Precast Concrete Market Size, Share & Industry Analysis, By Product Type (Columns & Beams, Girders, Floors & Roofs, Walls & Barriers, Pipes, Paving Slabs, and Others), By Application (Building Components, Transportation, Water & Waste Handling, and Others), By Type (Wet Concrete and Dry/Semi-dry Concrete), By End-Use (Residential, Commercial, Industrial, and Infrastructure {Tunnels, Roads & Bridges, Wind Towers, and Others}), and Regional Forecast, 2026-2034

Precast Concrete Market Size 2026-2034

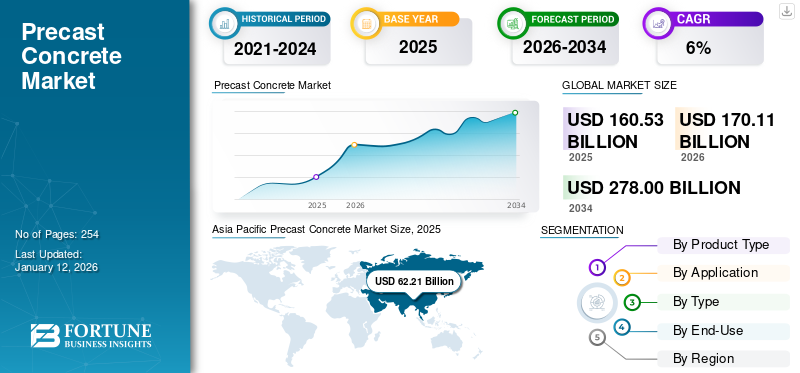

The global precast concrete market size was valued at USD 160.53 billion in 2025. The market is projected to grow from USD 170.11 billion in 2026 to USD 278 billion by 2034, at a CAGR of 6.3% during 2026-2034. Asia Pacific dominated the precast concrete market with a market share of 39% in 2025.

Concrete is precast using reusable molds in a process that takes place off-site within a controlled setting, ensuring that the concrete cures optimally and can be closely supervised. This method is more efficient than traditional on-site casting, as the molds can be used multiple times before being replaced. Advantages include higher quality control of materials, superior workmanship, and increased safety since the production occurs at ground level.

The demand for precast concrete is growing, driven by urbanization and increased construction activities. The construction industry's shift toward sustainable, economical, and modern building techniques is contributing to this growth. Additionally, the expansion of construction projects in developing nations, aimed at improving infrastructure, is expected to further propel the market for precast concrete.

Holcim Ltd, CEMEX S.A.B de C.V, CRH, Bouygues Group, and Larsen & Toubro (L&T) Limited are key players of precast concrete operating in the industry.

Global Precast Concrete Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 160.53 billion

- 2026 Market Size: USD 170.11 billion

- 2034 Forecast Market Size: USD 278 billion

- CAGR: 6.3% from 2026–2034

Market Share:

- Asia Pacific dominated the precast concrete market with a 39% share in 2025. The region’s growth is driven by rapid urbanization, residential and commercial construction booms, and increasing infrastructure investments in countries such as China, India, and Japan.

- By product type, columns & beams are expected to retain the largest market share in 2026, supported by their wide usage in both commercial and residential construction due to fast installation, superior strength, and reduced labor costs.

Key Country Highlights:

- China: Led the market with a size of USD 42.78 billion in 2026. Massive investments in infrastructure development, especially under Belt and Road projects, continue to drive demand.

- United States: The market is growing due to advanced and sustainable construction practices and a high demand for time-efficient building techniques using precast components.

- India: Government initiatives for affordable housing and smart city projects are fostering significant demand for precast solutions in both urban and rural developments.

- Europe: Increased use of precast products in non-residential buildings and infrastructure projects, along with labor efficiency and regulatory support, is propelling market expansion.

