Polyurethane Protective Gloves Market Size, Share & Industry Analysis, By Application (Automotive, Construction, Healthcare, Food & Beverages, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

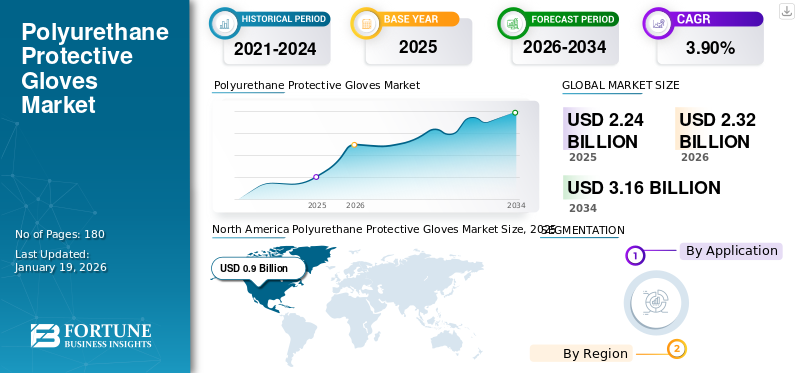

The global polyurethane protective gloves market size was valued at USD 2.24 billion in 2025. The market is projected to grow from USD 2.32 billion in 2026 to USD 3.16 billion by 2034, exhibiting a CAGR of 3.90% during the forecast period. North America dominated the polyurethane protective gloves market with a market share of 40% in 2025.

Polyurethane protective gloves are witnessing significant demand across various industries due to their unique mixture of comfort, flexibility, and superior grip. These gloves are coated with a thin layer of polyurethane, which enhances tactile sensitivity and allows precise handling. It also helps in impact protection, making them ideal for tasks requiring skill, such as electronics assembly, automotive repair, and quality control operations. Unlike latex or nitrile gloves, polyurethane gloves offer excellent cut resistance without sacrificing breathability, ensuring prolonged comfort during extended use. Their resistance to oils, solvents, and light mechanical hazards makes them suitable for both dry and slightly oily environments. Increasing product demand from the automotive, construction, and healthcare industries will significantly drive market growth.

Leading players in the market include ANSELL LTD, HANVO Safety, PIP Global, Global Glove, Safety Manufacturing, Inc., and Engelbert Strauss Inc.

POLYURETHANE PROTECTIVE GLOVES MARKET TRENDS:

Rising Demand for Touchscreen Compatible Protective Gloves is a Key Market Trend

One prominent trend shaping the market is the growing demand for touchscreen-compatible gloves. As industrial workplaces increasingly adopt digital tools, machines, and interfaces requiring frequent touchscreen interaction, traditional gloves often hinder responsiveness. In response, polyurethane gloves, known for their thinness and flexibility, are being specifically engineered to enable accurate touch sensitivity without requiring workers to remove them. This feature is particularly valuable in sectors such as manufacturing, logistics, healthcare, and automotive assembly, where workers frequently interact with digital equipment. Glove manufacturers are capitalizing on this trend by developing models with enhanced conductivity, enabling precision control.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS:

Surging Need from Automotive Industry to Drive Market Development

The global growth of automotive manufacturing has significantly boosted the demand for high-performance protective gear, including polyurethane gloves. Automotive assembly involves tasks such as handling sharp metal parts, dealing with lubricants, and working with sensitive components, all of which require gloves that offer both protection and flexibility. As electric vehicles and hybrid technologies gain traction, production lines are evolving to demand more precise and safe handling of electrical components. Hence, increasing product demand from the automotive industry is expected to drive the polyurethane protective gloves market growth.

MARKET RESTRAINTS:

Limited Heat and Chemical Resistance Affects Glove Demand

One of the major limitations of polyurethane protective gloves is their relatively low resistance to heat and strong chemicals. While these gloves offer excellent agility and abrasion resistance, they are not ideal for tasks involving high temperatures or aggressive chemical exposure. In industries such as metallurgy, chemical processing, or certain heavy-duty manufacturing sectors, the inability of polyurethane gloves to withstand extreme conditions restricts their application. Unless future technological innovations enhance their resistance to harsh conditions, this limitation will continue to restrain broader adoption across high-risk industrial segments.

