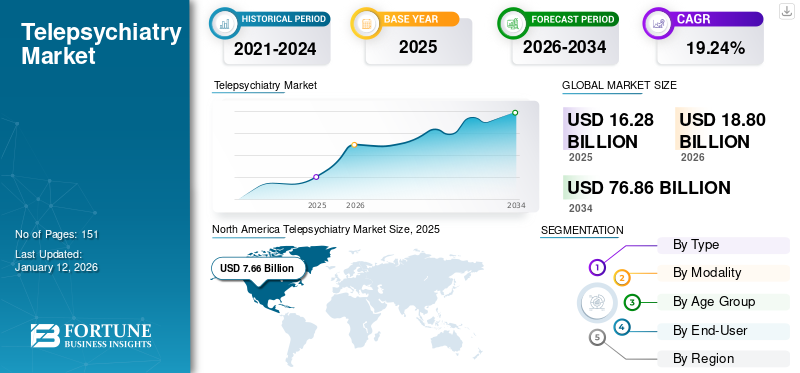

Telepsychiatry Market Size, Share & Industry Analysis, By Type (Products and Services), By Modality (Synchronous and Asynchronous), By Age Group (Adults and Pediatrics & Adolescents), By End-User (Healthcare Facilities, Homecare, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global telepsychiatry market size was valued at USD 16.28 billion in 2025. The market is projected to be worth USD 18.8 billion in 2026 and reach USD 76.86 billion by 2034, exhibiting a CAGR of 19.24% during the forecast period. North america dominated the telepsychiatry market with a market share of 47.03% in 2025.

The market has showcased an upward growth trajectory, with projections indicating continued strong expansion in the coming years. Array Behavioral Care, BetterHelp, and American Telepsychiatrists, are some of the leading entities operating in the market. The market is experiencing significant growth both globally and in India, driven by technological advancements, increasing mental health awareness, and supportive governmental policies. Below is an in-depth analysis encompassing trends, challenges, key players, regional insights, industry developments, and market segmentation.

Telepsychiatry, a subset of telemedicine, involves delivering psychiatric assessment and care through telecommunications technology, primarily via video conferencing. This approach enhances accessibility to mental health services, especially in remote or underserved areas. In recent years, mental health issues have become increasingly prevalent, as the COVID-19 pandemic drastically boosted the demand for this service.

Primarily, increasing incidences of mental illness, cost and time saving benefits offered by digital health services, the rising adoption of advanced technologies are some of the factors significantly driving the growth of the market during the forecast period.

- For instance, according to a study published in the Journal of Healthcare Communications January 2020, an estimated 26.2% of American individuals over the age of 18 met the criteria of psychiatric disorder.

The market is poised for substantial growth, however, addressing challenges such as regulatory variability, reimbursement policies, and technological barriers will be crucial for sustained expansion.

Telepsychiatry Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 16.28 billion

- 2026 Market Size: USD 18.8 billion

- 2034 Forecast Market Size: USD 76.86 billion

- CAGR: 19.24% from 2026 to 2034

Market Share:

- Leading Region: North America dominated the telepsychiatry market with a 47.03% share in 2025. This is driven by high telemedicine penetration, rising mental health awareness, and favorable reimbursement policies.

- Leading Segment: The services segment held the largest share in 2024, supported by growing prevalence of mental illness, increased adoption of remote consultations, and the cost/time-saving benefits of telepsychiatry services.

Key Country Highlights:

- United States: The U.S. holds the highest market share in North America, driven by widespread adoption of tele-mental health services, increasing awareness of mental health issues, and favorable reimbursement frameworks. Initiatives such as NAMI’s #MoreThanEnough campaign (2023) promote mental health awareness and support telepsychiatry adoption.

- Canada: Canada is witnessing steady growth supported by government-backed digital health initiatives and increased investments in telehealth infrastructure, facilitating broader access to psychiatric care.

- Europe: Europe is expected to experience remarkable growth owing to supportive government guidelines for digital health adoption and increasing prevalence of mental health conditions. According to WHO, over 150 million Europeans lived with a mental health disorder in 2021.

- Asia Pacific: The Asia Pacific region, particularly India and China, is projected to register the fastest growth rate. Government programs like India’s National Tele-Mental Health Programme (T-MANAS) with a USD 15.4 million budget (2023–2024) boost adoption. However, legal, reimbursement, and infrastructure challenges persist.

