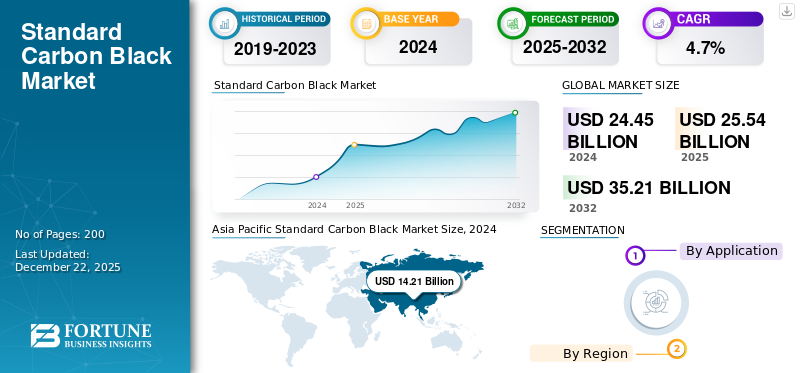

Standard Carbon Black Market Size, Share & Industry Analysis, By Application (Tire, Rubber Products, Plastics, Inks & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global standard carbon black market size was valued at USD 25.54 billion in 2025. The market is projected to grow from USD 26.69 billion in 2026 to USD 38.59 billion by 2034, exhibiting a CAGR of 4.7% during the forecast period. The Asia Pacific dominated the standard carbon black market, accounting for a 58% market share in 2025.

Standard carbon black is a fine black powder manufactured by the incomplete combustion of hydrocarbons such as natural gas or oil. It is widely utilized as a black pigment and a reinforcing agent in rubber products, plastics, inks, and coatings. Its significance stems from its ability to improve product strength, UV resistance, and coloring properties, particularly in tires, rubber seals, and molded goods.

The market is witnessing higher growth due to the consistent demand from the automotive, printing, and plastic industries. Moreover, expanding infrastructure and manufacturing sectors create new opportunities in applications such as paints, construction materials, and industrial equipment.

Major manufacturers operating in the market include Birla Carbon, Cabot Corporation, Tokai Carbon Co., Ltd., Imerys, and Mitsubishi Chemical Group Corporation.

- According to the Department of Chemicals and Petrochemicals, Government of India, India produced 348.78 thousand metric tons of carbon black in 2020-21, with an installed capacity of 696.00 thousand metric tons, resulting in a capacity utilization of 55.28%.

Download Free sample to learn more about this report.

STANDARD CARBON BLACK MARKET TRENDS

Increasing Emphasis on Cost-Effective Production and Versatile End-Use Applications to Boost Market Growth

The market is gradually shifting toward more cost-efficient manufacturing and broader application versatility. Producers are streamlining production techniques to enhance efficiency and reduce costs while maintaining quality standards. This shift is supported by growing demand for the product across sectors such as rubber, plastics, coatings, and printing inks. In particular, emerging markets drive the need for affordable and durable materials. Additionally, innovations in dispersion and formulation technologies are enabling wider use of standard carbon black in diverse industrial processes, directing the market toward more adaptable and value-driven solutions.

MARKET DYNAMICS

MARKET DRIVERS

Growing Manufacturing Activities and Infrastructure Development Fuel Product Demand

The demand for is propelled by increased manufacturing output and infrastructure development globally, particularly in developing regions. As industries including construction, packaging, and automotive components expand, the need for materials such as standard carbon black, used in rubber products, tires, inks, plastics, and coatings, continues to grow. Its cost-effectiveness and versatility make it an essential component in mass-market applications. Moreover, the rise in consumer goods production and sustained demand for durable, functional materials in both industrial and domestic applications further accelerates the momentum, thus driving the standard carbon black market growth.

MARKET RESTRAINTS

Fluctuating Raw Material Costs Pose Challenges to Market Stability

The production is highly dependent on the presence and pricing of raw materials such as oil-based feedstock and natural gas. Frequent fluctuations in these input costs create uncertainty in manufacturing expenses, thus affecting profit margins and pricing strategies. While some manufacturers are adopting cost-control measures and seeking alternative sources to manage volatility, consistent instability in raw material pricing remains a significant hurdle. This ongoing unpredictability can disrupt supply chains and investment planning, ultimately restraining market growth.

