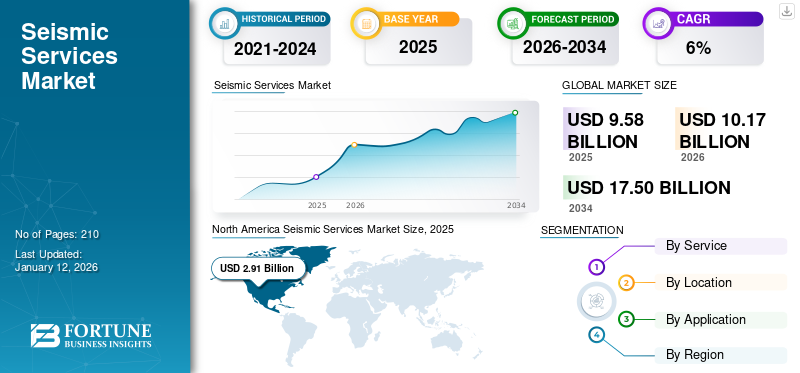

Seismic Services Market Size, Share & Industry Analysis, By Services (Data Acquisition, Data Processing and Interpretation, and Data Sales), By Location (Onshore and Offshore), By Application (Oil & Gas, Mining, Geothermal, Construction/Engineering, and Others) and Regional Forecast, 2026-2034

Seismic Services Market Size and Future Outlook

The global seismic services market size was valued at USD 9.58 billion in 2025. It is projected to be worth USD 10.17 billion in 2026 and reach USD 17.50 billion by 2034, exhibiting a CAGR of 7.01% during the forecast period. North America dominated the seismic services market with a market share of 30.34% in 2025.

Seismic services involve techniques to measure and analyze the Earth's subsurface using seismic waves, commonly applied in oil and gas, civil engineering, mining, environmental studies, and geotechnical investigations. The seismic services market is expected to grow due to rising energy demand, technological advancements, and increased focus on safety and resource exploration.

Schlumberger is a leading provider in the seismic services industry, offering exploration and reservoir analysis solutions. Its services include seismic data acquisition, processing, and imaging for oil, gas, and geothermal projects. The company's technology-driven approach optimizes resource extraction and infrastructure safety.

MARKET DYNAMICS

MARKET DRIVERS

Increased Offshore and Deepwater Exploration Activities Drive Market Growth

With the increasing exploration of offshore and deepwater oil and gas reserves, and as onshore resources deplete or become more challenging to extract, energy companies are shifting their focus to untapped offshore fields. According to the International Energy Agency (IEA) reports of 2023-2024, offshore oil production is expected to increase by over 30% by 2040, with deepwater and ultra-deepwater projects becoming a key component of the global energy supply.

Seismic surveys are critical in these environments to map complex subsea geological formations, identify hydrocarbon reserves, and assess the feasibility of drilling operations. Companies such as BP and ExxonMobil increasingly rely on 3D and 4D seismic imaging technologies to improve exploration accuracy in deepwater zones, which are often in the areas where traditional methods fail to deliver sufficient data.

In particular, the North Sea and Gulf of Mexico have seen considerable growth in deepwater exploration. For instance, in 2023, Shell made a major deepwater oil discovery in the Gulf of Mexico, employing cutting-edge seismic technology to identify and assess potential resources. Such seismic activities provide essential data on reservoir size, depth, and production potential, driving demand for high-precision seismic services.

Growing Focus on Seismic Risk Assessment and Monitoring Augments the Market Expansion

The increasing frequency of natural disasters, including earthquakes, and infrastructure growth in seismic-prone regions fuel demand for seismic risk assessment and monitoring services. As urban populations grow, particularly in Asia Pacific and North America, assessing and mitigating seismic risks is becoming more urgent. For instance, California, a seismically active region, has seen significant investments in earthquake monitoring systems, with the state’s ShakeAlert early warning system becoming operational in 2023. This system relies heavily on real-time seismic data to alert residents and infrastructure managers ahead of seismic events, minimizing potential damage.

In addition to natural earthquakes, human activities including fracking and geothermal energy extraction also contribute to induced seismicity, driving the demand for monitoring services. In 2023, the U.S. Geological Survey (USGS) issued reports noting the rise of earthquakes in regions associated with hydraulic fracturing, prompting the need for continuous seismic monitoring to mitigate risks. With governments and private sectors increasingly investing in infrastructure resilience and safety, the need for seismic hazard assessments and monitoring services is expected to grow substantially, especially in densely populated or high-risk areas.