Precast Concrete Market Trends

Incorporation of Precast Concrete Products in Residential Buildings to Propel Market Growth

Precast concrete products such as beams, columns, walls, and stairs are incorporated into residential buildings. The speed and ease with which these products can be built have led to their high demand in the building & construction industry. Cast concrete products offer efficient and economical construction in varied weather conditions. These products are meticulously manufactured off-site, which enhances their overall quality. The use of pre cast products significantly reduces cost, construction time, and waste.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rapid Urbanization Activities and an Increase in Population to Fuel Demand

The market is experiencing growth driven by rapid urbanization and a significant increase in population. The escalating demand for non-residential infrastructure, including airports, sports complexes, malls, and commercial buildings, is poised to streamline the supply chain, reducing construction timelines and improving cost efficiency.

The rising demand for residential spaces due to the growing population, coupled with the government's initiatives to provide housing for the Economically Weaker Section (EWS), will further boost the demand for the product. Moreover, the pursuit of better career opportunities has led to more urbanization activities, increasing its use of offices and other commercial spaces.

Ease of Installation and Relocation Drives Market Growth

The market is experiencing growth driven by the ease of installation and relocation of precast concrete structures. This method of construction allows for faster and more efficient building processes, reducing costs and project timelines. Additionally, these structures are durable and require minimal maintenance, making them a popular choice for a variety of applications, such as buildings, bridges, and retaining walls.

The product market continues to grow as a result of the easy handling of precast products. With precast, various elements such as walls, columns, and slabs are manufactured off-site and transported to the construction site for installation. This reduces the amount of on-site labor required and allows for faster and more efficient building processes.

MARKET RESTRAINTS

Rising Environmental Concerns Regarding Cement Manufacturing to Hamper Growth

Cement is an important constituent of concrete. However, its production is a major contributor to global warming and several types of pollution. Cement manufacturing sites are significant sources of toxic gases such as nitrogen oxides, sulfur dioxide, and carbon monoxide. These gases are associated with health issues such as asthma, visual impairment, and cardiovascular diseases. Moreover, the environmental impacts of these gases include acid rain, depletion of water quality, and global warming. The environmental concerns and health issues related to cement manufacturing are likely to restrain the precast concrete market growth. Additionally, regulations enforced by the governments to reduce emissions from cement production sites will further slowdown the CAGR of the market.

MARKET OPPORTUNITIES

Increasing Incorporation of Precast Products in Residential Constructions is Creating Opportunities for Market Growth

The incorporation of precast products in residential constructions is becoming increasingly popular, creating new opportunities for the growth of the market. This trend is due to the numerous benefits of precast, such as faster construction, lower costs, and improved durability. As a result, more and more construction companies are turning to precast as a viable option for their projects. Commercial and infrastructural sectors have been the major contributors to the growth of the precast concrete market. However, the residential sector is also witnessing a rise in the incorporation of concrete and precast products owing to factors such as design flexibility, cost & and time-efficient construction, minimum waste, and excellent quality assurance.

In addition, a few of the precast product manufacturers have started adopting green concrete, which is made using waste materials such as fly ash, silica fume, wood ash, and others. The aim of using green concrete is to lessen the burden on natural resources and increase dependency on recyclable materials. With the shifting focus toward sustainability, green precast products are estimated to witness a surge in demand.

MARKET CHALLENGES

Coordination in Multi-Material Projects Creates a Challenge during Installation

In multi-material construction projects involving precast material, coordination poses a significant challenge due to the fragmented nature of the construction industry and the interdependence among various stakeholders. Each phase, i.e., planning, design, manufacturing, transportation, and installation, requires precise alignment of activities and information across different teams and materials.

Early and ongoing collaboration, supported by digital tools such as BIM and cloud-based platforms, is essential to streamline information flow, detect clashes early, and optimize the integration of multiple materials. Without coordination, the complexity of projects using many materials can get stuck, even for skilled teams, and reduce the benefits of using precast systems.

