Snowmobile Market Size, Share & Industry Analysis, By Product Type (Touring, Trail, Mountain, Crossover, Performance, and Utility), By Engine Type (Two Stroke Engine and Four Stroke Engine), By Seating Capacity (Less than 400CC, 400-600CC, 600-800CC, and More than 800CC), By Seating (Single Seater, Two Seater, Three Seater, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

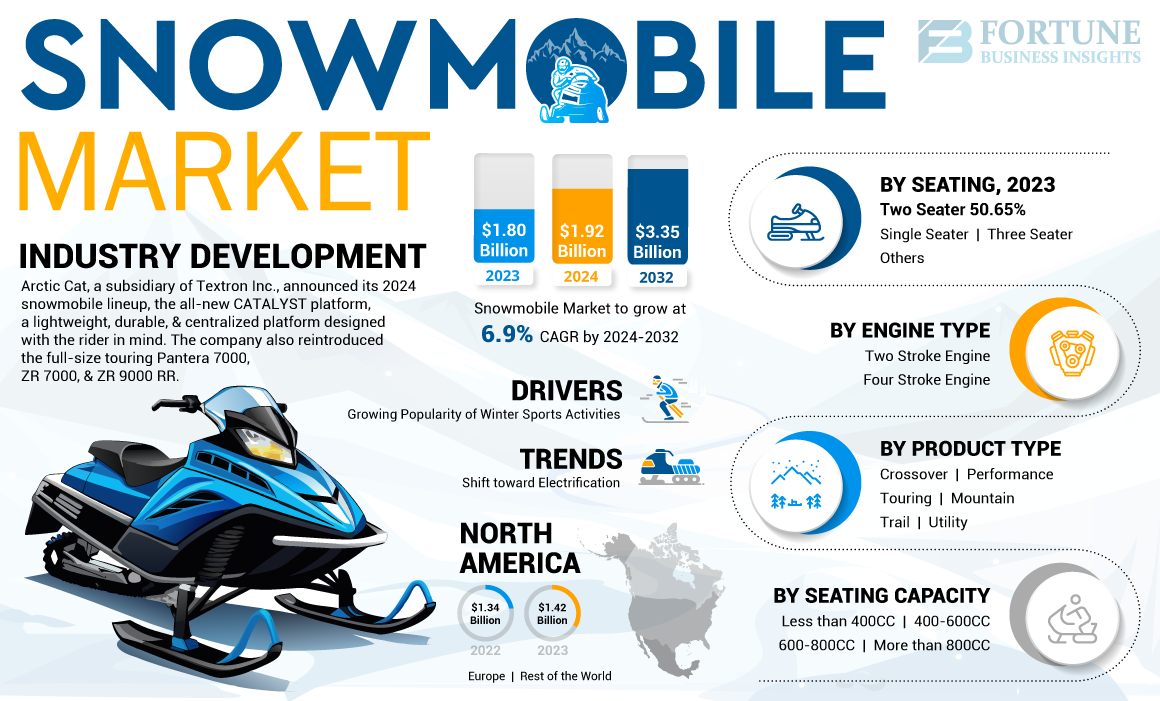

The global snowmobile market size was valued at USD 1.80 billion in 2023 and is projected to grow from USD 1.92 billion in 2024 to USD 3.35 billion by 2032, exhibiting a CAGR of 6.9% during the forecast period. The North America dominated the Snowmobile Market with a share of 78.88% in 2023.

A snowmobile, a skimobile, Ski-Doo, or snow scooter, is a motorized recreational vehicle designed for winter sports activities or recreation on snow. This vehicle is designed to be operated on snow and does not require a trail or road, but most are driven on open terrain or trails.

