Synthetic Single Crystal Diamond Market Size, Share & Industry Analysis, By Type (HPHT and CVD), By Application (Electronics {Cooling Application, Semiconductor Package, and Others}, Machinery, Geological Mining, Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

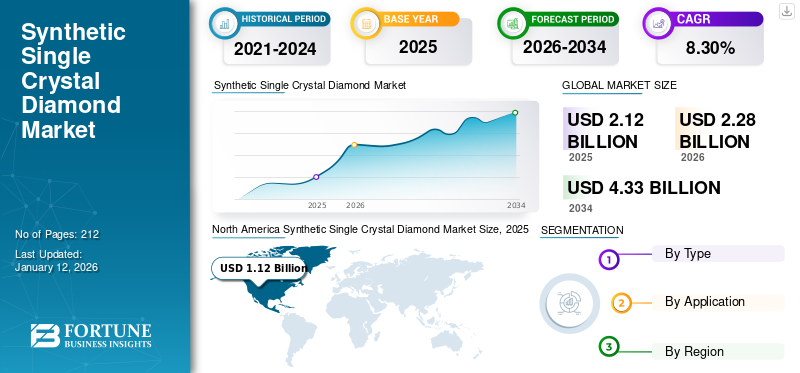

The global synthetic single crystal diamond market size was valued at USD 2.12 billion in 2025. The market is projected to grow from USD 2.28 billion in 2026 to USD 4.33 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. North America dominated the synthetic single crystal diamond market with a market share of 53% in 2025.

Synthetic single crystal diamonds (SCDs) are man-made diamonds grown in a controlled laboratory environment, exhibiting identical chemical and physical properties to natural diamonds. These diamonds, also known as lab-grown or laboratory-created diamonds, are produced through methods such as chemical vapor deposition (CVD) or high-pressure, high-temperature (HPHT) techniques. The market is experiencing remarkable growth, fueled by technological advancements in manufacturing processes such as High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). These diamonds are gaining popularity due to their wide range of applications, especially in electronics, healthcare, and industrial sectors. Element Six, Sumitomo Electric Industries Ltd, Hyperion Materials & Technologies, Orbray Co., Ltd., and Diamond Elements Pvt. Ltd are key players operating in the industry.

GLOBAL SYNTHETIC SINGLE CRYSTAL DIAMOND MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 2.12 billion

- 2026 Market Size: USD 2.28 billion

- 2034 Forecast Market Size: USD 4.33 billion

- CAGR: 8.30% from 2026–2034

Market Share:

- North America led in 2025 with a 53% share, rising from USD 1.12 billion in 2025 to USD 1.21 billion in 2026.

- By type: The Chemical Vapor Deposition (CVD) segment dominated, driven by demand from electronics and automotive sectors.

- By application: Electronics held the largest share owing to SCD’s exceptional thermal conductivity used in heat spreaders and semiconductors.

Key Country Highlights:

- U.S.: Leading in semiconductor and quantum computing applications, contributing USD 0.88 billion in 2024.

- China: Rising adoption in high-tech and semiconductor manufacturing driving regional growth.

- Japan: Strong demand from precision engineering and optical component manufacturing.

- Germany: Focus on precision tools and sustainable lab-grown diamond applications.

- India: Increasing demand in automotive and aerospace manufacturing.

Synthetic Single Crystal Diamond Market Trends

Rising Investments in Developing Diamond-Based Quantum Processors are Latest Trend

For decades, quantum computing remained largely theoretical and confined to science fiction. Today, it's rapidly becoming a reality, with soaring demand from companies, governments, and research institutions eager to harness its transformative potential. This momentum has sparked a global race to develop quantum technologies capable of revolutionizing industries.

The demand for high-quality synthetic single crystal diamonds is surging, driven by the burgeoning quantum computing industry. Companies and research institutions are investing heavily in developing diamond-based quantum processors, sensors, and communication devices.

- North America witnessed a synthetic single crystal diamond market growth from USD 0.97 billion in 2023 to USD 1.04 billion in 2024.

These applications range from drug discovery and materials science to secure communication networks and advanced sensing technologies. The journey toward fully functional diamond-based quantum computers is still emerging. Challenges such as scaling production and fine-tuning material properties remain. However, ongoing research continues to reveal the quantum capabilities embedded within the crystalline structure of synthetic diamonds. As breakthroughs emerge, these lab-grown gems are poised to become foundational to the quantum future.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Demand for Heat Spreaders and Dissipaters to Drive Market Expansion

The increased demand for heat spreaders and dissipaters in the electronics industry is significantly driving the growth of the synthetic single crystal diamond market. As high-performance electronic devices become increasingly compact, efficient thermal management has become essential to address overheating challenges.

Synthetic diamond heat spreaders find applications across diverse industries, including aerospace (satellite systems), automotive (electric vehicles), telecommunications (5G technology), and high-performance computing (CPUs and GPUs), highlighting their versatility and expanding adoption.

Unlike most thermally conductive materials, which are also electrically conductive, synthetic diamonds provide efficient high dissipation without interfering with electric circuits. This property is invaluable in electronics, where synthetic diamonds are used as heat sinks to efficiently dissipate heat, extending the lifespan of electronic devices without compromising their performance.

In a groundbreaking development, Element Six, in collaboration with Delft University of Technology, demonstrated quantum entanglement between atom-like defects in two separate synthetic diamonds. This milestone paves the way for diamond-based quantum networks, quantum repeaters, and secure long-distance quantum communication. Such advancements could revolutionize information processing by enabling systems capable of solving problems beyond the reach of current technologies.

Superior Product Properties to Drive Demand Across Various End-use Industries

The market is witnessing robust growth, driven by a combination of superior properties, cost-effectiveness, technological advancements, expanding industrial applications, ethical sourcing considerations, and favorable regional growth dynamics. Although challenges such as production costs persist, ongoing innovations continue to unlock significant opportunities across industries such as electronics, healthcare, aerospace, and jewelry.

Synthetic single crystal diamonds are valued for their exceptional hardness, thermal conductivity, optical transparency, and chemical inertness. These properties make them indispensable in high-tech applications. Their extreme hardness is utilized in precision cutting tools and industry abrasives, especially in construction and manufacturing. For example, synthetic diamonds are used in drilling equipment for geological mining due to their durability. In geological drilling, synthetic diamonds are embedded in drill bits to penetrate hard rock formations, offering cutting performance and longevity compared to traditional steel or tungsten carbide drill bits, driving the synthetic single crystal diamond market growth.

One prominent application of the product is in stone cutting, where synthetic diamond-coated wires are used. These wires consist of metallic cables with beads embedded with diamond powder, providing superior cutting efficiency. Synthetic diamonds are increasingly used in healthcare for medical imaging equipment, diagnostic equipment, and surgical tools due to their biocompatibility, chemical inertness, and mechanical stability. Diamond-coated scalpels provide precision cutting during surgeries while maintaining durability. Moreover, synthetic diamonds are integrated into advanced imaging technologies such as X-ray detectors for clearer resolution.

Market Restraints

High Initial Cost May Hamper Market Growth

The formation of synthetic diamonds relies on refined technologies such as High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). Both methods demand significant financial investment and intensive research and development (R&D), creating high entry barriers for new industry players.

The HPHT technique replicates the natural diamond formation process by subjecting a carbon source to extreme pressures (exceeding 870,000 pounds per square inch) and temperatures (1300-1600°C). This technique requires specialized equipment capable of sustaining such conditions, which significantly adds to the high costs of production. Additionally, the presses utilized in HPHT are large, intricate, and costly to produce, requiring immense pressure and heat, making them expensive to manufacture and operate.

The CVD approach grows diamonds by introducing a carbon-rich gas (such as methane) into a vacuum chamber at lower pressures and moderate temperatures (800-1000°C). Although this technique is more energy-efficient compared to HPHT, it still involves considerable costs due to the sophisticated technology required. Hence, the high capital investment needed for production setup and technological advancements may hamper market growth.

Market Opportunities

Growing Demand for Diamond Powder to Present Key Opportunity for Market Players

Monocrystalline diamond powder is emerging as a key enabler for next-generation electronics, offering unmatched performance and reliability. Rapid advancements in synthesis and processing techniques, coupled with the relentless demand for high-performance electronics, provide various growth opportunities for companies and researchers who are willing to invest in this transformative technology. As the demand for smaller, faster, and more energy-efficient continues to grow, this advanced material is capturing the attention of innovators across the electronic industry. Among the most promising materials is monocrystalline diamond powder, renowned for its exceptional properties such as extreme hardness, high thermal conductivity, and chemical inertness. These characteristics position it to revolutionize various electronic applications. As demand accelerates, manufacturers and researchers have an opportunity to leverage the material’s advantages. By addressing the challenges and capitalizing on the unique properties, the industry can unlock the full potential of monocrystalline diamond powder and drive the next wave of innovation in electronics.

Market Challenges

Rising Preference for Natural Stones to Hinder Market Progress

Synthetic diamonds face strong competition from natural diamonds, particularly in the jewelry sector, where consumer preference continues to favor natural stones due to their perceived value and rarity. Regulatory restrictions and environmental concerns related to energy-intensive manufacturing processes also pose hurdles, with stricter regulations potentially increasing production costs.

Impact of COVID-19

Supply Chain Disruptions During Pandemic Hampered Market Expansion

The COVID-19 pandemic significantly disrupted the market, causing supply chain bottlenecks and reduced demand across key industries such as automotive, electronics, and construction. Lockdowns and travel restrictions halted mining operations, delayed manufacturing, and disrupted distribution networks, leading to order cancellations and inventory surpluses.

Despite these setbacks, the market demonstrated resilience, rebounding in 2021 as restrictions eased. Lab-grown diamonds gained traction due to their lower prices and shifting consumer preferences toward sustainable options. The pandemic also accelerated digital adoption, with a significant percentage of diamond sales moving to online platforms in 2020.

While the initial shock led to reduced luxury spending, recovery was bolstered by increased demand for high-quality synthetic diamonds in the technology and manufacturing sectors. Post-pandemic strategies emphasizing ESG (environmental, social, governance) goals and omnichannel retail models are expected to sustain growth. Despite challenges such as complex manufacturing processes persisting, the market’s adaptability positions it well for continued expansion.

Segmentation Analysis

By Type

CVD Segment Held Largest Share Due to Increasing Demand from Electronics and Automotive Industries

In terms of type, the market is segmented into High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). The CVD segment accounted for the largest share contributing 57.02% globally in 2026 owing to the increasing demand from the electronics, automotive, and medical industries.

HPHT diamonds are created in controlled environments that mimic the high-pressure, high-temperature conditions under which deep natural diamonds form deep within the Earth. The demand for HPHT single crystal diamonds is projected to maintain a strong growth trajectory, owing to their superior properties and increasing applications in various industries.

By Application

To know how our report can help streamline your business, Speak to Analyst

Electronics Segment Held Largest Market Share Due to SCD’s Exceptional Thermal Conductivity

In terms of application, the market is segmented into electronics, machinery, geological mining, construction, and others.

The electronics segment accounted for the largest synthetic single crystal diamond market share of 60.09% in 2026. The electronics industry is a major driver of SCD demand, particularly for high-power and high-frequency devices. SCD's exceptional thermal conductivity, five times that of copper, makes it an ideal heat spreader for dissipating heat generated from densely packed microchips and power amplifiers.

The machinery segment accounted for the second-largest share. The segment, which encompasses precision tools and heavy industrial equipment, benefits from the exceptional hardness and wear resistance of SCDs. These properties make SCDs highly suitable for use in cutting tools, grinding wheels, and wire drawing dies, delivering exceptional precision and significantly extending the lifespan of these critical components. The Machinery segment is expected to hold a 18% share in 2024.

Synthetic Single Crystal Diamond Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Synthetic Single Crystal Diamond Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest share in 2025, generating USD 1.12 billion. This growth is attributed to advancing technological capabilities and rising disposable incomes across the region.

The U.S. dominated the North American market in 2026, contributing USD 1.03 billion, driven by its robust technological landscape. The semiconductor industry is a major consumer of heat sinks, which are essential in high-power electronics and advanced computing. In these applications, synthetic single crystal diamonds are valued for their exceptional thermal conductivity, crucial for dissipating heat and improving device performance. Furthermore, the burgeoning quantum computing sector relies on SCDs with nitrogen-vacancy (NV) centers for creating qubits, the fundamental building blocks of quantum processors.

While Canada’s economy is historically rooted in resource extraction, its market is being reshaped by its growing technological capabilities. Similar to the U.S., the demand for synthetic single crystal diamonds in Canada stems from the semiconductor industry and applications in high-power electronic systems.

- In U.S. , the Machinery segment is estimated to hold a 18.3% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe's product demand is rooted in its long-standing tradition of precision engineering and emphasis on scientific research. High-precision cutting tools, crucial for industries such as aerospace and automotive, rely on SCDs for their exceptional hardness and wear resistance. Europe’s strong focus on fundamental research in fields such as optics, photonics, and quantum technologies further drives the demand for the product. Synthetic single crystal diamonds are employed in advanced optical components, high-energy particle detectors, and as substrates for growing other advanced materials. Furthermore, Europe's commitment to sustainable practices impacts the diamond jewelry market, with increasing consumer preference for lab-grown diamonds due to their lower environmental impact. The UK market is projected to reach USD 0.03 billion by 2026, while the Germany market is projected to reach USD 0.06 billion by 2026.

Asia Pacific

The Asia Pacific region is experiencing a surge in demand for single crystal diamonds, expanding beyond their traditional role in jewelry to become vital components in advanced technologies. In China, demand is propelled by its expanding high-tech industries. Leading the growth is the semiconductor sector, where diamonds are crucial for heat management in high-power devices and the production of advanced silicon wafers. The China market is projected to reach USD 0.26 billion by 2026 and the India market is projected to reach USD 0.16 billion by 2026.

Japan exhibits a strong demand for SCDs, driven by its emphasis on precision engineering and advanced research. The Japan market is projected to reach USD 0.11 billion by 2026. Japanese manufacturers are renowned for their expertise in precision machining, requiring diamond tools for cutting, grinding, and polishing extremely hard materials. In India, the demand for single crystal diamonds is steadily increasing, fueled by the growing manufacturing sector, particularly in the automotive and aerospace industries, where diamond tools are essential for machining hard and abrasive materials.

Latin America

In Latin America, synthetic single crystal diamonds are increasingly used in electronics due to their exceptional thermal conductivity, electrical insulation, and durability. They play a crucial role in the production of semiconductors, high-frequency devices, laser diodes, and optical sensors, enhancing device performance and reliability. The growing consumer electronics market and the push for miniaturization and advanced functionality are driving demand. As Latin American countries invest in technology and manufacturing, the use of synthetic diamonds in electronics is set to expand further.

Middle East & Africa

The Middle East & Africa market is poised for steady growth. It is driven by rising demand in industrial sectors such as construction, automotive, and aerospace, where synthetic diamonds are valued for their exceptional hardness and thermal conductivity. The region is also experiencing increased interest from ethically-minded consumers, particularly in the jewelry sector, where lab-grown diamonds are seen as affordable and sustainable alternatives to mined stones.

Competitive Landscape

Key Industry Players

Market Players Focus on Strategic Partnerships to Boost Their Presence

Element Six, Sumitomo Electric Industries Ltd, Hyperion Materials & Technologies, Orbray Co., Ltd, and Diamond Elements Pvt. Ltd are the leading players operating in the industry. Companies are pursuing strategies such as mergers, acquisitions, strategic partnerships, and R&D investment to enhance product offerings and boost market share. Government initiatives and the rising need for sustainable, high-quality materials across industries further support the market’s growth. The global market is highly competitive and fragmented, characterized by the presence of both established industry leaders and emerging players, with the top 5 players accounting for around 60% of the market share.

LIST OF KEY SYNTHETIC SINGLE CRYSTAL DIAMOND COMPANIES PROFILED

- Sumitomo Electric Industries Ltd. (Japan)

- Reade International Corp. (U.S.)

- K&Y Diamond (U.S.)

- Diamond Materials GmbH (Germany)

- Element Six (U.K.)

- Zhuhai Zhong Na Diamond Co., Ltd (China)

- Diamond Elements Pvt Ltd (India)

- Orbray Co., Ltd (Japan)

- Hyperion Materials & Technologies (U.S.)

- Industrial Abrasives Ltd (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2025 – Orbray Co., Ltd. launched a radiation detector that employs its unique and high-quality single-crystal diamond technology with a large diameter. The exceptional physical characteristics of the diamond, such as its resistance to radiation, enable detectors to operate effectively in high-radiation settings where traditional detectors made from different materials would deteriorate.

- March 2025 - Orbray announced production technology for the largest single-crystal (111) diamond substrates that stand independently, with dimensions of 20mm × 20mm. This milestone represents a major advancement in the development of diamond-based quantum and power devices. The company intends to bring large (111) diamond substrates to market by 2026. It is also making progress in developing n-type self-standing diamond substrates, which are essential for the widespread adoption of synthetic diamonds in semiconductor devices.

- September 2024 – Element Six, a global leader in high-quality diamond materials, and DS, a leading provider of scientific instrumentation, announced the launch of the SDS-E600, a compact and advanced 2.45 GHz microwave plasma CVD diamond reactor. This innovative CVD system leverages E6's decades of expertise in diamond growth with SDS's widely adopted and robust 2.45 GHz platform. The SDS-E600 represents a significant advancement in the research and development of synthetic diamond, offering unparalleled capabilities for growing high-quality diamond materials using microwave plasma-assisted chemical vapor deposition (MPCVD).

- August 2022 – Hyperion Materials & Technologies, a prominent global leader in materials science that focuses on creating advanced hard and super-hard materials for diverse industries and applications, revealed its acquisition of Premium Diamond Solutions SA. This enhances Hyperion’s offerings in synthetic and industrial diamond super abrasives.

- January 2021- Hyperion Materials & Technologies announced the successful completion of its acquisition of NanoDiamond Products (NDP), a provider of solutions in synthetic diamond and cubic boron nitride (CBN) products. This acquisition would enhance Hyperion's status as a leading global provider of synthetic diamond and CBN products, resulting in a unified organization that is well-prepared to meet the needs of customers across various sectors, including stone cutting, electronics, oil & gas, and toolmaking.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, types, and applications. Additionally, it offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, it encompasses various factors contributing to the market's growth in recent years.

This report includes historical data and forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

CAGR (2026-2034) |

CAGR of 8.30% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 2.12 billion in 2025 and is projected to record a valuation of USD 4.33 billion by 2034.

In 2025, the North America market size stood at USD 1.12 billion.

Growing at a CAGR of 8.30%, the market will exhibit steady growth during the forecast period (2026-2034).

Based on application, the electronics segment led the market in 2026.

Increasing demand for heat spreaders and heat dissipaters in the electronic industry is a key factor driving market growth.

Element Six, Sumitomo Electric Industries Ltd, Hyperion Materials & Technologies, Orbray Co., Ltd, and Diamond Elements Pvt. Ltd are major players operating in the industry.

North America dominated the synthetic single crystal diamond market with a market share of 53% in 2025.

Growing recognition of quantum computing is expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us