- Latin America and Middle East & Africa: These regions currently hold smaller market shares due to limited telepsychiatry adoption but are expected to grow sustainably as healthcare infrastructure improves.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Access to Mental Health Services to Boost Market Growth

In recent years, the market has witnessed a significant adoption by healthcare providers and patients. Owing to the several benefits offered by these services, mental health providers have developed a positive outlook toward telebehavioral health. With the growing incidences of mental health issues, including anxiety and other disorders, online platforms have made psychiatry care more accessible, thereby expanding the access to treatment.

MARKET RESTRAINTS

Poor Reimbursement Framework to Obstruct Service Adoption

In spite of many countries coming up with reimbursement policies for telepsychiatry services, improper and inadequate reimbursement, especially in developing countries, still possess a major restriction for their adoption. Additionally, the reimbursement framework of these services lacks clarity, further limiting its adoption among the general population. Moreover, ambiguities surrounding the terms and conditions related to the location of the patient and services usage persists in many countries, creating uncertainty and negatively impacting the telepsychiatry market growth.

MARKET OPPORTUNITIES

Developments in Telecommunication Technology to Offer Lucrative Growth Opportunities

Rapid advancements in the telecommunication sector, such as the introduction of 4G LTE have created significant opportunities for the industry to flourish. Owing to the introduction of such facilities, developing regions that lack proper communication capabilities will have the opportunity to experience an enhanced network facility, thereby witnessing the benefits of telepsychiatry. Advancements in telecommunication technology have resulted in development of easily accessible mobile apps, which are being extensively used by patients. Additionally, companies are continuously launching advanced applications to improve patient access and improve the overall experience.

MARKET CHALLENGES

Barriers Related to Technology Reach to Hinder Market Growth

One of the several factors affecting the adoption of telepsychiatry, especially among older adults, is technology-related challenges. The cost of the technology required for accessing telebehavioral health services results in economic barriers for individuals with limited financial resources, making it more expensive compared to in-person services. The access to internet can be expensive and, for some populations especially those in tribal communities, nearly impossible to obtain.

- For instance, as per the data provided by the U.S. Federal Communications Commission in 2021, approximately 21% of Americans living in Tribal lands and 17% of rural Americans lack access to high-speed broadband Internet.

Other Challenges

Regulatory Variability

Variations in telemedicine regulations across regions can create complexities for service providers operating in multiple areas. The industry requires stringent regulations and monitoring, which pose significant challenges for operating players. Along with this, the regulatory bodies have enforced strict regulations for data privacy and management, further adding to compliance requirements.

TELEPSYCHIATRY MARKET TRENDS

Growing Adoption of Artificial Intelligence (AI) is a Key Market Trend

In recent years, integration of artificial intelligence in mental healthcare has been reshaping the landscape of mental healthcare. In telepsychiatry, the role of AI includes tele-assessment, tele-diagnosis, tele-interactions and tele-monitoring. It plays a vital role in enhancing diagnostic accuracy, improving remote patient monitoring, analysis of medical imaging and other aspects. Thus, AI in telepsychiatry offers tremendous opportunities, driving a growing trend toward its adoption in service offerings by market players.

- For instance, according to an article published in Journal of Medicine, Surgery, and Public Health in April 2024, some of the AI tools used in telepsychiatry include Mindstrong Health, BetterHelp, Talkspace, and others.

Other Trends

Regulatory Support

Many countries are updating telemedicine guidelines to meet the growing demand for remote mental health services, a trend further accelerated by the COVID-19 pandemic. In developing countries such as India, government initiatives have driven the adoption of telehealth services. Key efforts include the establishment of the National Telemedicine Task Force in 2005, the launch of the telemedicine initiatives such as SEHAT in 2015, and the introduction of ‘eSanjeevani’ in 2019. China has been taking steps to improve the adoption of e-health through various policy measures.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly accelerated reforms in this space as governments, physicians, health systems, insurance companies and patients realized the role of digital health in ensuring the mental wellbeing of the COVID-19 patients and the general population. During the pandemic period, this modality proved to be an effective route for delivering mental healthcare. According to a survey published by the American Psychiatric Association in July 2021, 81% of respondents indicated that they continue to witness between 75 – 100% of their patients via telehealth as of January 2021. This indicates the higher usage of telepsychiatry during the pandemic period.

SEGMENTATION ANALYSIS

By Type

Growing Prevalence of Mental Illness Support Services Segment’s Growth

On the basis of type, the market is segmented into products and services. In 2024, the services segment held the highest global telepsychiatry market share and is anticipated to maintain its dominance throughout the study period. Several factors such as growing prevalence of mental illness including anxiety, stress, and behavioral issues have driven the growing need for telepsychiatry services. Along with this, advantages of remote consultation further support its adoption among patients.

- For instance, according to the WHO data published in March 2023, the number of individuals suffering from depression was around 280 million across the world.

