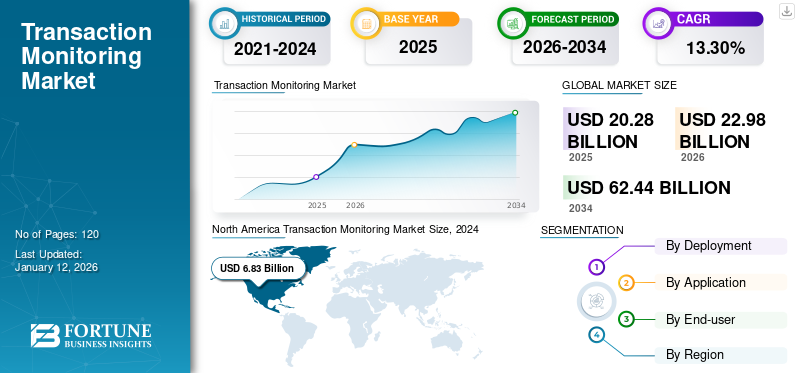

Transaction Monitoring Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Application (Customer Identity Management, Anti-Money Laundering, Compliance Management, and Fraud Detection and Prevention), By End-user (Banks, Fintechs, E-commerce, and Others), and Regional Forecast, 2026 – 2034

TRANSACTION MONITORING MARKET OVERVIEW AND FUTURE OUTLOOK

The global transaction monitoring market size was valued at USD 20.27 billion in 2025. The market is projected to grow from USD 22.98 billion in 2026 to USD 62.44 billion by 2034, exhibiting a CAGR of 13.30% during the forecast period. The North America dominated global market with a share of 37.26% in 2025.

Transaction monitoring is the process of observing, analyzing, and assessing financial transactions in real-time or batch mode to identify suspicious or fraudulent activities. It is primarily used by financial institutions, businesses, and regulatory bodies to comply with Anti-Money Laundering (AML) regulations, detect financial crimes, and ensure transaction security. As financial crimes grow increasingly sophisticated, transaction monitoring systems are expected to evolve with enhanced AI, blockchain integration, and predictive analytics. It will continue to play a critical role in ensuring financial integrity, bolstering compliance, and protecting businesses from fraud and regulatory penalties.

The market is dominated by established and emerging players, such as Oracle Corporation, Experian Information Solutions, Inc., SAS Institute Inc., FICO, FIS, and Ondato. These players focus on developing advanced Transaction Monitoring Systems (TMS) that leverage technologies such as artificial intelligence and machine learning. For instance,

- SAS Institute Inc. uses AI-powered analytics for real-time fraud detection and adaptive learning to improve accuracy

- FICO offers advanced fraud detection solutions with predictive analytics and ML capabilities.

The COVID-19 pandemic accelerated digital transformation and reshaped the transaction monitoring market by increasing the reliance on digital payments, online banking, and e-commerce. The surge in digital transactions created more opportunities for fraud, such as phishing, account takeovers, and money laundering, highlighting the need for advanced transaction monitoring tools. In the post-pandemic financial institutions turned to AI and machine learning technologies to manage the increasing volume and complexity of transactions.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Increasing Demand for Enhanced Anomaly Detection Aids Market Growth

Generative AI models analyze vast datasets to detect subtle patterns and irregularities in transactions that traditional systems might miss. The GenAI model helps financial institutions reduce false positives by providing more precise insights into unusual behavior. AI models generate profiles of typical customer behavior and compare them to real-time activity to identify deviations. Moreover, generative AI plays an important role in identifying emerging fraud schemes and proactively generating countermeasures. It also automates the generation of Suspicious Activity Reports (SARs), ensuring timely compliance with regulatory requirements. The use of a generative AI model reduced manual intervention, saving time and resources and thus improving operational efficiency.

- For instance, in October 2024, Experian Information Solutions, Inc. launched Experian Assistant, a new generative AI-enabled solution. This solution helps to accelerate the modeling cycle by reducing the model-development timeline from months to days, empowering users to use their data quickly.

