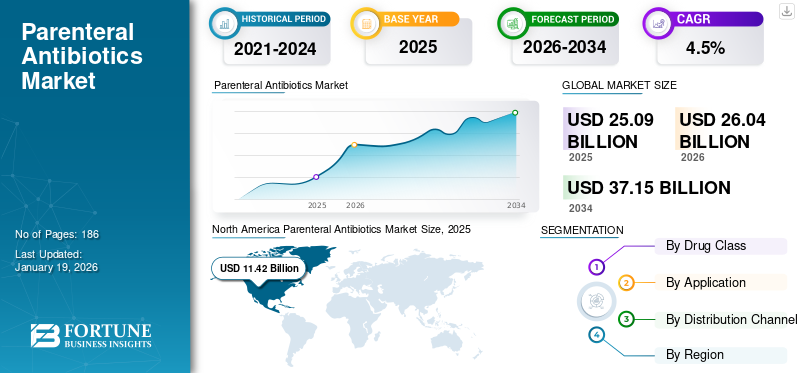

The global parenteral antibiotics market size was valued at USD 25.09 billion in 2025. The market is projected to grow from USD 26.04 billion in 2026 to USD 37.15 billion in 2034 at a CAGR of 4.50% during the forecast period. North America dominated the parenteral antibiotics market with a market share of 45.51% in 2025.

Parenteral antibiotics are administered through intramuscular (IM) or intravenous (IV) routes and play a crucial role in the management of severe infections such as sepsis, hospital-acquired infections, and pneumonia. These medications are mostly used in hospital and critical care environments, especially for high-risk patients.

The demand for these formulations is fueled by their fast-acting nature, higher bioavailability, and the increasing need to manage drug-resistant infections in clinical settings.

- For instance, according to a study published in National Canter for Biotechnology Information (NCBI) in November 2021, in Nepal, the total defined daily dose (DDD) of parenteral antibiotics reached 48,947.7 in 2019 with an increase of 23% from 39,639.7 in 2017.

Furthermore, major companies operating in the market, including Pfizer Inc., GSK plc., AbbVie Inc., and Merck & Co., Inc., which are boosting the presence of their antibiotics in the market with the launch of both branded and generic products.

MARKET DYNAMICS

MARKET DRIVERS

Increased Hospitalization Due to Rising Cases of Severe Infections to Propel Market Growth

A rise in chronic diseases and surgical procedures leads to more patients requiring parenteral antibiotic treatment, either in hospitals or through outpatient parenteral antibiotic therapy (OPAT). OPAT, where patients receive intravenous antibiotics outside of a traditional hospital setting, is becoming more common, contributing to the overall demand for parenteral antibiotics. The intravenous route is preferred in hospital settings due to its efficacy in critical infections. These factors collectively drive the parenteral antibiotics market growth.

Additionally, a growing number of individuals have weak immune systems due to conditions such as HIV/AIDS, cancer, or autoimmune diseases, making them more susceptible to severe infections. This results in increased hospitalizations, further boosting the market growth. HAIs, also known as nosocomial infections, are infections acquired during healthcare delivery. These can be particularly dangerous due to the presence of drug-resistant bacteria in healthcare settings and the invasive nature of different medical procedures.

- For instance, as per the data released by the WHO, approximately one in ten patients are impacted by the HAIs, with a significant caseload in the lower and middle income countries. The HAIs include surgical site infections, urinary tract infections, and others. Such conditions increase the demand for antibiotics to treat bacterial infections and thus drive the market growth.

MARKET RESTRAINTS

Barriers to Access for Antibiotics in Emerging Countries Restrict the Market Growth

In emerging countries, barriers to access essential antibiotics include factors such as economical barriers, weak healthcare infrastructure, poverty, and inadequate regulatory frameworks. These challenges hinder both the availability and affordability of quality antibiotics, impacting patient outcomes and contributing to the rise of antibiotic resistance. Poor infrastructure, including a lack of reliable electricity, storage facilities, and transportation, can disrupt the supply chain and could lead to antibiotic spoilage or unavailability.

Additionally, heavy dependence on selective countries for active pharmaceutical ingredients (APIs) makes global supply chains vulnerable to disruptions, trade limitations, and quality control issues, restricting the market growth to certain extent.

Moreover, the affordability of antibiotics in LMICs and inadequate government funding for health is resulting in high out-of-pocket (OOP) spending by patients, hampering the market growth.

MARKET OPPORTUNITIES

Cost-Effectiveness of Outpatient Parenteral Antibiotic Therapy (OPAT) Provides Growth Opportunities

Outpatient Parenteral Antibiotic Therapy (OPAT) is usually considered a cost-effective alternative to traditional inpatient intravenous antibiotic treatment. It has several advantages including reduced hospital stays, improved patient outcomes, and effective cost savings. OPAT programs can significantly reduce healthcare costs by shortening hospital stays and optimizing resource allocation. It allows patients to receive necessary intravenous antibiotic treatment in a more comfortable and convenient setting, often their own home, and leading to better overall well-being. Thus, emphasis on offering Outpatient Parenteral Antibiotic Therapy (OPAT) is anticipated to create growth opportunity in the market.

- For instance, according to a study published in BMJ journal in September 2021, the cost of diabetic foot infections treatment in OPAT was estimated in the range of 22%–42% as compared to that of inpatient stay.

MARKET CHALLENGES

Low Profitability in Antibiotic R&D and Complex Regulatory Landscape Poses Market Growth Challenges

Antibiotics generally offer low return on investment due to short treatment duration and restrictive reimbursement models, which discourages pharmaceutical industries from investing heavily in new parenteral antibiotic development. This is majorly driven by a combination of several factors including economic, and regulatory factors. This makes it difficult to attract investment and sustain the development of new antibiotics.

Additionally, stringent global approval processes for new antibiotic drugs, especially injectables, prolong development timelines and increase operational costs. International agencies and several regional governments are taking various initiatives to reduce antibiotics' excessive and unwanted use, which further pose a challenge to the market growth.

PARENTERAL ANTIBIOTICS MARKET TRENDS

Rise in Adoption of Combination Therapies

The inappropriate use and excessive consumption of antimicrobials are leading factors contributing to the emergence of drug-resistant pathogens. This has resulted in need for the development of effective and innovative therapies to combat these infections. Thus, the use of combination parenteral antibiotic therapy is constantly increasing, particularly in cases of severe infections caused by multidrug-resistant Gram-negative bacteria. This is one of the key parenteral antibiotics market trends. Combination therapy can broaden the spectrum of activity and potentially enhance effectiveness of the treatment. Some of the potential benefits of combination therapies include wide range of activity against various pathogens, synergetic effects due to combined therapy, reduced resistance, and improved outcomes.

- For instance, in May 2024, a research study was published by the team of researchers at the Ineos Oxford Institute (IOI) in the journal Engineering which demonstrated a new potential combination therapy to treat antimicrobial resistance (AMR). It was a combination of three drugs namely MBL inhibitor called indole-2-carboxylate 58 (InC58), β-lactam antibiotic meropenem, and an SBL inhibitor called avibactam (AVI).

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Drug Class

Widespread Availability of Penicillin Enhanced the Segment's Growth

By drug class, the global market is divided into cephalosporin, aminoglycosides, penicillin, tetracycline, macrolides, sulfonamides, fluoroquinolones, and others.

In 2024, penicillin segment accounted for the highest parenteral antibiotics market share. The dominance of the segment is attributed to the surging bacterial infections’ cases and higher adoption of this drug class for the treatment of various indications including meningitis, throat infections, syphilis, and others. Additionally, increasing introductions of generic penicillin are significantly propelling the adoption.

- For instance, in March 2025, the company Avenacy announced the launch of a suite of five antibiotic products for injection, which includes the product of Penicillin G Potassium for Injection, USP. This is aimed at strengthening the company's portfolio of critical and high-usage injectable products.

The cephalosporin segment also held one of the leading market shares in 2024 and is expected to grow with a significant CAGR across 2025-2032. The various generations of this drug class have specific activity and indications, which allow healthcare professionals to choose the most appropriate cephalosporin for specific indication, thus increasing the adoption of the segment.

