Synchrophasor Market Size, Share & Industry Analysis, By Component (Phasor Measurement Unit (PMU), Phasor Data Concentrator, and Others), By Application (Monitoring and Analysis, Control, and Offline Applications), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

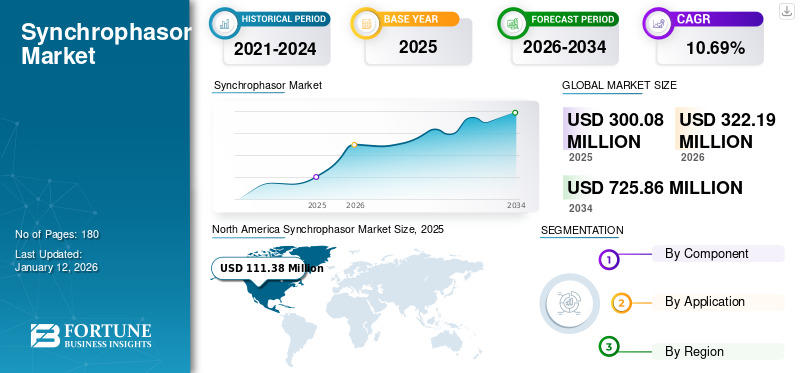

The global synchrophasor market size was valued at USD 300.08 million in 2025. It is projected to be worth USD 322.19 million in 2026 and reach USD 725.86 million by 2034, exhibiting a CAGR of 10.69% during the forecast period. North America dominated the global market with a share of 37.12% in 2025.

Synchronized phasors/synchrophasors offer a real-time measurement of electrical quantities from across the electricity grid. In practice, the Phasor Measurement Unit (PMU) is equipment used to measure the waves in the electrical network and send them via communications network, thereby creating what is referred to as a synchrophasor network. These networks are data acquisition-oriented systems for supervision, real-time monitoring, and control of the electrical network.

The market is expected to witness significant growth owing to factors such as the increasing trend of smart grids/advanced grids for reliability and resilience grid, which has led to increasing demand for synchrophasors. In addition, such problems as voltage instability and frequency issues are leading to increased demand for advanced sensors such as synchrophasors.

WAMSTER is one of the prominent players in the market. It has expertise in creating complete technical solutions by incorporating hardware, software, and firmware.

MARKET DYNAMICS

MARKET DRIVERS

Economic and Operational Advantages to Grid Operators are Driving Market Growth

The incorporation of synchrophasor leads to economic advantages to customers/end-user such as decreased operations & maintenance costs, lower energy and ancillary services expenses, savings due to enhanced asset utilization and operational effectiveness, and lower costs to customers in the long term. The lower operations and maintenance save cost and time through continuous monitoring and analyzing of data through the use of a Phasor Measurement Unit (PMU) and Phasor Data Collector (PDC). As the cost is saved for the operators, this benefit can be passed on to the consumer in the form of a lower cost of electricity per unit. So, the deployment of such advanced technology is a win-win situation for operators and consumers. In addition, it also offers more accurate identification of system limits and improved voltages, currents, and frequency resolution, allowing operations to be closer to those limits.

Modernization of Electricity Grid Infrastructure Accelerates PMU Deployments Globally

The majority of the countries in the world face the issue of old electricity grid/energy infrastructure, which creates problems such as equipment failures, blackouts, more maintenance time, and other factors. Aging electricity infrastructure can lead to problems for the industrial & commercial sectors and residential consumers as well, which can lead to slow economic growth of any country. The utilization of advanced technologies such as synchrophasors can avoid these problems. They continuously monitor the voltage, frequency, which helps the utility operators in decision-making. PMUs play a central role in stabilizing and modernizing grids to ensure their strength and make them capable of adapting to developments such as integrating renewable sources, driving the synchrophasor market growth.

MARKET RESTRAINTS

Cost Associated with Synchrophasor is Hindering Market Growth

The initial cost associated with synchronized phasor is one of the key factors hindering market growth. It requires components such as a phasor data concentrator, a phasor measurement unit, storage, software, communication equipment, and others. In addition, a skilled workforce is also one of the factors that results in increased costs for the synchrophasor technology. Furthermore, the need for cybersecurity to protect grid-related data also contributes to the cost and hinders market growth. Moreover, it is expected that government support, advancements in technology, increased literacy, and trust regarding the product in the developing regions will result in the increased availability of synchronized phasors in the market, which might result in decreased prices in the coming period.

MARKET OPPORTUNITIES

Digitization of Grid Is Expected to Create Prospects for Progression

Increased electrification and growing use of variable solar and wind power and electricity storage necessitate more advanced methods to balance demand and supply, particularly at peaks. Long-term underinvestment has left most electricity grids incapable of handling such stress.

Digital technologies can significantly improve the performance of power networks to assist with the successful integration of clean sources of energy. Neglecting to invest in the networks may hinder the energy transition and raise costs, particularly in emerging and developing economies.

Digitalization is one of the enablers to overcome some of the challenges for electricity networks, operators, and utilities today. Digital solutions allow utilities to improve the forecasting of demand and supply imbalances and to detect and repair faults more rapidly. However, investments in grids globally today are below the requirement to achieve net zero emissions by mid-century. The annual investment will have to double more than twice to approximately USD 750 billion by 2030, from approximately USD 320 billion currently.

By prolonging the lifespan of grids, digital technologies might save USD 1.8 trillion of global grid investment by 2050, as reported by a recent study by the International Energy Agency. They might also assist in integrating renewables and reducing supply outages. However, not keeping network infrastructure up to date and digitalized adequately can reduce economic production in emerging and developing nations by nearly USD 1.3 trillion as lower productivity, missed sales, and costly expenditures on redundant generation drive up expenses and threaten net zero goals.

MARKET CHALLENGES

Cybersecurity is a Key Factor that Act as a Challenge in Market

When deploying synchrophasor systems, the cybersecurity of the current substation infrastructure must be taken into account, as well as the confidentiality, integrity, and availability of synchrophasor data. Confidentiality refers to the fact that unauthorized parties cannot access the data. Typically, synchrophasor data are confidential for security and competitive purposes. In addition, integrity implies that received data remains the same as that sent by the source and has not been altered on its way to the destination. For instance, an attacker may alter the voltage angles supplied to a wide-area synchronism-check system by introducing pi radians to the actual value, which may close the breaker during out-of-synchronism conditions of power systems and lead to serious damage to the equipment of a power system.

Availability refers to the fact that data is taken and brought to the organizations that require them in a timely fashion. An attacker can disrupt the process in hopes of having an undesirable impact on the system or concealing a different form of attack on the system. These three security facets of synchrophasor information need to be implemented end-to-end, beginning from the PMUs, via the substation network, and the Wide Area Networks (WANs), all the way up to the end-user application. Once security is bypassed at any point, the system security is considered ineffective.

SYNCHROPHASOR MARKET TRENDS

Synchrophasor is Gaining Recognition as a Current Market Trend

Synchrophasor technology received international certification from a reputed global industrial organization, leading to trust and acceptance of the product.

For instance, in 2020-2021, the Phasor Measurement Unit, RES670, is now IEEE certified. Hitachi ABB Power Grids’ Phasor Measurement Unit – the IEEE Standards Association has approved RES670 version 2.2 as compliant with the IEEE C37.118.1a -2014, IEC/IEEE 60255-118-1-2018 standard. Hitachi ABB Power Grids' RES670 is a Phasor Measurement Unit (PMU) that serves as a cornerstone of Wide Area Monitoring Systems (WAMS). PMU is an instrument that gives power system AC voltages and currents in the form of phasors for all voltage levels of power system networks based on a single source for synchronization.

The testing and certification were done as part of Hitachi ABB Power Grids' membership in the IEEE Conformity Assessment Program (ICAP). The tests were performed in an IEEE-accredited PMU Test Laboratory, according to the IEEE Synchrophasor Measurement Test Suite specifications, and the RES670 version 2.2 is now included in the renowned IEEE Certification Registry.

An IEEE certification mark assists in instilling and reinforcing confidence in consumers and can become a competitive asset by distinguishing their products and services as authenticated, conforming, and technically sound.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The global synchrophasor market was challenged and impacted by the COVID-19 pandemic. It witnessed challenges such as the implementation of work in the workplace due to numerous regulations during the pandemic period. In addition, product delivery-related problems, workforce shortage, delay in decision-making from clients, and other factors, due to COVID-19-related restrictions created challenges for the market. However, advantages this technology offers were much needed during this period such as remote access to the grid health without deploying human workforce on the field.

SEGMENTATION ANALYSIS

By Component

Rising Demand for Grid Modernization Boosts PMU Segment Growth

Based on component, the market is classified into Phasor Measurement Unit (PMU), Phasor Data Concentrator, and others. The phasor measurement unit is a key element in a synchrophasor system. The Phasor Measurement Unit (PMU) segment led the market accounting for 53.39% market share in 2026. PMUs take voltage and current phasor measurements at predetermined points on the power grid and align these measurements to a shared time source, often GPS. Moreover, it has been deployed over the grid, generation points, important transmission lines, and others. The implementation of utilities for grid modernization and real-time monitoring is expanding, resulting in a significant synchrophasor market share.

After PMU, the PDC is the major component in the system. In a synchrophasor system, the Phasor Data Concentrator (PDC) plays a key intermediary role, collecting and aggregating data from Phasor Measurement Units (PMUs), time-synchronizing the data, and then sending it to different applications for monitoring, control, and protection of the power system.

By Application

To know how our report can help streamline your business, Speak to Analyst

Monitoring and Analysis is a Major Application Due to Deployment of a Synchrophasor System for Area Monitoring

Based on application, the market is classified into monitoring and analysis, control, and offline. The monitoring and analysis segment led the market share of 67.54% in 2026. Synchrophasor is being deployed for wide-area monitoring applications as they offer accurate, time-synchronized measurements of voltage and current phasors over a large geographical area. This enables real-time data monitoring (power grid conditions) that facilitates quicker response to disturbances and enhances overall grid stability and reliability.

Furthermore, the offline application also plays a major role in the market. Synchrophasors are applied in offline applications such as post-event analysis and model validation. The post-event analysis is, in fact, a major application offline, which makes it possible to reconstruct and understand power system events. Synchrophasor measurements, captured by Phasor Measurement Units (PMUs), offer rich, time-aligned snapshots of the power system, making it possible to investigate events such as blackouts or outages efficiently.

SYNCHROPHASOR MARKET REGIONAL OUTLOOK

The market forecast has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Synchrophasor Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Rising Trend of Smart Grid in North America Propels Market Growth

According to the market analysis, North America is the dominant region. This dominance is attributed to adopting smart grid infrastructure investments that drive the market growth for the technologies associated with smart grid systems. These technologies comprise software, hardware, and others, surging in the adoption of synchrophasors. The feasibility studies related to the synchrophasor were initially started in North America, especially in the U.S. For instance, in 2019, the Department of Energy selected around eight projects to evaluate advanced tech such as machine-learning technology & tools, artificial intelligence on PMU data to identify and enhance existing knowledge and find new understanding and tools for better grid operation and management.

U.S.

Literacy Regarding Synchrophasor Propels U.S. Market Growth

The investments in the synchrophasor increased the literacy and awareness regarding the synchrophasors in the country. For instance, the swift developments in PMU capability, availability, and connectivity were all spurred by the American Reinvestment and Recovery Act (ARRA). ARRA financed federal Smart Grid Investment Grants (SGIG) and Smart Grid Demonstration Projects (SGDP) with matching private investment. The U.S. market is projected to reach USD 100.12 billion by 2026.

Europe

Energy Transition and Grid Complexity are Leading to Increased Investment in Wide-Area Monitoring Systems (WAMS)

Europe's ambitious decarbonization objectives, high levels of intermittent renewable integration, and cross-border energy trading under the ENTSO-E regime have driven the implementation of synchrophasor systems. TSOs (such as TenneT, RTE, and National Grid) are investing in WAMS to manage frequency instability and grid congestion. EU-funded smart grid development projects and a robust regulatory drive for digital grid monitoring also support the market with matching private funds. The UK market is projected to reach USD 11.12 billion by 2026, while the Germany market is projected to reach USD 13.62 billion by 2026.

Asia Pacific

Rapid Grid Expansion and Blackout Risks are Growing Demand for Grid Stability Tools Such as PMUs

Asia Pacific's power industry is experiencing rapid growth, especially in India, Southeast Asia, and Australia. Aging grid infrastructure in parts of the region, coupled with high-growing demand and integration of renewable energy, has prompted utilities to move to synchrophasors for preventing widespread outages. International finance institutions and national smart grid initiatives (such as India's Smart Grid Mission) are driving market expansion. The Japan market is projected to reach USD 13.32 billion by 2026, and the India market is projected to reach USD 24.46 billion by 2026.

China

Strategic Implementation of Synchrophasors Due to UHV Transmission Drives Market Growth

China is a world leader in the application of ultra-high voltage transmission grids, which need situational awareness in real-time due to their complexity and magnitude. Synchrophasors are being used by the State Grid Corporation of China (SGCC) in its centralized dispatch and WAMS structure in order to improve grid stability, particularly since renewables are increasing in scale. The availability of local manufacturing and technological independence also makes synchrophasor systems more affordable and prevalent in China. The China market is projected to reach USD 52.83 billion by 2026.

Latin America

Grid Reliability Challenges and Renewable Penetration are Expected to Lead Adoption of Synchrophasor Technology

Latin America is at the initial stages of synchrophasor implementation, with Brazil, Chile, and Mexico conducting pilots first. The growing incorporation of wind and solar energy, usually in rural locations has revealed the limitations of traditional SCADA systems. Synchrophasors are tested on initiatives supported by regional development banks aimed at enhancing the reliability of the grid and lowering blackout threats. High upfront investments and a shortage of local expertise, though, are still the main hindrances.

Middle East & Africa

Modernization of Transmission Infrastructure Results in Gradual Uptake of Synchrophasors for Grid Visibility

Within the MEA region, transmission modernization investment, particularly in gulf countries, such as Saudi Arabia and the UAE, is gradually opening doors to synchrophasor adoption. Such systems are being implemented as part of larger smart grid and digital substation strategies. In Africa, adoption is restricted to pilot programs funded by donors for improved grid stability and resilience within high-loss, low-resilience networks. The market within this region continues to be in a development phase, but has long-term potential.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

The global synchrophasor market is moderately consolidated, led by some established market players with huge track records for monitoring and automation of power grids. In addition, the sector is also observing more action from regional players and niche tech companies with software-defined products, data analytics, and cybersecurity services. Hitachi Energy, Schweitzer Engineering Laboratories, Inc., Power Side, and others, are some of the key players in the market. Hitachi ABB (Hitachi Energy) offers holistic WAMS, SCADA/EMS, deployed PMUs integration, and PDCs in India, North America, and Europe. Furthermore, GE Vernova possesses a robust PMU, PDC, and synchrophasor software stack North American leader, installed in BPA, PJM, and European TSOs.

List of Key Synchrophasors Market Companies Profiled

- Schweitzer Engineering Laboratories, Inc. (U.S.)

- Powerside (U.S.)

- Electro Industries GaugeTech (U.S.)

- GE Vernonva (U.S.)

- VIZIMAX (Canada)

- Siemens (Germany)

- WAMSTER (Croatia)

- Arbiter Systems (U.S.)

- NR Electric Co., Ltd. (China)

- Hitachi Energy (Switzerland)

- Electric Power Group (U.S.)

- Valiant Communications Limited (India)

KEY INDUSTRY DEVELOPMENTS

- In February 2021, the WAMSTER monitoring system deployed a cruiser newbuilding in Croatia. The system deployed onboard was composed of a WAMSTER PDC server, three portable STERPMUs, an Ethernet switch, and Ethernet cabling between PMUs and the PDC server and others.

- In December 2020, KPTCL enabled the future smart grid with innovative technologies. In addition, in pursuance of its strategy to proceed toward smart grids, the installation of Phasor Measurement Units (PMUs) in the system is also in planning by KPTCL.

- In December 2020, two STERPMU-Rp devices were delivered to IPTOand installed in Chania substation (Crete) and Sklavouna substation (Peloponnese) for remote monitoring of test electrification of the submarine cable that connects Crete with the Greek mainland system.

- In November 2020, STERPMU-Rp was in the Hamburg Sud transmission substation from 05 October 2020 to 18 November 2020. A 400 kV line to the Vattenfall Moorburg power plant was being monitored during that time. Moorburg is a double-block, hard-coal-fired power station consisting of two 820MW units, A and B. The objective of the campaign was to obtain PMU data for the estimation of inertia parameters of the 800 MW block B in Moorburg.

- In October 2020, ZTE Corporation, together with China Southern Power Grid and China Mobile, completed the industry's first 5G R16 end-to-end high-precision timing power distribution service and the 5G end-to-end practical testing between the terminal of the synchro-phasor measurement unit and the main station of the wide-area measurement system based on the physical isolation slicing environment of the smart power distribution grid.

Investment Analysis and Opportunities

- There are significant investment prospects in the market since the market is still likely to expand significantly because of the expanding smart grid market. The industry globally offers a high-value investment prospect based on the imperative need for real-time grid visibility, system stability, and renewable integration in power grids.

- With global transmission systems experiencing increasing complexity resulting from decentralization, electrification, and climate-related events, utilities and system operators are increasingly investing capital in Wide Area Monitoring Systems that use Phasor Measurement Units and Phasor Data Concentrators.

REPORT COVERAGE

The global synchrophasor market report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, the report offers insights into the global market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.69% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Component

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 322.19 million in 2026.

The market is likely to grow at a CAGR of 10.69% over the forecast period (2026-2034).

The monitoring & analysis application segment is expected to lead the market in the forecast period.

The market size of North America stood at USD 111.38 million in 2025.

Modernization of electricity grid infrastructure is one of the key factors driving the market growth.

Some of the top players in the market are Schweitzer Engineering Laboratories, Inc., and WAMSTER Powerside, among others.

The global market size is expected to reach USD 725.86 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us