Polybutadiene Rubber Market Size, Share & Industry Analysis, By Application (Tire, Non-tire Automotive, Industrial Rubber Goods, Footwear, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

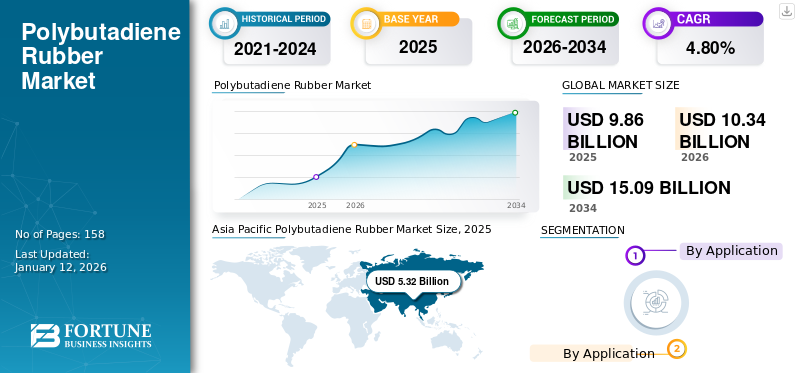

The global polybutadiene rubber market size was valued at USD 9.86 billion in 2025 and is projected to grow from USD 10.34 billion in 2026 to USD 15.09 billion by 2034, exhibiting a CAGR of 4.8% during the forecast period. Asia Pacific dominated the polybutadiene rubber market with a market share of 54% in 2025.

Polybutadiene rubber (PBR), also known as butadiene rubber (BR), is a synthetic rubber produced through the polymerization of 1,3-butadiene, a monomer derived from petroleum. It belongs to the class of elastomers and is characterized by high resilience, excellent abrasion resistance, low glass transition temperature, and high elasticity, allowing it to return to its original shape after deformation.

The increased demand for tires in the automotive sector is expected to drive the growth of the polybutadiene rubber market. The product demand is favored for its superior properties, such as excellent abrasion resistance, low rolling resistance, and high resilience, which enhance tire performance and durability.

Major companies operating in the market include ARLANXEO, Indian Oil Corporation Ltd, Reliance Industries Limited, ENEOS Materials Corporation, Goodyear Tire and Rubber Company, and SIBUR International GmbH.

Global Polybutadiene Rubber Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 9.86 billion

- 2026 Market Size: USD 10.34 billion

- 2034 Forecast Market Size: USD 15.09 billion

- CAGR: 4.8% from 2026–2034

Market Share:

- Asia Pacific dominated the polybutadiene rubber market with a 54% share in 2025, driven by strong industrial and automotive manufacturing bases in countries such as China, India, and Japan. The region’s growth is further propelled by rising production capacities, urbanization, and expanding infrastructure.

- By application, the tire segment is expected to retain the largest market share in 2025 due to PBR’s high abrasion resistance, low rolling resistance, and resilience — making it ideal for enhancing tire durability and performance in a growing global automotive market.

Key Country Highlights:

- China: Strong demand driven by the nation's robust tire production and infrastructure boom. Government investments in transportation and industrial projects support high PBR consumption.

- India: Rapid growth in the automotive sector and increasing infrastructure development are fueling polybutadiene demand, especially in tire and non-tire applications.

- United States: A mature automotive market and rising demand for high-performance tires drive PBR usage, though growth is tempered by strict environmental regulations and competition from alternatives.

- Japan: Pioneering innovation in sustainable rubber manufacturing. High-quality automotive production and eco-regulatory compliance support steady demand for polybutadiene rubber.

- Germany (Europe): Sustainability-focused initiatives in the automotive and construction sectors are spurring demand for eco-conscious PBR products.

- Brazil (Latin America): Growing but slower adoption in automotive and industrial applications. Economic fluctuations may impact long-term growth.

MARKET DYNAMICS

POLYBUTADIENE RUBBER MARKET TRENDS

Shift Toward Eco-Friendly Materials to Propel Product Demand

The rising trend towards the adoption of sustainable and eco-friendly materials is significantly influencing the polybutadiene rubber market growth. Manufacturers are increasingly exploring bio-based polybutadiene and recycling options to comply with environmental regulations and address shifting consumer preferences. Growing public awareness and preference for eco-friendly products are compelling manufacturers to innovate and incorporate sustainable practices into their production processes. As a result, the demand for eco-conscious polybutadiene rubber products is on the rise.

