Penicillin Market Size, Share & Industry Analysis, By Product Type (Penicillin G, Penicillin V, Amoxicillin, Piperacillin, Amoxicillin, and Others}), By Disease Indication (Skin Infections, Respiratory Infections, Urinary Tract Infections, Septicemia, Ear Infection, Gastrointestinal Infections, and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

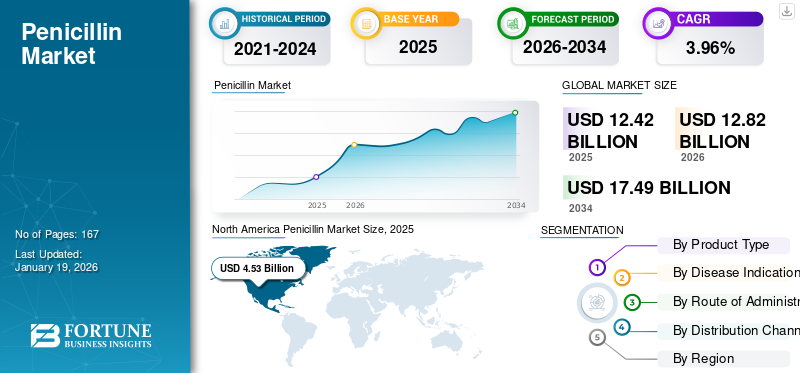

The global penicillin market size was valued at USD 12.42 billion in 2025 and is projected to grow from USD 12.82 billion in 2026 to USD 17.49 billion by 2034, exhibiting a CAGR of 3.96% during the forecast period. North America dominated the penicillin market with a market share of 36.45% in 2025.

The global market continues to hold a vital position in the antibiotic landscape. Due to the increasing prevalence of bacterial infections globally, the demand for penicillin is steadily increasing. These factors largely drive the market growth. These antibiotics remain the first line of defense in treating many treatment guidelines because of their proven safety, affordability, and adaptability across diverse patient groups.

Furthermore, the enhanced ability due to the combination of penicillin with β-lactamase inhibitors helps preserve their effectiveness against resistant bacteria, making them indispensable in both hospital care. As the prevalence of infectious diseases rises, the demand for effective antibiotics such as penicillin also rises.

- For instance, in January 2025, National Healthcare Safety Network reported that UTIs account for more than 9.5% of infections reported by acute care hospitals. Such high prevalence of infectious diseases to augment the demand of penicillin.

Furthermore, the market encompasses several key market players with Pfizer Inc., Aurobindo Pharma Limited., GSK plc., Teva Pharmaceutical Industries Ltd., and Sandoz Group AG at the leading positions in pharmaceutical industry. Strategic partnerships, new product launches, and expansion of manufacturing capacity, and a robust geographic presence to support the growth of these companies.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Infectious Diseases to Boost the Demand and Drive Market Growth

The increasing prevalence of respiratory tract infections and skin infections for which penicillin is administered ubiquitously, is expected to boost the market growth. Such a rising prevalence of these infectious diseases sustains the global demand. In many treatment guidelines, penicillin remains first-line therapy due to its safety, cost effectiveness, and established clinical efficacy. Expanding antibiotic consumption in developing regions also acts as a driver, alongside supportive government initiatives to secure local API manufacturing capacity.

- For example, in January 2024, BMC Infectious Diseases published an article titled ‘Epidemiological trends of respiratory tract pathogens detected via mPCR in Australian adult patients before COVID-19’ reported that there were 12,453 pathogens detected amongst the 12,185 positive samples, for respiratory tracts. Such high pathogens result in an increasing incidence of infectious diseases.

MARKET RESTRAINTS

Development of Penicillin Allergies to Drive Patients towards Alternatives, Hampering Market Growth

Penicillin has long been considered one of the safest and most effective classes of antibiotics, often recommended as a first-line treatment for many common and hospital-acquired infections. However, one of the biggest barriers to its widespread use is the high number of patients who are labeled as allergic to penicillin. This widespread mislabeling has created a persistent challenge for hospitals, pharmacies, and healthcare providers, as it directly influences prescribing behavior and limits the role of penicillin in modern infection management. This creates a significant barrier to penicillin prescribing in hospitals and pharmacies. Such factors limit the adoption of penicillin antibiotics and further hamper the global penicillin market growth.

- For instance, in August 2025, the CDC reported that more than 10.0% of the U.S. population reported an allergy to penicillin.