Macrolides, fluoroquinolones, sulfonamides, and tetracycline are expected to grow substantially during the forecast period. The growth is attributed to the increasing adoption of antibiotics and the rising availability of various generics. Additionally, strong emphasis of key players to expand their product offering with new-aged antibiotics propels the segments’ growth during 2025-2032.

By Application

Rising Incidences of Respiratory Infections to Boost the Segment Growth

On the basis of application, the market is segmented into respiratory infections, skin infections, septicemia, urinary tract infections, gastrointestinal infections, and others.

In 2024, the respiratory infections segment contributed to the highest market share in 2024. The segment's dominance is attributed to increasing cases of bacterial respiratory infections such as tuberculosis, pneumonia, sinusitis, and others, leading to increased demand for antibiotics. With increasing severity of the infection, the demand for parenteral antibiotics is surging.

- For instance, according to the CDC report on tuberculosis in 2023, in the U.S., around 9,633 cases of TB were registered, and this has increased by 15.6% compared to 2022.

Meanwhile, the urinary tract infections (UTI) segment is likely to uphold second leading position in the market over the forecast period. The segment is projected to witness a significant growth in the coming years owing to the rising incidence of UTIs especially in women and frequent new product launches by the market players.

- For instance, in June 2024, Orchid Pharma Limited launched a new antibiotic, Cefepime-Enmetazobactam, used to treat complicated urinary tract infections (cUTI), hospital-acquired pneumonia (HAP), and ventilator-associated pneumonia (VAP).

Moreover, other segments such as gastrointestinal infection, skin infections and others are expected to grow with moderate CAGR during the forecast period. Robust pipeline of products coupled with increasing investment in research and development of innovative products are anticipated to boost the growth of the segment over the forecast timeframe.

By Distribution Channel

Online Pharmacy Segment to Exhibit High Growth in the Near Future

In terms of distribution channel, the global market is divided into retail pharmacy, hospital pharmacy, and online pharmacy.

Hospital pharmacy segment held the leading position in the global market. Hospital pharmacies are considered to be the integral part of the healthcare system and thus offer medications directly to patients admitted to hospitals. Additionally, these settings have immediate access to a wide range of injectable and high-potency antibiotics, thus holding the maximum share of the market.

On the other hand, the online pharmacy segment would grow at a fastest rate over the study period. The increasing popularity of home delivery options, in turn enhances the accessibility and efficiency for consumers in their healthcare choices have driven the segment growth. The recent pandemic crisis has contributed heavily to the preference for online pharmacies over retail, thus boosting the segment growth.

PARENTERAL ANTIBIOTICS MARKET REGIONAL OUTLOOK

In terms of region, the global market can be segmented into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Parenteral Antibiotics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, the North American market size was valued at USD 11.42 billion and is projected to maintain its dominance across 2026-2034. The growing aging population which is more susceptible to infections, increasing cases of bacterial infectious diseases, and presence of well-established operating players boost the adoption of products in the region. Rising advancements in technology and increasing consumer preferences for e-commerce to procure antibiotics based on their convenience, boosts the market growth.

U.S.

The U.S. held the dominating position in the North America region, owing to the rising number of infectious disease cases and growing demand to combat antimicrobial resistance in the country. Additionally, strategic initiatives undertaken by operating players further supports the U.S. market growth.

- For instance, in December 2024, Basilea Pharmaceutica Ltd signed an exclusive distribution and licensing agreement with Innoviva Specialty Therapeutics, Inc., to commercialize Basilea's hospital anti-MRSA antibiotic Zevtera (ceftobiprole medocaril sodium for injection) in the U.S.

Europe

European region captured the second-leading position of the market in 2024. Increased rate of consumption of antibiotics in European countries along with the rising partnerships and collaborations between market players have boosted the market growth.

- For instance, according to the data published by Italian Medicine Agency, in 2022, over 30.0% of citizens received at least one antibiotic prescription, with usage rising with age, peaking at 60.0% among those over 85 in Italy. This marks a 25.0% increase in consumption compared to 2021.