MARKET OPPORTUNITIES:

Growing Demand for Electronics-Compatible Gloves to Bring Opportunity for Market

The rise in demand for electronics-compatible gloves offers a great opportunity for the market. These gloves are perfect for environments that require low particulate shedding and high tactile precision, such as electronics assembly, semiconductor manufacturing, and laboratory research. Polyurethane gloves do not leave residues and are non-reactive, and are available in disposable gloves, making them perfect for handling sensitive electronic components without contamination. As industries move toward miniaturization and advanced tech manufacturing, the need for gloves that combine precision with cleanliness is increasing. Polyurethane gloves meet these requirements effectively, positioning them as the best solution for businesses seeking to meet strict operational and regulatory standards.

- As per the Semiconductor Industry Association (SIA) report, in 2024, the global semiconductor sales hit USD 627.6 billion, marking an increase of 19.1% compared to USD 526.8 billion in 2023. The U.S. and China held the largest share, accounting for 44.8% and 18.3% of sales globally. This rapid growth in the semiconductor industry further reinforces the rising demand for electronics-compatible gloves, creating a strong growth opportunity for the market.

MARKET CHALLENGES:

High Price Point Could Pose a Challenge to Market

The market is under constant pressure from price-sensitive competitors offering alternatives such as PVC or low-cost latex gloves. While polyurethane gloves deliver enhanced performance in terms of abrasion resistance and tactile sensitivity, they are often priced higher than basic glove options. In regions with tight procurement budgets or in industries that prioritize cost over performance, buyers may opt for the most affordable solutions regardless of long-term durability or quality. This heightened price sensitivity poses a challenge for manufacturers, impacting their ability to maintain healthy profit margins.

Trade Protectionism

Trade protectionism, through tariffs and restrictions, can impact the global trade dynamics of polyurethane protective gloves. For instance, the U.S. has imposed higher tariffs on Chinese imports, which has benefited domestic producers by making locally produced gloves more competitive. However, these measures have led to higher costs for manufacturers who depend on imported raw materials and components, raising concerns about long-term impacts on price competitiveness.

Segmentation Analysis

By Application

Automotive Segment Holds Largest Share Due to Increasing Safety Awareness at Work

Based on application, the market is classified into automotive, construction, healthcare, food & beverages, and others.

The automotive segment holds the largest market share due to the need for precision, grip, and flexibility during assembly, maintenance, and parts handling. Workers in this sector often deal with small tools, complex components, and surfaces that require delicate handling without compromising on protection. Polyurethane gloves offer excellent tactile sensitivity, allowing technicians to maintain control while assembling or inspecting parts. These gloves also provide resistance to oils and light solvents commonly encountered in automotive workshops.

The construction sector increasingly relies on polyurethane protective gloves for tasks that demand a secure grip, abrasion resistance, and flexibility. These gloves are well-suited for handling tools, raw materials, and machinery in dynamic and rugged environments. Their enhanced grip is especially beneficial when dealing with wet or oily surfaces, which are common on construction sites. Moreover, the lightweight nature of polyurethane gloves makes them comfortable for long hours without sacrificing protection.

In the healthcare sector, polyurethane protective gloves are gaining traction due to their superior sensitivity, cleanroom compatibility, and comfort. These gloves are especially suitable for environments where precision and hygiene are essential, such as diagnostic labs, pharmaceutical handling, and medical device manufacturing, with their low particulate generation and hypoallergenic properties. Furthermore, polyurethane gloves provide a consistent barrier against light chemical splashes and contaminants, enhancing patient safety and reducing the risk of cross-infection.

Polyurethane Protective Gloves Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Polyurethane Protective Gloves Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the major polyurethane protective gloves market share, largely driven by stringent workplace safety regulations and a strong culture of workplace protection. Industries such as automotive, healthcare, food processing, and construction are major end-users that emphasize high-quality personal protective equipment. Rising concerns over chemical exposure and worker injury prevention have prompted companies to prioritize polyurethane gloves for their balance of safety and flexibility. As a result, North America continues to maintain a strong position in the global protective glove industry.

The market in the U.S. is witnessing major growth, driven by increasing demand for lightweight, flexible, and abrasion-resistant hand protection across industries such as electronics, automotive, construction, and manufacturing. Moreover, growing awareness about cut, puncture, and chemical hazards is prompting companies to shift toward more specialized PPE, including PU gloves.

