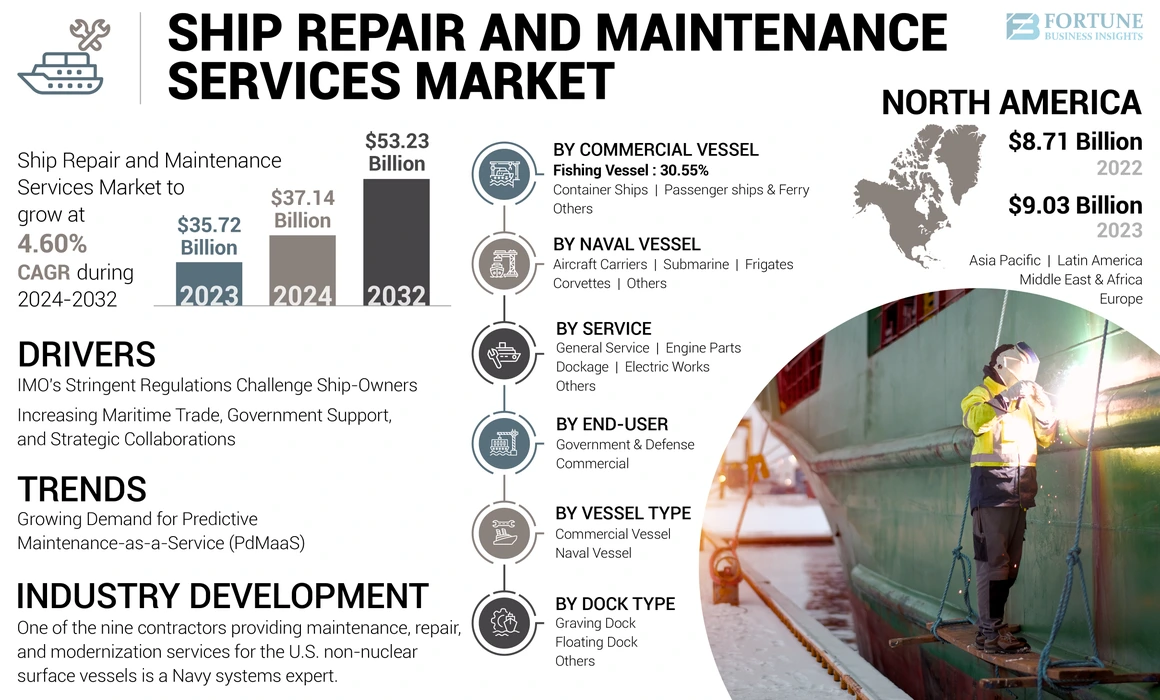

Ship Repair and Maintenance Services Market Size, Share & Industry Analysis, By Vessel Type (Commercial Vessel and Naval Vessel), By Commercial (Fishing Vessel, Container Ships, Passenger Ships & Ferry and Others), By Naval Vessel (Aircraft Carriers, Submarines, Frigates, Corvettes and Others), By Service (General Service, Engine Parts, Dockage, Electric Works and Others), By Dock Type (Graving Dock, Floating Dock and Others), By End-user (Government & Defense and Commercial) and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

The global ship repair and maintenance services market size was valued at USD 35.72 billion in 2023 and is projected to grow from USD 37.14 billion in 2024 to USD 53.23 billion by 2032, exhibiting a CAGR of 4.60% during the forecast period. North America dominated the ship repair and maintenance services market with a market share of 25.28% in 2023.

Ship repair and maintenance services encompass scheduled and unscheduled maintenance. They constitute an integral part of ship operations, focusing on crucial ship elements such as the engine, electrical system, propulsion, and others. Maintenance ensures vessels remain in optimal working condition. Ships are taken to repair docks for various activities, including rust removal, repainting, and engine repairs. Repair docks come in various types, such as dry docks, floating docks, ship lifts, sliding docks, and more. Additionally, there are four types of maintenance: preventive, corrective, risk-based, and condition-based maintenance.

Regular inspections occur; however, routine maintenance adheres to the ship's logbook, indicating specific items requiring inspection and upkeep frequency. This includes regular inspections, lubrication intervals, and major maintenance. The ship repair and maintenance services market is driven by the increasing age of marine fleets and stringent emissions regulations.

GLOBAL SHIP REPAIR AND MAINTENANCE SERVICES MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 35.55 billion

- 2024 Market Size: USD 36.84 billion

- 2032 Forecast Market Size: USD 51.89 billion

- CAGR: 4.3% from 2024–2032

Market Share

- Asia Pacific dominated the ship repair and maintenance services market with a 36.7% share in 2023, driven by the presence of major shipyards and expanding regional maritime trade.