MARKET OPPORTUNITIES

Rising Electric Vehicle Demand and Evolving Applications to Create New Growth Avenues

The increasing expansion of the electric vehicle (EV) industry presents significant opportunities for standard carbon black, particularly in automotive components beyond tires. As EV manufacturers focus on lightweight, durable, and cost-effective materials, it is increasingly used in applications such as non-tire rubber parts, plastic housings, cable insulation, and underbody components. Its reinforcing agent, coloring properties, and affordability make it a preferred material in high-volume EV manufacturing. With the ongoing shift toward sustainable mobility and rising EV adoption, demand for the product is expected to accelerate, contributing to long-term market growth.

- According to the National Investment Promotion and Facilitation Agency of the Government of India, India’s EV market is expected to grow at a CAGR of 49% between 2022 and 2030, reaching an estimated 10 million annual sales by 2030. This surge in EV production is expected to drive substantial demand for standard black carbon, particularly in high-performance tires, cable insulation, and conductive materials.

MARKET CHALLENGES

Environmental Emissions and Health Risks Create Barriers to Market Growth

The production of standard carbon black involves processes that release harmful gases and particulate matter, thus raising serious health and environmental concerns. Prolonged exposure to these emissions can affect worker safety and contribute to air pollution, prompting stricter regulatory oversight. Manufacturers are under increasing pressure to invest in advanced emission control systems and adopt cleaner technologies to meet evolving environmental and safety standards. These regulatory needs increase operational costs and create barriers to capacity expansion, making environmental compliance and worker health protection challenging for the market.

Segmentation Analysis

By Application

Tire Application Led Market due to Rising Demand for Cost-Effective Reinforcement Materials

Based on application, the market is segmented into tire, rubber products, plastics, inks & coatings, and others.

The tire segment held a dominant standard carbon black market share in 2024, driven by its essential role as a cost-effective reinforcing filler in tire manufacturing. With the steady rise in global vehicle production, particularly across cost-sensitive and emerging markets, automakers and tire producers rely on it to enhance tire durability, tread life, and performance. The increasing demand for affordable, fuel-efficient tires and the growing replacement tire sector further strengthen the segment’s leading position within the overall market.

In the rubber products segment, it is crucial to produce various industrial and automotive components, such as seals, gaskets, hoses, and anti-vibration parts. It provides the mechanical strength and resistance needed for heavy-duty manufacturing, agriculture, and construction applications. As industrial activity rises and infrastructure investments grow, the demand for durable, reinforced rubber goods boosts the consumption of standard carbon black in this segment.

In the plastics segment, the product is used for pigmentation, UV protection, and conductivity in products ranging from packaging materials to automotive and electrical components. Its ability to improve longevity and surface appearance makes it an essential additive in outdoor plastic products such as pipes, containers, and construction materials. With the growth of the packaging and infrastructure industries globally, the demand for functional and aesthetically enhanced plastics is driving the product application in this segment.

Standard Carbon Black Market Regional Outlook

The market is categorized by geography into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Standard Carbon Black Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 14.87 billion in 2025 and USD 15.58 billion in 2026, fueled by accelerating industrial activity, expanding automotive production, and growing demand for rubber and plastic products in China, India, and Southeast Asia. Supportive government initiatives for infrastructure development, low-cost manufacturing, and increased mobility are key drivers for the product demand, particularly in tire and non-tire rubber applications. Rising urbanization, increasing vehicle ownership, and a surge in the construction and packaging sectors further strengthen market growth. With strong local manufacturing capabilities and rising export potential, the region remains a major hub for standard carbon black production and consumption.

- According to the World's Top Exports, China exported rubber tires worth USD 21.3 billion in 2023, accounting for 21.8% of global exports. This reflects its strong manufacturing base, enhancing the region's demand for standard carbon black.

North America

The market in North America is witnessing steady growth, driven by strong demand from the automotive industry and industrial manufacturing sectors. Ongoing infrastructure upgrades, including road repair and expansion projects, support the increased carbon black consumption in tire and rubber applications. Additionally, government programs promoting sustainable manufacturing practices and shifting toward electric vehicle production propel market growth. The rising emphasis on lightweight, high-performance automotive components, coupled with consistent growth in the plastic industry, also contributes to the region’s market expansion.