Asia Pacific

The Asia Pacific market is likely to grow with the fastest rate during the forecast period. Increasing approvals for commercialization of the parenteral antibiotics by the regional companies coupled with high consumption of antibiotics in Asian countries collectively propel the regional market's growth.

- For example, in February 2024, the Central Drugs Standard Control Organization (CDSCO) approved the Cipla’s application for the commercialization of Plazomicin, an innovative aminoglycoside that is to be administered intravenously for the treatment of complicated urinary tract infections (cUTI).

Latin America and Middle East & Africa

The market in the Latin America and the Middle East & Africa regions are expected to witness a considerable growth in the near future. The growing awareness regarding several bacterial infections as a result of awareness campaigns and government initiatives is anticipated to augment the regional market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus of Major Companies on Strategic Initiatives to Strengthen their Market Positions

The marketspace for parenteral antibiotics products demonstrates a fragmented structure and comprises of several entities offering branded as well as generic products. These players maintain a strong presence in hospitals, launch new injectable formulations, and invest in advanced antimicrobial pipelines to maintain their market position. Additionally, increasing strategic activities amongst the key players also supported these companies.

- For instance, in November 2024, Zai Lab collaborated with Pfizer Inc. for the commercialization activities for XACDURO (sulbactam for injection; durlobactam for injection) in mainland China.

Other companies with a notable establishment in the global market comprises of Cipla, Bayer AG, and Bristol-Myers Squibb Company, and AdvaCare Pharma. These companies focus on new product launches, and introduction of generic products to boost their market presence across 2025-2032.

LIST OF KEY PARENTERAL ANTIBIOTICS COMPANIES PROFILED

- Bristol-Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- GSK plc. (U.K.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Cipla (India)

- AbbVie Inc. (U.S.)

- AdvaCare Pharma (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: A biotechnology company ArrePath received a funding of USD 3.7 million to advance novel antibiotic for the treatment of multidrug-resistant infections. This funding was awarded by Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator (CARB-X).

- February 2025: Shionogi & Co., Ltd. announced that its partner, JEIL PHARMACEUTICAL CO., LTD., South Korea, received marketing approval for Fetroja (cefiderocol) injection from the South Korean regulatory authorities used for the gram-negative bacterial infection treatment.

- February 2024: Allecra Therapeutics GmbH announced that the U.S. Food and Drug Administration (FDA) has approved EXBLIFEP (cefepime/enmetazobactam) to treat complicated urinary tract infections (cUTI).

- December 2023: Shionogi & Co., Ltd. launched Fetroja (cefiderocol) intravenous infusion 1g vial in Japan. The company had received manufacturing and marketing approval from the Ministry of Health, Labour and Welfare, Japan in November 2023.

- March 2022: Cumberland Pharmaceuticals Inc. and Tabuk Pharmaceutical Manufacturing Company announced the launch of Cumberland's Vibativ (telavancin) injection in the Middle East.

REPORT COVERAGE

The parenteral antibiotics market report offers in-depth and detailed analysis of the current market. The report focuses on several key aspects related to the market such as growth drivers, market challenges, and advancements in product offerings, pricing analysis, and others. Additionally, the report also encompasses key industry developments such as mergers, acquisitions, & collaborations and new product launches in recent years. Besides these, market analysis offers insights into the market trends and comprises a detailed pipeline analysis of new drugs.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.50% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Class

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 25.09 billion in 2025 and is projected to reach USD 37.15 billion by 2034.

In 2025, market value in North America stood at USD 11.42 billion.

Registering a CAGR of 4.50%, the market will exhibit steady growth over the forecast period.

Based on drug class, the penicillin segment is expected to lead this market during the forecast period.

The rising incidence of various infections is one of the key factors driving the growth of the market.

Pfizer Inc., GSK plc., Abbvie Inc., and Merck & Co., Inc. are some of the key players in the global market.

North America dominated the global market in 2025.

The increasing demand for parenteral antibiotics in developing countries and the rising cases of infectious diseases across the world are anticipated to drive the growth and adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us