Permanent Magnet Market Size, Share & Industry Analysis, By Type (Neodymium Iron Boron (NdFeB), Ferrite, Samarium Cobalt (SmCo), Aluminum Nickel Cobalt (Alnico), and Others), By Application (Consumer Electronics, Automotive, General Industrial, Medical Devices, Energy, Aerospace, Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

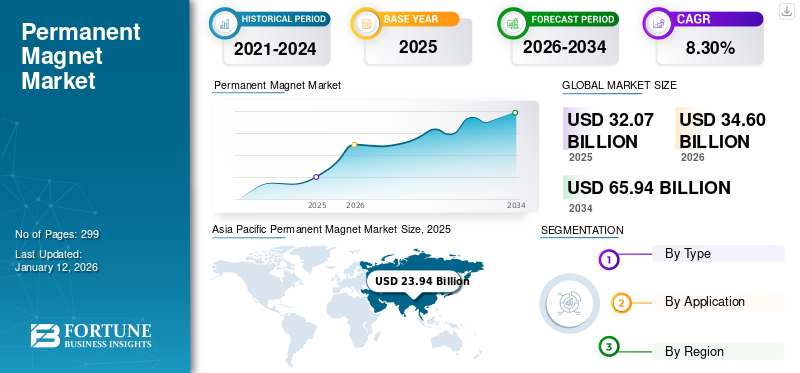

The global permanent magnet market size was valued at USD 32.07 billion in 2025. The market is projected to grow from USD 34.6 billion in 2026 to USD 65.94 billion by 2034 at a CAGR of 8.30% during the forecast period of 2026-2034. Asia Pacific dominated the permanent magnet market with a market share of 75% in 2025.

A permanent magnet, widely known as a hard magnet, is an object that retains its magnetic properties even in the absence of a magnetizing force such as an inducing field or current. The core structure of the material generates the magnetic field in this magnet. This magnet has low permeability, large magnetic moments, and is stable to external magnetic fields. It converts electrical energy into mechanical energy and vice versa, further controlling the electrons and using the repulsion between magnets. The permanent magnets include alloy magnets, ferrite magnets, and bonded magnets.

These are integral to a wide range of industrial and consumer applications, including electric motors, generators, sensors, and magnetic locking systems. The product offers high reliability, low maintenance, and long operational life, making it a crucial component in energy-efficient technologies and modern manufacturing systems. These factoCrs collectively contribute to the overall market growth.

Proterial, Ltd., Shin-Etsu Chemical Co., Ltd., Daido Steel Co., Ltd., TDK Corporation, and Arnold Magnetic Technologies Corp. are a few key players operating in the market.

Global Permanent Magnet Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 32.07 billion

- 2026 Market Size: USD 34.6 billion

- 2034 Forecast Market Size: USD 65.94 billion

- CAGR: 8.30% from 2026–2034

Market Share:

- Asia Pacific dominated the permanent magnet market with a 75% share in 2025, driven by strong demand from automotive, consumer electronics, and energy applications, coupled with abundant rare earth deposits and large-scale manufacturing capacity in China.

- By type, Neodymium Iron Boron (NdFeB) magnets are expected to retain the largest market share in 2025 due to their high performance, compact size, cost efficiency, and essential role in electric motors, power tools, and green technologies.

Key Country Highlights:

- China: The world’s largest producer and consumer of permanent magnets, supported by abundant rare earth resources, booming renewable energy installations, and strong domestic manufacturing.

- United States: Growth supported by rising consumer electronics demand, electric vehicle adoption, and government-backed initiatives to develop domestic rare earth production and recycling capacity to reduce reliance on imports.

- Japan: Advanced manufacturing sectors such as automotive, robotics, and electronics continue to drive demand for high-performance magnets, with a strong focus on precision engineering and energy efficiency.

- Europe: Expansion fueled by the shift toward electric and hybrid vehicles, EU Green Deal initiatives, and investments in recycling and local rare earth processing to strengthen supply chain resilience.

PERMANENT MAGNET MARKET TRENDS

Increasing Trends of Renewable Energy Sources Will Significantly Impact the Product Adoption

The products are crucial in various renewable energy technologies, including wind turbines and electric vehicles (EVs). Their role in enhancing performance and efficiency is vital for the success of these systems. While the use of hard magnets in renewable technologies contributes to sustainability, manufacturing processes can emit substantial greenhouse gases. As the demand for these magnets grows, addressing the environmental impact of their production becomes highly important.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Consumer Electronics is a Key Driver for Market Growth

The rising demand for consumer electronics is a key driver for the permanent magnet market growth. Hard magnets are essential components in a wide range of consumer electronics, including smartphones, laptops, televisions, music systems, computers, smart home devices, and wearable technology. Their unique properties, such as attraction, repulsion, and efficient energy conversion, make them critical for the miniaturization and performance of modern electronic devices.

Advancements in technology and shifting consumer preferences toward more compact, powerful, and energy-efficient electronics are fueling this demand. As devices become smaller and more sophisticated, the need for high-performance magnets, particularly neodymium iron boron (NdFeB) magnets, has increased. These magnets are used in components such as speakers, microphones, hard drives, and various sensors, enhancing device efficiency and functionality.

Rising Use of Neodymium Iron Boron (NdFeB) in Various Applications Augments Market Growth

The increasing use of Neodymium Iron Boron (NdFeB) magnets is a significant driver for market growth. NdFeB magnets are known for their exceptional strength, high magnetic stability, and compact size, making them the strongest commercially available product in the market. These benefits increase its use in several applications, such as automotive parts, wind turbines, actuators, speakers, electronics equipment, and domestic appliances. Hence, the growth of these applications leads to a rise in demand for NdFeB magnets, thereby aiding market growth.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices Hamper Market Growth

Fluctuations in the prices of raw materials, especially rare earth elements including neodymium, praseodymium, and dysprosium, pose a significant challenge to the market growth. These materials are essential for manufacturing high-performance magnets used in electric vehicles, wind turbines, and electronics.

The volatility in raw material prices creates uncertainty in cost projections and financial planning for manufacturers, leading to potential disruptions in supply chains and profit margins. When prices rise sharply, manufacturers may face higher production costs, which can be passed on to consumers or could result in reduced demand. Conversely, sudden price drops can lead to excess inventory and decreased competitiveness.

Market Opportunities

Growing Use of Permanent Magnets for Hybrid Electric Vehicles in Automotive Industry is a Lucrative Opportunity for Market Growth

The automotive industry is witnessing a significant shift toward electrification, with hybrid electric vehicles (HEVs) and electric vehicles (EVs) gaining higher traction globally. Magnets, especially those made from rare earth elements, including neodymium and samarium-cobalt-play a crucial role in this transformation.

Magnet motors are more efficient and compact as compared to conventional motors. This is vital for HEVs, where space and weight savings directly impact vehicle performance and range. These magnets offer excellent thermal stability and resistance to demagnetization, making them ideal for the challenging conditions inside automotive powertrains. In addition, the use of product magnets in electric motors leads to lower energy losses, improving the overall efficiency of HEVs and helping manufacturers meet stricter emission standards.

Market Challenges

Environmental Concerns and Regulatory Compliance are Expected to Challenge Market Growth

The market, while experiencing growth, also faces environmental concerns as various challenges could impact market growth. The mining and processing of rare earth elements can have substantial environmental impacts, including habitat destruction and pollution. Increasing regulatory scrutiny and public awareness of environmental issues might also hinder production and increase costs.

Achieving regulatory compliance can pose a significant challenge for the market. As governments globally implement stricter regulations regarding environmental impact and resource extraction, manufacturers may face hurdles in ensuring compliance with these laws. This can lead to increased costs, delays in production, and limitations in the sourcing of raw materials, especially rare earth elements. Additionally, navigating the complex regulatory landscape may require companies to invest in better technologies and processes, further straining their resources.

Impact of COVID-19

Stalled Supply Chain Due to Pandemic Hampered Market Growth

The COVID-19 pandemic significantly disrupted the global supply chains, leading to delays and shortages that hampered market growth. With manufacturing halts and transportation issues, the availability of raw materials was also affected. This situation made it challenging for companies to meet the rising demand for products across various industries, including electronics, automotive, and renewable energy.

Impact of Trade Protectionism and Geopolitics

The U.S. tariffs are likely to push companies to diversify their supply chains and reduce reliance on China for products. Non-Chinese producers are increasing their investments in refining and manufacturing facilities across North America and Europe. Buyers are focusing on securing long-term contracts with alternative suppliers and exploring multi-sourcing strategies. Moreover, the focus on recycling and circular supply chains is rising as hydrogen-based recycling projects and direct reuse of materials help mitigate the reliance on primary rare earths, enhancing supply chain resilience.

Research and Development (R&D) Trends

R&D in sustainable manufacturing is expected to positively impact the market in the near future. There's a strong focus on developing eco-friendly magnet production processes. This includes recycling old magnets and using less harmful substances in the manufacturing process to minimize environmental impact.

SEGMENTATION ANALYSIS

By Type

Neodymium Iron Boron (NdFeB) Segment Led Market Due to Its High Performance, Small Size, And Low-Cost Features

Based on type, the market is classified into neodymium iron boron (NdFeB), ferrite, samarium cobalt (SmCo), aluminum nickel cobalt (Alnico), and others.

The Neodymium Iron Boron (NdFeB) segment accounted for the highest permanent magnet market share of 63.90% in 2026. The growth of this segment is attributed to its high performance, small size, and low-cost features. These magnets are highly utilized in electric motors and power tools. Furthermore, the lack of efficient substitutes for NdFeB magnets, coupled with initiatives taken by several governments to encourage the use of green technologies, is anticipated to push the market growth.

Ferrite magnets provide high-temperature operations, resistance to demagnetization, and are cost-effective. These properties increase its use in automotive components such as door closing, fuel pump, engine starter, windshield wipers, and antenna lift, thereby anticipating a showcase of notable growth during the forecast period.

Samarium Cobalt (SmCo) magnets are essential in high-performance applications requiring thermal stability and resistance to demagnetization, such as aerospace, military, and advanced industrial applications. They perform consistently in extreme environments, including high-temperature and corrosive conditions. Demand for these magnets is rising due to their role in concentrated wind turbines and under-the-hood EV components. Despite high costs, their stability and reliability make them a preferred choice for critical systems. SmCo remains a strategic material in precision industries focused on quality and durability over cost, ensuring steady long-term demand in specialized industries.

By Application

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Leads Market, Attributed to Increasing Consumer Disposable Income and Technological Advancements

In terms of application, the market is segmented into consumer electronics, automotive, general industrial, medical devices, energy, aerospace, defense, and others.

Consumer electronics is the largest application segment in the market with a share of 22.95% in 2026. The growing use of magnets in this application is associated with the rising demand for consumer electronics products. The increasing consumer disposable income and technological advancements are major factors propelling the demand for various electronic products such as air conditioning, cameras, compressors, loudspeakers, and mobile phones. Increasing demand for consumer electronics will increase the use of hard magnets globally.

The automotive industry is expected to witness significant growth during the forecast period. In the automotive sector, hard magnets are utilized in moving car parts, battery components, and engine components. The rising need for hybrid electric vehicles and electric vehicles, coupled with the growing automotive industry, will surge the product demand.

Aerospace magnet demand is rising with the shift to electric aircraft systems and lightweight designs. Permanent magnets enable the reliable operation of actuators, avionics, and auxiliary power units. NdFeB and SmCo magnets are critical due to their strength and stability at extreme temperatures and altitudes. They are also used in satellites and spacecraft, where performance in radiation-rich environments is vital. Growth in electric vertical takeoff, landing aircraft and satellite constellations further fuels innovation. Aerospace manufacturers are adopting advanced magnet shapes through additive manufacturing, reducing weight and enhancing magnetic field control, thus contributing to safer, more efficient flight technologies. This, in turn, is anticipated to benefit and drive the segment growth during the forecast period.

PERMANENT MAGNET MARKET REGIONAL OUTLOOK

The global market has been segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Permanent Magnet Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 25.94 billion in 2026, dominating the global market. It is also the fastest-growing region in the market, owing to the rising demand for product demand from automotive, consumer electronics, and energy applications. China is the leading producer and consumer of these magnets owing to the presence of abundant rare earth deposits across the region. Expanding renewable energy capacity, especially in wind and solar, requires efficient and compact magnets. In addition to this, regional growth in robotics, aerospace, and high-tech industries also supports the rising magnet demand. Government support, low-cost manufacturing, and strong domestic markets create a powerful combination, ensuring Asia Pacific’s continued dominance in both magnet production and consumption across the global supply chain. The Japan market is projected to reach USD 4.48 billion by 2026, the China market is projected to reach USD 18.01 billion by 2026, and the India market is projected to reach USD 1.51 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market size in North America stood at USD 3.03 billion in 2026, dominating the global market. In North America, the product growth is attributed to the rapidly increasing demand for consumer electronics such as wearable devices, personal computers, medical devices, and mobile phones. In addition, supply chain concerns, especially due to China’s dominance in rare earths, are prompting U.S. initiatives for domestic production and recycling. While government supportive policies targeting clean energy and carbon reduction will continue to encourage investment in recycling. These factors, combined with advancements in energy storage, automotive tech, and industrial applications, position North America as a growing market. The U.S. market is projected to reach USD 2.4 billion by 2026.

Europe

The market in Europe is expected to rise remarkably with market share 14% in 2025, owing to the rapidly growing automotive industry. Additionally, the rising demand for electric vehicles and hybrid electric vehicles, along with government regulations to increase the use of these vehicles over conventional vehicles, will drive the market in Europe. Initiatives, including the EU Green Deal, encourage green technologies while recycling and local processing investments aim to close the loop on rare-earth supply chains. Growth in automation, robotics, and clean transportation also fuels the product demand. The UK market is projected to reach USD 0.53 billion by 2026, and the Germany market is projected to reach USD 1.47 billion by 2026.

Competitive Landscape

Key Market Players

Key Players are Blending Organic and Inorganic Growth Strategies to Continue Dominating Market

Permanent magnets are mainly produced in China due to the abundant availability of raw materials. China accounts for about 70% of the production volume. Hence, many players in the market have branches in China and are investing a considerable number of resources in the research and development of customized permanent magnet products according to the needs of end users.

Furthermore, these companies have adapted strategies for new product development, expansion, and acquisition to increase their product offerings and geographic presence and efficiently serve customer demand. These strategies are projected to positively impact the global market during the forecast period, as many companies would increase their market share.

LIST OF KEY PERMANENT MAGNET COMPANIES PROFILED

- Proterial, Ltd. (Japan)

- Adams Magnetic Products Co., Inc. (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Arnold Magnetic Technologies Corp. (U.S.)

- Daido Steel Co., Ltd. (Japan)

- TDK Corporation (Japan)

- Electron Energy Corporation (U.S.)

- Hangzhou Permanent Magnet Group (China)

- Earth-Panda Advanced Magnetic Material Co., Ltd. (China)

- Tengam Engineering, Inc. (U.S.)

- Bunting Magnetics Co. (U.S.)

- Alpha Magnetics Pty Ltd (Australia)

- Tridus Magnetics and Assemblies (U.S.)

- Ningbo Yunsheng Co., Ltd. (China)

- Magnequench International, LLC (Singapore)

- Integrated Magnetics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024 – Arnold Magnetic Technologies Corporation announced the expansion its new facility in Amata City, Chonburi, Thailand. The company’s new facility enables it to serve customers across Asia Pacific, Europe, and the U.S. Such strategic expansion helped it gain more market share.

- April 2023 – Arnold Magnetic Technologies Corporation partnered with Cyclic Materials to develop a rare earth recycling program. This partnership helps to create an unprecedented circular supply chain for rare earth materials. Arnold is focusing on more options for expanding this partnership to cover their other North American locations.

- April 2023 – Neo Performance Materials Inc., the parent company of Magnequench International LLC, completed the acquisition of SG Technologies Group Limited. The company is an advanced specialty manufacturer of rare-earth-based and high-performance magnets for industrial and commercial markets. Such acquisitions are expected to boost the company’s rare earth business across the globe.

- December 2022: Hitachi Metals conducted a simulation study utilizing the company's NMF 15 high-performance ferrite magnets in xEV traction motors. As a result, the company verified that ferrite magnet motors can achieve the same output level as a motor using a neodymium magnet under certain conditions. Such a study increases the company's share in the market in the near future.

REPORT COVERAGE

The permanent magnet market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types, and applications of the product. Besides this, the report offers insights into the market's current trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 8.30% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 34.06 billion in 2026 and is projected to reach USD 65.94 billion by 2034.

Growing at a CAGR of 8.30%, the market will exhibit steady growth in the forecast period (2026-2034).

By type, the Neodymium Iron Boron (NdFeB) segment led the market.

Rising demand for consumer electronics is driving the market.

Asia Pacific dominated the permanent magnet market with a market share of 75% in 2025.

Rising demand for electric vehicles and the use of renewable energy sources will drive the product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us