Europe:

The market in Europe is characterized by its strong focus on sustainability, safety solutions, and regulatory compliance. Countries such as Germany, France, and the U.K. are key contributors, with sustained demand from the automotive, healthcare, and food sectors. European manufacturers are also leading the charge in developing eco-friendly and reusable polyurethane gloves, in line with the continent’s sustainability goals. Additionally, Europe’s aging workforce has led to increased ergonomic considerations in glove design, promoting demand for lightweight, comfortable options.

Asia Pacific:

Asia Pacific holds a significant share in the market due to rapid industrialization, expanding manufacturing hubs, and increasing awareness of worker safety across sectors. Countries such as China, India, Japan, and South Korea have seen substantial growth in the automotive, electronics, healthcare, and construction industries, all of which are major consumers of protective gloves. Additionally, the region’s cost-effective glove production capabilities have led to a surge in exports, reinforcing its dominance in global supply chains.

Latin America:

Latin America is witnessing steady growth in the market due to rising industrial activity, healthcare expansion, and improving regulatory enforcement. The healthcare sector in the region is also evolving, with greater emphasis on infection control and hygiene standards, especially in urban centers.

Middle East & Africa:

Countries such as South Africa and UAE are investing in construction, oil & gas, and manufacturing sectors, creating higher demand for PPE, including gloves. In addition, government-led initiatives and improved regulations related to labor safety are expected to drive product demand in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Firms Focus on Capacity Expansion to Strengthen Their Market Presence

The polyurethane protective gloves market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include ANSELL LTD., PIP Global, Global Glove and Safety Manufacturing, Inc., Engelbert Strauss Inc., and HANVO Safety. These companies compete based on product innovation, cost efficiency, and regional dominance as the automotive and healthcare industries are growing. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY POLYURETHANE PROTECTIVE GLOVECOMPANIES PROFILED:

- ANSELL LTD. (Australia)

- PIP Global (U.S.)

- Radians, Inc. (U.S.)

- Global Glove and Safety Manufacturing, Inc. (U.S.)

- Engelbert Strauss Inc. (Germany)

- HANVO Safety (China)

- NANTONG JIADELI SAFETY PRODUCTS CO., LTD. (China)

- Tilsatec (U.K.)

- Kimberly-Clark Worldwide, Inc. (U.S.)

- HexArmor (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2025: Radians, Inc., a personal protective equipment manufacturer, launched 14 new disposable gloves to meet the growing need for single-use gloves. These gloves help to safeguard people and products from contamination, chemicals, and injuries.

- November 2024: PIP Global announced that they have acquired Honeywell’s Personal Protective Equipment Business, including leading brands Fendall, Fibre-Metal, Howard Leight, KCL, Miller, Morning Pride, North, Oliver, Salisbury, UVEX, and others. This expansion will help the company expand its portfolio and enhance its geographic reach.

- June 2024: ANSELL LTD. announced the completion of its acquisition of Kimberly-Clark's Personal Protective Equipment (KCPPE) business. This acquisition would help the company’s position as a global leader in personal protection solutions. This acquisition also brings new growth opportunities for its polyurethane protective gloves segment.

- June 2023: PIP Global, a leader in personal protective equipment, completed the acquisition of Ultimate Cleaners Industrial, Limited, headquartered in Wolverhampton, U.K. The company specializes in PPE and hand protection products, enhancing PIP Global’s product portfolio.

REPORT COVERAGE

The global polyurethane protective gloves market analysis provides market size and forecast for all segments included in the report. It includes details on the market dynamics and market trends expected to drive the market over the forecast period. It offers information about the product in key regions, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of polyurethane protective gloves manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.90% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application and Region |

|

By Application |

|

|

By Geography |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.24 billion in 2025 and is projected to reach USD 3.16 billion by 2034.

In 2025, the market value stood at USD 0.9 billion.

The market is expected to exhibit a CAGR of 3.90% during the forecast period of 2026-2034.

The automotive segment leads the market by application.

The growth of the automotive manufacturing industry is one of the key factors driving the market growth.

ANSELL LTD., PIP Global, Global Glove and Safety Manufacturing, Inc., Engelbert Strauss Inc., and HANVO Safety are some of the leading players in the market.

North America holds the largest market with a share of 40% in 2026.

Increasing demand for touchscreen compatible protective gloves and the rising electronics industry are the factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us