Global Snowmobile Market Overview

Market Size:

- 2023 Value: USD 1.80 billion

- 2024 Value: USD 1.92 billion

- 2032 Forecast Value: USD 3.35 billion, with a CAGR of 6.9% from 2024–2032

Market Share:

- Regional Leader:North America dominated the market in 2023 in terms of total market size

- Fastest-Growing Region: (Not explicitly specified in the source)

- End-User Leader: The trail segment is expected to lead the market due to growing popularity among younger riders

Industry Trends:

- Product Type Segmentation: The market is organized by product types such as touring, trail, mountain, crossover, performance, and utility

- Engine Type Segmentation: Clear categorization into two-stroke and four-stroke engines

- Seating & Capacity Segmentation: Divided by seating (single, two, three seater, others) and engine capacity (<400cc, 400–600cc, 600–800cc, >800cc)

Driving Factors:

- Youth Engagement: Young rider preferences are elevating the trail product type, influencing market leadership

- North American Demand: Strong market share indicates significant consumer interest and infrastructure support in North America

- Engine Trends: The segmentation by engine type and capacity suggests evolving preferences and potential shifts in product development

Snowmobiles are popular in regions with heavy snowfall where winter tourism is prevalent. Tourists often seek out snowmobile rentals and tours for recreational activities, driving the demand for snowmobiles in these areas. The growing popularity of snowmobiling in the U.S., Canada, and Northern Europe is owing to the rise in winter sports activities. As per the International Snowmobile Manufacturers Association (ISMA) report, there were 1.2 million registered units in the U.S. and over 601,000 in Canada in 2020-21. The growing number of these vehicle registration indicates the growing popularity of snowmobiling as a healthy winter sport activity. Snowmobiling is a popular outdoor recreational activity for individuals and families. As people seek ways to enjoy outdoor activities during the winter months, the demand for snowmobiles for personal use increases.

Economic factors, such as rising disposable income levels, can impact consumer spending on recreational vehicles like snowmobiles. Consumers with more disposable income may be more likely to invest in high-ticket items such as snowmobiles. Weather patterns and snowfall fluctuations can affect the demand for snowmobiles. Regions experiencing consistent snowfall are likely to have a steady demand for snowmobiles, while areas with unpredictable snow conditions may see fluctuating demand. Effective marketing campaigns and promotions by manufacturers and dealers can stimulate interest and drive sales in the snowmobile market. Special events, demos, and sponsored races can attract potential buyers and enthusiasts.

Snowmobile Market Trends

Shift toward Electrification is Expected to Set a Positive Trend in the Snowmobile Market

Electric snowmobile technology can be a game changer in the market in the coming years. OEMs in this market are introducing electric snow machines with enhanced performance, maneuverability, and reliability. Electric motors provide instant torque, delivering quick acceleration and responsive handling on snow-covered terrain. Electric snowmobiles offer smooth and quiet operation, enhancing the overall riding experience for enthusiasts. There has been robust growth in the electric mobility market. The gradual shift from IC engine vehicles to electric vehicles will create growth opportunities for OEMs in the power sports industry. Electric snowmobiles produce zero emissions during operation, addressing air and noise pollution concerns in snow-covered environments. As environmental awareness grows, there is increasing demand for eco-friendly transportation options, including electric snowmobiles. Advances in battery technology have improved the performance and range of electric snowmobiles. Modern lithium-ion batteries offer longer run times and faster charging capabilities, making electric snowmobiles more practical and appealing to consumers.

A few manufacturers have entered the electric vehicle market by launching an electric variant of the snow vehicles to support the demand for zero-emission vehicles and widen their market share. For instance, in November 2022, Taiga Motors announced the launch of its new electric snow bike, the Nomad, with innovative features. Similarly, in February 2023, Ski-Doo and Lynx announced to launch their first electric lineup in 2024. The lineup will include Ski-Doo Grand Touring Electric and European-only Lynx Adventure Electric. Electric snowmobiles offer new opportunities for rental businesses and tour operators catering to eco-conscious travelers. Electric models may appeal to environmentally conscious tourists seeking sustainable and immersive outdoor experiences.

Download Free sample to learn more about this report.

Snowmobile Market Growth Factors

Growing Popularity of Winter Sports Activities is Accelerating the Snowmobile Market Growth

The growing popularity of outdoor recreational and winter sports activities surges the demand for snowmobiles. Growing expenditure on outdoor recreational activities, leisure, and rising sports competitions during winter surges the demand for these vehicles. According to the U.S. Bureau of Economic Analysis (BEA), the outdoor recreation economy accounted for 1.9% of the country's nominal Gross Domestic Product (GDP) in 2021.

There is growing usage of this vehicle by search & rescue teams as their primary vehicle in high altitudes during winters. This vehicle can also be used as an ambulance sled and puller in snow belts. This vehicle also allows rapid search for clues, allowing for rapid deployment of medical care in case of emergencies.

RESTRAINING FACTORS

High Maintenance Cost May Restraint the Market Growth

The high maintenance cost is a key factor restraining the market growth. As per the ISMA report, an average snowmobile owner spends approximately USD 3,000– USD 4,000 yearly on travel gear and related services. The annual ownership costs of this vehicle range between USD 1,500 to USD 5,500 for an average ride of 1,500 miles a year. Used sleds are cheaper to maintain but less reliable. Hence, they need more maintenance. Ownership costs of new sleds cost around USD 2,500-USD 5,500 a year, depending on the model, feature, and year.

Snowmobile Market Segmentation Analysis

By Product Type Analysis

Trail Segment is Anticipated to Lead the Market Owing to its Lightweight and Reliability

The market is divided into touring, trail, mountain, crossover, performance, and utility based on product type.

The trail segment held a significant market share in 2023 and is anticipated to grow further, owing to its easy availability. Trail types are lightweight, agile, reliable, comfortable, and economical. These snowmobiles are popular among entry-level riders owing to their easy operation and are suitable for cruising around on groomed trails for recreational activities. Moreover, the growing popularity of trail-specific ski-doo among young-age group people will drive the segment growth.

The touring segment is anticipated to register the highest CAGR over the forecast period. The positive market outlook can be attributed to its higher reliability for long-distance travel. Touring type is meant to be ridden for a long time, usually more comfortable than other types of sleds, and has space to carry more cargo. Due to their enhanced stability, safety, and heavier sledge, they are ideal for long, comfortable rides.

By Engine Type Analysis

Two Stroke Engine is Anticipated to Register High CAGR over the Forecast Period Owing to its Lower Maintenance Cost

The market is categorized into two stroke engine and four stroke engine based on engine type.

The two stroke engine segment held a leading market share in 2023 and is expected to grow at a significant growth rate over the forecast period. Two stroke engines are lighter and generate more power than four stroke engines. Moreover, they are cheaper to build and have lower maintenance costs. Owing to their lower maintenance cost and higher power-to-weight ratio, manufacturers are more focused on building reliable two stroke engine-powered snow vehicles. For instance, in January 2020, Ski-Doo launched a two stroke turbo snowmobile, the Summit 850 E-TEC Turbo, the world’s first factory-built two stroke turbo engine. The model is lighter and designed to provide consistent performance as altitude increases.

The four stroke engine segment held a significant market share in 2023. Four stroke engines are quieter and more complex and require more maintenance as compared to two stroke engines. Four stroke engines are gaining popularity in recent years as they are more fuel-efficient and offer near-complete combustion, resulting in better performance. They are ideal for long-distance trail riding owing to liquid-cooled engines and better gas mileage. Moreover, four stroke engines help ensure better fuel, higher torque, and lower emission levels.

By Seating Capacity Analysis

600-800CC Segment to Lead the Market due to its Higher Performance and Enhanced Maneuverability

The market is categorized into less than 400CC, 400-600CC, 600-800CC, and more than 800CC based on seating capacity.

The 600-800CC segment is currently the largest shareholder in the global market and is anticipated to dominate the market throughout the forecast period. When navigating tight terrain, these engine capacities provide higher torque, enhanced performance, and extra maneuverability. These vehicles with higher engine capacity can also be used in winter rescue work, repairing power and telephone lines, checking forest land, and providing winter transportation for professional conservationists.

The less than 400CC segment is anticipated to register a significant CAGR over the forecast period. Snowmobiles with engine capacity of less than 400CC are lightweight, affordable, and easy to handle and are mostly used in touring and trailing. This range of engine capacity is suitable for kids owing to their easy handling and operation.

By Seating Analysis

To know how our report can help streamline your business, Speak to Analyst

Two Seater Held a Considerable Market Share Owing to its Higher Application in Touring

The market is categorized into single seater, two seater, three seater, and others based on seating.

The two seater segment held a significant market size of and is anticipated to register a strong growth rate over the forecast period. Two seater snowmobiles are designed to accommodate two passengers. Two seaters are primarily used for touring, designed to provide comfort for the driver and passenger on longer tours on groomed trails.

Single seater segment accounts for a substantial growth rate over the forecast period. Single seaters are generally used for racing activities. Rising winter sports activities across different regions, especially in North America and Europe, have positively impacted the expansion of the single seater segment share globally.

REGIONAL INSIGHTS

North America Snowmobile Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest snowmobile market share in 2023. It will dominate over the forecast period owing to increased expenditure on recreational activities and tourism-related businesses. As per the New Hampshire Snowmobile Association, snowmobiling generates over USD 30 billion worth of economic activity in North America. Over 70% of snowmobilers in North America are club or snow sports association members. Moreover, the region's presence of major manufacturers such as Polaris, Arctic Cat, Bombardier Recreational Products, and Yamaha contributes to the market growth. These manufacturers are emphasizing on diversifying their product portfolio to widen their customer base.

The rising popularity of winter sports activities is leading to the expansion of the Europe market. As per the ISMA, around 25,880 new sledge were sold in Europe in 2021-2022. The growing number of snowmobiling clubs in Scandinavian countries, trail development, and sports show further propels the regional market growth. In some European countries, snowmobiling is a major part of their winter economic engine and provides thousands of employment opportunities.

The rest of the world is projected to grow at a substantial CAGR over the forecast period. The steady market growth in Asia Pacific countries can be attributed to the growing popularity of winter tourism in countries, including India, Australia, China, and Japan. For instance, the number of people participating in seasonal winter sports in China has grown from 170 million in 2016 to 2017 to 254 million in 2020 to 2021.

List of Key Companies in Snowmobile Market

Key Players are Focusing on Mergers & Acquisitions and Partnerships to Gain a Competitive Edge in the Market

The companies are focusing on cost-reduction strategies, electrifying their sledge, strategic partnerships, and acquisitions to enhance their product offerings. They use modern technologies to improve their products and strengthen their footprint in the global market. For instance, In February 2022, BRP Inc. launched the fifth generation of the REV, designed for a more natural and controlled driving position, particularly for deep snow and trail riders.

List of Key Companies Profiled:

- Artic Cat Inc. (U.S.)

- Bombardier Recreational Products (Canada)

- Polaris Inc. (U.S.)

- Yamaha Motor Corporation (Japan)

- Alpina Snowmobiles S.r.l.

- TAIGA (Canada)

- Aurora Powertrains (Finland)

- AD Boivin Inc. (Canada)

- Crazy Mountain Xtreme (Canada)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – X Games, the foremost global event for action sports, and Taiga Motors Corporation, a leading Canadian brand specializing in electric powersports, unveiled an unprecedented partnership. This landmark agreement designates Taiga as the exclusive provider of Electric Snowmobiles for X Games Aspen 2024, marking a significant milestone in electrified winter sports.

- January 2024 – The Forest Service granted a contract to Weller Recreation Inc. for procuring and transporting 18 snowmobiles to the Dillon Ranger District within the White River National Forest. The contract, valued at $18,000, underscores efforts to bolster mobility and operational capabilities within the district's snowy terrain.

- March 2023- Arctic Cat, a subsidiary of Textron Inc., announced its 2024 snowmobile lineup, the all-new CATALYST platform, a lightweight, durable, and centralized platform designed with the rider in mind. The company also reintroduced the full-size touring Pantera 7000, ZR 7000, and ZR 9000 RR.

- March 2023 – Polaris Inc. announced the launch of a comprehensive snow bike portfolio with new and improved rider-driven innovations and features to deliver high performance, agility, and control. The lineup includes the new Series 9 325 track and Timbersled's new RIOT Gen 2 system.

- July 2022 – Pro Armor, one of the leaders in aftermarket powersports, a subsidiary of Polaris’ PG&A, launched its snowmobile line. With this launch, the company aims to enhance riders’ adventures with customized, purpose-built style, and performance accessories.

REPORT COVERAGE

The report provides the market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

An Infographic Representation of Snowmobile Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.9% from 2024 to 2032 |

|

Unit |

Value (USD Billion) Volume (Units) |

|

Segmentation |

By Product Type

|

|

By Engine Type

|

|

|

By Seating Capacity

|

|

|

By Seating

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1.80 billion in 2023.

The market is likely to grow at a CAGR of 6.9% over the forecast period (2024-2032).

The trail segment is expected to lead the market due to its growing popularity among young riders.

Some of the top players in the market are Arctic Cat, Polaris, Yamaha, and Taiga.

North America dominated the market in terms of the market size in 2023.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic