Standard Pen Needles Market Size, Share & Industry Analysis, By Drug Type (Insulin, GLP-1, Growth Hormone, and Others), By Disease Indication (Diabetes, Obesity, Hormone Deficiency, and Others), By Needle Size (4 mm, 5 mm, 6 mm, 8 mm, and 12 mm), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

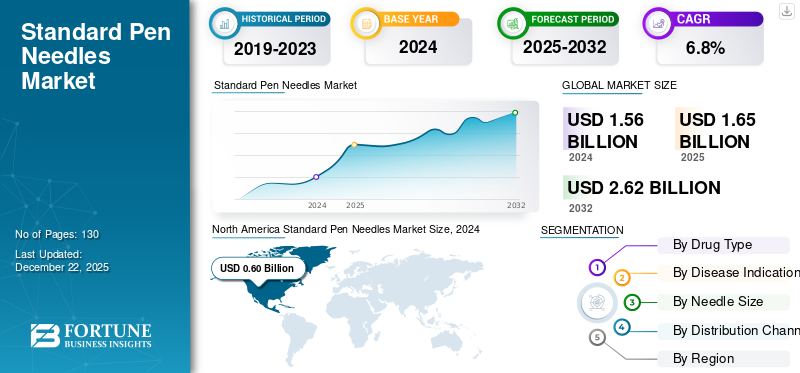

The global standard pen needles market size was valued at USD 1.65 billion in 2025. The market is projected to grow from USD 1.74 billion in 2026 to USD 3.07 billion by 2034, exhibiting a CAGR of 7.31% during the forecast period. North america dominated the standard pen needles market with a market share of 66.00% in 2025.

Standard pen needles are medical devices used with insulin pens and other injectable medications for subcutaneous delivery. They are designed for single use and are available in various gauges and lengths. Pen needles provide a painless, convenient, and precise method for self-administering medication, especially in diabetes management.

The market growth is attributed to the rising global prevalence of diabetes, which fuels continuous demand for efficient insulin delivery solutions. In addition, increasing patient preference for insulin pens over traditional syringes, due to convenience and portability, is also estimated to accelerate the use of pen needles. Moreover, technological advancements such as thinner, shorter, and ultra-fine needles have improved user comfort and compliance, particularly among needle-phobic patients.

Some of the major players in the market are Novo Nordisk A/S, BD, and Embecta Corp. These players are focusing on technological advancements, extensive investments, and strategic agreements in order to maintain substantial market share.

MARKET DYNAMICS

Market Drivers

Rising Prevalence of Diabetes and Growing Adoption of Insulin Pens to Boost Market Growth

The increasing prevalence of diabetes globally is one of the prominent drivers for the standard pen needles market growth. In addition, sedentary lifestyles, aging populations, rising obesity rates, and poor dietary habits have contributed significantly to a surge in diabetes diagnoses worldwide.

- For instance, according to the International Diabetes Federation (IDF), over 530 million adults were living with diabetes in 2023, and this number is expected to rise in the coming decades.

As insulin therapy is a vital treatment, especially for Type 1 and advanced Type 2 diabetes, the demand for insulin delivery tools such as pen needles is steadily increasing. Standard pen needles are widely used for their compatibility with most insulin pens and ease of use, particularly in elderly or visually impaired patients who benefit from their simplicity and reduced need for training.

Moreover, initiatives by governments and health organizations to improve access to insulin and related products, especially in developing regions, further strengthen demand. Educational campaigns aimed at improving diabetes awareness and management are also enhancing the market by encouraging early treatment and self-administration.

- For instance, in August 2024, Breakthrough T1D announced the launch of a national campaign called “Detect so you can decide” to raise awareness about early detection of T1D.

Market Restraints

Needle Phobia Along with Poor Injection Compliance & Adherence to Guidelines Hamper Market Growth

Despite the convenience and improved comfort of modern pen needles, a significant portion of patients, especially newly diagnosed individuals, struggle with anxiety and fear associated with needle-based injections. This psychological barrier can lead to skipped doses, reduced adherence to prescribed insulin regimens, and ultimately, poor glycemic control.

