Smart Home Market Size, Share & Industry Analysis, By Application (Retrofit and New Construction), By Protocol (Wired and Wireless), By Device Type (Safety & Security Access Control, Home Appliances, HVAC, Lighting Control, Smart Entertainment Devices, Smart Kitchen Appliances, and Others), and Regional Forecast, 2026 – 2034

Smart Home Market Size, Share & Trends

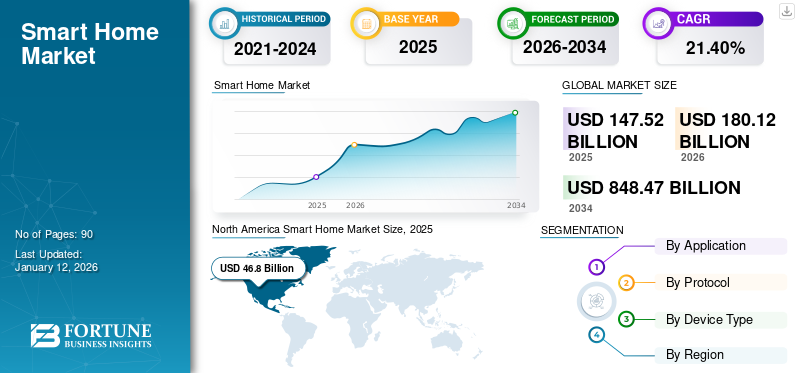

The global smart home market size was valued at USD 147.52 billion in 2025 and is projected to grow from USD 180.12 billion in 2026 to USD 848.47 billion by 2034, exhibiting a CAGR of 21.40% during the forecast period. North America dominated the smart home market with a share of 31.70% in 2025.

As a part of their growth strategy, companies such as ABB, Alphabet, Samsung, and Emerson aim to engage in partnership, collaboration, mergers, and acquisitions (M&A) activities to expand their business and geographical presence.

KEY TAKEAWAYS

- The global smart home market reached USD 147.52 billion in 2025.

- It is projected to reach USD 848.47 billion by 2034, growing at a CAGR of 21.40%.

- North America dominated the market with a 31.70% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- The retrofit segment led the market in 2024, while new construction is expected to grow fastest.

- The wireless protocol segment held the largest share in 2024.

- Smart entertainment devices dominated the market by device type in 2024.

- Safety & security access control is anticipated to grow at the highest CAGR through 2032.

Key Metrics and Overview

|

Metric |

Details |

|

Market Size in 2025 |

USD 147.52 Billion |

|

Projected Market Size in 2034 |

USD 848.47 Billion |

|

CAGR (2026 - 2034) |

21.40% |

|

Market Segmentation |

By Application, Protocol, Device Type, and Region |

|

Top Key Players |

Honeywell International, ABB, Johnson Controls International plc, Siemens, Alphabet, Emerson, Robert Bosch Smart HomeGmbH, Samsung, LG Electronics, Crestron Electronics, Apple, Ecobee, Schneider Electric, Vivint, Fantasia Trading LLC, Snap One, Govee, Xiaomi, Signify Holdings |

What is Smart Home?

A smart home is a home with devices that can be handled remotely using a smartphone or computer. These devices can be used to control lighting, temperature, security, and other functions. Smart homes provide multiple benefits, including energy efficiency, convenience, and enhanced security. The automation of tasks reduces time for the residents, making their lives easier. The devices can also adapt to the behavior of the household, offering personalized service. For instance, a smart thermostat can provide the preferred temperature settings of the inhabitants and adjust the temperature accordingly.

IMPACT OF GENERATIVE AI

Synergy of Gen-AI and Smart Home is Unlocking Unprecedented Opportunity Fueling Innovation and Growth

Gen-AI can create text, images, and human sounds, making it an impressive technology nowadays. The technology has improved rapidly in ten years, becoming more efficient and adaptable. From content to automation content, Gen-AI technology helps to modify multiple sectors. With the emergence of products such as chat GPT, Google Bard, Amazon LLM, and others, Generative AI is positively creating a new way for smart technologies. The integration of Gen-AI into the smart home ecosystem has the potential to make everyday life more effective, practical, and pleasant. For instance,

- As per Stlouisfed Org's 2024 survey, nearly 40% of U.S. adults aged 18 to 64 used generative AI. About 1/3 of respondents stated using it daily or at least a few times per week. Remarkably, AI usage was slightly lower at work (28.1%) than at home (32.6%).

Smart Home Market Trends

Increasing Adoption of Home Automation is a Significant Market Trend

Home automation plays a pivotal role in driving the smart home market growth by enhancing convenience, improving energy efficiency, and providing increased security. The home automation system allows homeowners to remotely control various devices (lights, security cameras, appliances, thermostats) through smartphone or voice commands. This convenience appeals to consumers seeking a more seamless and efficient lifestyle.

- Nest Thermostat can learn a homeowner’s temperature preferences and adjust accordingly. This can be controlled remotely via a mobile app, allowing users to change their home’s temperature before they arrive.

- Philips Hue Smart Bulbs allow users to program their lighting to turn off when not needed or adjust brightness based on natural light levels, helping to save energy.

MARKET DYNAMICS

Smart Home Market Drivers

Integration of Advanced Technologies with Smart Home Appliances to Drive Market

Advanced technology plays a crucial role in smart homes by enabling devices to connect and communicate with each other. This connectivity allows for seamless control and automation of various aspects of a home, such as lighting, temperature, security systems, and appliances. By leveraging IoT, homeowners can remotely monitor and control their smart devices, enhancing convenience and efficiency. Companies are introducing new smart home products by incorporating advanced technologies mentioned previously. For instance,

- In March 2025, ZTE Corporation launched a new home network product range at MWC Barcelona. The portfolio includes the next-gen 4K AI Soundbar, high-performance LinkPro Wi-Fi 7 BE9400/BE6500, and AI home media center. The product is equipped with AI screen FTTR RoomPON 6.0 and the ZENIC ONE management platform.

Integrating these advanced technologies with smart home appliances drives the market by offering increased convenience, efficiency, security, and personalization.

Smart Home Market Restraints

Cybersecurity and Data Protection Concerns Restrict Market Growth

The rising cyberattack in high-end connected technology is the major obstacle to market expansion. Smart technology connects to home systems and gadgets, which makes it vulnerable to hackers if it is not effectively protected. For instance,

- As per the Zscaler report, there has been a substantial rise in cyberattacks targeting smart home devices and the Internet of Things (IoT) in 2024.

- According to a new report by cyber security firm SonicWall, attacks on smart home products have increased by 124% in 2024.

Smart Home Market Opportunities

Development of Advanced Monitoring Devices for Child Safety to Expand Market Growth

Advanced monitoring devices designed specifically for child safety offer a range of features and functionalities that address parents' unique needs and concerns. These devices utilize various smart home technologies and sensors to provide comprehensive monitoring, tracking, and alert systems to keep children safe. For instance,

- In September 2023, Vtech launched its latest advanced product, the V-Care VC2105 Smart Nursery Baby Monitor. The monitor has unique local AI capabilities that provide baby sleep analytics and real-time alerts.

- In September 2022, Amazon.com, Inc. launched the Ring Spotlight Cam Pro, Ring Spotlight Cam Plus, and 2nd Gen Ring Alarm Panic Button. These products are incorporated with radar and 3D motion detection features, providing security and access control and enhancing child safety within smart homes.

SEGMENTATION ANALYSIS

By Application

Surge in Adoption of Energy-Efficient Devices Accelerated Retrofit Segment Growth

Based on application, the market is divided into retrofit and new construction.

Retrofit captured the largest smart home market share in 2024, owing to the increasing adoption of energy-efficient devices and renewable energy sources by homeowners, which includes solar panels to reduce energy consumption and promote sustainable living.

New construction is anticipated to grow at the highest CAGR during the forecast period. New homes are deploying AI-driven automation, enhanced security systems, and immersive entertainment options that provide residents with modern, connected living spaces. For instance,

- American Scientific Publishing Group 2024 stated that AI-powered smart home systems offer improved convenience by providing personalized experiences and automating routine tasks.

By Protocol

Wireless Segment Led Due to Rising Consumer Demand for Convenience

Based on protocol, the market is divided into wired and wireless.

The wireless segment captured the largest market share in 2024 and is anticipated to grow at a prominent CAGR during the forecast period. This has been propelled by advancements in technology, consumer demand for convenience, and the seamless integration of devices. AI and ML have become central to modern smart homes, enabling devices to learn user preferences and habits for a personalized experience. For instance,

- Smart thermostats such as the Nest Learning Thermostat adjust temperature settings based on occupancy patterns, optimizing comfort and energy efficiency.

By Device Type

To know how our report can help streamline your business, Speak to Analyst

Rising Adoption of Smart Entertainment Devices to Enhance User Experience Fostered Segment Expansion

Based on device type, the market is studied into safety & security access control, home appliances, HVAC, lighting control, smart entertainment devices, smart kitchen appliances, and others (smart furniture, home healthcare, etc.).

Whereas safety & security access control further studied into security cameras, smart door locks, and remote monitoring software & services, home appliances further studied into smart water heaters, smart washing machines, smart vacuum cleaners, HVAC further studied into smart, thermostats, sensors, smart vents, heating & cooling coils, and others (control valves, etc.), lighting control further studied into smart lights, dimmers, occupancy sensors, switches, and others (accessories, etc.), smart entertainment devices further analysed into smart displays/tv, sound bars & speakers, and others (other streaming devices, etc.), and smart kitchen appliances further segmented into refrigerators, dishwashers, microwave/ovens, and others (kettle, cookers, etc.).

Smart entertainment devices captured the largest market share in 2024. The rising adoption of home entertainment systems to control several smart devices, play music, and deliver news and weather information to enhance the user experience boosts the demand for smart entertainment devices.

Safety and security access is anticipated to grow at a prominent CAGR during the forecast period. Security cameras and video doorbells have become a major part of smart home security systems. Manufacturers are continually improving these devices with features such as two-way audio, motion detection, and high-definition video recording. Integration with cloud storage allows homeowners to review and access footage remotely, boosting security and market growth.

SMART HOME MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Smart Home Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a major share of the smart home market, with the market size reaching USD 56.29 billion in 2026 owing to the presence of major players, including Honeywell International Ltd, Snap One LLC, SmartRent LLC, Creston Corporation, and others. Key players in the region are adopting strategies such as acquisition, partnership, and product launches to expand their business, enhance their presence, and improving customer base. For instance,

- In October 2024, Develco Products acquired Datek Smart Home, one of three divisions of the Norwegian company Datek. With this acquisition, the two companies offer dedicated white-label cloud services and IoT hardware for home care, smart energy, and security providers in North America.

Download Free sample to learn more about this report.

The US market is projected to reach USD 35.28 billion by 2026, owing to the growing number of tech-savvy consumers in the country. According to the Enterprise Apps Today survey 2023, the total number of smart homes in the U.S. is expected to reach USD 35.28 billion by 2026. Furthermore, household penetration is expected to grow 39% by 2027.

Europe

There are major factors that drive the market, including the rising number of IoT services, government initiatives, and integrations of various technologies such as Artificial Intelligence and Machine Learning. The UK market is projected to reach USD 12.29 billion by 2026, while the Germany market is projected to reach USD 12.72 billion by 2026. For instance,

- The European Commission stated that 266 million electric smart meters are expected to be installed in the EU by 2030.

- In May 2023, Sky and Zurich Insurance unveiled a smart home protection IoT service that offers customers smart home tech products and comprehensive home insurance.

Asia Pacific

The Asia Pacific market is driven by many factors, including energy saving, a rising number of IoT-connected devices, regulatory initiatives by the government, awareness of sustainable ecosystems, and others. Moreover, increasing demand for smart consumer electronics is also a growth factor that is driving the market in the region. Companies are launching many innovative products and solutions that aid consumers in a better, sustainable life. The Japan market is projected to reach USD 9.15 billion by 2026, the China market is projected to reach USD 14.34 billion by 2026, and the India market is projected to reach USD 6.97 billion by 2026. For instance,

- In January 2025, Dreame Technology launched a series of smart home appliances at CES 2025, comprising the X50 Ultra robot vacuum with advanced detangling features and obstacle navigation.