MARKET RESTRAINTS

High Investment Requirement for Advanced Seismic Equipment and Services Hampers the Market Growth

High initial investment and costs associated with acquiring advanced seismic equipment, deploying specialized personnel, and conducting extensive surveys are substantial, creating profound financial barriers to market entry. These high upfront expenses can lead to extended payback periods, limiting market participation to only well-capitalized firms. The financial constraints are particularly challenging for smaller companies, with advanced seismic technologies requiring investments ranging from USD 50,000 to USD 250,000 per unit. This economic barrier excessively impacts emerging regions and smaller enterprises, potentially stifling innovation and seismic services market growth.

The complexity is further compounded by the need for specialized personnel, sophisticated data processing technologies, and comprehensive survey methodologies, dramatically increasing the investment required to participate effectively in the seismic services sector. As a result, only financially robust organizations can afford to undertake comprehensive seismic projects, creating a significant structural limitation in market expansion and technological democratization.

MARKET OPPORTUNITIES

Advancement In Deepwater And Ultradeep Exploration Activities to Create Opportunities

The advancement of deepwater and ultra-deepwater reserves presents a transformative opportunity for the market. Global energy demand is driving exploration into increasingly complex offshore environments, with regions including the Middle East & Africa offering substantial untapped hydrocarbon potential. The offshore seismic services segment is expected to grow significantly, supported by increased exploration and production activities in deep and ultra-deepwater deposits.

For instance, in September 2023, In the Pearl River Mouth basin, COOC Limited drilled a natural gas well in the ultra-deepwater Liwan 4-1 structure. The first significant exploration discovery in ultra-deepwater carbonate rocks offshore China was made when the well was tested and found to generate 430,000 cmd of absolute open flow natural gas.

MARKET CHALLENGES

Need for Highly Skilled Personnel for Advanced Seismic Activities Challenges the Market

The market is experiencing a critical challenge related to skilled personnel shortage, with global industry projections revealing that only around 5-10% of the workforce possesses specialized technical training in geophysical surveying. This significant skill deficit creates substantial recruitment challenges for service providers, particularly in advanced technological domains requiring complex geological interpretation and sophisticated equipment operation.

This skill deficit significantly impacts the industry's technological advancement, with companies struggling to find professionals capable of operating sophisticated equipment involving advanced 3D and 4D imaging, artificial intelligence (AI)-driven data processing, and complex geological interpretation. Organizations are responding by developing specialized training programs, creating targeted apprenticeship initiatives, and exploring technological alternatives such as automation to bridge the critical skill gap and maintain competitive positioning in the highly specialized seismic services.

SEISMIC SERVICES MARKET TRENDS

Advancements in Technologies Related to Seismic Activities is the Latest Trend in the Market

The seismic services market is advancing technologically, with cutting-edge imaging technologies including cable-free nodal recording equipment dramatically improving survey automation and data precision. These innovations enable high-density 3D and multicomponent seismic data capture, significantly enhancing subsurface visualization capabilities.

The emergence of 4D time-lapse technology has transformed seismic services from traditional exploration tools to comprehensive production monitoring systems. Artificial intelligence and machine learning integration accelerate this transformation, enabling faster, more accurate geological data processing and providing deeper insights into complex subsurface structures.

For instance, in January 2025, Smart Exploration Research Center and Nordic Iron Ore AB launched a collaborative deep drilling program targeting smart seismic features in the Blötberget exploration area. Building on extensive seismic surveys since 2014, the multidisciplinary team aims to explore potential iron-oxide reserves and rare earth element deposits through strategic drilling positions identified using advanced seismic imaging techniques.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic profoundly disrupted the market, causing significant project delays, reduced exploration activities, and substantial economic constraints across global energy sectors. Increased workforce limitations led to widespread cancellations of seismic survey operations, with oil and gas exploration budgets experiencing dramatic reductions. Despite these challenges, the pandemic accelerated digital transformation, driving increased adoption of remote sensing technologies and cloud-based data processing solutions. Companies pivoted towards more agile, technology-driven approaches, emphasizing operational efficiency and cost-effective methodologies. The seismic services market analysis demonstrated resilience by adapting to new technological landscapes, gradually recovering and repositioning itself with enhanced digital capabilities and streamlined operational strategies developed during the pandemic.

SEGMENTATION ANALYSIS

By Services

Growing Need for Gaining Critical Geological Insights Through Advanced Imaging Techniques Drives the Data Acquisition Segment

Based on the services, the market is segmented into data acquisition, data processing and interpretation, and data sales.