- For instance, according to an article published by the Public Library of Science in June 2021, an estimated 28% of all diabetic patients, regardless of age, suffer from needle phobia worldwide. These results were published after conducting a cohort study.

In addition, lack of adherence to guidelines among patients, especially in emerging countries, is leading to a rising prevalence of reuse of pen-needles, sometimes exceeding the maximum threshold. Reducing the overall treatment cost and the lack of awareness among the general population are some of the leading factors affecting consumer behavior. This is further compounded by the lack of strong and established guidelines and limited reimbursement policies for these products.

Market Opportunities

Robust Focus on Expansion of Market in Middle-Income Countries to Offer Lucrative Opportunity

The most promising market opportunity lies in expanding access to standard pen needles in middle-income countries across Asia, Latin America, and Africa. These regions are experiencing a rapid rise in diabetes prevalence due to urbanization, lifestyle changes, and improved diagnostic capabilities.

- In June 2025, Médecins Sans Frontières (MSF), an international organization for better human care, welcomed Novo Nordisk’s commitment to supply analogue insulin pens to South Africa at a reduced price of USD 1 per pen.

As governments and NGOs increase their focus on non-communicable diseases, there is a growing demand for cost-effective, safe, and easy-to-use insulin administration options. Moreover, establishing a strong presence in these emerging markets through local distribution, product customization, and healthcare collaboration can offer a favorable opportunity for market growth during the forecast period.

Market Challenges

Limited Penetration of Autoinjectors to Offer Substantial Challenge for Market Growth

Although autoinjectors and other novel needle-based drug delivery systems have gained traction and witnessed increased penetration in developed countries, the adoption seems to be lackluster, especially in emerging countries with a considerably higher proportion of the patient population.

Comparatively higher costs of autoinjectors and novel devices, as well as limited reimbursement policies in China, India, and other countries, have been detrimental to the demand and adoption of these devices.

STANDARD PEN NEEDLES MARKET TRENDS

Technological Innovation to Enhance Patient Comfort Reshapes the Market

Currently, manufacturers are increasingly investing in research & development to develop ultra-fine, thin-gauge pen needles with shorter lengths and advanced lubrication coatings. These features help to reduce injection pain and anxiety, enhancing user adherence, particularly among children, older people, and first-time insulin users. Some newer models incorporate safety-engineered mechanisms, such as retractable needles or shielded designs, with an aim to reduce the risk of needlestick injuries for caregivers and healthcare professionals.

- For instance, in September 2022, the Indian arm of Terumo Corporation announced the launch of its new FineGlide, a sterile pen needle for patients. This device is compatible with self-medication along with insulin injections.

In addition, digital integration is also emerging, where smart pens with compatible pen needles can record and transmit insulin dosing data for better disease management. As consumer expectations rise and regulatory bodies tighten standards around safety and usability, technological advancements that enhance the injection experience are becoming a competitive differentiator.

Download Free sample to learn more about this report.

Impact of COVID-19

During the initial period of the COVID-19 pandemic, disruptions due to lockdowns led to interruptions in manufacturing and logistics chains. These disruptions consequently led to supply shortages and delays in the delivery of pen needles, especially in low- and middle-income countries. Moreover, hospitals and healthcare providers also redirected resources toward managing COVID-19 pandemic cases, which temporarily reduced routine diabetes care visits and insulin administration in clinical settings.

Furthermore, post-COVID recovery and rising diabetes prevalence contributed to renewed market growth. While initial challenges created short-term disruptions, the long-term outlook for the standard pen needles market remained positive due to increased focus on chronic disease management, home healthcare trends, and improvements in supply chain resilience across regions.

SEGMENTATION ANALYSIS

By Drug Type

Higher Adoption of Smart Insulin Pens to Bolster Insulin Sector Development

Based on drug type, the market is segmented into insulin, GLP-1, growth hormone, and others.

By drug type, the insulin segment held a substantial global standard pen needles market share in 2024. The widespread and long-term use of insulin therapy among Type 1 and advanced Type 2 diabetes patients is primarily responsible for a major segment share in the global market. Moreover, the increasing prevalence of diabetes, especially in aging populations and developing economies, continues to drive insulin-related usage.

On the other hand, GLP-1 segment held the second-largest market share in 2024. Certain factors such as rising prescriptions for GLP-1 therapies coupled with a growing number of approvals are projected to positively impact the segment growth during the forecast period.

- For instance, in February 2025, Biocon Limited announced the launch of its new GLP-1 peptide, Liraglutide, for treating obesity and diabetes in the U.K.

By Disease Indication

Extensively Increasing Prevalence of Diabetes to Boost Segment Growth

Based on disease indication, the market is segmented into diabetes, obesity, hormone deficiency, and others.

By disease indication, diabetes segment dominated the market in 2024, owing to the massive global diabetic population requiring long-term injectable therapies. With increasing awareness and early diagnosis, more patients are turning to pen-based delivery systems, particularly in developing regions. Moreover, public health initiatives and improved access to essential diabetes supplies are reinforcing the dominance of this segment.

- For instance, in June 2023, the government of Zimbabwe announced the launch of a diabetes campaign to increase awareness about the disease and strategies related to its treatment management.

The obesity segment is estimated to exhibit a substantial CAGR during the forecast period. As obesity rates are surging globally, especially in the U.S., Europe, and parts of Asia, more patients are being prescribed subcutaneous therapies that require pen needle compatibility. In addition, with new drug launches and increased medical recognition of obesity as a chronic condition, this segment is expected to witness strong growth and contribute a larger share to pen needle consumption.

By Needle Size

Considerable ergonomics offered by the 4 mm Needle to Drive Segment Expansion

Based on needle size, the market is segmented into 4 mm, 5 mm, 6 mm, 8 mm, and 12 mm.

By needle size, the 4 mm needle size dominated the global standard pen needles market in 2024. Certain factors such as its superior comfort, reduced risk of intramuscular injection, and widespread physician preference are prominently driving the segment growth. It is suitable for almost all patients, including children and those with lower BMI, without requiring skin pinching.

On the other hand, 6 mm pen needle size is likely to exhibit substantial CAGR during the forecast period. These needles are commonly used among adults with higher body mass or those transitioning from longer syringe needles. Further, rising utilization of pen needles for obesity is also projected to accelerate segment growth by 2032.

By Distribution Channel

Retail Pharmacy to Hold Significant Market Share Due to Better Convenience

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

By distribution channel, retail pharmacy held the largest market share in the distribution of standard pen needles due to their accessibility, convenience, and widespread presence in both urban and rural settings. Patients prefer pharmacies for regular refills and pharmacist-guided support, especially for chronic conditions such as diabetes that require continuous therapy.

Online pharmacies are estimated to register fastest CAGR during the forecast period. Certain factors such as the convenience of home delivery, subscription models, and competitive pricing are likely to boost segment growth by 2032. Moreover, growing internet penetration, increased digital literacy, and telehealth expansion have further supported this shift.

STANDARD PEN NEEDLES MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Standard Pen Needles Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2024. The market in this region stood at USD 0.60 billion in 2024. This growth is attributed to the high prevalence of diabetes, well-established insulin delivery infrastructure, and growing preference for home-based care.

In the U.S., substantial adoption of pen injectors among Type 1 and Type 2 diabetic patients, coupled with lucrative reimbursement policies is accelerating market growth. Additionally, in Canada, a growing number of pen injectors are explicitly estimated to positively impact the market during the forecast period.

- For instance, in November 2024, Sol-Millennium Medical Group announced the launch of its InsuJet for the administration of insulin for diabetic patients. This newly introduced device provides improved patient comfort as compared to traditional needles.

Europe

The market in Europe held a significant share in 2024. This region holds a significant share of the market, supported by rising diabetic patient populations, increased awareness of self-injection therapies, and favorable healthcare policies across key countries. Moreover, the substantial growth in prescribing pen needles is also projected to offer a substantial opportunity for the Europe standard pen needles market.

- For instance, as per the data provided by the National Health Service (NHS) in August 2024, there were 71 million items prescribed for treating diabetes in the U.K., an increase of 21 million items since 2016.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. The region is witnessing rapid market growth due to an accelerating diabetes burden, increasing urbanization, and improving healthcare access. China and India are experiencing a surge in demand for insulin pens and compatible pen needles, driven by rising awareness, new product introductions, improving diagnosis rates, and expanding insurance coverage.

