Sulfonamides Market Size, Share & Industry Analysis, By Application (Urinary Tract Infections, Acute Otitis Media, Chronic Bronchitis, Shigellosis, Skin Infections, and Others), By Route of Administration (Oral and Topical), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

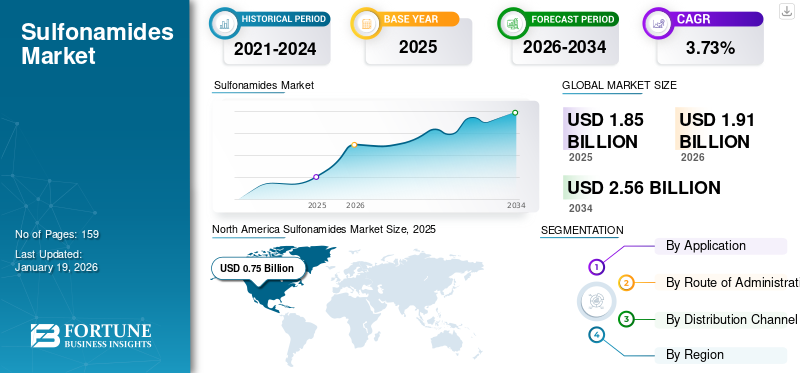

The global sulfonamides market size was valued at USD 1.85 billion in 2025. The market is projected to grow from USD 1.91 billion in 2026 to USD 2.56 billion by 2034, growing at a CAGR of 3.73% during the forecast period. North America dominated the sulfonamides market with a market share of 3.68% in 2025.

The global sulfonamides market is estimated to grow with an upward growth trajectory. Established pharmaceutical companies such as Pfizer Inc., Amneal Pharmaceuticals LLC, and Aurobindo Pharma are operating in the market and are focusing on providing the essential antimicrobials globally.

Sulfonamides, also known as sulfa drugs, are a class of compounds derived from sulfonic acid, characterized by the amide group (-SO2NH2). These were the first class of antibiotics to be introduced. Sulfamethoxazole (SMX) is the most widely used sulfonamide for various applications. They are effective against gastrointestinal tract infections (GIT), urinary tract infections (UTI), respiratory tract infections (RTI), and other applications.

Sulfonamides are effective against gram-negative and gram-positive bacteria, providing a wide range of protection. The rising prevalence of infectious diseases necessitates the need for effective sulfonamides.

- For instance, in July 2022, NIH published an article titled ‘Disease burden and long-term trends of urinary tract infections: A worldwide report’ emphasized that the Global Burden of Disease Study 2019 estimated a prevalence of 404.6 million urinary tract infections globally.

For the treatment of urinary tract infections, sulfonamides are indicated. Such a high prevalence of these infections is expected to drive the market growth.

MARKET DYNAMICS

MARKET DRIVERS

Application of Sulfonamides as First-Line Treatment for Infections to Drive Market Growth

Sulfadiazine is indicated as a first-line antibiotic in hospital settings, such as for treating pneumocystis pneumonia and nocardiosis in immunocompromised people. Also, Toxoplasmosis is usually treated with a combination of sulfadiazine and pyrimethamine in a specialist setting.

- For instance, in February 2021, NIH published an article titled ‘Sulfonamides without trimethoprim in the treatment of Nocardia infections: A case report and literature review’ emphasized on use of sulfonamides as part of first-line therapy for most Nocardia infections, with trimethoprim-sulfamethoxazole (TMP-SMX) considered the drug of choice for susceptible isolates.

MARKET RESTRAINTS

High Rate of Antimicrobial Resistance to Impede Market Growth

Antibiotic resistance is one of the major restraints for the market. Resistance to TMP-SMX approached 18.0% to 22.0% in the U.S. The increase in TMP-SMX resistance is associated with poor bacteriologic and clinical outcomes when TMP-SMX is used for therapy.

- For instance, in January 2024, NIH published a report titled ‘Update on Urinary Tract Infection Antibiotic Resistance—A retrospective study in females in conjunction with Clinical Data’ that highlighted the highest resistance rates for aminopenicillins, fluoroquinolones, and trimethoprim-sulfamethoxazole—such high rates of antimicrobial resistance render the growth of the market.

MARKET OPPORTUNITIES

Advancements in Synthetic Methods and Combination Offers Growth Opportunity

A combination of sulfonamide with other antibiotics or moieties offers a significant market opportunity to restore the effectiveness of the drug class. Research and development to offer such combined antibiotics can potentially overcome antibiotic resistance.

Additionally, advancements in synthetic methods enhance the efficiency and safety of sulfonamide production, and the combination with small moles is expected further to strengthen the role of sulfonamide in pharmaceutical development. The potential for combination therapies and the exploration of new formulations offer avenues for innovation to ensure the continued application of sulfonamides.

- For instance, in February 2022, the U.S. FDA approved mitapivat, a sulfonamide by Agios Pharmaceuticals, for the treatment of hereditary hemolytic anemias. This molecule is an allosteric activator of the pyruvate kinase enzyme.

MARKET CHALLENGES

Risks Associated with Microbial Contamination to Impede Market Growth

One of the major challenges associated with the sulfonamide market is the risk of microbial contamination. The production of these antibiotics should be carried out by following the protocol. Failure to adhere to these protocols may result in bacterial contamination. This can result in a product recall and potential loss of resources.

- For instance, in June 2025, Amneal Pharmaceuticals LLC recalled three lots of Sulfamethoxazole/Trimethoprim Tablets, USP, 400 mg/80 mg due to microbial contamination.

SULFONAMIDES MARKET TRENDS

Increasing Research and Development for Expanding Applications Drive Market Growth

Various ongoing research and development initiatives are being undertaken to expand the application of the sulfonamides. Various studies are conducted to discover the potential application of the drug class and its derivatives for cancer treatment.

- For instance, in May 2024, NIH published an article titled ‘Effective Anticancer Potential of a New Sulfonamide as a Carbonic Anhydrase IX Inhibitor Against Aggressive Tumors’ that discussed the potential application of a sulfonamide derivative for the treatment of breast cancer.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Rising Number of Urinary Tract Infections to Propel Segmental Growth

Based on application, the market is divided into urinary tract infections, acute otitis media, chronic bronchitis, shigellosis, skin infections, and others.

Urinary tract infections are expected to dominate the global sulfonamides market share in the forecast period. The segment's high market share is attributed to the rising urinary tract infections. Combination drug Bactrim is administered to treat urinary tract infections.

- For instance, in June 2020, Stanford Medicine published an article emphasizing sulfonamide use for urinary infections. It also highlighted that the combination drug of sulfonamide was used in 26.0 % of UTIs in the U.S.

The acute otitis media is expected to hold a substantial share of the global market owing to the high rate of infections of the disease in children.

- For instance, in May 2024, NIH published an article titled ‘New insights into the treatment of acute otitis media’ that reported that in the U.S., 60.0% of children experience at least one acute otitis media (AOM) infection before the age of 3 years, and up to 80.0% experience at least one AOM infection during their lifetime. Such a high incidence of the disease raises the demand for sulfonamides for treating bacterial infections and supports the market's growth.

The shigellosis segment is estimated to account for a considerable market share in the forecast period owing to the rising number of drug-resistant infections.

- For instance, in March 2024, the CDC reported that 450,000 cases of Shigella were estimated in the U.S. Trimethoprim-sulfamethoxazole is administered if susceptibility is registered for fluoroquinolones and cephalosporins.

Furthermore, chronic bronchitis and the others segment are expected to grow with a stable CAGR in the forecast period due to the rising prevalence of bacterial infections globally and the adoption of generics.

By Route of Administration

Site-specific Application and Effective Results by Topical Application to Bolster Market Growth

Based on route of administration, the market is segmented into oral and topical.

The topical segment is expected to account for the largest market share globally. The dominant segment share is attributed to site-specific action and effective results from topical application. These topical applications are primarily used to treat skin infections.

- For example, SULFACETAMIDE, a sulfonamide antibiotic in topical cream and lotion, treats skin infections and conditions such as seborrhea (red, scaly skin rashes or dandruff). Some sulfonamide brands are Carmol, Ovace, Ovace Plus, and Seb-Prev.

The oral segment is expected to account for a considerable market share due to easy administration. Also, the oral sulfonamides exhibit a low risk of allergic reactions in hospitalized patients.

- For instance, in February 2024, The Journal of Allergy and Clinical Immunology published a report titled ‘Direct Oral Challenge for Low-Risk Sulfonamide Allergy: Safety and Antimicrobial Stewardship Impacts in Hospitalized Patients’ that emphasized that Trimethoprim-sulfamethoxazole DOC in hospitalized patients with a low-risk sulfonamide allergy is safe and improves antimicrobial prescribing in patients requiring trimethoprim-sulfamethoxazole directed or prophylactic therapy.

By Distribution Channel

High Volumes of Prescriptions from Medical Practitioners to Position Hospital Pharmacies as a Dominant Segment

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

The hospital pharmacy segment is expected to be the leading segment in the sulfonamides market during the forecast period. The high market share of hospital pharmacies is accredited because these sulfonamides are used as a first-line treatment in hospital settings. This leads to increasing antimicrobial prescriptions by medical practitioners in the hospital pharmacy.

The retail pharmacy segment is expected to account for a considerable market share with factors such as, ease of access, convenience for customers, and personalized care. The number of retail pharmacies is increasing to meet the rise in demand. Furthermore, increasing collaborations and initiatives are undertaken by these retail pharmacies to provide better access to medicines.

- For instance, in June 2025, Amazon.com, Inc. introduced a new prime membership benefit, RxPass from Amazon Pharmacy. The benefit provides patients with affordable access to generic medications that treat more than 80 common health conditions for just USD 5 a month.

The online pharmacy segment is expected to grow with a significant CAGR over the forecast period. The convenience offered by online pharmacies, accompanied by benefits such as cost-saving, privacy, and heightened accessibility to favor their easy adoption. Additionally, rising online consultations and telemedicine are some factors responsible for the increased adoption of online pharmacies. Many key players are shifting their focus to the pharmacy and wellness space.

- For instance, in February 2025, Zepto, a quick commerce platform, launched a pharmacy and wellness category, underscoring the need for online pharmacies.

SULFONAMIDES MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Sulfonamides Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 0.73 billion in 2024 and is anticipated to continue to dominate the global market during the forecast period. The dominant market share of the region is attributed to the rising prevalence of infections such as MRSA in the region. The rising demand for effective medications against such infections drives regional growth.

- For instance, in June 2023, a report published by the Public Health Agency of Canada highlighted the rise of methicillin-resistant Staphylococcus aureus (MRSA) bloodstream infections. Data collected from 88 Canadian care hospitals from January 2017 through December 2021 showed that rates of methicillin-resistant Staphylococcus aureus (MRSA) bloodstream infections (BSIs) rose by 35.0%. The Sulfonamides have shown effectiveness against MRSA infections.

U.S.

The U.S. is dominating the market in North America with the presence of developed infrastructure and prominent regional players. Additionally, rising cases of contagious infections are expected to drive the growth further.

- For instance, the CDC reported that in the U.S., the percentage of Shigella infections caused by XDR strains increased from zero in 2015 to 5% in 2022. CDC received reports of 239 XDR Shigella isolates, with Shigella sonnei accounting for the largest percentage (66%), followed by Shigella flexneri (34%). The incidence of such isolates in the country necessitates effective sulfonamides.

Europe

Europe’s sulfonamides market growth is anticipated to be high with the region capturing a substantial share due to rising antimicrobial-resistant strains. This heightens the demand for sulfonamides and drives the market's growth in the region.

- For instance, in December 2023, the Center for Infectious Disease Research & Policy (CIDRAP) published an article that reported the outbreak of drug-resistant Shigella. In the U.K., XDR Shigella cases have risen by 53% in 2023, driven primarily by a cluster of 97 cases of an XDR strain of Shigella sonnei with non-susceptibility to penicillin, third-generation cephalosporins, aminoglycosides, tetracycline, sulfonamides, quinolones, and azithromycin.

Asia Pacific

Asia Pacific is projected to grow with a significant CAGR in the forecast years. The region's growth is attributed to rising infections, such as urinary tract infections, otitis media, due to poor healthcare infrastructure in China, India, Japan, and Korea.

- For instance, in January 2024, NIH published an article titled ‘Global, Regional, and National Burdens of Otitis Media From 1990 to 2019: A Population-Based Study’ that reported the Asia Pacific region witnessed the highest increase in Otitis media cases. Nationally, the largest increase in the incidence of otitis media was observed in the Republic of Korea, with an average annual percentage change (AAPC) of 0.8 in the period.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for moderate market revenue during the forecast period. The region is expected to grow due to improved healthcare infrastructure, increasing prevalence of bacterial infections, and the growing need for effective antimicrobial drugs.

- For example, in October 2022, a study published in the Journal of Health and Biological Sciences indicated that the overall prevalence of urinary tract infections (UTIs) in sub-Saharan Africa is 32.1%. The highest prevalence, at 67.6%, was observed in South Africa, followed by Nigeria at 43.6% and Zambia at 38.2%.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Progress

The global sulfonamides market holds a semi-consolidated market structure featuring prominent players such as Sandoz Group AG, Pfizer Inc., AbbVie Inc., and GSK plc. The substantial share of these companies in the market is due to robust product offerings focusing on research and development to enhance their market positions.

Generic manufacturers of the sulfonamide drugs also comprise of a major share. Other notable players in the global market include Merck & Co., Inc., Reyoung Pharmaceutical Co., Ltd., and Astellas Pharma, Inc. These companies are anticipated to prioritize new product launches and collaborations to boost their global sulfonamides market share during the forecast period.

LIST OF KEY SULFONAMIDES COMPANIES PROFILED IN THE REPORT

- Pfizer Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Aurobindo Pharma (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Reyoung Pharmaceutical Co., Ltd. (China)

- Viatris Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Apotek, Produktion & Laboratorier (APL), bought one of the production facilities of Meribel Pharma Solutions’ sites in Sweden. The 8,000 m2 production facility secures the domestic production capacity for the country.

- March 2024: Sandoz unveiled a new production facility in Kundl, Austria, to serve more patients with affordable life-saving drugs produced entirely in Europe. The new production facility and automated production lines are estimated to increase production capacity by 20.0% compared to the current capacity.

- November 2023: The Indian Pharmacopoeia Commission (IPC) issued a drug safety alert for Co-trimoxazole, which is indicated to treat different bacterial infections, citing adverse drug reactions named Fixed Drug Eruption.

- December 2022: Amneal Pharmaceuticals, Inc. launched 26 new generic products in 2022. In the fourth quarter of 2022, the Company launched 8 new generic products, including the antibiotic portfolio of the company.

REPORT COVERAGE

The global sulfonamides market research report comprises global analysis, emphasizing key aspects such as research and development, ongoing studies, and the regulatory environment. The report also examines the applications of sulfonamides alongside notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it includes detailed regional analysis of various segments and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.73% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.91 billion in 2025 and is projected to reach USD 2.56 billion by 2034.

In 2025, North Americas market size stood at USD 0.75 billion.

The market is anticipated to register a CAGR of 3.73%over the forecast period.

Based on application, the urinary tract infections segment is expected to lead the market during the forecast period.

The application of sulfonamides as the first-line treatment for infections in hospital settings drives market growth.

Sandoz Group AG, Pfizer Inc., and GSK plc. are the major players in the global market.

North America dominated the market in terms of with a share of 3.68% in 2025

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us