IMPACT OF COVID-19

The COVID-19 pandemic significantly affected the building & construction industry, leading to the abrupt cessation of building and construction and infrastructure development activities. The market suffered from slowed raw material production, supply chain disruptions, restrictions on the movement of labor and material, and disturbances in trade movements. The pandemic resulted in reduced demand for precast products, resulting in overcapacity.

From January to May 2020, China's cement output totaled 769 million tons, a decline of 8.2% from the previous year, as reported by the Ministry of Industry and Information Technology. Nevertheless, the rise in COVID-19 cases increased the demand for modular healthcare buildings. Government initiatives to construct new healthcare facilities to care for the growing number of patients boosted the use of precast components, helping to offset the pandemic's adverse effects on production.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism has significant geopolitical and economic implications for the precast concrete industry, which relies heavily on global supply chains for raw materials, specialized machinery, and cross-border construction projects. Rising tariffs, quotas, and subsidies, such as those observed in the U.S.-China trade war, can disrupt the flow of critical inputs such as steel rebar or cement additives, increasing production costs and delaying infrastructure projects. Geopolitical tensions, including "friend-shoring" policies and regional trade blocs (e.g., ASEAN or EU carbon border taxes), may force precast manufacturers to diversify suppliers or relocate production, as witnessing in other sectors such as semiconductors and EVs.

Additionally, deglobalization trends risk fragmenting standards and innovation, as precast concrete technology often benefits from international collaboration, such as seismic-resistant designs developed across borders.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Precast concrete is increasingly focused on innovation, sustainability, and digital integration to meet the evolving demands of the construction industry. Key areas of R&D include the adoption of advanced manufacturing technologies such as automation, robotics, and 3D printing, which enhance production efficiency, precision, and allow for greater design flexibility and customization of precast elements.

There is a strong emphasis on developing eco-friendly and recyclable materials, driven by the growing demand for sustainable construction methods and the need to reduce the environmental impact of building activities. The integration of smart technologies, including IoT-enabled sensors embedded in precast components, is gaining traction for real-time monitoring of structural health and performance, supporting proactive maintenance and extending the lifespan of structures.

Segmentation Analysis

By Product Type

Columns & Beams Dominate as Use of Precast Products Surges in Commercial and Residential Construction

Based on product type, the market is classified into columns & beams, girders, floors & roofs, walls & barriers, pipes, paving slabs, and others.

The columns & beams segment held the highest share of 28.96% in 2026 and is estimated to grow at a significant rate during the forecast period. This growth can be attributed to increasing urbanization and the rising demand for sustainable construction methods from the commercial and residential sectors. Precast columns are structural elements manufactured off-site in controlled environments and then transported to construction sites for assembly. These columns are typically made of reinforced concrete and are used to support the weight of the structure above, such as floors, beams, and roofs.

The girders segment is expected to register significant growth during the forecast period owing to the rising infrastructure development. Precast girders play a vital role in the construction industry, especially in infrastructure projects such as bridges, highways, and railways. Precast girders, also known as prestressed concrete girders, serve as structural elements that provide support and stability to bridge decks and other structures.

Precast walls & barriers come in various types, including retaining walls, sound barriers, security walls, boundary walls, and decorative panes. Each type serves a specific function and is effective at reducing noise pollution from roads, railways, industrial facilities, and other sources, improving the quality of life for nearby residents and workers.

Precast paving slabs are pre-made concrete slabs used for paving walkways, driveways, patios, and other outdoor areas. Precast paving slabs come in a wide range of designs, colors, shapes, and sizes, allowing for creativity and customization in outdoor spaces.

By Application

Building Components to Hold Large Share Owing to Need for Affordable Construction Projects

Based on application, the market is classified into building components, transportation, water & waste handling, and others.

The building components segment holds the major share due to its widespread use in different construction and building projects. This segment includes beams, joints, and columns used in construction, including industries and manufacturing plants. Moreover, the rising population and increasing demand for affordable houses will augment growth in the coming years. The segment is poised to hold 54.54% of the market share in 2026.

