Specialty Amine Market Size, Share & Industry Analysis, By Type (Ethanolamines, Propylamines, Ethyleneamines, Isopropanolamines, and Others), By End-Use Industry (Agrochemicals, Pharmaceuticals, Water Treatment, Personal Care, Petrochemicals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

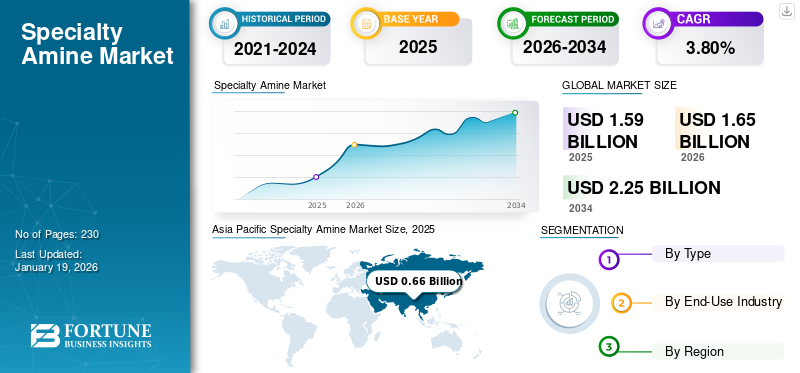

The global specialty amine market size was valued at USD 1.59 billion in 2025. The market is projected to grow from USD 1.65 billion in 2026 to USD 2.25 billion by 2034, exhibiting a CAGR of 3.80% during the forecast period. The Asia Pacific dominated the specialty amine market, accounting for a 42% market share in 2025.

Specialty amines are a class of organic compounds derived from ammonia (NH₃), where one or more hydrogen atoms are exchanged with alkyl or aryl groups. These amines include ethanolamines, ethyleneamines, and isopropanolamines, which are widely preferred due to their enhanced solubility, reactivity, and compatibility with various chemical systems.

The market is witnessing steady growth opportunities driven by its expanding applications across various industries, particularly pharmaceuticals, water treatment, personal care, agriculture, and petrochemicals. Rising demand for high-performance chemicals and expanding end-use industries in emerging economies also drive the market growth.

A few major players operating in the market include Arkema, Eastman Chemical Company, Huntsman International LLC., Alkyl Amines Chemicals Limited, and Evonik.

GLOBAL SPECIALTY AMINE MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 1.59 billion

- 2026 Market Size: USD 1.65 billion

- 2034 Forecast Market Size: USD 2.25 billion

- CAGR: 3.80% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 42% share, rising from USD 0.66 billion in 2025 to USD 0.69 billion in 2026.

- By type: Ethanolamines dominated due to multifunctional properties and wide industrial applications.

- By application: Agrochemicals held the largest share driven by the need for efficient crop protection solutions.

Key Country Highlights:

- China & India: Major consumers due to industrialization, pharmaceutical expansion, and agrochemical demand.

- U.S.: Strong demand in pharmaceuticals, petrochemicals, and water treatment sectors.

- Germany, France, U.K.: Focus on sustainable specialty chemicals and regulatory-compliant formulations.

- Latin America: Import-reliant market with growing demand in water treatment and personal care.

- Middle East & Africa: Rising demand from oil & gas, agrochemical, and water treatment industries.

SPECIALITY AMINE MARKET TRENDS

Rising Adoption of Green Chemistry in Specialty Amine Production is an Emerging Trend in Market

The market is witnessing a growing trend toward green chemistry practices to reduce environmental impact and improve sustainability. Manufacturers are increasingly adopting eco-friendly raw materials, safer solvents, and energy-efficient processes. Stringent environmental regulations and heightened consumer awareness about sustainable products drive this shift. Companies investing in green technologies enhance their brand reputation and gain a competitive edge in markets with strict ecological standards. Asia Pacific witnessed a specialty amine market growth from USD 0.62 billion in 2023 to USD 0.64 billion in 2024.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand from Agrochemical Industry Supports Market Growth

The increased food demand and the need for higher agricultural productivity significantly boost the demand for specialty amines in agrochemical formulations. These amines enhance herbicides, pesticides, and fertilizers' solubility, stability, and delivery efficiency. The demand rises as developing countries expand their farming practices and adopt advanced crop protection methods. These compounds improve nutrient uptake and minimize environmental impact, aligning with the rising trend toward sustainable agriculture. Moreover, government support through subsidies and research initiatives encourages the development of eco-friendly agrochemicals, through which the demand for green chemicals is expected to increase.

