Secure Digital Card Market Size, Share & Industry Analysis, By Type (SD, MiniSD, and MicroSD), By Distribution Channel (Online and Offline), By Capacity (SDSC (Up to 2GB), SDHC (2GB - 32GB), SDXC (32GB - 2TB), and SDUC (Above 2TB)), By Speed Class (Class 2/4/6/10, UHS-I/UHS-II/UHS-III, and Others), By End-user (Individual Customers, Enterprises, OEMs, Government & Defense Agencies, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

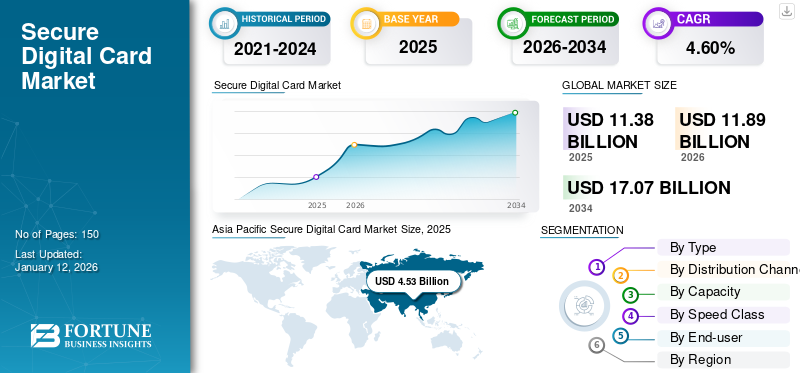

The global secure digital card market size was valued at USD 11.38 billion in 2025. The market is projected to grow from USD 11.89 billion in 2026 to USD 17.07 billion by 2034, exhibiting a CAGR of 4.60% during the forecast period. Asia Pacific dominated the market with a share of 39.80% in 2025.

The secure digital card market comprises the production and distribution of these cards used as data storage options across various electronic devices. These cards are widely used by individual customers, enterprises, OEMs, and government & defense agencies. The market includes various card capacities, SDSC (Up to 2GB), SDHC (2GB - 32GB), SDXC (32GB - 2TB), and SDUC (Above 2TB). The market is driven by the rising creation of digital content, increasing mobile device usage, and demand for portable and expandable storage solutions.

Western Digital Corporation, Samsung Electronics, Kingston Capacity, Lexar, Transcend Information, Inc., PNY Technologies, ADATA Capacity Co., Ltd., Sony Corporation, Dell Technologies, and Panasonic Corporation are the key players in the market. These companies dominate the market through extensive product portfolios, technological innovation, and strong distribution networks across consumer electronics, industrial, and enterprise applications.

The COVID-19 pandemic initially disrupted the market due to supply chain interruptions, factory shutdowns, and reduced consumer spending on non-essential electronics. However, the shift toward remote work, online education, and increased digital content consumption led to a resurgence in demand for secure digital cards in the post-pandemic period.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs have increased cost pressure for manufacturers that depend on international trade for components and raw materials. Trade tensions between key trading nations, such as the U.S. and China, have amplified production expenses, resulting in higher consumer retail prices. This rise in pricing has negatively affected demand in cost-sensitive regions, contributing to a moderate market growth. For instance,

- The imposition of U.S. tariffs on imported components is projected to raise production costs by approximately 4 to 6%, posing notable implications for the consumer electronics segments.

Therefore, companies have relocated manufacturing operations to countries with more favorable trade environments to reduce tariff-related impacts. Although this strategy helps to reduce direct tariff costs, it presents added logistical challenges and transition-related expenditures. In the long run, reciprocal tariffs are expected to reshape supply chain strategies, capital investments, and pricing approaches throughout the SD card industry.

SECURE DIGITAL CARD MARKET TRENDS

Increased Need for Higher Storage Capacities Fuels Market Growth

The increasing demand for higher storage capacities to accommodate the growing volume of digital content is a major trend in the market. With consumers and professionals increasingly capturing high-resolution photos, 4K and 8K videos, and working with large datasets, there is a rising demand for SD cards offering capacities of 1TB and above. For instance,

- According to Semrush Holdings, Inc., around 407.74 million terabytes of data is generated daily.

This surge in data creation has encouraged manufacturers to develop cards with larger storage sizes, ensuring compatibility with various devices. Additionally, there is a growing focus on improving the durability and reliability of SD cards to cater to harsh environments and industrial applications. This trend toward ruggedized and high-capacity SD cards is expected to drive sustained growth in the secure digital card market.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rapid Growth of Digital Content Creation Drives Market Expansion

The growing use of smartphones, digital cameras, drones, and gaming devices is increasing the need for efficient and high-capacity storage solutions. For instance,

- Data published by Backlinko states that people spend an average of 3 hours and 45 minutes online on their smartphones daily.