MARKET DYNAMICS

Market Drivers

Increasing Financial Fraud and Cybercrime Drive Need for Transaction Monitoring Systems (TMS)

A rise in sophisticated cyber threats such as phishing, identity theft, and transaction tampering is driving the need for robust TMS. Traditional monitoring systems struggle to detect these evolving threats, owing to this, financial institutions seek advanced monitoring tools to detect and mitigate fraud in real time. The rapid adoption of online banking, digital payments, and e-commerce has significantly expanded the surface area for fraud. Monitoring tools are essential to analyze large volumes of transactions and identify anomalies quickly. Moreover, the rise of fintech platforms, cryptocurrencies, and mobile wallets introduces additional risks, such as unregulated transactions and anonymous transfers. Transaction monitoring solutions help mitigate these risks by ensuring transparency and compliance across diverse payment channels, boosting the transaction monitoring market growth. For instance,

- In April 2024, Oracle Corporation unveiled its AI-powered platform known as Oracle Financial Services Compliance Agent. This platform is developed to help banks in minimizing the risks associated with money laundering.

Market Restraints

High Implementation Costs and Data Privacy Concerns May Hinder Market Growth

Setting up TMS involves significant investments in software, hardware, and infrastructure. Small and Medium Sized Enterprises (SMEs) often find it difficult to afford these solutions, limiting adoption in certain market segments. This monitoring system processes sensitive financial and personal data, raising concerns about data breaches and compliance with privacy laws such as the General Data Protection Regulation (GDPR) or the Central Consumer Protection Authority (CCPA). Organizations may hesitate to adopt such solutions due to fear of reputational damage or regulatory penalties in case of data misuse. Thus, these factors are expected to hinder market growth.

Market Opportunities

Increasing Adoption of Cloud-based Solutions to Create Lucrative Opportunities for Market Growth

The shift toward cloud-based TMS allows organizations to scale operations, reduce costs, and improve accessibility. SaaS-based solutions are particularly appealing to Small and Medium Sized Enterprises (SMEs). Organizations are prioritizing real-time fraud detection to mitigate risks and enhance customer trust, presenting a significant growth opportunity for solution providers. Moreover, partnerships between transaction monitoring providers and fintech companies create opportunities to innovate and expand market reach. These collaborations can drive the development of tailored solutions for niche markets.

TRANSACTION MONITORING MARKET TRENDS

Increasing Emphasis on Real-time Monitoring and Updates Boosts Market Growth

With the rise of global trade and cross-border transactions, organizations require monitoring systems capable of handling multi-currency and jurisdictional complexities. Cross-border transaction monitoring solutions are becoming a critical focus in banking financial services and insurance sectors. In addition, businesses are seeking monitoring systems that offer seamless integration, user-friendly interfaces, and minimal disruption to customer experiences. Enhancing customer satisfaction through advanced and efficient systems provides a competitive advantage. Monitoring systems are being tailored to specific business needs, offering customizable dashboards, user-friendly interfaces, and industry-specific features. This trend improves user experience and system effectiveness. For instance,

- In January 2024, Novatus Advisory unveiled Transaction Reporting Assurance (TRA), a new transaction monitoring solution designed to assist companies in ensuring transaction reporting.

SEGMENTATION ANALYSIS

By Deployment

Cloud Segment Led due to Growing Demand for Real-time Monitoring Updates and Global Accessibility

Based on deployment, the market is bifurcated into cloud and on-premises.

Cloud-based deployment captured the largest market share of 75.63% in 2026 and it is expected to continue its dominance by growing at the highest CAGR during the forecast period. Cloud platforms support real-time monitoring and seamless updates to stay ahead of emerging fraud patterns. With a cloud-based platform, continuous system enhancements are provided without downtime. Furthermore, cloud systems enable remote access, allowing teams to monitor transactions from anywhere.

On-premises deployment is expected to grow at a prominent CAGR in coming years, as they provide full control over sensitive data, which is critical for organizations handling confidential financial information. They are often chosen in highly regulated industries such as banking, insurance, and healthcare. Unlike cloud-based solutions, on-premises systems do not rely on constant internet connectivity, ensuring uninterrupted operation.

By Application

Rising Demand for Risk Assessment and Enhanced Reporting Boosted Popularity of Anti-Money Laundering Segment

Based on application, the market is divided into customer identity management, anti-money laundering, compliance management, and fraud detection and prevention.

Anti-money laundering captured the largest market share in 2024, as they evaluate transaction risk levels based on customer profiles, transaction amounts, and geographic locations. These systems support risk-based approaches to monitoring and compliance, facilitate the generation of streamlined Suspicious Activity Reports (SARs) and other compliance documentation. The use of a monitoring system reduced the burden of manual reporting processes. The segment is set to capture 34.10% of the market share in 2026.

Customer identity management is expected to grow at the highest CAGR of 17.78% during the forecast period (2025-2032), as it verifies customer identities and maintains accurate records for Know Your Customer (KYC) requirements. Additionally, monitoring systems create a detailed customer risk profiles by analyzing historical and real-time data, helping identify high-risk individuals or entities. This plays an important role in fueling the segment growth during the forecast period.

By End-user

Banks Segment Leads due to Surge in Demand for Improving Customer Experience

Based on end-user, the market is classified into banks, fintechs, e-commerce, and others (insurance companies, crypto, etc.).

Banks captured the highest market share in 2024, as TMS provides risk-based analysis to assess transaction risks based on customer profiles and behavior. This system helps banking institutions prioritize high-risk accounts for further investigation. Moreover, TMS automates compliance processes, reducing the risk of regulatory penalties, which plays a vital role in enhancing customer experience in banks. The segment is likely to capture 39.46% of the market share in 2026.

E-commerce companies are expected to grow at the highest CAGR of 17.17% during the forecast period. The surge in digital payments and e-commerce transactions has increased the need for robust monitoring systems. TMS tracks high transaction volumes to detect fraudulent purchases or account misuse. Furthermore, by ensuring secure payment processes, e-commerce companies build trust with customers, protecting both buyers and sellers from fraudulent activities.

To know how our report can help streamline your business, Speak to Analyst

TRANSACTION MONITORING MARKET REGIONAL OUTLOOK

North America

North America held the largest transaction monitoring market share with a valuation of 37.26% in 2025 and USD 8.38 billion in 2026, owing to stringent regulatory frameworks, a high volume of digital transactions, and a rapidly evolving financial services ecosystem. Increasing incidents of financial fraud, identity theft, and cyberattacks in the U.S. and Canada are propelling the demand for robust monitoring systems. TMS helps detect fraudulent transactions in real-time, minimizing financial losses. North America leads in adopting AI, machine learning, and big data analytics in transaction monitoring, which makes TMS more efficient in the region.

- For instance, in March 2024, Treasury Prime, the U.S.-based company engaged in a collaboration with Effectiv, a fraud and risk management platform for banks and fintech firms. This partnership would help companies and financial institutions associated with Treasury Prime to use transaction monitoring solutions.

North America Transaction Monitoring Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Organizations in the U.S. are increasingly using AI and ML technologies to enhance the accuracy and efficiency of TMS. The country’s robust regulatory environment, advanced technological infrastructure, and high transaction volumes position it as a leader in North America in TMS adoption, with continued growth expected across sectors. These factors play an important role in fueling market growth across the U.S. The U.S. market is set to reach a market value of USD 5.96 billion in 2026.

South America

The adoption of TMS is growing significantly in South America, driven by increase in cybercrimes, fraud, and money laundering activities, necessitating robust TMS adoption. The region relies heavily on payment flows, requiring TMS solutions to monitor and secure these transactions. The rapid growth of digital banking, mobile payments, and e-commerce platforms in South America is driving the demand for TMS.

Europe

Europe is the third largest market, anticipated to hold USD 5.18 billion in 2026. In Europe, the market is growing at a prominent pace. The U.K. market is likely to gain USD 0.98 billion in 2026. The European Union’s Interconnected financial systems require robust monitoring for cross-border payments, and TMS ensures transparency and security in multi-jurisdictional transactions. Regulations such as the EU Anti-Money Laundering Directives (AMLD) and General Data Protection Regulation (GDPR) drive the adoption of TMS in the region. Banks, financial institutions, and e-commerce companies adopt TMS to meet compliance requirements and avoid penalties. For instance,

- In 2023, A European investment bank engaged in a contract with PwC to support their in-house KYC work to identify clients' entities quickly.

Germany is projected to reach a market value of USD 0.95 billion in 2026, while France is set to reach USD 0.76 billion in 2025.

Middle East & Africa

The Middle East & Africa (MEA) is expected to grow at the second-fastest CAGR of 16.90% during the forecast period. In terms of valuation, Middle East & Africa is the fourth largest market and is estimated to hold USD 1.99 billion in 2026. The rise of mobile banking and digital wallets in MEA is increasing the need for robust transaction monitoring. TMS helps ensure these platforms against fraud. MEA has witnessed an increase in financial fraud, money laundering, and terrorist financing, prompting organizations to invest in real-time monitoring systems. With MEA being a hub for international trade, TMS adoption is crucial for monitoring cross-border financial activities. For instance,

- In September 2024, Eastnets engaged in a regional partnership with Simpaisa in Dubai, UAE. Through this partnership, Eastnets would provide its Compliance Technology to Simpaisa to enhance its fraud protection and regulatory compliances.

The GCC market is set to acquire USD 0.54 billion in 2025.

Asia Pacific

Asia Pacific is the second largest market expected to acquire USD 5.90 billion in 2026, as the rapid growth of e-commerce, mobile payments, and digital wallets in APAC countries has increased the need for TMS. China is estimated to reach a value of USD 1.38 billion in 2026. Real-time monitoring solutions ensure the security of high-frequency transactions. Countries such as China, India, and Australia have implemented stringent AML and Counter-Terrorism Financing (CTF) regulations. Moreover, APAC has witnessed a surge in cybercrime and financial fraud due to the growing adoption of digital payments. The adoption of TMS provides a proactive approach to fraud detection and prevention.

- For instance, in October 2024, the government of India is collaborating with fintech companies to develop a transaction monitoring and Anti-Money Laundering (AML) system to address financial frauds in India.

India is projected to attain USD 0.91 billion in 2026, while Japan is likely to hold USD 1.22 billion in the same year.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Transaction Monitoring Companies Profiled:

- Oracle Corporation (U.S.)

- Experian Information Solutions, Inc. (Ireland)

- FICO (U.S.)

- SAS Institute, Inc. (U.S.)

- FIS (U.S.)

- Ondato (U.K.)

- Vespia OU (Estonia)

- Moody’s Corporation(U.S.)

- NICE Actimize (U.S.)

- Acuity Knowledge Partners (U.K.)

- Unit21, Inc. (U.S.)

- Fiserv, Inc. (U.S.)

- EastNets (U.A.E.)

- ACI Worldwide (U.S.)

- AML Watcher (U.S.)

- Merkle Science (U.S.)

- Fenergo (Ireland)

- HAWK (Germany)

- CaseWare (Canada)

- IdentityMind (U.S.)

..and more

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Crystal Intelligence engaged in a partnership with Clear Junction, a provider of correspondent account services. Through this collaboration, the company aims to enhance regulatory controls and security for its digital asset transactions.

- June 2024: Finastra, financial software applications engaged in a partnership with Sumsub. Through this partnership, Finastra and Sumsub aim to work on mutual projects and provide anti-fraud solutions to the banking sector.

- March 2024: DataVisor, a provider of AI-powered fraud and risk platform launched an end-to-end Anti-Money Laundering (AML) solution. This solution is powered by AI and ML technologies, which help to keep real-time track of financial activities.

- October 2023: WorkFusion, a provider of AI digital solutions for banking services launched a novel Digital Worker, an AI-enabled Transaction Monitoring Investigator. This solution allows Anti-Money Laundering (AML) analysts to emphasize on the highest-risk activity.

- June 2023: Hawk AI engaged in a partnership with Scorechain, a provider of crypto AML compliance solutions. Through this partnership, the company unveiled an end-to-end transaction monitoring solution for banks and FinTech firms.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Strategic partnerships play a crucial role in accelerating the transaction monitoring market growth by enhancing technological capabilities, expanding market reach, and improving compliance solutions. Key players operating in the market, such as Oracle Corporation, Experian Information Solutions, Inc., SAS Institute Inc., FICO, FIS, and Ondato are engaged in partnerships with financial institutions, fintech companies, and e-commerce companies to enhance their product offerings, compliance capabilities, customer bases, and market reach. These factors are expected to create a lucrative opportunity for the market growth. For instance,

- In January 2024, AMLYZE, a provider of anti-financial crime solutions for banks and fintech companies engaged in a partnership with TransactionLink. Through this collaboration, AMLYZE will provide its anti-money laundering solution to TransactionLink’s clients to revolutionize their AML/KYC efforts.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By End-user

By Region

|

|

Companies Profiled in the Report |

Oracle Corporation (U.S.), Experian Information Solutions, Inc. (Ireland), FICO (U.S.), SAS Institute, Inc. (U.S.), FIS (U.S.), Ondato (U.K.), Vespia OU (Estonia), Moody’s Corporation (U.S.), NICE Actimize (U.S.), Acuity Knowledge Partners (U.K.), etc. |

Frequently Asked Questions

The market is expected to reach USD 62.44 billion by 2034.

In 2025, the market was valued at USD 20.27 billion.

The market is projected to grow at a CAGR of 13.30% during the forecast period.

By application, anti-money laundering segment led the market.

Increasing financial fraud and cybercrime are key factors driving the market growth.

Oracle Corporation, Experian Information Solutions, Inc., FICO, SAS Institute, Inc., FIS, Ondato, Vespia OU, Moody’s Corporation, NICE Actimize, and Acuity Knowledge Partners are the top players in the market.

North America held the highest market share.

By end-user, the e-commerce segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us