The transportation segment is anticipated to exhibit noteworthy CAGR of 6.3% during the forecast period (2026-2034). Precast transportation products are used for the construction of tunnels, flyovers, metro pillars, and railways. The growing construction activities in emerging economies to improve connectivity will further boost the market for precast concrete.

By Type

Wet Concrete Dominates Owing to Its Versatility and Adaptability for Various Construction Needs

Based on type, the market is classified into wet concrete and dry/semi-dry concrete.

The wet concrete segment accounted for the largest precast concrete market share and is expected to continue its dominance during the forecast period. Precast wet concrete refers to the process of casting concrete in a mold or formwork while it is still in a wet or plastic state. This method involves pouring a mixture of cement, aggregates, water, and additives into pre-prepared molds, which are allowed to set and cure before being removed and transported to the construction site. Increased construction activities, particularly in infrastructure, residential, and commercial sectors, are expected to drive the demand for precast wet concrete products such as panels, beams, columns, and slabs. The segment is expected to attain 63.82% of the market share in 2026.

In precast dry concrete, the concrete mixture used for casting is relatively dry, with a low water-to-cement ratio. On the other hand, precast semi-dry concrete falls between the dry and wet concrete methods in terms of moisture content. Demand for dry/semi-dry concrete is anticipated to rise significantly, owing to the swiftly rising demand for precast concrete products from the building and construction industry. This segment is likely to grow with a substantial CAGR of 5.70% during the forecast period (2026-2034).

By End-Use

To know how our report can help streamline your business, Speak to Analyst

Infrastructure Segment Captured Largest Market Share Owing to Rising Public and Private Investment in Infrastructure Projects

In terms of end-use, the market is segmented into residential, commercial, industrial, and infrastructure.

The infrastructure segment accounted for the largest market share in 2025, attributed to rising public and private investment in infrastructure projects, including hospitals, educational buildings, government offices, correction facilities, roads, reservoirs, and dams. Both new constructions and the remodeling of old constructions are surging the demand for precast products from the infrastructure sector. This segment is estimated to grow rapidly with a CAGR of 6.68% during the forecast period (2026-2034).

The residential segment is projected to observe substantial growth during the estimated timeframe. The rising global population and investments in developing real estate and infrastructure will contribute to the growth of the market. Proactive initiatives by governments to develop affordable housing for the lower economic group of society will lead to substantial growth of the market. The segment is set to hold 38.75% of the market share in 2026.

PRECAST CONCRETE MARKET REGIONAL OUTLOOK

Based on geography, the market is divided into Europe, Latin America, North America, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific Precast Concrete Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In the global market for precast concrete, Asia Pacific is the leading region and is projected to dominate the market growth during the review period. The region dominated the market with a valuation of USD 58.36 billion in 2024 and USD 62.21 billion in 2025. China’s market size accounted for USD 40.01 billion in 2025 and is expected to gain USD 42.78 billion in 2026. It is anticipated to be the country with the fastest-growth during the forecast period. Rising investments by China, India, and Japan to develop infrastructure will increase the demand for the product. Additionally, the growing residential sector in these countries, attracted by its cost efficiency, will further boost the demand for products, providing impetus to the market. India is set to grow with a valuation of USD 6.1 billion in 2026, while Japan is estimated to be worth USD 4.89 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market anticipated to hold USD 32.4 billion in 2026. The growth of the market in this region is attributed to advanced and sustainable construction practices, propelling the demand for advanced products. The U.S., known for adopting modern construction strategies and technologies, prioritizes time efficiency, leading to rising consumption of precast construction products. The U.S. market is expected to reach a market value of USD 29.37 billion in 2026.