MARKET DRIVERS

Growing Adoption of Polybutadiene Rubber in Construction & Infrastructure Sectors to Drive Market Growth

The polybutadiene rubber adoption in the construction and infrastructure sectors is on the rise, driven by its exceptional properties and rising demand for durable materials across various applications. The product is known for its flexibility, resilience, and resistance to weathering, making it an ideal choice for construction applications. These properties allow PBR to perform well in challenging environments, ensuring longevity and reliability in construction components.

The rising number of infrastructure projects, such as road construction and the expansion of transportation networks, is significantly boosting the adoption of polybutadiene rubber. Its use in conveyor systems and other structural materials is becoming increasingly common as global infrastructure development accelerates.

- The National Action Plans on Business and Human Rights Association indicates that the global construction industry is expected to increase by USD 4.5 trillion, reaching a total of USD 15.2 trillion in the coming years, with the U.S., India, China, and Indonesia accounting for 58.3% of this projected growth. Emphasizing sustainable and ethical construction practices, through the use of innovative products and solutions is essential for meeting Sustainable Development Goals (SDGs) 9 and 11, which target resilient infrastructure, inclusive industrialization, and the development of sustainable cities and communities.

MARKET RESTRAINTS

Health Concerns Regarding Exposure to Polybutadiene May Restrain Market Growth

The market faces potential restraints due to health concerns associated with exposure to this synthetic rubber. Exposure to polybutadiene can lead to various health issues. At high levels, it may cause irritation to the eyes, nasal passages, throat, and lungs. In more severe cases, individuals may experience neurological symptoms such as blurred vision, fatigue, headache, and vertigo. These potential health risks are raising concerns among workers in manufacturing and processing environments, potentially leading to stricter regulations.

MARKET OPPORTUNITIES

Increasing Use in Consumer Products to Create Growth Opportunities

The growing adoption of polybutadiene rubber in consumer products presents significant opportunities for market expansion. The butadiene rubber is increasingly being utilized in a variety of consumer products due to its excellent properties, such as high resilience, abrasion resistance, and low rolling resistance. These characteristics make it ideal for applications in footwear, sports equipment, and various industrial rubber products. For instance, its absorption capabilities enhance the performance of items such as golf balls and athletic shoes, making them more appealing to consumers.

MARKET CHALLENGES

Stringent Environmental Regulations to Challenge Market Growth

Increasingly stringent environmental regulations are compelling manufacturers to invest in compliance measures. These regulations often mandate the adoption of cleaner production technologies and strict control of emissions in the manufacturing of butadiene rubber. This can lead to increased operational costs and may deter new entrants into the market, thereby slowing growth. Such factor reduces the polybutadiene rubber market share.

Concerns regarding the environmental impact of polybutadiene production are becoming more pronounced. The production process can generate hazardous waste and emissions, prompting regulatory bodies to impose stricter guidelines. This affects existing manufacturers and creates barriers for potential new players in the market.

TRADE PROTECTIONISM

Trade protectionism often takes the form of tariffs and import restrictions on foreign-produced products. These measures can increase the cost of imported materials, making domestic products more competitive. While this can benefit local manufacturers, it may also lead to higher prices for consumers and reduced availability of certain grades of polybutadiene rubber.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Tire Segment Leads the Market due to Soaring Demand for High-Quality Tires

Based on application, the market is classified into tire, non-tire automotive, industrial rubber goods, footwear, and others.

The tire segment dominates the market, accounting for a leading share of the market. PBR is favored in tire production due to its excellent abrasion resistance, low rolling resistance, and high resilience, properties that enhance tire performance and durability. This segment is expected to maintain its lead in the market as global automotive production and demand for tires grow.

The product is also utilized in various non-tire automotive applications, such as seals, gaskets, and other rubber parts that require flexibility and long-term durability. The increasing focus on automotive innovation and the demand for high-performance materials in vehicles are driving growth in the segment.

PBR finds application in the footwear industry, particularly in the production of soles and components that benefit from its flexibility and comfort. The growing trend toward high-performance athletic footwear is likely to drive further growth in this segment.

