Recycling Equipment Market Size, Share & Industry Analysis, By Product (Shredders, Separators, Balers, Compactor, Crusher, Conveyor System, and Others), By Waste Type (Hazardous and Non-hazardous), By Application (Industrial Waste, Municipal Waste, Construction & Demolition Waste, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

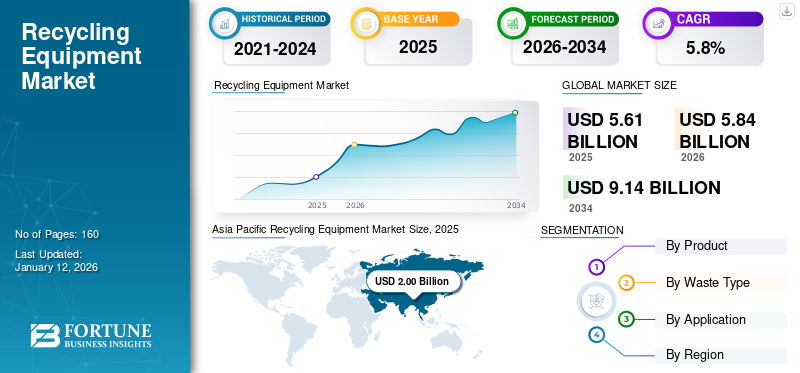

The global recycling equipment market size was valued at USD 5.61 billion in 2025 and is projected to grow from USD 5.84 billion in 2026 to USD 9.14 billion by 2034, exhibiting a CAGR of 5.8% during the forecast period. Asia Pacific dominated the recycling equipment market with a share of 35.6% in 2025.

Recycling equipment is machinery designed for collecting, sorting, processing, and converting waste materials into reusable resources. This equipment facilitates the recycling process by transforming discarded materials into forms that can be used again, thereby reducing waste and conserving natural resources. These types of equipment are used to collect hazardous and non-hazardous waste, with applications spanning from industrial, municipal, construction & demolition waste and agricultural waste. This equipment includes products such as shredders, separators, balers, compactors, crushers, and conveyor systems.

Global Recycling Equipment Market Overview

Market Size:

- 2025 Value: USD 5.61 billion

- 2026 Value: USD 5.84 billion

- 2034 Forecast Value: USD 9.14 billion

- CAGR: 5.8% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific led the market with a share of 35.6% in 2024, driven by rapid industrialization, growing urban populations, and increasing environmental awareness in key countries

- End-User Leader: Industrial waste segment held the largest share in 2024 due to rising waste generation in manufacturing and infrastructure development

- Product Segment Leader: Balers dominated in 2024 for their role in compressing recyclables and minimizing transportation volume

- Fastest-Growing Product Segment: Shredders are expected to witness the highest growth rate due to rising demand for efficient on-site processing and adherence to stricter waste handling norms

Industry Trends:

- Adoption of AI-integrated and IoT-enabled recycling equipment to improve material sorting, reduce contamination, and enhance operational efficiency

- Launch of innovative shredding and baling technologies designed to meet the needs of high-volume industrial waste processors

- Increasing demand for automation in waste management systems, particularly in developed and rapidly urbanizing economies

Driving Factors:

- Urbanization and industrial growth accelerating the generation of municipal and commercial waste

- Environmental regulations and sustainability goals pushing industries toward investment in recycling infrastructure

- Operational cost benefits of recycling equipment, including reduced landfill reliance and efficient material recovery

- Technological advancements making systems more scalable, efficient, and easier to integrate across facilities

Increasing global population, growth in industrialization, and rising manufacturing sector across developed and developing economies, results in rising demand for such products for collecting and dumping waste to landfills and incineration plants. Moreover, stricter government policies on waste management and the promotion of recycled plastic are pushing industries to adopt better equipment, further fueling market growth.

In addition, rising construction and demolition activities, especially in developing regions, have resulted in huge amounts of waste generated during building operations, requiring such equipment for effectively handling waste management, which boosts product demand. For instance, in June 2019, the Japanese government planned to invest around USD 367 billion in building construction projects across Southeast Asia, including Singapore, Indonesia, and the Philippines, to drive the sales of this equipment.

The COVID-19 pandemic significantly impacted the global market due to disruptions in the supply chain for raw materials and slowing the production and delivery of such equipment. Moreover, innovation in recycling technologies is projected to drive market growth in the post-pandemic period.