Data acquisition segment is leading the market share by 53.22% in 2026, propelled by increasing global energy demands, technological advancements in seismic imaging, and growing infrastructure development projects. This segment collects high-quality subsurface data through advanced exploration techniques, leveraging sophisticated equipment and methodologies to capture detailed geological information.

The data processing and interpretation segment is the second leading and most technologically sophisticated segment, driven by AI and machine learning innovations that enable precise subsurface mapping and enhanced reservoir characterization. Integrating advanced computational technologies allows for more accurate risk assessment and detailed geological insights.

The data sales segment continues to grow, driven by increasing demands from oil & gas industries and production (E&P) activity, particularly the number of exploration wells drilled. Technological advancements in seismic data acquisition and processing, government regulations impacting resource exploration, and commodity prices (oil and gas) also significantly influence demand.

By Location

Offshore Seismic Services Dominate Due To Higher Quality Data, Favorable Survey Conditions, And Increasing Offshore Exploration Activities

Based on location, the market is fragmented into offshore and onshore segments.

Offshore seismic services led the market share by 62.42% in 2026, as they are increasingly sophisticated and technologically advanced. These services focus on marine environments, utilizing specialized vessels and advanced sensing technologies to map underwater geological structures. The growing demand for deep water and ultra-deep-water hydrocarbon resources drives the offshore segment. Complex marine seismic surveys require significant technological investments, including advanced 3D and 4D imaging techniques, sophisticated data processing capabilities, and robust marine equipment.

Onshore seismic services represent a fundamental approach to geological exploration. These services are characterized by their accessibility, cost-effectiveness, and relatively straightforward implementation. Exploration teams can rapidly deploy seismic survey equipment across terrestrial landscapes, enabling comprehensive geological mapping and resource assessment. The onshore segment benefits from lower operational costs, easier logistical management, and more predictable environmental conditions than offshore operations. Onshore segment is projected to exhibit CAGR of 5.86% during the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Oil & Gas Dominate the Market Due to Increasing Energy Exploration to Meet Rising Global Energy Demands

The market is segmented into oil & gas, mining, geothermal, construction/engineering, and other segments based on its application.

The oil and gas segment dominates the global market share, as this industry needs continuous advanced geological exploration techniques, sophisticated subsurface mapping, and resource identification. As global energy demands escalate, oil and gas companies increasingly rely on cutting-edge seismic imaging technologies to discover and evaluate potential hydrocarbon reserves, particularly in challenging deepwater and ultra-deepwater environments. The segment is expected to capture 69.20% of the market share in 2026.

The mining segment is the second leading segment, focusing on comprehensive geological mapping and mineral resource identification. Driven by technological advancements and the need for precise subsurface understanding, mining companies leverage seismic surveys to mitigate exploration risks, optimize resource extraction strategies, and make informed investment decisions. The segment's growth is closely tied to global mineral demand and technological innovations in geophysical survey methodologies.

The geothermal segment is emerging as promising, as these services are gaining significant traction in the global renewable energy landscape. These services are crucial in identifying and evaluating potential geothermal energy sites and supporting sustainable energy transition strategies. This segment is anticipated to exhibit a CAGR of 6.70% during the forecast period.

In construction and engineering, seismic services are instrumental in geological risk assessment, site suitability studies, and infrastructure planning. Engineers and urban planners utilize advanced seismic imaging techniques to understand subsurface conditions, evaluate potential geological hazards, and make informed decisions about infrastructure development.

SEISMIC SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Seismic Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Market in this Region Is Driven by Increasing Oil and Gas Exploration Activities and Technological Advancements

North America's seismic services sector is experiencing a dynamic transformation driven by technological innovation in unconventional shale formations including the Permian Basin. The regional market value in 2025 was USD 2.90 billion, and in 2026, the market value led the region by USD 3.06 billion. Major companies are investing in advanced 3D and 4D seismic imaging technologies, enabling precise subsurface mapping and resource identification. For instance, in January 2025, TGS unveiled its Dawson Phase III 3D multi-client seismic survey in the Western Canadian Sedimentary Basin. The comprehensive poll covers 141 square kilometers and will be integrated with an additional 121 square kilometers from the existing Dawson Phase II 3D survey, creating an expanded dataset for enhanced geological insights. The project incorporates 291 wells and 191 LAS logs, further refining the dataset and offering valuable insights for operators in the Montney Formation.

U.S.

