Tokenization Market Size, Share & Industry Analysis, By Component (Solution and Services), By Application (Payment Security, User Authentication, and Compliance Management), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-Users (BFSI, Retail and Consumer Goods, IT and Telecommunications, Healthcare, Energy and Utilities, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

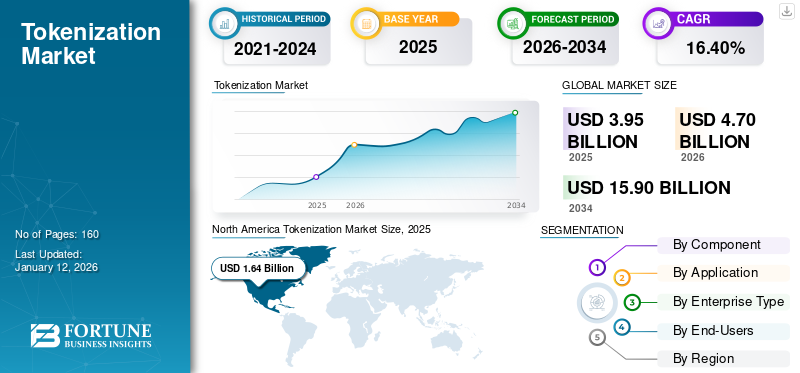

The global tokenization market was valued at USD 3.95 billion in 2025. The market is projected to be worth USD 4.7 billion in 2026 and reach USD 15.9 billion by 2034, exhibiting a CAGR of 16.40% during the forecast period. North America dominated the global market with a share of 34.90% in 2025.

The growth of the industry is due to the increasing adoption of digitization processes and the digital processing of all sensitive data. The rise in complex and simple digital payments has accelerated industry growth. Advances in technology have enabled the provision of advanced data security solutions and services to the market.

During the COVID-19 pandemic, nearly every business has been affected or closed. After the first global pandemic, companies started digitizing their processes to ensure that disruptions did not lead to further delays or stagnation of processes. This digitization means that businesses need to process sensitive consumer data on a regular basis. As companies rapidly digitize their services, this technology has proven to be an excellent tool for ensuring the security of sensitive data. During this extraordinary event, the market grew as a direct result of the influx of digital payments.

The COVID-19 pandemic brought positive change, such as the shift towards digitalization and cashless payment or online commerce, which could be beneficial to this market over time. Since the pandemic, digital payment companies such as Phonepe, Paytm, and Amazon Pay have seen a sudden spike in transactions through their digital wallets..

Tokenization Market Trends

Increasing Demand for Secure Payment Gateways is a Key Trend

Organizations need to manage their security to protect sensitive data from financial and other kinds of fraud. The increasing adoption of payment gateways and an increasing number of government regulations on the use of private information are some of the key trends witnessed in this market.

Due to the growing number of data breaches, the demand for a secure payment gateway is increasing, which is a major key trend in this market. According to Baymard Institute’s research, in 2023, 18% of online carts were left unordered because users didn’t trust the site for payment gateway. Customers are switching to more secure payment gateway options due to the currency involved in the process as a result of the increased adoption of payment gateways. Thus, the rising demand for secure payment gateway is increasing the use of tokenization solutions and services.

Download Free sample to learn more about this report.

Tokenization Market Growth Factors

Rapid Proliferation of Digital Payment Methods to Aid Market Growth

The market is driven by the rapid proliferation of digital payment methods. There are several challenges, especially in terms of security, with the increased use of digital payments. End-users such as retail, healthcare, and banking & insurance use tokenization to replace confidential data in a unique code known as a token, for protection against security breaches due to the volume of digital payments. According to a survey conducted in the year 2021, more than 80% of Americans used digital payments and demanded easier, safer, and faster payments.

Businesses and consumers are seeking solutions to reduce risk exposure while improving compliance, given the increasing incidence of security breaches and threats associated with digital payments. Furthermore, due to fraud and inaccurate information, there is a growing drop in payment card use, which leads to the loss of sales and poor customer experience. Therefore, tokenization as a solution overcomes these obstacles and is being adopted by businesses.