Polybutadiene Rubber Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polybutadiene Rubber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market in 2025 with valuation of USD 5.32 billion, driven by a robust industrial and automotive manufacturing base in countries such as China, India, and Japan. Rapid urbanization and increasing demand for automotive tires are key factors contributing to the region’s dominance. The market is expected to continue expanding, supported by rising production capacities and investments in infrastructure.

North America

In North America, particularly the U.S., features a strong automotive industry that fuels the demand for high-performance tires and industrial rubber goods. However, polybutadiene rubber market growth in the regional market may face challenges from stringent environmental regulations and competition from alternative materials.

Europe

Europe is experiencing positive growth in the market, with a strong focus on innovation and sustainability. The automotive sector, along with various industrial applications, plays a crucial role in driving demand. European manufacturers are increasingly adopting eco-friendly practices, which may influence the types of polybutadiene rubber products developed and marketed.

Middle East & Africa

The Middle East and Africa region is witnessing gradual growth in the market, primarily due to increasing industrial activities and infrastructure development. However, the market is still in its nascent stages compared to other regions and faces challenges such as economic and logistical challenges.

Latin America

Latin America’s PBR market is growing, though at a slower pace compared to other regions. The demand is primarily driven by the automotive and industrial sectors. Economic fluctuations and political instability in some countries may pose challenges to market growth in this region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Capacity Expansion to Strengthen their Positions in the Market

The polybutadiene rubber market is highly competitive, with major players focusing on capacity expansion, sustainability initiatives, and mergers & acquisitions to strengthen their market presence. Key global companies include Indian Synthetic Rubber Private Limited, Apcotex Industries Limited, Reliance Industries Limited, Sinopec, and Goodyear Tire and Rubber Company. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition and reshaping the industry landscape.

LIST OF KEY POLYBUTADIENE RUBBER COMPANIES PROFILED

- ARLANXEO (Netherlands)

- Indian Oil Corporation Ltd (India)

- Reliance Industries Limited (India)

- ENEOS Materials Corporation (Japan)

- Goodyear Tire and Rubber Company (U.S.)

- SIBUR International GmbH (Austria)

- LANXESS (Germany)

- KURARAY CO., LTD. (Japan)

- JSR Corporation (Japan)

- Kumho Petrochemical (South Korea)

KEY INDUSTRY DEVELOPMENTS

- February 2023: Arlanxeo announced the launch of a polybutadiene rubber production facility with a capacity of 65 ktpa in southern Brazil. Located within the Triunfo petrochemical complex in Rio Grande do Sul, this new plant emphasizes the company's commitment to enhancing its presence in Latin America.

- March 2022: Indian Oil Corporation Limited planned to build a 60 ktpa polybutadiene rubber (PBR) facility at the current naphtha cracker complex located in Panipat. The project involves an investment of INR 14.6 billion (USD 169 million). It plans to obtain the necessary feedstock, butadiene, from the 138 ktpa butadiene extraction unit (BDEU) already operating within the Panipat complex.

- February 2019: SIBUR initiated an investment project focused on improving the efficiency of polybutadiene rubber (Nd-BR) production at its Voronezh plant (Voronezhsintezkauchuk). The goal of the project is to implement a comprehensive upgrade that enhances the operational efficiency of the current facility and guarantees the consistent production of high-quality products. This initiative will allow SIBUR to manufacture superior products while increasing operational efficiency.

REPORT COVERAGE

The global polybutadiene rubber market analysis provides market size and forecasts for all segments included in the report. It includes details on the market dynamics and emerging market trends. It offers information on key regions, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.8% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 10.34 billion in 2026 and is projected to reach USD 15.09 billion by 2034.

In 2025, the market value stood at USD 9.86 billion.

The market is expected to exhibit a CAGR of 4.8% during the forecast period.

By type, the tire segment led the market.

Rapid automotive industry development is a key factor driving the market.

ARLANXEO, Indian Oil Corporation Ltd, Reliance Industries Limited, ENEOS Materials Corporation, Goodyear Tire and Rubber Company, and SIBUR International GmbH are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

Increasing construction activities and rapid infrastructure development are some of the major factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us