South Korea Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (ML, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

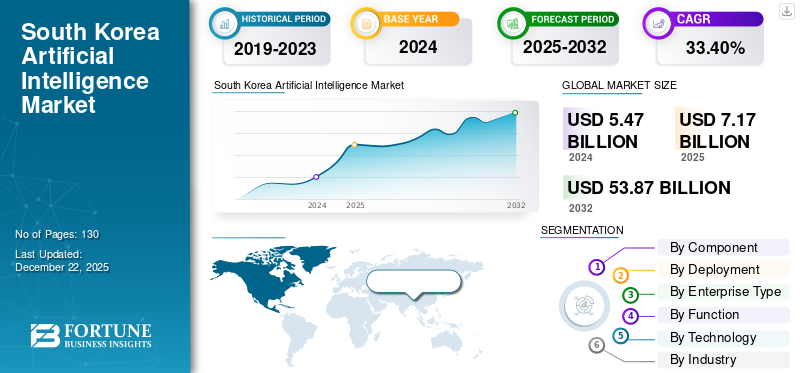

The South Korea Artificial Intelligence market size was worth USD 5.47 billion in 2024. The market is projected to grow to USD 7.17 billion in 2025 to USD 53.87 billion by 2032, exhibiting a CAGR of 33.40% during the forecast period.

As of 2025, South Korea is emerging as a dynamic force in the global artificial intelligence landscape, driven by a national vision to integrate AI into its digital economy. With a strong foundation in high-speed connectivity, advanced manufacturing, and smart city infrastructure, South Korea is channeling AI innovation into sectors like healthcare, mobility, education, and public services. What sets the country apart is its targeted investment in applied AI, focused on delivering measurable societal and economic outcomes. Supported by strategic government funding, forward-looking regulations, and growing ecosystem of startups and research centers, South Korea is advancing from experimentation to scaled adoption.

Impact of Generative AI

Generative AI is reshaping South Korea’s AI landscape by introducing powerful tools that can create content, designs, and solutions with minimal human input. This technology is enabling companies to reduce costs and speed up innovation cycles, particularly in sectors like media, fashion, and product development.

- A Google-Ipsos survey found that 55% of South Koreans used generative AI tools like ChatGPT, Gemini, and Claude last year.

Impact of Reciprocal Tariffs

Reciprocal tariffs can raise costs for South Korea’s AI market by making key imports like semiconductors and hardware more expensive. This can slow down AI development and increase prices for end products. For instance, If tariffs on semiconductor imports rise, South Korean AI companies might face chip shortages or higher costs, delaying new AI innovations and impacting competitiveness.

South Korea Artificial Intelligence Market Trends

Acceleration of Industrial AI Adoption to be the Key Driver for Market Growth

One of the major trends in South Korea's AI market is the rapid advance of industrial AI within sectors such as automotive, electronics, and manufacturing. Companies are using AI for predictive maintenance, real-time quality control, energy optimization, and smart production scheduling. This trend has strong support through government-led initiatives, including smart factory programs and the convergence of AI technologies with IoT and 5G.

Key Takeaways

- The South Korea Artificial Intelligence Market is projected to be worth USD 53.87 billion in 2032.

- By component segmentation, Software accounted for around 48.5% of the South Korea Artificial Intelligence Market in 2024.

- By deployment segmentation, cloud is projected to grow at a CAGR of 34.9% in the forecast period.

- By enterprise type segmentation, large enterprises accounted for around 59.5% of the market in 2024.

- By function segmentation, risk is projected to grow at a CAGR of 36.3% in the forecast period.

- By technology, Machine Learning accounted for around 41.4% of the market in 2024.

- By industry segmentation, healthcare is projected to grow at a CAGR of 40.7% in the forecast period.

South Korea Artificial Intelligence Growth Factors

Government Investment and Policy Support to Boost Market Growth

The government of South Korea is committing to the growth of AI, given its potential to transform the economy on the account of investment and policies. From the beginning, it made AI a strategic priority in national development and economic transformation by making a serious commitment to funding AI research, innovation, and industry development. For instance,

- In August 2025, South Korea has launched a five-year plan to build a “super-innovation economy,” investing USD 71.5 billion in AI across all sectors. The strategy includes developing a sovereign Korean-language AI model, humanoid robots, autonomous vehicles, and AI integration in healthcare, education, welfare, and tax services.

South Korea Artificial Intelligence Market Restraints

Geopolitical and Market Competition to Hinder the Market Growth

South Korean AI companies compete with major global organizations such as Nvidia, Google, Microsoft, and others as a result of AI semiconductors, cloud computing systems, and advanced AI platforms. These large organizations have not only attain economies of scale, but also consist of established advanced ecosystems and therefore enable accelerated innovation and ownership of large market shares.

As a result, dominance in their respective sectors effectively makes it impossible for South Korean AI companies to operate on global level and raises questions about technological dependence.

South Korea Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

In South Korea's artificial intelligence market, software holds a majority due to the mass adoption of AI platforms, frameworks, and applications across industries. Software serves as the foundation for the majority of AI solutions in use, ranging from natural language processing tools, to machine learning algorithms and AI-as-a-service (AIaaS) platforms.

The hardware segment is expected to grow at the highest CAGR as demand for AI-optimized semiconductor chips, servers, and edge computing devices increases. South Korea's position in the semiconductor industry, fueled by companies like Samsung and SK Hynix, is encouraging advancement in AI-optimized hardware,

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

Cloud deployment has a dominant market share in the South Korean AI industry and is also likely to have the fastest growth rate in forthcoming years. This popularity can be credited to its scalability, affordability, and ability to be more easily integrated than other platforms, making cloud-based AI solutions highly appealing for organizations of all sizes and scopes.