The U.S. Market is Driven by Expansion of Offshore Wind Energy Projects

The U.S. seismic service market is driven by the expansion of offshore wind installations, which require detailed subsurface mapping for turbine foundation design and safe selection. The U.S. market size is estimated to hit USD 2.69 billion in 2026. The rapid growth of offshore wind projects, such as those in the Atlantic and Pacific regions, has amplified the need for advanced 3D and 4D seismic imaging to ensure structural stability and minimize environmental impact. For instance, the federal government has set a goal of 30 GW of offshore wind capacity by 2030, leading to key developments such as leasing areas in the Gulf of Maine with the potential to power over 2.3 million homes.

Europe

Europe's Market Is Driven By Increasing Exploration Activities In Unconventional Reserves And Offshore Exploration

Europe is expected to be the fourth-largest regional market with a value of USD 1.49 billion in 2026. The European seismic services market is characterized by moderate growth, focusing on offshore exploration and advanced 4D seismic technologies. The market is also driven by increasing exploration activities in unconventional reserves, particularly in Norway and the U.K., with significant developments in the North and Norwegian seas. Key strategic initiatives include Shell's investment in the Jackdaw gas field and IOG PLC's Saturn Banks project, highlighting the region's commitment to domestic energy production. For instance, in 2023, Shell initiated drilling operations at its 100% owned Jackdaw gas field in the Central North Sea. The field is projected to begin production in the middle of 2025, potentially contributing over 6% of the U.K.'s North Sea gas production at peak rates of 40,000 barrels of oil equivalent per day. Moreover, the market remains highly concentrated, with major players including Schlumberger, Halliburton, CGG SA, and Fugro NV leading technological innovations. The market value in U.K. is expected to be USD 0.24 billion in 2026.

On the other hand, Russia is projecting to hit USD 0.41 billion and Norway is likely to hold USD 0.19 billion in 2025.

Asia Pacific

Increased Investment in Seismic Services Surveys and Infrastructure Development drive the Asia Pacific Seismic Services Market

Asia Pacific is anticipated to account for the second-highest market size of USD 2.72 billion in 2026, exhibiting the second-fastest growing CAGR of 8.28% during the forecast period. The seismic service market in the Asian Pacific region is growing rapidly due to increased demand for energy, urban infrastructure development, and disaster management efforts. The region’s oil and gas exploration activities, particularly offshore, are significant drivers, with countries such as India, Malaysia, and Indonesia investing heavily in seismic surveys to discover new reserves. For instance, in November 2023, Petronas and CGG initiated a strategic 2D seismic survey in the northern Straits of Melaka's Langkasuka Basin, targeting open blocks PM320 and PM321. The multi-client seismic program aims to map potential hydrocarbon resources and enhance geological understanding. Petronas seeks to attract investor interest and support Malaysia's energy production growth strategy in emerging offshore basins by investing in data enrichment and advanced exploration techniques. The Australian market size is expected to reach USD 0.53 billion, and Southeast Asian market is likely to hit USD 0.43 billion in 2025.

China

China's Seismic Services Market Is Driven by Strategic Initiatives to Boost Domestic Oil and Gas Production

The China market is experiencing robust growth with a market value of USD 0.93 billion in 2026, driven by escalating energy demands, increasing offshore exploration activities, and technological advancements. China National Offshore Oil Corporation (CNOOC) plays a pivotal role, planning to develop deepwater oilfield complexes and aiming to double the exploration workload by 2025. In 2022, CNOOC planned to drill 227 offshore and 132 onshore unconventional exploration wells, acquiring approximately 17,000 sq km of 3D seismic data. Rising exports, domestic investments in geological prospecting, and the strategic importance of seismic surveillance in both national and international contexts further support the market's growth.

Latin America

Latin America Market is Growing Due to Higher Strategic Investments In Energy Transition Initiatives

Latin America's seismic services market is experiencing significant growth, driven by investments in exploration and production activities across diverse geological landscapes. Countries such as Brazil and Colombia are leading the regional market expansion, focusing on conventional and unconventional resource development. According to the International Trade Administration, Brazil leads Latin America's oil production with major offshore output. The country possesses the world's largest recoverable oil and 50.3 billion cubic meters of natural gas annually, as reported by the Brazilian ultra-deep oil reserves, producing 1.1 billion barrels National Agency for Petroleum, Natural Gas and Biofuels (ANP). Moreover, Brazil’s 2022-2032 Energy Expansion Plan forecasts that the country’s oil production will reach 4.9 million barrels per day by 2032.