The product segment is projected to witness a notable growth rate during the forecast period. The demand for products such as mental health apps is constantly growing owing to the fact that apps play an important role in the management of mental health disorders. Several research studies have also demonstrated that these apps are quite effective in managing mental health disorder symptoms. The segment captured 19.2% of the market share in 2024.

- For instance, in March 2023, a research study published by NCBI, stated that digital mental health tools help in improving the symptoms related to mental health disorders. Such tools are crucial in filling the supply-demand gap in low-and middle income countries.

To know how our report can help streamline your business, Speak to Analyst

By Modality

Wide Adoption of Live/Real-Time Visits Boosted Synchronous Segment Growth

Based on modality, the market is segmented into synchronous and asynchronous.

The synchronous segment held the leading position in 2025. This dominance is driven by the increasing number of live/real-time teleconsultation visits coupled with several benefits offered by this type of teleconsultation. Some of the benefits include increased accessibility, convenience, reduced stigma associated with in-person visits to psychiatrists. The segment is likely to gain 56.02% of the market share in 2026.

- For instance, as per an article published by TechTarget in June 2024, out of the total psychiatrist visits in 2021, 43.2% occurred via telecommunication.

The asynchronous segment is also anticipated to witness considerable growth with a CAGR of 17.27% during the forecast period. The increasing usage of mental health apps and increasing number of downloads and subscriptions has been a key factor driving the segment growth.

By Age Group

Increasing Adoption of Telepsychiatry among Elderly Population to Impel the Segment Expansion

Based on age group, the market is categorized into adults and pediatrics & adolescents.

The adult segment accounted for the largest global market share in 2025. Higher adoption of telepsychiatry services due to the increasing prevalence of anxiety and depression among adult individuals is propelling demand for teleconsultation in the segment. The segment is expected to grow with a share of 55.64% in 2026.

- For instance, as per a research study published in Adultspan Journal in November 2022, one in five older adult individuals in the U.S. meets the criteria for a mental health or substance use disorder.

The pediatrics & adolescents segment is expected to grow at a significant CAGR of 17.39% during the forecast period (2025-2032). Telepsychiatry has gained prominence in the past few years, especially in the developed countries to manage psychotic disorders in children.

By End-User

Increasing Adoption of Mobile Health Apps Boosted Healthcare Facilities Segment Expansion

Based on end-user, the market is categorized into healthcare facilities, homecare, and others.

The healthcare facilities segment accounted for the largest global telepsychiatry market share in 2025. The increasing adoption of virtual consultations by healthcare providers coupled with increasing adoption of the mobile health apps by healthcare professionals has supported the segment growth. The segment is poised to gain 56.65% of the market share in 2026.

The homecare segment is expected to witness a considerable CAGR of 18.41% during the forecast period (2025-2032). Supportive government initiatives to increase the awareness about mental health and high smartphone penetration leading to an increasing number of active users of mental health apps are some of the factors boosting the growth of the market in homecare settings.

- For instance, in October 2022, the Government of India introduced The National Tele Mental Health Programme (NTMHP) to offer a wide range of mental health services. It includes psychotherapy, telephone-based counselling, urgent care, and psychiatric consultations.

TELEPSYCHIATRY MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Telepsychiatry Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated a revenue of USD 7.66 billion in 2025 and USD 8.86 billion in 2026 and secured a leading position in the market. The regional market is anticipated to witness a strong growth in the near future. Factors such as high penetration of telemedicine services, rising number of service providers, and favorable reimbursement scenario have majorly driven the regional market. The U.S. held the highest market share in the North American region, driven by the widespread adoption of tele-mental health services, coupled with increasing awareness regarding mental health issues. The U.S. market is set to be worth USD 8.03 billion in 2025.

- For instance, in my 2023, National Alliance on Mental Illness (NAMI) launched a campaign named - #MoreThanEnough, to empower the mental health community. The campaign was initiated as part of the Mental Health Awareness Month in 2023.

Europe

Europe is the second largest market estimated to grow with a valuation of USD 4.36 billion in 2026, exhibiting a CAGR of 23.33% during the forecast period (2026-2034). The region is anticipated to witness a remarkable growth in the coming years. The introduction of supportive government guidelines for digital health adoption coupled with rising incidences of mental health illness have contributed to the market growth. The U.K. market continues to grow, estimated to be valued at USD 0.76 billion in 2026.

- For example, according to the data published by the World Health Organization (WHO), in 2021, more than 150 million individuals lived with a mental health condition in Europe.

Germany is poised to reach USD 0.94 billion in 2026, while France is set to be valued at USD 0.62 billion in the same year.

Asia Pacific

Asia Pacific is the third leading region projected to be valued at USD 3.82 billion in 2026. The market in this region, especially in India and China, is poised to witness the fastest growth in the coming years. Increasing penetration of digital technologies in mental health consulting, coupled with growing awareness of mental health problems, has significantly boosted the regional growth. In India, the market for telepsychiatry is anticipated to witness strong growth in the near future. China is expected to attain USD 0.7 billion in 2026. The Indian government launched various programs to promote telemedicine, including the National Tele-Mental Health Programme (T-MANAS), with a budget allocation of USD 15.4 million (INR 134 crore) for 2023–2024. However, despite these advancements, challenges such as legal and reimbursement issues, high initial capital investments, and lack of physician support can limit market growth in developing countries. India is set to capture a valuation of USD 0.81 billion in 2026, while Japan is poised to be worth USD 0.89 billion in the same year.

Latin America and the Middle East & Africa

Latin America is the fourth largest market expected to hit USD 1.26 billion in 2026. Latin America and the Middle East & Africa regions experienced a smaller share of the market due to a relatively lower adoption of telepsychiatry services. However, with improving healthcare infrastructure these regions are anticipated to witness a sustainable growth in the coming years. The GCC market is foreseen to be valued at USD 0.21 billion in 2025.

COMPETITIVE LANDSCAPE

Key Market Players

Leading Companies Focus on Collaborations to Boost their Market Presence

The landscape for the global market is competitive as it encompasses several well-established and emerging service providers. In 2024, key players such as Array Behavioral Care, Telemynd, MDsafari Inc., and innovatel captured a significant market share. These companies are actively involved in regional expansions, strategic collaborations, and service enhancements to strengthen their market presence.

- For instance, in November 2024, Array Behavioral Care partnered with KeyCare to expand countrywide access to mental health treatment. This partnership aims to coordinate care across hospitals, home settings, and community/outpatient settings.

Other key players operating in the market include Advanced Telemed Services, American Telepsychiatrists, Iris Telehealth Inc., and others. Along with these players, the market comprises several small-scale players investing in technology and services expansion to meet the increasing demand for mental health care.

TRADE PROTECTIONISM

While telepsychiatry is less affected by traditional trade barriers, issues such as data privacy laws and cross-border telemedicine regulations can impact service delivery. Ensuring compliance with varying international standards is crucial for providers operating globally.

LIST OF KEY TELEPSYCHIATRY COMPANIES PROFILED:

- Array Behavioral Care (U.S.)

- Teladoc Health, Inc. (U.S.)

- American Well (U.S.)

- Telemynd (U.S.)

- Advanced Telemed Services (U.S.)

- American Telepsychiatrists (U.S.)

- Iris Telehealth Inc. (U.S.)

- MDLIVE (U.S.)

- Encounter Telehealth (U.S.)

- Access TeleCare, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Class Technologies, Inc., and Rogers Behavioral Health signed a collaboration agreement to offer innovative mental health services to patients in Colorado, Wisconsin, Florida, Minnesota, Illinois, and Tennessee.

- July 2024: Magellan Health, Inc. collaborated with Talkiatry to extend telepsychiatry services across California.

- June 2024: Andreessen Horowitz led a USD 130 million investment in Talkiatry, a behavioral healthcare company specializing in virtual psychiatry services, indicating strong investor interest in the sector.

- April 2024: Concert Health collaborated with Advancing Integrated Mental Health Solutions (AIMS) Center in the University of Washington Department of Psychiatry and Behavioral Sciences, to facilitate mental health care for 2,700 patients with complex psychiatric disorders.

- April 2023: Health Net and L.A. Care Health Plan invested USD 24 million to provide telehealth mental health services to L.A. County’s K-12 public school students.

- March 2023: - Brightline joined Evernorth Health Services to enhance the virtual behavioral health care for children and families.

REPORT COVERAGE

The global telepsychiatry market research report research provides a detailed analysis of the industry. It emphasizes key aspects, such as major companies, solution types, modality, age group, and a few others. In addition, it includes detailed insights into market dynamics, new service launches, and key industry developments such as mergers, partnerships, and acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.24% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Modality

By Age Group

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global telepsychiatry market was valued at USD 16.28 billion in 2025 and is projected to reach USD 76.86 billion by 2034

The telepsychiatry market is forecast to expand at a CAGR of 19.24% from 2026 to 2034, propelled by growing acceptance of remote mental healthcare and technological integration.

Key growth drivers include the increasing global burden of mental health disorders, expanded government support, technological advancements, and the convenience of remote access for underserved populations.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us