Europe

Europe is the second largest market set to be valued at USD 33.78 billion in 2026, exhibiting a CAGR of 20% during the forecast period (2026-2034). The region is expected to showcase significant growth during the forecast period, owing to the increasing usage of these concrete products for non-residential and infrastructural development. The U.K. market continues to grow, projected to reach a valuation of USD 3.27 billion in 2026.Implementation of precast concrete products has resulted in significantly reduced construction time and labor costs, thereby boosting the market in the region. Germany is likely to attain USD 7.48 billion in 2026, while Japan is projected to capture the valuation of USD 4.89 billion in the same year.

Latin America

The market in Latin America will rise due to the high demand for residential construction. The development of infrastructure in Latin America is another factor responsible for the regional market growth.

Middle East & Africa

The Middle East & Africa is likely to gain USD 21.21 billion in 2026. The region is expected to showcase substantial growth during the forecast period. Investment by countries to develop commercial spaces such as malls, airports, hotels, and public places, due to high demand from the tourism industry, has propelled demand in this region. Additionally, upcoming projects of high-rise buildings and sports complexes will aid in expanding the regional market. The GCC market is poised to reach USD 9.54 billion in 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Forming Partnerships to Bolster their Market Presence

Holcim Ltd, CEMEX S.A.B de C.V, CRH, Bouygues Group, & Larsen & Toubro (L&T) Limited are the key players in the market. These companies are making major investments in developing additives that address evolving demands for sustainability and performance.

Key players in the market have invested a sizable amount in developing sustainable construction products. Partnerships with raw material suppliers and construction companies are the strategies used by the market players to increase their presence globally and maintain their mark in the competition.

List of Top Precast Concrete Companies

- Boral (Australia)

- Holcim Ltd (Switzerland)

- Gulf Precast (UAE)

- Olson Precast Company (U.S.)

- Larsen & Toubro Limited (India)

- CEMEX (Mexico)

- Forterra Building Products Ltd (U.K.)

- The Wells Companies (U.S)

- Elementbau Osthessen GmbH & Co., ELO KG (Germany)

- Bouygues Group (France)

- Balfour Beatty plc (U.K.)

- CRH (Ireland)

- Tindall Corporation (U.S)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Boral collaborated with the Gamuda and Laing O’Rourke Consortium (GLC) to develop an innovative precast mix aimed at reducing the embodied carbon footprint of the Sydney Metro West project. This mix incorporates 50% supplementary cementitious material (SCM), an Australian first for precast tunnelling segment production.

- October 2024: Larsen & Toubro (L&T) reached a significant milestone in the construction of the Delhi-Meerut RRTS, with the completion of casting for the final 6290 precast box segments for Package 7 of the project.

- January 2024: Holcim Ltd. closed three acquisitions in Europe, expanding its Solutions & Products business segment. Artepref S.A. in Spain, W.A.T.T. Recycling in Greece, and the acquisition of Eco-Readymix Ltd in the U.K. These acquisitions helped the company expand its business growth.

- March 2023: Holcim Ltd. acquired an HM Factory, a provider of precast concrete solutions, enhancing its presence in Poland. This acquisition advances Holcim’s “Strategy 2025 – Accelerating Green Growth” with the goal of expanding its Solutions & Products business to 30% of Group net sales by 2025.

- September 2022: Tindall Corporation expanded its production of precast concrete floor slab systems (T-SLAB). The company started a new production line at its Mississippi manufacturing plant. Such a new expansion helps the company expand its market presence in the precast market.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product types, the compositions used to produce these products, and end-users of the product. Besides this, it offers insights into the market, current industry trends, and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.3% from 2026 to 2034 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Type

|

|

|

By End-Use

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 160.53 billion in 2025 and is projected to reach USD 278 billion by 2034.

In 2025, the market value stood at USD 62.21 billion.

Growing at a CAGR of 6.3%, the market will exhibit steady growth during the forecast period of 2026-2034.

The infrastructure segment captured the largest share and led the market in 2025.

Rapid urbanization activities and an increase in population are key factors driving the growth of the market.

Asia Pacific held the dominant market share in 2025.

The increasing demand for cost-effective and sustainable concrete products will drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us