RESTRAINING FACTORS

Absence of Consistent Regulation and Technical Issues to Hamper the Market Growth

A key obstacle to the widespread application of this technology is the lack of regulatory clarity. The current draft standards for security token values are still being developed at an early stage, which is expected to evolve substantially over time. These challenges are creating difficulties for the widespread adoption of tokenization in combination with the borderless nature of the blockchain.

Mostly, where sensitive data is moved to the cloud environment, some organizations also encounter technical issues. As a result, issues related to system integration and regulation could hamper growth during the forecast period.

Tokenization Market Segmentation Analysis

By Component Analysis

Operational Flexibility and Visibility of Tokenization Components to Increase the Demand for Services

Based on the component, the market is segmented into solutions and services. In terms of market share, solutions dominated the market with a share of 54.19% in 2026. This growth is mainly driven by the increasing need to secure compliance with payment security guidelines, ensure constant customer experience, and maintain fraud prevention levels due to an increase in financial crime. In addition, lucrative growth opportunities are seen for the market through increasing consumer interest in digital payment.

The services are expected to grow at a higher CAGR during the forecast period. The growth of this segment can be attributed to the increasing need for visibility between organizations to diagnose and resolve problems before affecting the diagnosis of operations. These services are secure and can be enhanced and tailored. Several service providers and value-added resellers have been helped by the increasing demand for services in this market, which has also encouraged them to increase their partnerships.

By Application Analysis

High Adoption of Advanced Payment Security Measures to Increase the Demand for Payment Security

Based on the application, the market is segmented into payment security, user authentication, and compliance management. In terms of market share, payment security dominated the market with a share of 39.57% in 2026.. The growth is due to the increasing demand for advanced payment security solutions for online retail and across different sectors and the growing need to protect online business transactions from advanced cyber-attacks. Banks are adopting this solution and payment application developers to help protect consumers' sensitive data due to the rapid growth of digital payments.

User authentication is expected to grow at a higher CAGR during the forecast period. The growth of this segment is due to enhanced payment security measures and the need to prevent unauthorized users from accessing devices and networks. Also, an increase in cyberattacks on financial technology services providers and a growing demand for protecting user payment transaction data is increasing the demand for this market.

By Enterprise Type Analysis

Increase in Need of Compliance Rules for SMEs to Aid Market Expansion

Based on enterprise type, the market is segmented into large enterprises and Small & Medium Enterprises (SMEs). Small & Medium Enterprises (SMEs) are expected to significantly grow at a higher CAGR during the forecast period, owing to the need for complying with the rules of tokens with risks related to data fraud. For small businesses, it offers a significant opportunity to simplify operations, increase the engagement of customers and strengthen their growth prospects. Furthermore, the cost and flexibility benefits made available to SMEs justify their preference for operating expense business models over capital expenditure.

As per market share, large enterprises dominated the market with a share of 52.32% in 2026. As a result of the rise in money laundering and other forms of fraud, processing of high risk transactions, as well as cost effectiveness measures to avoid manual operations, large enterprises are implementing tokenization systems.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Due to Need to Secure Highly Sensitive Data of Users to Grow Market Share in BFSI

Based on end-users, the market is categorized into BFSI, retail and consumer goods, IT and telecommunications, healthcare, energy and utilities, and others. Among these, BFSI dominated the market with a share of 26.13% in 2026. The BFSI industry invests largely to prevent any malicious data breaches and protect its data. In all their service offerings, the firms in this industry deal with highly sensitive data. The dependence and use of tokens and their techniques in this industry have increased due to the growing number of digital financial services and digital payments.

Retail and consumer goods are expected to grow at a higher CAGR during the forecast period significantly. Due to its importance in data protection, this industry invests heavily in the market. A large number of transactions are carried out on an ongoing basis in online shopping. Retailers and consumer goods companies are using tokenization to make safe payments easier and more efficient while protecting users from sensitive payment data.