This extensive usage generates the demand for secure digital cards storing large volumes of photos, videos, and other multimedia files while supporting fast data transfer speeds. Consumers and professionals are generating and accessing more digital content, from high-resolution images to 4K and 8K videos, which require substantial storage capacity. The growing popularity of content-sharing platforms and social media further augments this demand. Therefore, SD card manufacturers focus on developing products with higher capacities and improved performance to expand the digital SD card market.

Market Restraints

Increasing Adoption of Alternate Storage Solutions to Hamper Market Expansion

The increasing adoption of alternative storage solutions, such as cloud storage and embedded memory, hinders secure digital card market growth. These alternatives offer greater convenience, accessibility, and scalability, reducing reliance on physical storage media such as secure digital cards. As a result, consumer preference is gradually shifting toward cloud-based services for data storage and backup. Additionally, SD cards face compatibility issues across different devices and carry the risk of data corruption or physical damage, restricting the widespread adoption of the products.

Market Opportunities

Growing Demand from Industrial and Automotive Sectors to Create Significant Opportunities for Market Players

The growth of advanced applications such as driver-assistance systems, in-vehicle infotainment, and industrial automation is driving the need for storage devices that can operate efficiently under extreme temperature, vibration, and humidity conditions. For instance,

- According to Convergix Automation, the industrial automation market is projected to grow at a CAGR of 9.3%, reaching USD 307.7 billion by 2030.

This demand is driving the development of ruggedized SD cards designed to meet the stringent durability and performance requirements of these sectors. Moreover, the increasing integration of Internet of Things (IoT) technologies in the industrial and automotive sectors is further fueling the need for data storage solutions. SD cards with enhanced endurance and reliability features are becoming essential for real-time data logging, processing, and storage in connected devices. These trends present lucrative opportunities for manufacturers to boost their secure digital card market share.

SEGMENTATION ANALYSIS

By Type

Micro SD Card Dominates Due to Their Compact Size and Smartphone Compatibility

Based on type, the market is divided into SD, MiniSD, and MicroSD.

Micro SD cards dominate the market share of 84.02% in 2026 and are expected to grow at the highest CAGR due to their compact size and wide compatibility with smartphones, tablets, and portable devices. Their convenience makes them the preferred choice for mobile storage.

The SD segment holds the second largest share, as they are widely used in digital cameras, camcorders, and professional equipment that require larger form factors.

By Distribution Channel

Online Channel Leads due to its Convenience, Variety, and Competitive Pricing

Based on distribution channel, the market is divided into online and offline.

The online distribution channel commands the highest market share of 65.26% in 2026 and is also expected to witness the highest CAGR due to convenience, extensive product variety, and competitive pricing offered by e-commerce platforms.

Offline channels hold the second-largest share, as many consumers still prefer physical retail stores for product inspection, immediate purchase, and access to direct customer support.

By Capacity

SDHC Segment Leads due to its Compatibility with Broad Devices

Based on capacity, the market is separated into SDSC (Up to 2GB), SDHC (2GB - 32GB), SDXC (32GB - 2TB), and SDUC (Above 2TB).

SDHC cards lead the market share of 73.43% in 2026 by capacity as they offer sufficient storage for everyday consumer needs and maintain compatibility with various devices.

SDUC cards are forecast to register the highest CAGR owing to their ultra-high storage capacities. These cards are well-suited for demanding professional applications such as 8K video recording and AI data processing.

By Speed Class

Class 2/4/6/10 Segment Dominates due to their Broad Compatibility

By speed class, the market is categorized into Class 2/4/6/10, UHS-I/UHS-II/UHS-III, and others.

Class 2/4/6/10 speed class cards dominate the market due to their broad compatibility and sufficient performance for standard photo and video recording, making them suitable for general use. Their affordability and wide availability further reinforce their market leadership.

The others segment, including video speed and advanced performance classes, are projected to grow at the highest CAGR, driven by the increasing need for high-speed data transfer in 4K/8K video, gaming, and professional applications.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Individual Customers are Leading End-Users as they are Mass User Base for Personal Electronics

By end-user, the market is fragmented into individual customers, enterprises, OEMs, government & defense agencies, and others.

Individual consumers dominate the market as they represent the largest user base for personal electronics such as smartphones, cameras, and gaming devices requiring expandable storage.

The government and defense agencies are expected to grow at the highest CAGR due to increased investments in secure, durable, and high-capacity storage for surveillance, intelligence, and communication systems.

SECURE DIGITAL CARD MARKET REGIONAL OUTLOOK

By geography, the market is studied across North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

North America

Asia Pacific Secure Digital Card Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the second-largest share owing to the early adoption of advanced electronics and high demand for storage solutions in consumer electronics, professional media, and security sectors. The presence of leading technology companies and mature digital infrastructure supports consistent market demand.

The U.S. leads the secure digital card market due to strong demand for high-speed storage in consumer electronics and widespread adoption of advanced SD technologies such as UHS and SD Express. The U.S. market is projected to reach USD 2.02 billion by 2026.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 4.53 billion in 2025 and USD 4.78 billion in 2026, due to the widespread use of smartphones, digital cameras, and consumer electronics across highly populated nations such as China, India, and Japan. The presence of major manufacturing hubs and the growing demand for digital technologies continue to drive strong demand in the region. Additionally, the region is anticipated to project the highest CAGR owing to increasing internet penetration and expanding e-commerce platforms. The Japan market is projected to reach USD 1.11 billion by 2026, the China market is projected to reach USD 1.39 billion by 2026, and the India market is projected to reach USD 0.91 billion by 2026.

Europe

Europe accounts for a significant market share driven by stable consumer electronics and automotive demand. The region’s well-established industrial base and increasing use of digital technologies in enterprise and professional settings support market strength. The UK market is projected to reach USD 0.55 billion by 2026, while the Germany market is projected to reach USD 0.48 billion by 2026.

Middle East & Africa (MEA) and South America

The Middle East & Africa and South America are projected to witness moderate growth due to ongoing improvements in digital infrastructure and rising smartphone adoption. Increasing government focus on digital transformation and growing online retail adoption offer gradual growth potential. However, economic constraints and lower consumer purchasing power continue to limit rapid market expansion.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Their Market Position

Players are launching new product portfolios to enhance their market position by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. These strategic product launches play a crucial role in helping companies maintain and grow their market share in a rapidly evolving industry.

Long List of Companies Studied (including but not limited to)

- Western Digital Corporation (U.S.)

- Samsung Electronics (South Korea)

- Kingston Capacity (U.S.)

- Lexar (U.S.)

- Transcend Information, Inc. (Taiwan)

- PNY Technologies (U.S.)

- ADATA Capacity Co., Ltd. (Taiwan)

- Sony Corporation (Japan)

- Dell Technologies (U.S.)

- Panasonic Corporation (Japan)

- Toshiba Corporation (Japan)

- Patriot Memory (U.S.)

- Silicon Power (Taiwan)

- Delkin Devices (U.S.)

- Integral Memory (U.K.)

- And more..

KEY INDUSTRY DEVELOPMENTS

- May 2025: Lexar launched its latest products in India: the Lexar ARMOR SILVER PRO SDXC UHS-II Card and the Lexar ARMOR GOLD SDXC UHS-II Card. These stainless-steel SD cards are designed to deliver high performance, enhanced durability, and long-term reliability for professional creators.

- April 2025: ADATA Technology Co., Ltd. launched three new products: the UE720 USB 3.2 Gen2 Flash Drive, the Premier Extreme SD 8.0 Express memory card, and the EC680 M.2 SSD Enclosure. These innovations aim to enhance efficient storage solutions, targeting the needs of remote workers and professional creators.

- November 2024: RaspberryPi launched its microSD cards, specifically optimized for Raspberry Pi single-board computers. These cards are designed to deliver optimal performance, ensuring reliable and efficient operation.

- August 2024: Western Digital announced two pioneering memory cards: an 8TB SD card and a 4TB microSD card. These high-capacity cards offer significant creative flexibility for still photography and video recording, provided proper care and handling are maintained.

- July 2024: Samsung Electronics Co., Ltd. released 1TB high-capacity microSD cards, PRO Plus and EVO Plus. These cards offer enhanced performance and capacity, catering to content creators and tech enthusiasts requiring fast file transfers and reliable storage for everyday use.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product types, and leading product end-users. Besides, the report offers insights into the market trend analysis and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 4.60% from 2026 to 2034 |

|

|

Segmentation |

By Type

By Distribution Channel

By Capacity

By Speed Class

By End-user

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 17.07 billion by 2034.

In 2026, the market size stood at USD 11.89 billion.

The market is projected to grow at a CAGR of 4.60% during the forecast period.

By end-user, the individual customers segment holds the leading position in the market.

The rapid growth of digital content creation is a key factor driving market growth.

Western Digital Corporation, Samsung Electronics, Kingston Capacity, and Lexar are the top players in the market.7. Which region holds the highest market share and is anticipated to grow with the highest CAGR?

Asia Pacific dominated the market with a share of 39.80% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us