MARKET RESTRAINTS

Environmental and Safety Concerns Could Restrict Market Growth

The chemical properties of amines, including toxicity and potential for environmental harm, pose significant safety and ecological concerns. Improper handling or accidental release of these chemicals can lead to soil and water pollution, harming human health and biodiversity. Moreover, the disposal of amine-based waste streams requires specialized treatment to minimize environmental impact, which increases the manufacturer's and government's expenses. Public awareness and activism regarding chemical safety have pressured manufacturers to develop greener formulations or seek effective substitutes. These concerns decrease the demand for specialty amines in certain applications and markets, especially where stringent regulatory frameworks or consumer preferences favor eco-friendly products.

MARKET OPPORTUNITIES

Increasing Demand from Pharmaceutical Industry Offers Growth Opportunities for Market

The pharmaceutical sector’s rapid expansion and innovation bring a great opportunity for specialty amines, as these are essential intermediates and active ingredients in drug synthesis. These amines produce antibiotics, antivirals, and other critical medications, supporting global healthcare needs. The increasing focus on customized medicine and biopharmaceuticals further amplifies the need for specialized, high-purity amine compounds. Additionally, the pharmaceutical industry's stringent quality and regulatory requirements encourage the development of customized amine products, creating opportunities for specialized manufacturers.

- As per the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) in 2022, the global pharmaceutical industry contributed USD 2.3 trillion to the global GDP, and the pharmaceutical sector’s R&D activities alone added USD 227 billion to the global GDP in 2022, showcasing a major opportunity for the specialty amine sector as the pharmaceutical industry grows, the need of the amines is also increasing as they are important in manufacturing medicines.

MARKET CHALLENGES

Fluctuating Raw Material Prices Could Pose a Major Challenge to Market

The market faces significant challenges due to the volatility of raw material prices, which directly affects the production costs and profit margins. Many amines are derived from petrochemical feedstocks such as ammonia and ethylene, whose prices are influenced by geopolitical events, supply-demand imbalances, and crude oil price fluctuations. Additionally, a sudden spike in raw material costs can cause supply chain disruptions and delay order fulfillment.

TRADE PROTECTIONISM

Global trade protectionism significantly challenges the specialty amine market growth. Governments are increasingly implementing tariffs, import quotas, and stringent customs regulations to protect domestic industries. Such trade barriers lead to increased costs and delays in cross-border shipments, disrupting supply chains and affecting the timely delivery of specialty amines.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Ethanolamines Segment Dominated Market Due to Its Multifunctional Properties

Based on type, the market is classified into Ethanolamines, Propylamines, Ethyleneamines, Isopropanolamines, and others.

The ethanolamines segment held the highest market share in 2024, and these are the most widely used type due to their versatile chemical structure and multifunctional properties. These compounds serve as emulsifiers, corrosion inhibitors, surfactants, and intermediates in various formulations. In the agricultural sector, they are used in herbicides and pesticides, while in the personal care industry, they are utilized in shampoos, lotions, and creams. Furthermore, regulatory support for cleaner chemical processes has encouraged the adoption of ethanolamines in water treatment and environmental remediation.

Propylamines are gaining considerable attention in the market due to their wide applicability in chemical synthesis and industrial formulations. These amines are primarily used as agrochemicals, pharmaceuticals, and rubber chemical intermediates. Their stable chemical structure allows them to act as an effective corrosion inhibitor and fuel additive, contributing to their growing demand in petrochemical and automotive applications. Additionally, their use in water treatment and surfactants continues to expand as industries shift toward high-performance chemicals.

The ethyleneamines are essential in the market and are recognized for their highly reactive amine groups and diverse industrial applications. These compounds are commonly used in epoxy curing agents, fuel and lubricant additives, and chelating agents. Their unique properties make them highly suitable for enhanced bonding, reactivity, and stability applications. The demand for ethyleneamines is rising in water treatment and pharmaceutical industries, where they serve as vital raw materials. Their superior performance characteristics make them significant in producing resins and adhesives used across the automotive and construction sectors.

By End-Use Industry

Surging Need for Efficient and Targeted Crop Protection Solutions Propels Agrochemicals Segment Expansion

Based on the end-use industry, the market is classified into agrochemicals, pharmaceuticals, water treatment, personal care, petrochemicals, and others.

The agrochemicals segment holds a major market share, driven by the need for efficient and targeted crop protection solutions. These amines are essential in formulating herbicides, insecticides, fungicides, and growth stimulants. These compounds improve the solubility, dispersion, and bioavailability of active ingredients, enhancing the effectiveness of agrochemical products. With rising global food demand, there is increasing emphasis on agricultural productivity and sustainability, fueling the adoption in the industry.

Specialty amines are critical in the pharmaceuticals segment due to their chemical versatility and bioactive properties. These compounds are key intermediates in synthesizing active pharmaceutical ingredients and antibiotics. Their ability to form strong hydrogen bonds and improve solubility makes them crucial in drug development and delivery systems. The rising demand for precision medicine and advanced therapeutics further enhances amines' importance in pharma research. As global healthcare infrastructure expands and aging populations increase, the need for effective pharmaceutical chemicals continues to rise.