As cloud infrastructure continues to expand and digital transformation efforts increase across South Korean organizations, more organizations will be able to adopt cloud AI and seek applications in areas such as data analytics, automation, and customer engagement. This has provided a rapid growth opportunity for the South Korean AI market.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

At present, the South Korean AI market is dominated by large enterprises given their financial capabilities, developed digital infrastructure, and coverage of large-scale AI investment. Within the AI sphere, these organizations tend to be among the early adopters of technologies related to automation, data analytics, and customer experience, mainly within finance, telecommunications, and manufacturing.

At the same time, Small and Medium-Sized Enterprises (SMEs) are expected to have the highest CAGR in the foreseeable future. There are many cloud-based platforms that offer AI tools at a price point that SMEs can afford to implement AI into their processes to help productivity, decrease costs, and increase competitiveness.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

The service operation function currently holds the largest market share in South Korea’s AI market owing to the adoption of AI-powered customer service, virtual assistants, and chatbots from all sectors, including finance, retail, and telecommunications. These solutions help companies to enhance customer experience, improve response time, and decrease costs, contributing to the overall growth of AI in the service function.

The risk management segment is projected to grow at the fastest CAGR, as organizations increasingly turn to AI for fraud detection and optimizing the management of cyber threats and other financial risk factors across enterprises. AI-enabled advanced algorithms aid organizations by providing real-time and predictive analytics to monitor potential losses and to improve decision making.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

In the South Korean AI market, machine learning has the highest market share and is expected to have the highest CAGR. Machine learning is essential for multiple applications in business, including healthcare, finance, and manufacturing due to its versatility and its ability to analyze massive amounts of datasets to yield insights. Along with the improvements in algorithms and processing power, machine learning models will be adopted more widely, allowing businesses to create better predictive models, automate complex tasks, and improve decision-making.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

The Banking, Financial Services, and Insurance (BFSI) sector holds the majority share in South Korea artificial intelligence market share. This is driven by the sector’s early adoption of AI for applications like fraud detection, customer service automation, credit scoring, and risk management. The demand for enhanced security and personalized financial services continues to fuel AI investments, making BFSI a dominant industry in the AI landscape.

Healthcare is expected to grow with the highest CAGR as AI adoption accelerates in medical imaging, diagnostics, personalized treatment, and drug discovery. Advances in AI-powered tools are helping healthcare providers improve patient outcomes and operational efficiency. Growing government support, rising healthcare needs, and technological innovation are all contributing to the rapid expansion of AI in the healthcare industry.

List of Key Companies in the South Korea Artificial Intelligence Market

South Korea’s artificial intelligence market is gaining momentum with a growing focus on practical, high-impact solutions. Companies such as Nota Inc. are leading in edge AI by optimizing models for low-power devices across mobility and smart tech. Mathpresso is transforming education through its AI-powered learning app QANDA, offering personalized support to students. Bering Lab is advancing AI-based translation with a focus on legal and business content, helping enterprises navigate multilingual environments. Typecast is innovating digital media with AI-generated voice technology used in content creation and marketing. These companies reflect South Korea’s rising position in AI by combining technical excellence with real-world usability.

LIST OF KEY COMPANIES PROFILED

- Nota Inc. (South Korea)

- Korea Credit Data (South Korea)

- Mathpresso, Inc. (South Korea)

- Bering Lab, Inc. (South Korea)

- Typecast, Inc. (South Korea)

- FuriosaAI (South Korea)

- Stradvision (South Korea)

- MakinaRocks (South Korea)

- Omnious (South Korea)

- Dable (South Korea)

- TainAI (South Korea)

- Modulabs (South Korea)

KEY INDUSTRY DEVELOPMENTS

- September 2025: South Korea has proposed a 2026 budget of USD 12.30 billion to boost AI, deep tech, biotech, and startup support, marking a significant increase from this year. Key highlights include a USD 1.61 billion record R&D investment focused on AI adoption in manufacturing, a USD 949 million "re-challenge fund" for failed startup founders, and expanded venture capital funds.

- June 2025: South Korea’s Ministry of Trade, Industry and Energy announce to invest USD 349 million in AI projects in 2025, focusing on industrial innovation. Key areas include AI-powered factories, advanced AI chips, and autonomous vehicles. Additional funds will support AI in biotech, intelligent robotics, and display tech.

REPORT COVERAGE

This report offers an in-depth analysis of South Korea’s artificial intelligence market, covering current developments, adoption trends, and emerging opportunities across key sectors such as education, healthcare, manufacturing, mobility, and public services. It examines the country’s strategic focus on applied AI, including government-backed initiatives, national AI strategies, and investment in foundational models and high-performance computing infrastructure. The report evaluates the role of local startups and tech firms in building scalable, domain-specific AI solutions, and assesses collaboration between academia, industry, and government.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 33.40% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

Frequently Asked Questions

Fortune Business Insights says that the South Korea Artificial Intelligence market was worth USD 5.47 billion in 2024.

The market is expected to exhibit a CAGR of 33.40% during the forecast period.

By industry, the BFSI industry is set to lead the market.

Nota Inc., Mathpreeso, Inc., Bering Lab, and FuriosaAI are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us