- By service type, hull part repairs accounted for the largest market share in 2023 and are expected to maintain dominance through 2032 due to their essential role in maintaining vessel integrity and efficiency.

Key Country Highlights

- India: Strategic investments by Indian Navy, Cochin Shipyard, and Mazagon Dock support naval vessel repair capabilities.

- China: Dominant shipbuilding and repair industry bolstered by key players like COSCO Shipping Heavy Industry.

- Singapore: A regional hub for maritime repair with specialized drydocks and offshore vessel services.

- South Korea: Major shipbuilders such as Hyundai and Daewoo Marine Engineering extend capabilities into high-value repairs.

- UAE: Jebel Ali and other ports drive regional repair demand, especially for oil and gas vessels.

- Greece: Large commercial fleet ownership contributes to steady repair demand, especially in drydock services.

- United States: Growing naval support and modernization contracts are boosting the military segment of the repair market.

- Germany: Expanding green retrofitting services to meet stricter EU emission standards.

INDUSTRY ANALYSIS

Since the COVID-19 outbreak in December 2019, the disease spread globally, leading the World Health Organization (WHO) to declare it a pandemic. The global impacts of COVID-19 significantly affected the market. Additionally, UNCTAD estimated that global merchandise trade fell by 5% in the first quarter of 2020 and further contracted by 27% in the second quarter of the same year. For the full year, UNCTAD projected a 20% drop in maritime trade. This trade contraction caused by COVID-19 surpasses the one observed during the financial crisis of 2008-2009. Supply chain disruptions in spare parts greatly hindered the ship repair and maintenance services market share.

Ship Repair and Maintenance Services Market Trends

Growing Demand for Predictive Maintenance-as-a-Service (PdMaaS) to Propel Market Expansion

Predictive maintenance involves the systematic assessment of initial conditions to serve as warnings for timely maintenance before equipment failure occurs. In this approach, it is necessary to ensure that machines are equipped with systems and sensors that give early indications of failure.

Furthermore, maintenance forecasting is a proactive strategy aimed at mitigating unplanned downtime caused by equipment failure, which often results in costly offshore downtime. Compared to the strict preventive maintenance regime onboard, this approach is characterized by more abstract forecasts.

Proactive analysis of trends in the maintenance of a vessels' equipment and machinery, which can be used to warn about their imminent failure, is a vital aspect of these services. This will ensure that seafarers are aware of their equipment's current capabilities and its potential for further development.

In September 2023, India’s Mazgaon Dock Shipbuilders, Ltd. signed the Master Ship Repair Agreement with the U.S. Navy, which will make the country a future maintenance hub for the U.S. Navy’s assets. This was the second such agreement in 2023 between the Navy and Indian shipyards, the first of which was with Larsen & Toubro (L&T) in June. These two yards are building some of the biggest and most advanced warships in the Indian Navy.

Download Free sample to learn more about this report.

Ship Repair and Maintenance Services Market Growth Factors

Increasing Maritime Trade, Government Support, and Strategic Collaborations to Boost Market Growth

Around 80% of the global trade is handled by the international transport sector. The sea trade continues to expand and delivers benefits for global consumers through the provision of competition in freight costs. A key factor behind the continued growth of the ship repair and maintenance services industry is the increased efficiency of shipping as a mode of transport, in combination with more liberalization within the economy.

For instance, according to the Russia Briefing Report, traffic on the Northern Sea route is expected to rise to 80 million tons of shipments per year by 2025 across Arctic shipping. These rapid developments are leading to economic, environmental, political, and social challenges that have been highlighted by several governments.

In recent years, there has been consistent growth in global ship deliveries from countries outside the OECD Council Working Party on Shipbuilding (WP6). In 2021, the nonWP6 economies accounted for 47.4% of global deliveries driven primarily by a significant increase in Chinese ship completions, which represented 41.1% of total ships completed worldwide.

China's robust ship production propelled it to become the world's largest shipbuilding economy. In addition to the Chinese government's policy initiatives aimed at promoting the shipbuilding industry as a key strategic export sector, this achievement is attributed to the extensive expansion of the facilities of Chinese shipbuilders during the historic boom period.

In October 2023, according to the UNCTAD, the maritime transport sector projected a 2.4% increase in maritime trade volume and recovery from a contraction of 0.4% in 2022. On a ton mile basis, the outlook was even more positive, driven by geopolitical events which have resulted in global seaborne trade growth of almost 4%.