Middle East & Africa

The Middle East & Africa region is witnessing higher demands for smart consumer electronics and home appliances. The smart entertainment category, especially TV’s the main key growth factor for the market. For instance,

- According to industry analysis, around 8.73 million smart home devices were shipped across the META region, which is an increase of 35.1 % from the last year. The introduction of 5G in the GCC region and the acceptance of 4G in most countries within the META region have also added to the growth of the market.

South America

The market in South America is driven by the adoption of many corporate strategies by key players. They are merging, acquiring, and collaborating with other players to improve their customer base.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Product Enhancement & Innovation among Key Players to Propel Market Growth

Players in the market are upgrading their existing solutions and innovating new ones to expand their business and meet customer needs. The enhancement and expansion of the current product portfolio raise the position of vendors in the market.

List of Top Smart Home Companies Profiled

- Honeywell International, Inc. (U.S.)

- ABB (Switzerland)

- Johnson Controls International plc (Ireland)

- Siemens (Germany)

- Alphabet, Inc. (U.S.)

- Emerson (U.S.)

- Robert Bosch Smart HomeGmbH (Germany)

- Samsung (South Korea)

- LG Electronics (South Korea)

- Crestron Electronics, Inc. (U.S.)

- Apple, Inc. (U.S.)

- Ecobee (Canada)

- Schneider Electric (France)

- Vivint, LLC (U.S.)

- Fantasia Trading LLC (U.S.)

- Snap One, LLC (U.S.)

- Govee (China)

- Xiaomi (China)

- Signify Holdings (Netherlands)

KEY INDUSTRY DEVELOPMENTS

- In January 2025, ABB acquired Lumin, a U.S.-based provider and pioneer of energy management systems. This acquisition will help to expand the company’s home energy management abilities in the North American residential sector.

- In January 2025, LIFX, the smart lighting company, and Feit Electric introduced four new lighting products at CES. From Katalyst collection of ceiling and Feit’s Vista Skylight LED Fixtures to Luna Smart Lamp and LIFX’s futuristic smart oval supercolor ceiling light. These additions offer unmatched customization, versatility, and simplicity, available entirely at The Home Depot.

- In October 2024, ABB and Austrian-based Zumtobel Group, a professional lighting solutions provider, partnered, aimed at innovating smart building solutions. The partnership will help to create significant added value for customers in multiple sectors by offering smart and integrated solutions for smart buildings.

- In August 2024, Huawei Digital Power launched its “Smart Home Energy” solution in the Philippines. This will help the country to achieve a sustainable and energy-efficient future.

- In October 2022, ASSA ABLOY acquired Bird Home Automation GmbH, a German company specializing in IP door intercoms for single and multifamily buildings. This strategic acquisition will be crucial in ASSA ABLOY’s expansion into the growing smart home market.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investment in smart home technology is increasing, driven by increasing consumer demand for energy efficiency, convenience, and security. Key players like Amazon (Alexa), Google (Nest), and Apple (HomeKit) are growing their ecosystems through strategic acquisitions and R&D. Startups such as Wyze and Ecobee are attracting venture capital for innovative, affordable solutions. Asia-Pacific, especially India and China is emerging as a high-growth market due to urbanization and rising disposable incomes. The integration of IoT and AI is creating new monetization models through data analytics and subscription services. Overall, the market offers strong mid-to-long-term ROI potential for both institutional and corporate investors.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Protocol

By Device Type

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 848.47 billion by 2034.

In 2025, the market was valued at USD 147.52 billion.

The market is projected to grow at a CAGR of 21.40% during the forecast period of 2026 – 2034.

By device type, the smart entertainment device segment led the market.

Integration of advanced technologies with smart home appliances to Drive the Market

ABB, Alphabet, Samsung, and Emerson are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us