Solid State Cooling Market Size, Share & Industry Analysis, By Product Type (Refrigeration Systems and Cooling Systems), By Technology (Thermoelectric Cooling, Electrocaloric Cooling, Magnetic Cooling, and Others) By Type (Single Stage, Multi-Stage, and Thermocycler), By End-user (Consumer Electronics, Healthcare, Automotive, Food & Beverages, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

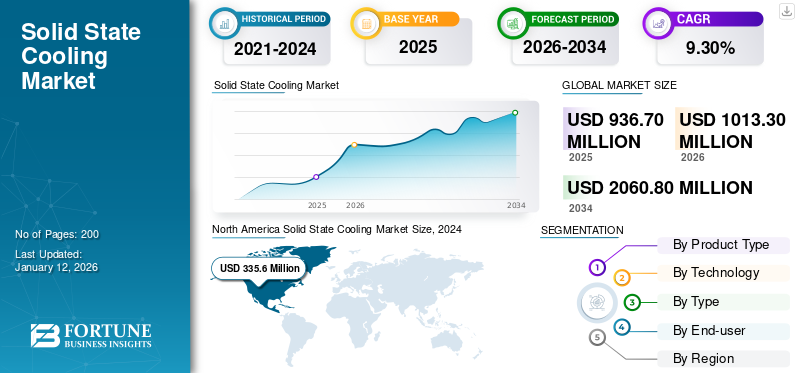

The global solid state cooling market size was valued at USD 936.7 million in 2025 . The market is projected to grow from USD 1,013.30 million in 2026 to USD 2,060.80 million by 2034, exhibiting a CAGR of 9.30% during the forecast period.

Solid State Cooling refers to advanced thermal management technologies that use thermoelectric, electrocaloric, or magnetocaloric effects to control temperature without the use of traditional refrigerants or mechanical compressors. These systems provide precise, silent, and eco-friendly cooling solutions for compact, sensitive, or mission-critical environments. Industries adopt solid state cooling to meet growing demands in sectors such as medical devices, electronics, telecommunications, and electric vehicles, where traditional cooling systems fall short in terms of efficiency, reliability, or form factor.

Major players dominating this market include Ferrotec Corporation, Laird Thermal Systems, Coherent Corp, Phononic Inc., and TE Technology Inc. Diverse product portfolios, material innovation, strong OEM partnerships, and scalable manufacturing capabilities support their leadership. These companies focus on delivering integrated thermal management solutions that offer high precision, energy efficiency, and long-term reliability across a wide range of industrial and consumer applications.

MARKET DYNAMICS

MARKET DRIVERS

Growth in Electronics and Semiconductor Industries to Propel Market Growth

The rapid expansion of the electronics and semiconductor industries is a major driver for the solid state cooling market. For instance,

- According to IBEF, in FY23, electronic goods exports reached USD 23.57 billion, marking a significant increase of 50.52% compared to USD 15.66 billion in FY22.

Solid state coolers, with their silent, vibration-free, and maintenance-free operation, are well-suited for high-performance components such as CPUs, GPUs, sensors, and medical instruments. Their ability to deliver precise, localized cooling makes them ideal for space-constrained applications in electronics, wearables, and medical devices where traditional systems fall short.

MARKET RESTRAINTS

Limited Cooling Capacity for Heavy-Duty Applications to Restrict Market Expansion

Solid state cooling technology is appropriate for small, precise niche applications such as electronics and medical devices, but unsuitable for large cooling loads required in large commercial or industrial applications. The limited cooling power of these devices prevents their widespread adoption in larger areas, including heavy-duty machinery. Current applications are limited to niche markets, which limits the size of the solid state cooling market growth potential until efficiency and scaling can be improved. Material science advancement and system integration are required to develop high-capacity cooling applications.

MARKET OPPORTUNITIES

Expansion into IoT and Wearable Devices to Create Lucrative Growth Opportunities

With the rapid growth of IoT and wearable technologies such as smartwatches, fitness trackers, and AR/VR devices, there’s a rising need for compact, quiet, and efficient cooling solutions. For instance,

- According to industry experts, the number of active IoT devices has surged from 10 billion in 2019 to an estimated 18.8 billion by the end of 2024.

Solid state cooling fits perfectly, offering precise temperature control in small spaces without noise or moving parts. This improves device performance and reliability, making it a key opportunity as these markets continue to expand.

SOLID STATE COOLING MARKET TRENDS

Adoption of Electric Vehicles to be a Key Trend in Market

The rapid growth of the electric vehicle (EV) market has heightened the need for efficient thermal management solutions. Solid state cooling technology is gaining traction in EVs due to its compact size, reliability, and precise temperature control. It plays a crucial role in battery thermal management by maintaining optimal temperatures, thereby enhancing battery performance, safety, and lifespan. For instance,

- In September 2025, Rimac unveiled a new solid state battery at the IAA Mobility show that charges from 10 to 80 % in just six and a half minutes. The battery is smaller, lighter, and safer than current liquid-based options, with high energy density and excellent performance in cold conditions.

