U.K. Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (Machine Learning, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

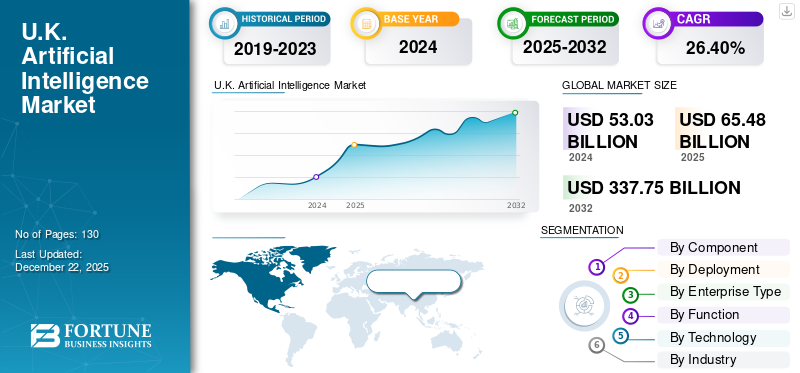

U.K. artificial intelligence market size was valued at USD 53.03 billion in 2024. The market is projected to grow from USD 65.48 billion in 2025 to USD 337.75 billion by 2032, exhibiting a CAGR of 26.40% during the forecast period.

As of 2025, the U.K. has established itself as a global competitor in artificial intelligence, enabled by cutting-edge research, strong private sector engagement, and a range of government policies. The U.K. AI ecosystem evolved from early-stage experimentation to large, fully-integrated and impactful deployments in a range of sectors across the economy, including healthcare, finance and manufacturing. The U.K.'s very vibrant AI ecosystem continued to grow through private and government investment, a deep skills base, and world-class universities.

- In April 2025, the Open University (OU) partnered with the Institute of Coding (IoC) to provide free courses in cybersecurity, coding, and AI for individuals aged 18-35 across the U.K.

As the demand for AI-driven solutions skyrocketed, the U.K. became a hub for AI research, development, and commercialization, drawing both domestic and international players to capitalize on its innovation-driven growth.

Impact of Generative AI

The impact of generative AI on the U.K. AI market is significant in stimulating innovation in content generation, creative industries, and automation. Generative AI tools are being adopted in businesses, particularly in the media, entertainment, and e-commerce sectors, allowing them to create high-quality, personalized content delivered at scale for improved engagement and new levels of productivity.

- According to the Accountant Online, over 18 million people in the U.K. have now used Generative AI.

Helping the creative industries, generative AI is reigniting design; users can implement large-scale rapid prototyping and real-time personalization, and generative AI is also improving customer support through chatbots and virtual assistants that use AI to assist customers.

Impact of Reciprocal Tariffs

Reciprocal tariffs can disrupt the U.K.'s AI market by raising the cost of importing essential technologies such as AI hardware and software. This could hinder the development and adoption of AI in key sectors such as healthcare and finance, as businesses face higher costs for crucial components.

- For instance, if the U.K. imposes tariffs on AI hardware from the U.S., a U.K.-based AI startup working on healthcare solutions might face higher costs for essential components. This could lead to price hikes for their products, making them less competitive and slowing innovation in the sector.

This could hinder innovation, especially for startups, and decrease U.K. competitiveness in the global race for AI. In the long run, these tariffs threaten to alter supply chains that are vital for AI development.

Key takeaways

- The U.K. Artificial Intelligence Market is projected to be worth USD 337.75 billion in 2032.

- In the by component segmentation, Software accounted for around 48.1% of the U.K. Artificial Intelligence Market in 2024.

- In the by deployment segmentation, Cloud is projected to grow at a CAGR of 28.0% in the forecast period.

- In the by enterprise type segmentation, Large Enterprises accounted for around 61.1% of the market in 2024.

- In the by function segmentation, Risk is projected to grow at a CAGR of 29.3% in the forecast period.

- In the by technology, Machine Learning accounted for around 40.6% of the market in 2024.

- In the by industry segmentation, Healthcare is projected to grow at a CAGR of 33.9% in the forecast period.

U.K. Artificial Intelligence Market Trends

Investment in AI Startup to be Key Driver for Market Growth

Investment in AI Startups and Innovation is one of the top trends in the U.K. AI market, complemented by government initiatives, such as the UK AI Strategy, supported by venture capital. These investments are contributing to and building a dynamic startup ecosystem in the U.K. where many new AI companies are quickly receiving considerable funding for the development of innovative applications or services based on machine learning, automation, big data, and data analytics.

- According to analysis from HSBC Innovation Banking and Dealroom, U.K. AI startups raised a record USD 2.40 billion in venture capital during the first half of 2025, accounting for 30% of all VC funding in the country, up from 13% a decade ago.

Furthermore, an array of AI incubators and accelerators are providing necessary support for early-stage companies to advance and commercialize advanced technologies that leverage AI.

U.K. Artificial Intelligence Growth Factors

Increasing Use of AI in Healthcare to Boost Market Growth

The increasing focus on AI in healthcare, which is a major driver to the U.K.'s AI market, is driven by the NHS's increasing application of AI to improve patient care and improve efficiencies in operations. AI is being used for predictive diagnostics, drug discovery, personalized medicine, patient management systems, improving outcomes, and lowering cost.

- In June 2025, U.K. became the first country to join the HealthAI Global Regulatory Network, led by the Medicines and Healthcare Products Regulatory Agency (MHRA). This partnership aims to speed up the safe and effective use of AI in healthcare worldwide, improving patient care, reducing NHS waiting times, and promoting health tech innovation.

While government support and initiatives such as the NHS AI Lab position the U.K. as a potential global leader in healthcare driven by AI, the abundance of healthcare data in the U.K. strengthens this position. Along with an advanced research ecosystem, this abundance of data helps to magnify AI's potential in driving innovation and growth in the healthcare sector.

U.K. Artificial Intelligence Market Restraints

Regulatory and Legal Uncertainty Challenges Hinder Market Growth

While the absence of a clearly defined legal framework in relation to AI in the U.K. complicates its development and adoption, the U.K. is developing an AI strategy and is aware of the challenges. Regulatory uncertainty remains, notably in contexts such as healthcare, finance, and autonomous vehicles where new laws, new regulations, or new guidance could be produced at any stage.

- For instance, companies operating in the EU must comply with the law, or face fines up to 7% of global annual revenue.

Without clarity in regulations, liability, and accountability exist within ambiguity when AI systems may cause harm or make errors.

U.K. Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

Software dominates the market, due to the uptake of AI platforms, machine-learning frameworks, and data analytics systems, across all sectors. As organizations integrate AI software applications for automation purposes, decision-making, and customer engagement, the range of software is now the main component of AI deployment in sectors such as finance, healthcare, and retail.

Hardware is expected to grow at the fastest CAGR, driven by the growing opportunities for high-performance computing infrastructure such as AI chips, GPUs, and edge devices.

- For instance, in October 2024, the UK’s Advanced Research and Invention Agency (ARIA) announced to invest USD 70 million to 57 AI hardware projects aimed at redefining how AI systems are built and scaled.

The training and real-time inference of AI models is becoming more complex and data intensive, and as we witness that trend increase, demand for specialized hardware to support AI workloads is increasing. Especially in areas such as autonomous systems, robotics, and industrial IoT.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

Cloud deployment has the largest share, and is expected to have the highest CAGR in the market due to the demand for agility and rapid scalability in firms' artificial intelligence strategies. The digital transformation in businesses has created a shift to using cloud infrastructure which does allow for faster model training, integration, and upfront costs. Given the growing demand for AI-oriented cloud services and support for hybrid and multi-cloud deployment options, it is reasonable to witness cloud deployment lead in the area of current adoption and future U.K. artificial intelligence market growth across industries.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large companies hold a majority in the U.K. AI market as they have better access to capital, advanced infrastructure, and a stronger focus on digital innovation. Large firms can use AI to improve efficiencies, automate processes, and gather new insights across systems and large datasets.

At the same time, SMEs are predicted to have the highest CAGR since AI is being made more accessible due to cloud-based tools, open-source platforms, and AI-as-a-Service. As awareness and understanding of AI for improving productivity and competitiveness continues to grow, small and medium-sized enterprises are actively adopting AI solutions to meet their needs and budget.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

The largest segment of the market is AI services, including predictive analytics, customer service automation, and intelligent recommendation systems. These AI applications are widely utilized across sectors such as retail, finance, and healthcare for improved efficiencies, increased user engagement, and better informed, data-driven decisions. Additionally, recent collaboration in the country to enhance the use of AI for service also supports this trend.

- In July 2025, TalkTalk partnered with NiCE to deploy the CXone Mpower AI platform, streamlining customer service with automated tools and real-time resolutions. This collaboration aims to enhance customer experience, simplify operations, and set a new standard for AI-driven support in the UK telecom industry.

Risk-related AI functionality is expected to grow at the highest CAGR as organizations experience increased pressure to preemptively manage threats amidst a challenging and complex data-heavy environment. AI is rapidly being adopted for use cases such as fraud detection, cybersecurity threat analysis, credit scoring, and regulatory compliance.

- According to Vention, 41% of U.K. financial firms use AI to optimize internal processes, with 37% leveraging it for cybersecurity and 33% for fraud detection, highlighting the growing role of AI in automating back and middle office operations.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning, by technology, holds the largest share of the U.K. artificial intelligence market share, and it's also expected to grow at the largest CAGR. The dimensions of machine learning dominance are characterized by its ability to process large amounts of data, recognize patterns, learn continuously, and improve performance. There is a strong demand for machine learning across sectors, including healthcare, finance, retail, and manufacturing. It also complements a range of applications, such as predictive analytics, customer personalization, fraud detection, and automation of processes.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

The BFSI sector holds the majority share in the market, as financial institutions increasingly rely on AI for fraud detection, risk assessment, algorithmic trading, and personalized customer services. The sector's strong investment capacity and focus on data-driven decision-making have made it a leading adopter of AI technology.

Meanwhile, the healthcare industry is projected to experience the highest growth in AI adoption, driven by rising demand for AI-powered diagnostic tools, medical imaging analysis, virtual health assistants, and predictive analytics. With growing pressure to improve patient outcomes and operational efficiency, healthcare providers are accelerating AI adoption, positioning the industry for rapid expansion in the coming years.

List of Key Companies in U.K. Artificial Intelligence Market

The U.K. AI market is driven by innovative companies such as Wayve, which is pioneering self-driving technology using end-to-end deep learning. Other companies include Graphcore, known for its advanced AI chips (IPUs) that power next-gen machine learning; and Quantexa, whose Contextual AI platform helps enterprises make smarter decisions through connected data insights. DIGICA brings AI to the edge in sectors such as automotive and space, delivering real-time, mission-critical solutions, while PolyAI is transforming customer service with sophisticated voice assistants that handle complex conversations at scale. Together, these firms reflect the U.K.’s focus on practical AI applications, deep tech innovation, and global competitiveness.

LIST OF KEY COMPANIES PROFILED

- Wavye (U.K.)

- Graphcore (U.K.)

- Quantexa (U.K.)

- Darktrace Holdings Limited (U.K.)

- DIGICA (U.K.)

- PolyAI Limited (U.K.)

- Thought Machine Group Limited (U.K.)

- Vention (U.K.)

- DeltaAI (U.K.)

- Evolution Artificial Intelligence Ltd (U.K.)

- Exometrics Ltd. (U.K.)

- Appinventiv (U.K.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: OpenAI signed a deal with the U.K. government to use AI to improve public services, including education, defense, security, and justice. The agreement allows OpenAI access to government data and involves developing an "information sharing program" while ensuring safeguards for privacy and democratic values. The deal also includes investment in AI infrastructure and expansion of OpenAI's London office.

- February 2025: Kyndryl has launched a new technology hub in Liverpool, U.K., aiming to create up to 1,000 AI and software engineering jobs over the next three years. The hub will support digital transformation and AI innovation, helping U.K. and global clients. Kyndryl will also expand its partnership with The Very Group to enhance digital capabilities.

REPORT COVERAGE

The U.K. AI market continues to grow as a dynamic and strategically important sector, marked by rapid innovation, strong public-private collaboration, and increasing commercial adoption. This evolving landscape is driven by advancements in generative AI, machine learning infrastructure, and responsible AI practices across key industries such as healthcare, finance, defense, and manufacturing. The market benefits from a robust ecosystem that includes leading AI startups, academic research hubs, and major technology firms, all contributing to breakthrough applications and scalable solutions. In parallel, government policies, funding initiatives, and talent development efforts are reinforcing the U.K.’s global standing as a center for ethical AI development, commercialization, and cross-sector integration.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 26.40% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Deployment

|

|

|

By Enterprise Type

|

|

|

By Technology

|

|

|

By Function

|

|

|

By Industry

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 53.03 billion in 2024.

The market is expected to exhibit a CAGR of 26.40% during the forecast period.

By industry, the BFSI segment is set to lead the market.

Wavye, Graphcore, Quantexa, and Darktrace are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us