Middle East & Africa

Market in the Region Is Expanding Due to Untapped Hydrocarbon Reserves Across the Region

The Middle East & Africa market size is estimated to be USD 1.91 billion in 2026. Geopolitical strategies, technological disruption, and energy transition imperatives profoundly transform the Middle East & Africa seismic services market. Unlike traditional exploration models, the current landscape is characterized by intelligent, data-driven approaches that leverage artificial intelligence, machine learning, and advanced computational techniques to unlock complex geological reservoirs. National oil companies increasingly invest in high-resolution seismic imaging technologies that penetrate challenging subsurface environments, reducing exploration risks and optimizing resource extraction strategies. For instance, in October 2024, Jordan signed a 3D seismic survey agreement with ARGAS to create a comprehensive geological database covering 4,285 square kilometers in the Jafer region. The eight-month project, described as the largest in Jordan, aims to attract international energy investments and support the country's exploration strategies by generating critical oil and gas resource data. Saudi Arabia’s market size is expected to reach USD 0.38 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Implementing Different Strategic Initiatives, Including Partnerships and Technology Adoption to Sustain the Competition

Large competitive players characterized by technological innovation and strategic partnerships dominate the global market for seismic services. CGG SA, PGS ASA, and Halliburton Company emerge as the primary market leaders, collectively commanding market share through advanced technological capabilities and extensive global operational networks. These industry giants increasingly focus on digital transformation, investing heavily in AI-powered seismic imaging, cloud-native processing solutions, and advanced data analytics technologies.

List of Key Seismic Services Companies Profiled:

- Viridien (France)

- TGS (Norway)

- Petroleum Geo-Services (PGS) (Norway)

- Halliburton (UAE)

- Fugro N.V. (Netherlands)

- BGP (China)

- Seitel (U.S.)

- Asian Energy Services (India)

- China Oilfield Services Limited (China)

KEY INDUSTRY DEVELOPMENTS:

October 2024- TGS completed its PGS24M04NWS seismic data acquisition program in the Outer Voring area of the Norwegian Sea, covering more than 1,500 sq km. TGS also revealed it had secured a baseline 4D streamer survey contract in the southern Atlantic region with an unnamed independent. The program should last about 90 days.

September 2024- Asian Energy Services received an order from Oil India for 2D Seismic Data Acquisition of 4,300 line kilometers (LKM) in the Rajasthan Basin. This project is part of the Mission Anveshan initiative and is valued at approximately 9.5 million.

July 2024- TGS received a contract and a license sale for its seismic surveys in North America, Europe, and West Africa. The contract technology involves an OBN survey offshore West Africa for an undisclosed oil major. This deepwater survey extends the ongoing acquisition campaign in the region, enabling the client to make informed decisions on well drilling and oil recovery.

February 2024- TGS and SLB are launching the Engagement 5 multi-client OBN seismic survey in the U.S. Gulf of Mexico, covering 3,650 square kilometers across 157 offshore blocks. The Q1 2024 project created a continuous 23,000 square-kilometer seismic mapping area from Mississippi Canyon to Garden Banks, enhancing regional subsurface exploration capabilities.

May 2023- TGS, PGS, and Schlumberger secured pre-funding for a 6,885 square kilometer multi-client 3D seismic survey offshore Malaysia, launched as part of a five-year Petronas contract to map the Sarawak Basin's North Luconia Province.

Investment Analysis and Opportunities

- Investments in seismic services especially in deeper and more complicated geological formations are driving market expansion. Enhanced data processing and innovative technologies are attracting significant capital, creating opportunities for improved seismic imaging and monitoring.

- In June 2024, Edison Partners invested USD 15 million in Seismos, an AI-driven acoustic technology firm based in Austin. This investment aims to enhance and advance seismic surveys and technologies to facilitate geophysical activities in the region.

- In August 2024, Condor Energy completed reprocessing 3D seismic data over a 4,585 sq km area in the Tumbes Basin offshore Peru. This initiative significantly enhanced the region’s oil and gas, with resource estimation for key prospects underway. Such investments are expected to create opportunities over the forecast period.

REPORT COVERAGE

The global seismic services market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies in seismic services. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.01% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service

|

|

By Location

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 9.58 billion in 2025.

The market will likely grow at a CAGR of 7.01% over the forecast period (2026-2034).

The oil and gas segment leads the market in.

The market size of North America stood at USD 2.91 billion in 2025.

Increased offshore and deepwater exploration activities are the key factors driving market growth.

Some of the top players in the market are Viridien, TGS, Petroleum Geo-Services (PGS), and others.

The global market size is expected to reach USD 15.13 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us