Segmentation Analysis

By End-user

Healthcare Sector Commands Largest Market Share Among End-Users Due to High Demand for Precision Cooling

On the basis of the segmentation of end-user, the market is classified into consumer electronics, healthcare, automotive, food & beverages, and others.

To know how our report can help streamline your business, Speak to Analyst

The healthcare sector segment will account for 29.28% market share in 2026, as precise temperature control is critical for medical devices, pharmaceuticals, and biotechnology applications. Solid state cooling offers reliable, compact, and vibration-free cooling ideal for sensitive healthcare equipment. Additionally, growing demand for portable and efficient cooling solutions in diagnostics and patient care drives this segment’s dominance.

By Product Type

Cooling Systems Held Largest Share Due to their Integration and Application Readiness

In terms of product type, the market is categorized into refrigeration systems and cooling systems.

The cooling system segment captured the largest share of the market in 2024. In 2026, the segment is anticipated to dominate with a 58.27% share. This is due to its widespread use in medical, automotive, and electronic applications where precise and reliable thermal management is essential. Unlike individual modules, integrated cooling systems offer ready-to-use solutions with optimized performance, easier installation, and better compatibility with end-user devices.

The refrigeration systems segment is expected to grow at a CAGR of 10.70% over the forecast period.

By Technology

Thermoelectric Cooling Led Market Owing to Its Efficiency and Broad Application Scope

Based on technology, the market is segmented into thermoelectric cooling, electrocaloric cooling, magnetic cooling, and others.

The thermoelectric cooling held the dominating position in 2024. By technology, the thermoelectric segment held the share of 58.27% in 2026 as it has become one of the most commercially viable and popular thermoelectric applications in use. As an accurate temperature control option when size and noise are limitations, thermoelectric systems have become accepted in electronics and health-related applications.

The segment of electrocaloric is set to flourish with a growth rate of 14.00% growth across the forecast period.

By Type

Single-Stage Systems Dominated Market Due to their Versatility and Cost-Effectiveness

Based on type, the market is segmented into single stage, multi-stage, and thermocycler.

In 2024, single-layer systems hold the majority share in the market. By type, single stage holds the share of 57.16% in 2026 as they provide a compact and relatively low-cost solution for all the major applications. Their design is uncomplicated and requires little to no maintenance, making design integration into the product more straightforward. For instance,

- In March 2025, ION Storage Systems’ single-layer solid state battery achieved 25 times more capacity and over 1,000 cycles, demonstrating high performance and scalability. This milestone shows how single-layer solid state technology can become compact, efficient, and commercially viable without complex systems.

In addition, the thermocycler is projected to grow at a CAGR of 13.50% during the study period.

Solid State Cooling Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

NORTH AMERICA

North America Solid State Cooling Market Size, 2024 (USD Million) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in the market in 2025, valued at USD 361.6 million, and continued to lead in 2026 with a valuation of USD 391 million. This regional dominance is attributed to the widespread adoption of thermoelectric cooling technologies across industries, the strong presence of key manufacturers and R&D centers, substantial investments in energy-efficient cooling systems, and stringent environmental regulations promoting sustainable technologies.

Download Free sample to learn more about this report.

In 2026, the U.S. market is estimated to reach USD 256.7 million, maintaining its position as a major contributor within North America.

EUROPE

During the forecast period, the European region is projected to grow at a rate of 9.90%, ranking third among all regions. It is anticipated to reach a valuation of USD 223.2 million in 2026. This growth is driven by increasing demand for eco-friendly and compact cooling solutions, rapid industrial automation, and rising implementation of solid state refrigeration systems in medical and consumer electronics. Among European countries, the U.K. is expected to reach USD 63.8 million, Germany USD 50.2 million in 2026 and France USD 32.0 million by 2025.

ASIA PACIFIC

Following Europe, the Asia Pacific region is estimated to attain a market value of USD 278.2 million in 2026, making it the second-largest regional market. The growth in this region is supported by expanding electronics and semiconductor industries, favorable government policies on energy-efficient technologies, and increasing adoption of solid state cooling technology in automotive and industrial sectors. Within the Asia Pacific, India and China are projected to record valuations of USD 74.1 million and USD 97.8 million, respectively, in 2026.

LATIN AMERICA & MIDDLE EAST & AFRICA

Over the forecast period, regions including Latin America and Middle East & Africa are set to witness moderate growth. The Latin America market is projected to reach USD 50.1 million in 2026, driven by the modernization of commercial infrastructure, growing demand for portable cooling devices, and a rising focus on sustainable cooling technologies. In the Middle East & Africa, the GCC region is expected to reach a valuation of USD 5.4 million by 2025, supported by increasing investment in next-generation cooling systems and rising awareness of energy-efficient solutions.

COMPETITIVE LANDSCAPE

Key Industry Players

A Broad Product Range and Strong OEM Partnerships Have Enabled Key Companies to Maintain Market Leadership

A diverse lineup of thermoelectric cooling products, along with strong partnerships with OEMs and global manufacturing capabilities, has allowed key players to sustain their leadership in the solid state cooling market. The market remains semi-consolidated, with a few major companies operating alongside emerging innovators driving material and design advancements.

Coherent Corp, Delta Electronics, and Ferrotec Corporation are some of the leading players in this space. These companies stand out through their focus on high-performance, compact, and energy-efficient cooling solutions tailored to automotive, medical, and electronics applications. Their global presence, technical expertise, and continued investment in R&D help them deliver reliable and scalable solid state cooling technologies across diverse industries.

LIST OF KEY SOLID STATE COOLING COMPANIES PROFILED

- Coherent Corp (U.S.)

- Delta Electronics, Inc. (Taiwan)

- Ferrotec Corporation (Japan)

- Same Sky (U.S.)

- TE Technology, Inc. (U.S.)

- TEC Microsystems GmbH (Germany)

- Phononic, Inc. (U.S.)

- Tark Thermal Solutions, Inc. (U.S.)

- Micropelt GmbH (Germany)

- Solid State Cooling Systems (U.S.)

- Mercury Systems, Inc. (U.S.)

- Kryotherm (Russia)

KEY INDUSTRY DEVELOPMENTS

- March 2025: HKUST developed the world’s first kilowatt-scale elastocaloric solid state cooling device. It cools spaces fast and efficiently without harmful emissions, using nickel-titanium alloys and graphene nanofluid for better heat transfer. This breakthrough offers a greener, energy-saving alternative to traditional air conditioning.

- February 2025: Mercedes-Benz and Mercedes AMG HPP began road testing a solid state battery in a modified EQS, offering 25% longer range (over 1,000 km), improved safety, and higher efficiency. Developed with Factorial Energy using Formula 1 tech, the battery features a solid electrolyte, lithium-metal anodes, and passive cooling.

- January 2025: xMEMS Labs introduced the XMC-2400, a solid state micro-cooling chip using all-silicon technology to cool ultra-thin mobile devices actively and AI hardware. Unlike traditional fans, this silent, vibration-free chip provides efficient solid state cooling at the chip level, enabling thinner, high-performance devices without bulky cooling systems.

- December 2024: Frore Systems showcased their AirJet solid state cooling at CES 2025, replacing fans with silent, efficient chips in a Samsung Galaxy Book4 Edge 14. This technology boosts performance by 50 %, reduces cooling size by 45 %, and extends battery life without adding noise or thickness. It points to a future of thinner, quieter, and more powerful laptops using solid state cooling.

- November 2023: Phononic and Halton have completed the world’s first commercial installation of a solid state HVAC system using Peltier technology (TTAP) in a historic Paris building. This emission-free platform offers both heating and cooling without refrigerants or complex infrastructure, cutting CO₂ emissions by over 15% and operational costs by 18.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.30% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type · Refrigeration Systems o Refrigerators o Freezers · Cooling Systems o Air Conditioners o Coolers o Chillers |

|

By Technology · Thermoelectric Cooling · Electrocaloric Cooling · Magnetic Cooling · Others (Cryogenic Cooling, etc.) |

|

|

By Type · Single Stage · Multi-Stage · Thermocycler |

|

|

By End-User · Consumer Electronics · Healthcare · Automotive · Food & Beverages · Others (Aerospace & Defense, etc.) |

|

|

By Region · North America (By Product Type, By Technology, By Type, By End-user, and By Country) o U.S. (By End-user) o Canada (By End-user) o Mexico (By End-user) · Europe (By Product Type, By Technology, By Type, By End-user, and By Country) o U.K. (By End-user) o Germany (By End-user) o France (By End-user) o Italy (By End-user) o Spain (By End-user) o Russia (By End-user) o Benelux (By End-user) o Nordics (By End-user) o Rest of Europe · Asia Pacific (By Product Type, By Technology, By Type, By End-user, and By Country) o China (By End-user) o India (By End-user) o Japan (By End-user) o South Korea (By End-user) o ASEAN (By End-user) o Oceania (By End-user) o Rest of Asia Pacific · Middle East and Africa (By Product Type, By Technology, By Type, By End-user, and By Country) o Turkey (By End-user) o Israel (By End-user) o GCC (By End-user) o North Africa (By End-user) o South Africa (By End-user) o Rest of Middle East & Africa · South America (By Product Type, By Technology, By Type, By End-user, and By Country) o Brazil (By End-user) o Argentina (By End-user) · Rest of South America |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 936.7 million in 2025 and is projected to reach USD 2,060.80 million by 2034.

In 2025, the market value stood at USD 361.6 million.

The market is expected to exhibit a CAGR of 9.30% during the forecast period of 2026-2034.

a. Which was the leading segment in the market by end-user?

Growing in Electronics and Semiconductor Industries to Propel the Market Growth.

Coherent Corp, Delta Electronics, Inc., Ferrotec Corporation and Kryotherm, are some of the prominent players in the market.

North America dominated the market in 2025.

The consumer electronics segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us