IMPACT OF TECHNOLOGY

Increasing Adoption of Automation Technologies to Drive Market Growth

Increasing adoption of advanced recycling technologies such as AI-powered and IoT-enabled systems with smart sensors is enhancing the remote operation and production capacity of machinery. Moreover, growing demand for integrated recycling solutions to collect industrial, municipal, and demolition waste. The rising use of Artificial Intelligence (AI) and machine learning technologies is further improving the accuracy and efficiency of identifying and sorting different types of recyclable equipment.

RECYCLING EQUIPMENT MARKET TRENDS

Technological Advancements in Products to Fuel Market Growth

Equipment manufacturers such as Wastequip, Terex Corporation, Tomra Systems ASA, and Marathon Equipment are introducing artificial intelligence (AI), advanced sensor technology, and machine learning into their recycling equipment. These innovations are improving the efficiency and accuracy of material sorting. For instance, in June 2024, SSI Shredding Systems Inc. launched a new Dual-Shear M180 sneak peek shredder for waste management practices. It is an artificial intelligence (AI) enabled machine used for recycling plastic, recyclable materials, and industrial waste. It features low-speed, high torque capacity with two shafts and cutting diameters ranging from 26 to 76 mm. This shredder reduces the carbon footprint generated during waste-handling operations. These technological advancements represent the latest trends in the market.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Population and Industrialization Drives Market Growth

Rising population and rapid industrialization in developed and developing countries such as India, China, and Japan are raising the demand for such products to support sustainable waste management practices. Global waste generation is increasing at an alarming rate due to population growth, urbanization, and rising consumer consumption, driving market expansion. According to the World Bank Report, annual waste generation will increase by 70% from 2016 to 3.40 billion tons by 2050. This surge in waste highlights the need for more efficient and higher-capacity recycling equipment, driving market growth.

Market Restraints

High Capital Initial Investments to Hinder Market Growth

Recycling equipment, especially advanced automated systems, requires huge capital investment, which can be prohibitively high for small and medium-scale enterprises. The costs associated with installing and setting up recycling facilities, including infrastructure and site preparation, can be high. The capital investment for this equipment manufacturing ranges from USD 10,000 to USD 50,000. These high upfront costs create a significant barrier for key players to enter the market, limiting the adoption of new technologies by small and medium enterprises and restraining the recycling equipment market growth.

Market Opportunities

Rapid Urbanization and Industrialization Globally to Present Significant Growth Opportunities

Rising urbanization and industrialization in developed and developing countries have led to increased waste generation, driving the demand for energy-efficient recycling solutions. In addition, growing waste output from households and municipalities is further boosting product demand, which fuels the growth of the market. For instance, according to UNICEF, urbanization in Asia Pacific is anticipated to reach 55% by 2030. All such factors enhance the demand for waste management equipment and fuel market growth.

SEGMENTATION ANALYSIS

By Product

Balers Dominated the Market Owing to Rising Demand from Waste Recycling Plants

Based on product, the market is divided into shredders, separators, balers, compactor, crusher, conveyor systems, and others. Others consist of granulator and extruder.

Balers held the largest market share in 2024, owing to increasing waste generation in developing and developed regions. In addition, the rising adoption of balers in waste treatment and recycling plants, aimed to reduce the volume of waste, lower transportation costs, and minimize costs for recycling companies will drive market growth. The segment is likely to attain 25% of the market share in 2026.

Shredders are expected to experience the highest market growth with a CAGR of 6.00% over the forecast period (2025-2032), due to industrialization and stricter waste management regulations in countries such as Germany, France, and China. There's also an increasing demand for mobile shredding solutions for on-site waste processing, fueling market growth.

Separators, compactors, and crusher products will grow steadily during the forecast period, owing to increased urbanization, global waste generation, rising focus on waste transportation efficiency, and stringent regulations on waste management practices. In addition, this type of equipment finds application in construction and demolition waste, driving market growth.

Conveyor systems are set to grow moderately during the forecast period, owing to the need for automation in waste recycling plants and increasing volumes of waste requiring efficient handling.

The other segment includes granulators and extruders. This segment is expected to grow at moderate growth owing to rising waste generation, stringent government policies, and rising adoption of waste recycling plants.

To know how our report can help streamline your business, Speak to Analyst

By Waste Type

Hazardous Waste Segment Dominated the Market Due to Rise in Waste Generated from Chemical and Construction Sectors

Based on waste type, the market is segmented into hazardous waste and non-hazardous waste.

The hazardous waste segment dominated the market in terms of market share in 2024 and will grow substantially during the study period due to rapid industrialization and the large volumes of waste generated by the chemical, medical, and construction sectors. Efficient equipment is required to control and manage this waste from industrial plants, further driving segment growth. The segment is anticipated to gain 65.41% of the market share in 2026.

The non-hazardous waste segment is projected to grow steadily with a CAGR of 4.70% during the forecast period (2025-2032), owing to increasing municipal solid waste, industrial waste, and government policies promoting recycling and waste reduction in developing and developed regions.

By Application

Industrial Waste Led Due the Market Due to Rapid Industrialization

Based on waste type, the market is segmented into industrial waste, municipal waste, construction & demolition waste, and others. Other segment includes medical sector and agricultural waste.

The industrial waste segment dominated the market in 2024 and is expected to experience substantial growth, owing to the large volume of waste generated from metal scrap, plastic industries, cardboard, and e-waste. Moreover, rapid industrialization in countries such as India and China further raises the demand for efficient waste-handling equipment, fueling market growth. In addition, growing awareness about industrial waste recycling in developed and developing economies drives the growth of the market. For instance, according to the World Bank, around 13.5% of global waste is recycled, and around 5.5.% is composted, underscoring the growing emphasis on waste management practices. The segment held 35.96% of the market share in 2026.

The municipal waste segment is projected to grow steadily during the forecast period owing to growing urbanization, growing public interest in recycling and sustainability, and the large volume of household waste generated across the globe. The rising demand for shredders and balers for effective waste management practices to propel segment expansion.

The construction and demolition waste segment is anticipated to grow moderately during the forecast period owing to rising construction activities across China and India, generating huge amounts of debris, concrete, wood, metal, and drywall. The need to manage and collect waste efficiently drives the demand for such products.

Others include medical waste, e-waste, and agricultural waste, which also hold growth potential. The huge amount of waste generated in these categories creates demand for such equipment, further increasing the recycling equipment market share.

RECYCLING EQUIPMENT MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East & Africa, and South America.

ASIA PACIFIC

Asia Pacific Recycling Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.00 billion in 2025 and USD 2.09 billion in 2026, due to rapid industrialization, growing environmental awareness in countries such as China, India, and Japan, and rising urbanization across the region. For instance, according to the World Bank Report, urbanization in India is projected to grow by 31% from 2023 to 2030. Moreover, rising construction-related activities and demolition activities are creating huge amounts of demolition waste, further driving the demand for such products.

China Witnesses Rapid Growth Owing to Rising Environmental Concerns and Focus on Sustainable Development

China is one of the major producers of waste, focusing heavily on improving its recycling infrastructure to address environmental concerns and promote sustainable development. The market in China is experiencing rapid growth, driven by stringent environmental regulations, increasing industrialization, and advancements in recycling technologies. China is expected to grow with a value of USD 0.80 billion in 2025.Moreover, government policies aimed at spreading awareness about effective waste management practices are further bolstering market growth. India is predicted to gain USD 0.35 billion in 2026, while Japan is poised to grow with a valuation of USD 0.42 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the second largest market anticipated to hit USD 1.65 billion in 2026, exhibiting a CAGR of 5.20% during the forecast period (2025-2032). North America is projected to experience steady growth during the forecast period owing to technological advancements, increasing waste generation, and stringent government policy on waste management. Moreover, government investments in constructing new waste recycling centers in the U.S. are boosting demand for such equipment. For instance, in January 2022, Novelis planned to invest USD 365 million to construct an advanced waste recycling plant in North America. The U.S. market is foreseen to be valued at USD 0.98 billion in 2026.

Europe

Europe is the third largest market projected to reach a market value of USD 1.21 billion in 2026. Europe is projected to grow moderately during the forecast period owing to the high recycling rate, stringent government regulations, and significant government investments in constructing a new waste management and recycling plant in Germany, France, Italy, and the U.K. The U.K. market is anticipated to be worth USD 0.23 billion in 2026. For instance, in May 2023, the government of Latvia planned to invest around USD 38 million to develop new waste recycling plants, contributing to market growth across the region. Germany is estimated to acquire USD 0.33 billion in 2026, while France is estimated to hold USD 0.17 billion in 2025.

Middle East & Africa and South America

The Middle East & Africa is the fourth largest market expected to grow with a value of USD 0.57 billion in 2026. The Middle East & Africa and South America regions are projected to witness decent growth during the forecast period, owing to rapid industrialization, urbanization, and investment in recycling infrastructure. The huge amount of municipal solid waste generated in these regions will create demand for the product, supporting market growth. The GCC market is estimated to stand at USD 0.26 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Market Players Adopt Acquisition Strategies to Strengthen Their Market Positions

Companies in the market, such as Wastequip, Terex Corporation, Tomra Systems ASA, Eldan Recycling A/S, and Terex Corporation, are focused on product launches, acquisitions, and product development as key strategies to strengthen their market competition. For instance, in August 2022, Terex Corporation acquired ZenRobotics Ltd, specializing in designing and creating robots for sorting, picking, and recycling waste materials. The basic aim of acquisition was to improve the automation in waste management practices.

List of Key Recycling Equipment Companies Profiled

- Eldan Recycling A/S (Denmark)

- Levstal Group (Estonia)

- Machines Industries Inc (Canada)

- Dover Corporation (Marathon Equipment) (U.S.)

- Sesotec GmbH (Germany)

- SSI Shredding Systems Inc (U.S.)

- Tomra Systems ASA (Norway)

- Terex Corporation (U.S.)

- Vecoplan AG (Germany)

- Wastequip (U.S.)

- The CP Group (U.S.)

- American Baler (U.S.)

- Kiverco (U.K.)

- General Kinematics (U.S.)

- MHM Recycling Equipment (U.K.)

- Marathon Equipment (U.S.)

- Ceco Equipment Ltd (U.K.)

- Hitachi Construction Machinery (Japan)

- Steinert GmbH (Germany)

KEY INDUSTRY DEVELOPMENT

- April 2024: ZenRobotics, a subsidiary of Terex Corporation, launched the TTS-620SE static Electric Trommel for waste recycling plants. It is an artificial intelligence (AI) based system that offers several advantages such as improved efficiency and reducing the downtime of recycling plants. This type of system can able to handle 500 different types of waste categories.

- August 2023: Vecoplan AG launched the VIZ 1700 shredder for the recycling plant, featuring high-quality output, energy efficiency, high speed, lower operating costs, and maximum output capacity.

- May 2023: Wastequip upgraded its line of compactors with added safety and connectivity features. These compactors are available through distributors or directly via the company’s website.

- April 2023: Environmental Solutions Group, a subsidiary of Dover Corporation, showcased a new series of balers, compactors, and recycling equipment at the Waste Expo held in Louisiana, U.S.

- March 2023: Wastequip launched the OptiPak Series of compactors for waste recycling plants, offering a 90-degree rotation and the ability to perform a full 360-degree rotation in 30 seconds. It provides reliability and reduces the downtime of waste recycling operations.

REPORT COVERAGE

The report provides an in-depth analysis of the recycling equipment industry dynamics and competitive landscape. The report also provides market estimation and forecast based on product, waste type, application, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 5.08% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Product, By Waste Type, By Application, and By Region |

|

|

Segmentation |

By Product

By Waste Type

By Application

By Region

|

|

|

Key Market Players Profiles in the Report |

Eldan Recycling A/S (Denmark), Levstal Group (Estonia), Machines Industries Inc (Canada), Dover Corporation (Marathon Equipment) (U.S.), Sesotec GmbH (Germany), SSI Shredding Systems Inc (U.S.), Tomra Systems ASA (Norway), Terex Corporation (U.S.), Vecoplan AG (Germany), and Wastequip (U.S.). |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 5.84 billion in 2026.

The market is expected to reach USD 9.14 billion by 2034.

The market is projected to grow at a compound annual growth rate (CAGR) of 5.8% during the forecast period (2026-2034).

The balers segment led the market in 2025.

Rising population and growth in industrialization are key factors driving the growth of the market.

Wastequip, Terex Corporation, Tomra Systems ASA, Machinex Industries Inc, Vecoplan AG, Sesotec GmbH, Eldan Recycling A/S, SSI Shredding Systems Inc, Dover Corporation (Marathon Equipment), and Levstal Group are the leading companies in this market.

Asia Pacific dominated the recycling equipment market with a share of 35.6% in 2025.

Technological advancement is the key trend in the market.

Based on application, the industrial waste segment dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us