- According to World's Top Exports, the U.S. exported USD 63.0 billion of cars in 2023, accounting for 6.6% of global exports. This boosts the demand for standard carbon black, which is widely used in tires and rubber applications.

Europe

In Europe, the market is driven by stringent environmental regulations and a strong focus on sustainable and energy-efficient manufacturing. The growing demand is primarily driven by the automotive sector’s transition toward electric and fuel-efficient vehicles, which rely on durable, cost-effective rubber and plastic components. The region’s emphasis on eco-friendly infrastructure development, renovation of aging public facilities, and adopting of smart city initiatives further supports using products in various construction and industrial applications.

- According to the World's Top Exports, Germany exported USD 40.1 billion worth of electric cars in 2023, accounting for 26.6% of global electric car exports, reflecting its shift toward energy-efficient vehicles and boosting product demand in the region.

Latin America

In Latin America, the market is growing steadily, driven by rising automotive production, infrastructure development, and increased demand for rubber products. Major economies such as Brazil and Mexico benefit from significant investments in transportation, housing, and public sector projects. Additionally, the gradual adoption of EVs and the growth of the plastics and packaging industries further support the demand for products across the region.

- According to the International Trade Administration, Mexico is the largest export market for U.S. automotive parts and the fourth largest producer globally, generating USD 107 billion annually.

Middle East & Africa

The market is expanding in the Middle East & Africa region, supported by rising infrastructure investments, industrial growth, and increasing automotive production. Countries, including UAE, Saudi Arabia, and South Africa, are key contributors with large-scale construction projects and expanding transportation networks driving demand for rubber and plastic-based components. Additionally, the growing interest in electric vehicle adoption and efforts to diversify economies and increase local manufacturing support the region's market growth.

- According to Tire World Exports, the African tire market is projected to reach USD 7.50 billion by 2023 due to the rise in passenger and commercial vehicle sales.

COMPETITIVE LANDSCAPE

Key Industry Players

Top Players Emphasize Constant Improvement and New Product Introductions to Uphold Their Dominance

The market is highly competitive, with main companies concentrating on technological innovations, mergers & acquisitions, and increasing capacity to boost their market presence. Major participants include Cabot Corporation, Tokai Carbon Co., Ltd., Birla Carbon, Imerys, and Mitsubishi Chemical Group Corporation. These players compete on the basis of purity levels, affordable processing methods, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders lead in developed markets, regional players are increasing aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY STANDARD CARBON BLACK COMPANIES PROFILED

- Birla Carbon (India)

- Beilum Carbon Chemical Limited (China)

- Cabot Corporation (U.S.)

- Tokai Carbon Co., Ltd. (Japan)

- Omsk Carbon Group (Russia)

- OCI COMPANY Ltd. (South Korea)

- Orion Engineered Carbons SA (Luxembourg)

- Imerys (France)

- Himadri Speciality Chemical Ltd. (India)

- Longxing Chemical Stock Co., Ltd (China)

- Mitsubishi Chemical Group Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Mitsubishi Chemical, in collaboration with Sumitomo Rubber, launched a joint initiative to commercialize sustainable carbon black by recycling end-of-life tires using coke ovens, making the world’s first-ever commercialization of such a process.

- May 2023: Orion Engineered Carbons expanded its gas black production capacity at Dortmund and Cologne, Germany. This move reinforces the company’s leadership in specialty-grade carbon black solutions.

- May 2021: Birla Carbon partnered with Circtec to establish the largest and most efficient pyrolysis plant for Sustainable Carbonaceous Materials used for tire, mechanical rubber goods, and plastic industries, with production expected to begin by the end of 2022.

REPORT COVERAGE

The global market analysis provides the market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to grow the market in the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 25.54 billion in 2026 and is projected to reach USD 26.69 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 14.87 billion.

The market is expected to exhibit a CAGR of 4.7% during the forecast period of 2026-2034.

The key factors driving the market are the rising manufacturing activities, industrialization, and global urban development.

Birla Carbon, Cabot Corporation, Tokai Carbon Co., Ltd., Imerys, and Mitsubishi Chemical Group Corporation are the top players in the market.

Asia Pacific holds the largest share of the market.

Increasing demand for cost-effective reinforcing fillers, rising automotive and industrial rubber production, and growing applications in plastics and coatings, especially in emerging markets, are key factors expected to favor product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us