REGIONAL INSIGHTS

Regionally, this market is fragmented into North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America Tokenization Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

As per the analysis, North America dominated the global market in 2025, with a market size of USD 1.64 billion. due to the presence of large players in countries such as the U.S., Canada, and Mexico, where new technologies have been adopted rapidly. Most Americans use some online payment mode for transactions. The regional market is driven by market trends in North America, such as buy now and pay later with cryptocurrencies. In addition, global payment networks for online transactions are largely provided by firms based in the U.S., such as Visa and Mastercard, providing a further boost to market growth. The U.S. market is projected to reach USD 1.04 billion by 2026. For instance,

- According to Visa in 2022, more than 90% of North American payment volume is aided to support digital tokens.

To know how our report can help streamline your business, Speak to Analyst

The UK market is projected to reach USD 0.23 billion by 2026, while the Germany market is projected to reach USD 0.18 billion by 2026.

Asia Pacific is expected to grow at a significantly higher CAGR during the forecast period. The growing penetration of smartphones, extensive internet usage and rapid adoption of advanced payment security technologies are driving the regional market. Moreover, owing to the proliferation of real-time payment platforms such as P2P money transfers and mobile payment platforms, the region is experiencing an increasing incidence of fraud. The Japan market is projected to reach USD 0.29 billion by 2026, the China market is projected to reach USD 0.32 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

Middle East & Africa is expected to register the second-highest CAGR during the forecast period. The rapid expansion of innovation and the digitization of data in this part of the region has led to a proliferation of tokenization technologies.

Key Industry Players

Market Players Announce Merger & Acquisition, Partnerships, and Product Development Strategies to Promote Reach

Prominent players operating in the global market focus on providing flexibility and secure solutions and services, by switching out to data security techniques. These companies focus on acquiring small and local firms to expand their business presence. Moreover, the merger & acquisitions, strategic partnerships, and leading investments in device technologies help increase the market growth.

List of Top Tokenization Companies

- Visa (U.S.)

- Fiserv, Inc. (U.S.)

- Mastercard (U.S.)

- Open Text Corporation (Canada)

- TrustCommerce (U.S.)

- American Express (U.S.)

- Thales (France)

- TokenEx, Inc (U.S.)

- Entrust Corporation (U.S.)

- FIS (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: The Bank for International Settlements (BIS) Innovation Hub launched a tokenization project and will advance CBDC research on payment privacy. The Bank for International Settlements (BIS) Innovation Hub will launch a tokenization based on a blockchain project and further develop a privacy testing program for central banks' digital currencies.

- December 2023: Akemona, Inc., an asset tokenization platform and funding portal, announced agreements with new issuers to enable global equity token offerings on the Akemona platform. Akemona, Inc., which operates under the U.S. Securities and Exchange Commission (SEC), offers issues with smart bonds and digital stocks and provides asset tokenization services to corporations and financial institutions across the globe.

- April 2023: Imperva, Inc., provider of cybersecurity services protecting critical applications, API and data, partnered with Fortanix to become a member of their strategic partner program. The emphasis of this partnership is on multi-cloud data protection. The ability to manage the entire data security process for customers ensures Imperva and Fortanix's joint Component provides data privacy and compliance.

- January 2023: Marqeta announced the introduction of a new web deployment product for its global modern card-acquiring platform with tokenization capabilities. By providing provisioning for web push services, Marqeta customers can reduce friction at Point of Sale without requiring users to download a mobile application and enabling them to pay directly from their mobile wallet.

- January 2023: OpenText announced the acquisition of Micro Focus, a provider of critical software technology and services that assist customers in accelerating digital transformation. This acquisition expands OpenText's corporate mission to help business professionals protect their activities, gain greater insight into their information, and better manage the new generation of tools.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Application

By Enterprise Type

By End-Users

By Region

|

Frequently Asked Questions

The market is projected to reach USD 15.9 billion by 2034.

In 2025, the market value stood at USD 3.95 billion.

The market is projected to grow at a CAGR of 16.40% during the forecast period.

BFSI is likely to lead the market.

Rapid proliferation of digital payment methods in tokenization to aid market growth.

Visa, Fiserv, Inc., Mastercard, Open Text Corporation, TrustCommerce, American Express, Thales, TokenEx, Inc, Entrust Corporation, and FIS are the top players in the global market.

North America is expected to hold the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us