MARKET OPPORTUNITIES

Innovation in Drug Delivery for Antibiotics to Provide Significant Growth Opportunity

One of the major growth opportunities for the market includes advancements in the drug delivery systems of penicillin. The development of innovative drug delivery systems, such as DUPLEX, provides an opportunity to combat traditional challenges in the market. Traditional injectable penicillin requires manual mixing or thawing. These processes pose a risk of contamination and are also is labor labor-intensive and time-consuming. Hospitals and healthcare systems increasingly demand formulations that reduce preparation time, minimize medication errors, and improve treatment efficiency. Advanced drug delivery systems create value by offering improved safety profiles and workflow convenience, which enhances adoption even in competitive generic markets. Integrating penicillin into ready-to-use or combination formats provides a significant growth opportunity.

- For instance, in April 2025, B. Braun Medical Inc. received approval from the U.S. FDA for Piperacillin and Tazobactam for use in the Company’s DUPLEX Drug Delivery System. Piperacillin (a penicillin) and Tazobactam in the DUPLEX Drug Delivery System is a ready-to-activate, two-compartment container that keeps pre-measured medication and diluent separate until the provider is ready to administer.

PENICILLIN MARKET TRENDS

Rising Investment in Manufacturing Infrastructure is a Prominent Trend Observed in the Market

Rising investment in manufacturing infrastructure has become a key trend in the market as countries and companies seek to strengthen supply chain resilience and reduce dependency on imports. Penicillin production is largely concentrated in a few regions, creating risks of shortages during supply disruptions. To counter this, governments are rolling out incentive schemes and funding programs to boost domestic API production, while leading pharmaceutical manufacturers are expanding and modernizing facilities to meet growing demand. These investments not only ensure a steady supply of essential antibiotics but also support compliance with evolving regulatory and environmental standards. As a result, capacity expansion and infrastructure upgrades are shaping the competitive landscape and driving long-term stability in the global market trends.

- For instance, in November 2021, USAntibiotics, the sole-licensed American maker of penicillin-based Amoxil (amoxicillin) and Augmentin (amoxicillin clavulanate relaunched production of its Amoxicillin manufacturing facility in the U.S.

MARKET CHALLENGES

Product Recalls is a Prominent Challenge to the Market Growth

Product recalls due to severe adverse reactions are one of the major challenges faced in the market. Products recalls occur due to issues such as contamination, quality control failures, or non-compliance with regulatory standards. Such recalls raise serious concerns about product safety and manufacturing reliability. Such factors pose a threat to market expansion potential.

For instance, in December 2024, the National Agency for Food and Drugs Administration and Control (NAFDAC) recalled a batch of Deekins Amoxycillin 500mg Capsule, manufactured by Ecomed Pharma Ltd, with lot number 4C639001. The drug batch was recalled due to serious adverse drug reactions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

New Product Launches in the Amoxicillin Segment to Contribute to Its Growth

In terms of product type, the market is segmented into penicillin G, penicillin V, amoxicillin, piperacillin, ampicillin, and others.

The amoxicillin segment captured the leading share of the market in 2024. The segment is attributed to a highest market share due to its efficiency against a broad spectrum of bacteria. They help to combat multidrug-resistant bacteria. Due to these advantages, many key companies are directing their resources towards new product launches, reinforcing their importance.

- For instance, in March 2025, Avenacy launched a suite of synthetic antibiotic products for penicillin injection, including Ampicillin for Injection, Ampicillin and Sulbactam for Injection, Nafcillin for Injection, Penicillin G Potassium for Injection, and Piperacillin and Tazobactam for Injection.

By Disease Indication

Rising Prevalence of Skin Diseases and Infections to Support Segmental Growth of Skin Infections

In terms of disease indication, the market is categorized into skin infections, respiratory infections, urinary tract infections, septicemia, ear infections, gastrointestinal infections, and others.

The skin infections segment captured the largest share of the market in 2024. The high share of the segment is due to increasing prevalence of skin diseases and effectiveness of penicillin against these gram-positive bacteria, prevention of complications, affordability, and long-standing clinical validation.

- For instance, in March 2023, over 89,000 cases of Lyme disease were reported to the CDC by state health departments and the District of Columbia. Lyme disease is a skin infection caused by Borrelia burgdorferi.

By Route of Administration

Easy Administration and Enhanced Safety of Oral Route of Administration to Drive Segmental Growth

In terms of route of administration, the market is categorized into oral and parenteral.

The oral segment captured the largest share of the market in 2024. The market share of the oral segment is due to various advantages exhibited such as lower cost, wider spectrum, and easy administration and safety.

- For instance, in January 2022, the American Heart Association, Inc. advised administration of oral penicillin over injectable for people with high-risk rheumatic heart disease.

By Distribution Channel

Increasing Prescription Leads to the Dominance of Hospital Pharmacies Segment

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The hospital pharmacies segment held the dominating position in the forecasted years. Hospitals act as a first line of contact. Also, to prevent hospital-acquired infections and to protect against severe Hospital-acquired infections (HAIs) such as pneumonia, bloodstream infections, and surgical site infections. Ensuring the timely availability of broad- and extended-spectrum penicillin and medical supervision at the hospital for allergic reactions to contribute to the growth of the segment.

- For instance, in March 2025, Houston Methodist nurses adapted a screening tool at the bedside to assess whether patients have true penicillin allergies, thus enabling their care teams to offer them the most appropriate antibiotics without delay—such high participation of hospitals for prescription medication of penicillin to drive the growth of the segment.

Penicillin Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Penicillin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant penicillin market share in 2025, valued at USD 4.53 billion, and also took the leading share in 2024, with USD 4.40 billion. The increasing prevalence of infectious diseases in the region is resulting in the increasing demand for safe and effective penicillin and robust healthcare infrastructure.

- For instance, in January 2024, NIH published a report titled ‘Rates of Lower Respiratory Tract Illness in US Adults by Age and Comorbidity Profile’ that reported that about 5.0% of US adults have an episode of acute bronchitis each year, making it among the ten most common outpatient illnesses in the U.S.

Europe and the Asia Pacific

Europe and the Asia Pacific are estimated to witness a prominent growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 3.8%, which is the second highest amongst all the regions, and is also expected to touch the valuation of USD 3.94 billion in 2025. The increased risk of infection to the elderly population drives the growth in the region.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions are set to witness moderate growth in this market. The Latin America market in 2025 is set to record USD 1.99 billion as its valuation. The rising incidence of infectious diseases and the need for safer and effective penicillin to drive growth in these regions further.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Collaboration Among Key Players Propel Their Leading Positions in the Market

The global market shows a semi-consolidated structure with many companies offering penicillin product offerings along with generics and combination products. These companies are actively participating in strategic activities such as the expansion of manufacturing capabilities, collaborations, and partnerships.

Pfizer Inc., Aurobindo Pharma Limited, and GSK plc., are some of the dominating players in the market. A comprehensive range of penicillin, global presence through a strong distribution network, and collaborations with research and academic institutes are few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include Teva Pharmaceuticals USA, Inc., Sandoz Group AG, Sun Pharmaceutical Industries Ltd., and others. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with pharmaceutical companies, and investment initiatives to enhance their market presence.

LIST OF KEY PENICILLIN COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- Aurobindo Pharma Limited. (India)

- GSK plc. (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz Group AG (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla (India)

- Merck & Co Inc. (U.S.)

- Reddy’s Laboratories (India)

KEY INDUSTRY DEVELOPMENTS

- June 2025: The Swedish state-owned pharmaceutical company Apotek, Produktion & Laboratorier (APL), acquired an antibiotic production facility to meet the demand for the penicillin antibiotics. The company bought one of Meribel Pharma Solutions’ sites in Sweden. The 8,000 m2 production facility for penicillin is located in Stockholm.

- July 2025: Toyama Chemical, under Fujifilm Holdings, invested about USD 617.76 billion to expand its plant in Toyama. The facility is expected to manufacture ampicillin hydrate, a stock solution used in the manufacture of penicillin antibiotics.

- October 2024: Lyfius Pharma, a unit of Aurobindo Pharma, inaugurated its Penicillin-G plant at Kakinada, India. The facility has an annual production capacity of 15,000 metric tonnes (MT) to cater to the increasing demand for penicillin.

- July 2020: Sandoz Group AG, in collaboration with the Austrian federal government, invested in strengthening antibiotics manufacturing in Europe. Sandoz invested more than USD 162.3 billion to strengthen antibiotic manufacturing operations. The government funding would primarily support new process technology to produce API for penicillin products.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.96% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type · Penicillin G · Penicillin V · Amoxicillin · Piperacillin · Ampicillin · Others |

|

By Disease Indication · Skin Infections · Respiratory Infections · Urinary Tract Infections · Septicemia · Ear Infection · Gastrointestinal Infections · Others |

|

|

By Route of Administration · Oral · Parenteral |

|

|

By Distribution Channel · Hospital Pharmacies · Retail Pharmacies & Drug Stores · Online Pharmacies |

|

|

By Region · North America (By Product Type, Disease Indication, Route of Administration, Distribution Channel, and Country) o U.S. o Canada · Europe (By Product Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market valued at USD 12.82 billion in 2026 and is projected to reach USD 17.49 billion by 2034, exhibiting a CAGR of 3.96% during the forecast period.

In 2025, the market value stood at USD 4.53 billion.

The market is expected to exhibit a CAGR of 3.96% during the forecast period.

The amoxicillin segment led the market, by product type.

The increasing prevalence of infectious diseases and the need for safe and effective antibiotics are expected to heighten the market demand and drive market growth.

Pfizer Inc., Aurobindo Pharma Limited, and GSK plc., are some of the prominent players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us