- For instance, in September 2022, Novo Nordisk A/S received marketing and distribution approval for its Novopen from China’s regulatory authority, NMPA.

Latin America and the Middle East & Africa

The standard pen needle market in Latin America and the Middle East & Africa is increasing steadily. Brazil and Mexico lead adoption in Latin America due to rising diabetic populations and expanding healthcare programs. On the other hand, in the Middle East & Africa, Saudi Arabia and the UAE are witnessing increasing demand, supported by government-led diabetes control strategies and rising investments in healthcare infrastructure.

- For instance, in October 2023, the UAE Ministry of Health and Prevention (MoHAP) announced the launch of the National Prediabetes and Diabetes Screening campaign. The campaign was introduced to reduce the prevalence of diabetes in the country with the help of lifestyle coaching, physician consultations, and treatment options.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players’ Strong Emphasis on New Product Introductions Boost their Revenues

The global pen needles market is fragmented, with several small and mid-sized companies. On the other hand, the increasing focus on launching new products is prominently estimated to drive revenue growth of the players. In addition, Embecta Corp. accounted for a significant proportion of the market in 2024. The company's strong presence in the market is attributed to its focus on forming strategic alliances with other companies to expand its footprint in the global market. Other players in the market include Terumo Corporation, Cardinal Health, MTD Medical Technology and Devices, and others. These companies have been focusing on strategic acquisitions to expand their footprint in the global market.

LIST OF KEY STANDARD PEN NEEDLES MARKETCOMPANIES PROFILED:

- Embecta Corp. (U.S.)

- Cardinal Health (U.S.)

- MTD Medical Technology and Devices (Italy)

- UltiMed, Inc. (U.S.)

- Allison Medical, Inc. (U.S.)

- Owen Mumford (U.K.)

- Medline Industries, LP. (U.S.)

- Braun SE (Germany)

- Neon Diagnostics Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- March 2025: Braun SE announced a collaboration agreement with Orlando Health, a nationally recognized healthcare provider with award-winning hospitals, to jointly develop innovative solutions to increase access to care for patients and clinicians.

- March 2024: Ypsomed sold its blood glucose monitoring systems and pen needle business to Medical Technology and Devices S.p.A.

- February 2024: Owen Mumford Limited announced a partnership with Duopharma Biotech to distribute its diabetes and eye care products in Malaysia and Brunei.

- May 2022: Roche Diabetes Care India announced the launch of its new ACCU-FINE pen needles for a smooth and painless procedure.

- April 2022: Embecta Corp. completed the spin-off from BD and was listed on NASDAQ as one of the major companies in the diabetes care industry.

REPORT COVERAGE

The global standard pen needles market analysis provides market size forecasts by drug type, disease indication, needle size, and distribution channel segment. It covers market dynamics and emerging market trends. It offers insights into the prevalence of key conditions, new product launches, and key industry developments. The report provides an in-depth analysis of the competitive landscape, including insights into market share distribution and detailed profiles of leading companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.31% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Region |

|

By Drug Type |

· Insulin · GLP-1 · Growth Hormone · Others |

|

By Disease Indication |

· Diabetes · Obesity · Hormone Deficiency · Others |

|

By Needle Size |

· 4 mm · 5 mm · 6 mm · 8 mm · 12 mm |

|

By Distribution Channel |

· Hospital Pharmacy · Retail Pharmacy · Online Pharmacy |

|

By Region |

· North America (By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country) o U.S. o Canada · Europe (By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Rest of Europe · Asia Pacific (By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Rest of Asia Pacific · Latin America (By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.65 billion in 2025 and is projected to reach USD 3.07 billion by 2034.

In 2025, the market value stood at USD 0.63 billion.

The market is expected to exhibit a CAGR of 7.31% during the forecast period of 2026-2034.

By drug type, the insulin segment led the market.

The key factors driving the market are increasing prevalence of diabetes and growing adoption of insulin pens.

Embecta Corp., Novo Nordisk A/S, and Terumo Corporation are the top players in the market

North America dominated the market with a share of 66.00% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us