The water treatment industry is a key product consumer, primarily due to its role in controlling pH, preventing scale formation, and removing contaminants. These compounds are neutralizing agents, corrosion inhibitors, and chelating agents in industrial and municipal water treatment systems. As global water quality regulations tighten, the demand for high-performance chemical additives grows. These amines ensure equipment longevity in power plants and cooling towers by minimizing corrosion and improving heat transfer efficiency.

Specialty Amine Market Regional Outlook

The market is categorized by geography into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Specialty Amine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market with a valuation of USD 0.66 billion in 2025 and USD 0.69 billion in 2026, driven by rapid industrialization, growing agricultural activities, and expanding pharmaceutical sectors. Countries including China, India, and Japan are major market consumers due to their large-scale chemical manufacturing bases and rising domestic demand. The region also benefits from lower production costs and a skilled labor force, which attracts global companies seeking to establish or expand manufacturing facilities. Urbanization and improved living standards are increasing the demand for personal care products and treated water, thus boosting market growth.

North America

North America holds a significant specialty amine market share, driven by a well-developed industrial infrastructure and strong demand from pharmaceuticals, petrochemicals, and personal care sectors. The region benefits from advanced research and development abilities, which drive innovation in amine formulations and applications. The U.S. houses several major chemical manufacturers supporting domestic and export demand. Regulatory support for clean water treatment and healthcare advancements further promotes the use of high-purity amines.

Europe

Europe is a major market for specialty amines, reinforced by a strong regulatory emphasis on sustainability, safety, and environmental compliance. A high demand for specialty chemicals in pharmaceuticals, agrochemicals, water treatment, and cosmetics characterizes the region. Countries including Germany, France, and the U.K. lead in research and production capabilities, fostering innovation in eco-friendly amine-based formulations. Additionally, increasing awareness about environmental impact is promoting the adoption of biodegradable and renewable amine derivatives.

Latin America

Latin America relies heavily on imports to meet its industrial and agricultural chemical requirements, creating a strong market for global suppliers. While domestic production remains limited, there is a growing product demand in water treatment, pharmaceuticals, and personal care, particularly in urbanizing areas. Public health initiatives, environmental concerns, and infrastructure development programs are driving the region's need for effective chemical formulations.

Middle East & Africa

The Middle East & Africa region's need for specialty amines is steadily increasing due to the growth of the oil and gas, water treatment, and agrochemical industries. These amines are surfactants significant to local environmental and industrial applications, corrosion inhibitors, and gas-sweetening agents. Furthermore, increased urbanization and investments in infrastructure and agriculture drive the demand for specialized amines in herbicide formulations and building chemicals. Long-term demand is further stimulated by government-backed industrial diversification initiatives, particularly in the GCC.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominance in Market

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Arkema, Eastman Chemical Company, Huntsman International LLC., Alkyl Amines Chemicals Limited, and Evonik. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY SPECIALITY AMINE COMPANIES PROFILED

- Arkema (France)

- Huntsman International LLC. (U.S.)

- Evonik (Germany)

- Eastman Chemical Company (U.S.)

- Alkyl Amines Chemicals Limited (India)

- China Amines (China)

- Balaji Amines (India)

- Syensqo (Belgium)

- Amines & Plasticizers Ltd. (India)

- Nouryon (Netherlands)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Eastman launched dimethylaminopropylamine (DMAPA ES) production at the Louisiana manufacturing site. The DMAPA ES will be made by using renewable raw materials, which will help in improving global warming potential (GWP) up to as much as 50%.

- November 2024: Evonik Industries officially broke ground for the expansion of a specialty amine production facility in Nanjing, China. This milestone underscores Evonik's commitment to the development of the polyurethane and epoxy curing agent markets.

- February 2022: Eastman Chemical Company completed the expansion of its tertiary amine capacity, primarily DIMLA 1214, at both its Ghent, Belgium, and Pace, Florida, manufacturing sites. The expansion will help them meet the growing customer demand.

- August 2021: Huntsman Corporation announced that its performance products division plans to expand its production facility in Pétfürdő, Hungary, to meet the growing demand for polyurethane catalysts and specialty amines.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.80% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kilotons) |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.59 billion in 2025 and is projected to reach USD 2.25 billion by 2034.

In 2025, the market value in Asia Pacific stood at USD 0.66 billion.

The market is expected to exhibit a CAGR of 3.80% during the forecast period of 2026-2034.

The ethanolamines segment led the market by type in 2025.

Increasing food demand, and agriculture industry, and the need for pesticides, herbicides, and fungicides in the agriculture sector are driving the market.

Arkema, Eastman Chemical Company, Huntsman International LLC., Alkyl Amines Chemicals Limited, and Evonik are some of the leading players in the market.

Asia Pacific holds the largest share of the market.

The growth of the agricultural and pharmaceutical industries in various countries, including China, India, and the U.S., is the major factor expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us