IMO's Stringent Regulations Challenge Ship-Owners to Embrace Greener Vessels

From January 1, 2023, ship-owners will have to comply with more stringent environmental regulations. To reduce greenhouse gas emissions and mitigate the environmental impact of ships at sea, three new IMO regulations have been introduced. According to the CII Regulation, by 2021 around 40% of container ships and bulk carriers will have been classified as non-compliant.

To comply with various standards, a variety of classes and sizes of ships will have to be adopted. The standards will be compared to a benchmark set, which is the average performance of ships constructed from 1999 until 2009.

- Phase I: The overall goal is to improve ship energy efficiency by 10% for new ships built from 2015 to 2019.

- Phase II: Ships built from 2020 to 2024 will have to improve energy efficiency by 15 to 20%, depending on the type of ship.

- Phase III: Ships delivered after 2025 must be 30% more efficient.

For each phase, smaller ships have a specific efficiency requirement. Energy Efficiency Existing Ship Index (EEXI), Carbon Intensity Indicator (CII), and Ship Energy Efficiency Management Plan (Part III) (SEEMP) represent some of the international and European decarbonization policies within the shipping sector.

Slower transport is the most immediate way to reduce emissions. Ship-owners, on the other hand, have the freedom to upgrade their vessels with energy saving technologies or switching to alternate fuels, such as LNG, methanol, ammonia, and electricity. However, these changes would lead to higher costs, affect the coverage of insurance, and influence access to new investments and funding. Alternative fuels are currently priced between two and five times more than the conventional fuel, which makes them economically unviable.

Nevertheless, fleet owners can still opt for dual-fuel vessels. As of March 1, 2022, more than 40% of the orders were for vessels that were able to operate on at least one fuel. Ports need to provide low-emission energy supply infrastructure to promote the use of alternative fuels.

RESTRAINING FACTORS

Capital Intensive Ship Repair and Maintenance Services to Hamper Market Growth

The shipbuilding industry is capital-intensive, requiring specialized technologies for ship construction, maintenance, and repair, along with specialized professionals. This nature limits ship owners' financing options for repairs, posing financial risks to shipyards. Usually, ship owners must finance the total repair costs from their funds. In exceptional cases, they might secure short-term financing from banks or other institutions to complete repairs. However, these services are often costly, potentially hindering the global ship repair and maintenance services market growth.

Ship Repair and Maintenance Services Market Segmentation Analysis

By Vessel Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Naval Vessel Segment Dominates Owing to Rising Demand for Modern Naval Vessels

By vessel type, the market is divided into commercial vessel and naval vessel. The naval vessel segment held the largest market share and is anticipated to be the fastest-growing segment. This growth is propelled by the rising demand for advanced and modern naval vessels amid cross-border tensions.

Moreover, due to the aging of the maritime fleet, a significant increase in market share is anticipated for commercial vessels. In addition, the market is likely to be further driven by a backlog of planned repairs resulting from the influenza epidemic.

By Commercial Vessel Analysis

Container Ship Segment Leads Due to Increased Utilization Across E-commerce and Other Industries

By commercial vessel type, the market is divided into fishing vessels, container ships, passenger ships & ferries, and others. The container ships segment dominates the market due to its diverse applications within the e-commerce sector. Additionally, it is estimated to be the fastest-growing segment owing to its widespread use and larger global fleet size.

Due to the dominance of fish production in China, Japan, India, and Indonesia, Asia Pacific is expected to emerge as a key market for these vessels. The growth of the fishing vessel market is driven by an expanding fish food sector, which supports restaurants and tourism sectors.

By Naval Vessel Analysis

Aircraft Carrier Segment’s Dominance Led by Rise in Demand for Fleet Modernization by Naval Organization

Based on naval vessel, the market is classified into aircraft carriers, submarines, frigates, corvettes, and others. The aircraft carrier segment dominated the market and is expected to be the fastest growing due to the growing emphasis of naval forces on modernization projects.

For instance, in July 2023, Orizzonte Sistemi Navali (OSN), a joint venture between Fincantieri and Leonardo with 51% and 49% shares respectively, awarded the Italian Navy's Cavour aircraft carrier, as well as the Andrea Doria and Caio Duilio Horizon-class destroyers, a Maintenance in Operational Conditions (MOC) Framework Agreement. The contract shall cover maintenance for the vessels concerned, with a maximum overall value of USD 207.7 million in respect of the period up to end 2028.

The submarines segment is expected to be the second-fastest growing segment due to the growing procurement of submarine fleets by different governments and defense bodies around the world for maritime surveillance and security.

For instance, in October 2023, the U.K. awarded three British companies a USD 4.9 billion contract to design and build a nuclear attack submarine as part of the country's AUKUS program with Australia and the U.S.

By Service Analysis

General Service Segment to Foster Growth Owing to Low Cost Associated with Repair Work

Based on service, the market is segmented into general service, engine parts, dockage, electric works, and others. The general service segment is anticipated to lead the market due to its numerous service contracts and relatively low cost. This segment encompasses services, such as painting, coating, general inspections, and more. It's also predicted to experience the fastest growth due to the frequent inspection demands across diverse ships.

The engine parts segment is projected to witness significant growth during the forecast period. The segment’s growth is attributed to the heightened regular maintenance needs of engines to comply with stringent emission regulations.

In September 2023, a service support contract for the Canadian Navy's small frigates and auxiliaries was awarded to Thales. It offers an initial service period of 5 years for up to USD 450 million, with additional one or two year options that can extend services over the duration of 19 years in total. The company is working with indigenous businesses and communities, such as the Malahat Nation, start-ups, academia, Canada's supercluster of innovative small and medium-sized enterprises to build a sustainable domestic industrial service sector that drives continuous capability.

By Dock Type Analysis

Wide Application in Repair and Maintenance Work Boosts the Graving Dock Segment Growth

Based on dock type, the market is divided into graving dock, floating dock, and others. The market is expected to be dominated by the graving dock segment in the upcoming years. Graving docks represent the most popular dry docking solution for ship repairs and maintenance. Due to their widespread use across various shipyards, graving docks are predicted to experience the fastest growth during the forecast period.

The floating dock segment is also expected to grow significantly due to its application in repairing and servicing small-sized ships.

By End-user Analysis

Increased Investment to Drive Government & Defense Segment Growth

By end-user, the market is segmented into government & defense and commercial. The government & defense segment has dominated the market and is anticipated to continue as the fastest growing during the forecast period. This dominance is attributed to the growing investments by the navy and other government sectors aiming to modernize their fleets.

The commercial segment is also poised for significant growth due to various factors such as aging fleets, stricter emission norms, and increased maritime trade activities, among others.

REGIONAL INSIGHTS

North America Ship Repair and Maintenance Services Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market is studied across North America, Europe, Asia Pacific, and the rest of the world.

North America is accounted for the largest market share in 2023. The region is increasingly focused on enhancing operational efficiency while concurrently minimizing environmental impacts. Furthermore, the U.S. administration is augmenting defense funding in response to heightened demands for naval vessels and the perceived threat of hostile interventions in coastal areas.

Asia Pacific is projected to achieve the highest CAGR during the forecast period. This growth in the region is attributed to the increased investments made by key players in the development of ship repair facilities and shipbuilding capabilities. Notable entities in the shipping industry include Cochin Shipyard (CMC), Goa Shipyard (GOWA), Mazagon Dock Shipbuilders Ltd. (MCD), Garden Reach Shipbuilders and Engineers Limited (GRE), Hyundai Mipo Dockyard (HM Dockyard), Dae Sun Shipbuilding Engineering (SSE), China Shipbuilding Industry Corporation (CSIC), among others.

Europe is anticipated to experience significant growth throughout the forecast period, holding the largest market share for ship repair and maintenance services. Recent advancements in frigates and offshore patrol vessels, particularly in terms of lethality, speed, and maneuverability, are key drivers in the regional market. Events such as the rise in illegal immigration and increased drug trafficking in Italy, Spain, and Albania have escalated the demand for naval vessel development in the region. Additionally, factors such as the enforcement of the U.N. Convention on the Law of the Sea (UNCLOS) III necessitate patrols in Exclusive Economic Zones (EEZs) extending up to 200 miles, requiring robust naval forces. Major shipbuilding industries in the region, including the United Shipbuilding Corporation and Damen Ship Repair Rotterdam (DSR), among others, contribute to the market's growth.

The market in the Middle East & Africa is expected to grow at a moderate pace over the forecast period. Shipbuilding activity and dry dock capacity are expected to increase in the region. For instance, for a long time, the dry-docks in Dubai, operated by DWD, and the dry-docks in Bahrain, operated by Arab Shipbuilding and Repair Yard (ASRY), were the only two places in the Middle East that were really suitable for the repair and maintenance of large tankers. More recently, two new yards have been added in the region, capable of handling very large containers (VLCCs). These developments in the region have contributed to the growth of the market.

Latin America is poised to experience significant growth in the coming years. This growth can be attributed to the increase in maritime trade within the region. Furthermore, the rise in container trade within Latin America indicates a conducive trading environment for both shippers and exporters. Mexico and Brazil emerged as major competitors for container shipping companies in the Latin America region, seeking to expand their freight trade routes from simple to more diversified pathways.

List of Key Companies in Ship Repair and Maintenance Services Market

Key Players Focus on Long Term Contracts with Ship Operators to Increase Market Share

In terms of market players, a handful of key companies, including Sembcorp Marine Ltd., Garden Reach Shipbuilders and Engineers Limited, BAE Systems, and Damen Shipyards Group, dominate the market. These companies are focused on expanding their capabilities in ship repair and maintenance services, particularly in response to increased demand post the COVID-19 pandemic. Additionally, these major players are expanding their dry docks to accommodate a larger number of ships for repair and maintenance operations.

LIST OF KEY COMPANIES PROFILED

- Sembcorp Marine Ltd (Singapore)

- Garden Reach Shipbuilders and Engineers Limited (India)

- Damen Shipyards Group (Netherlands)

- BAE Systems (U.S.)

- China Ship Repair and Maintenance Services Industry Corporation (China)

- Dundee Marine & Industrial Services Pte Ltd. (Singapore)

- General Dynamics NASSCO (U.S.)

- HD Hyundai Heavy Industries Co., Ltd (South Korea)

- Larsen & Toubro Ltd (India)

- ST Engineering (Singapore)

KEY INDUSTRY DEVELOPMENTS

- February 2024: One of the nine contractors providing maintenance, repair, and modernization services for the U.S. non-nuclear surface vessels is a Navy systems expert. Under contracts collectively worth USD 943 million, the contractor will provide maintenance, repair, and modernization services for the U.S. Navy (USN) surface vessels based in the northwest of the country, which are short-term or less than ten months in duration.

- February 2024: To ensure the long term availability and resilience of critical assets used by Royal Navy ships and submarines over the next 15 years, the U.K.'s security will be enhanced through a large new contract worth almost USD 2 billion. The contract will provide the Royal Navy with maximum days available to deploy by using data technologies, such as Artificial Intelligence (AI) and Virtual Reality (VR) to be more efficient and anticipate maintenance needs.

- February 2024: Babcock International was awarded a new five-year contract by the U.K. Ministry of Defense (MOD) to continue providing in-service support to the Royal Navy’s Ships Protective System (SPS) equipment. The contract is intended to reduce the rate of hull corrosion and magnetic signature so that ships and submarines are less susceptible to magnetic mines by means of degaussing, cathodic protection, or active shaft anchorage.

- July 2023: The Larsen and Toubro’s (L&T) Kattupalli shipyard, located near Chennai, was granted a Master Shipyard Repair Agreement (MSRA), which was signed with the U.S. Navy for the repair of vessels. The shipyard has been cleared by the Indian Navy and the Coast Guard.

- July 2023: Fincantieri and Leonardo signed a USD 211.5 million contract to maintain the Italian Navy’s Cavour aircraft Julycarrier and the Andrea Doria and Caio Duilio Horizon-class destroyers. Work under the agreement will be conducted until 2028 by a joint venture between Leonardo and Fincantieri, named Orizzonte Sistemi Navali (OSN). Tso maintain the Italian Navy's capability; companies shall ensure that all ships are operating in a functional condition.

- July 2023: According to the Pentagon's Monday announcement, Newport News Shipbuilding was awarded a contract for maintenance of U.S. Navy aircraft carriers in California worth 528.4 million dollars. If all the contract options are executed, the aircraft carrier builder will be responsible for the maintenance of carriers berthed at Naval Air Station North Island, short of a dry dock availability, until 2028, according to the announcement.

REPORT COVERAGE

An Infographic Representation of Ship Repair and Maintenance Services Market To get information on various segments, share your queries with us

The report covers all aspects of the market, including the vessel type, the commercial vessel, the naval vessel, the service, the dock type, the end-user and the key players. In addition, the research report covers the ship repair and maintenance services trends, the competitive landscape, the market competition, the product pricing, and the market conditions, with an emphasis on the development of industry keys. The report also covers several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

4.60% CAGR (2024-2032) |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Vessel type

|

|

By Commercial Vessel

|

|

|

By Naval Vessel

|

|

|

By Service

|

|

|

By Dock Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 35.72 billion in 2023 and is projected to reach USD 53.23 billion by 2032.

The market is projected to record a CAGR of 4.60% during the forecast period of 2024-2032.

By vessel type, the naval vessel segment is expected to be the leading segment of the market.

BAE Systems, China Ship Repair and Maintenance Services Industry Corporation, Damen Shipyards Group, Dundee Marine & Industrial Services Pte Ltd., General Dynamics NASSCO, and Garden Reach Shipbuilders & Engineers Ltd are the leading players in the global markets.

Europe held the highest market share in 2022.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic