U.S. Automotive Cabin Air Filter Market Size, Share, Industry Analysis, By Type (Particulate Filters and Combination Filters), By Vehicle Type (Passenger Vehicle (Hatchback, Sedan, and SUV) and Commercial Vehicle (Light Commercial Vehicle and Heavy Commrcial Vehicle)), By Sales Channel (OEM and Aftermarket), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

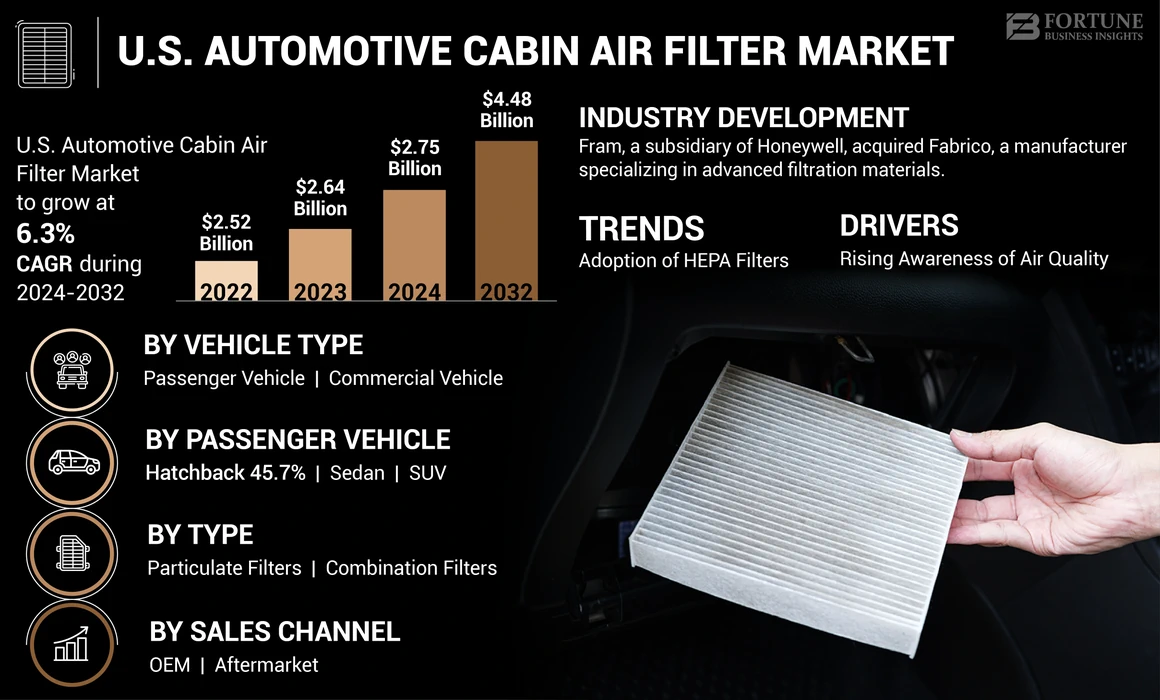

The U.S. automotive cabin air filter market size was valued at USD 2.64 billion in 2023 and is projected to grow from USD 2.75 billion in 2024 to USD 4.48 billion by 2032, exhibiting a CAGR of 6.3% during the forecast period.

A cabin air filter increases the quality of air in a vehicle. The amount of exposure to harmful allergens gets less as the air pollutants gets trapped into this filter before coming into the vehicle cabin. The primary function of an air filter in a vehicle should be cleansing the incoming air to make it cleaner and more pleasant for people inside. Contaminants, such as particles, dust, and pollen enter the HVAC system and then are filtered out by the cabin air filter.

Market Dynamics

Market Drivers

Rising Awareness of Air Quality to Result in Significant Market Growth

A major driving factor of the U.S. automotive cabin air filter market growth, especially in urban areas, is rising consciousness about air quality. As stated by many researches, the air inside one's vehicle can contain a greater concentration of pollutants than the air outdoors, primarily due to emissions from traffic, industrial pollution, or some allergens, such as pollen and dust. This realization has raised much concern about respiratory health, especially among those who already have conditions, such as asthma or allergies. Due to the increased awareness, the demand for cabin air filters of high quality with advanced technologies is increasing. Many modern filters, now designed with HEPA or containing activated carbon layers, capture finer particles and more harmful gases compared to the standard filters.

Market Restraint

High Manufacturing and Installation Costs to Act As Major Market Restraint

Producing high-quality cabin air filters often incurs high costs due to the material used and technology applied. It is quite expensive to use specialized materials and processes to produce advanced filters, such as those equipped with HEPA or activated carbon. Therefore, the additional cost of manufacturing may be shifted to consumers, raising retail prices for premium filters.

Installation of these filters also incurs cost. Some consumers hire professionals to install them, which can cost between USD 36 to USD 50 or more depending on the vehicle and complexity. Others replace filters themselves. However, the need for specific tools or knowledge about the vehicle's HVAC system may discourage DIY replacements, especially among less experienced car owners.

Market Opportunities

Growing Aftermarket Potential to Offer Market Expansion Opportunity

The U.S. automotive cabin air filter aftermarket has a lot of growth opportunities due to growing vehicle ownership and increased awareness among people regarding the importance of car maintenance. The demand for replacement parts, including cabin air filters, will rise in accordance with the number of buyers purchasing vehicles. Health hazards are one of the prominent drivers that will boost the sales of automotive cabin air filters since, they considerably minimize exposure to allergens and pollutants. More importantly, the rise of the e-commerce market has altered the dynamics of the aftermarkets. It has enabled consumers to access a variety of other products and compare their features and prices.

This convenience promotes intelligent buying decisions. Additionally, the aftermarket caters to various consumer groups, such as those seeking special filters that aim to reduce allergy cases or remove odor. The active promotion of the necessity of filter replacements can further increase the product demand. Overall, the automotive cabin air filter aftermarket in the U.S. is likely to witness substantial growth as the economy continues to create more jobs, awareness increases, e-commerce continues to expand, and opportunities for product innovation open up in the market.

Market Challenge

Lack Of Maintenance Awareness Poses Major Challenge for Market Development

The main reason impacting the U.S. automotive cabin air filter market growth is the lack of awareness with regards to the maintenance of these filters. Customers often fail to recognize the key role cabin air filters play in increasing the quality of air within the automobiles and also do not replace them from time to time. This oversight increases the length of time that clogged filters are in use, which negatively impacts air quality within the vehicle, increases the burden on the HVAC system, and boosts energy consumption, resulting in high repair costs.

Manufacturers and retailers can capitalize on this problem by educating consumers on the need to frequently replace filters through targeted marketing campaigns that communicate the impact of infrequent or non-replacement of filters on health and vehicle performance. The awareness created among people concerning the significance of air filter maintenance will foster greater demand for them in the market and increase consumers’ satisfaction with their vehicles.

Download Free sample to learn more about this report.

U.S. Automotive Cabin Air Filter Market Trends

Adoption of HEPA Filters to Become Major Market Trend

A key trend changing the automotive industry landscape is the electrification of vehicles. In the cabin air filter sector, this trend is crucial to the industry as hybrid vehicles and EVs are increasingly being introduced in the market. As these vehicles become more available, the demand for special-purpose-built cabin air filter systems for these vehicles will rise. EVs purely operate on electric power and do not produce waste heat from combustion in the engines, unlike conventional ICE vehicles. This lack of thermal output from the engine calls for advanced heating solutions as when the cold weather sets in, passengers may require more battery life in their electric vehicles.

Consequently, manufacturers are paying keen interest in developing high-tech cabin air filters that will optimize energy usage and offer a comfortable cabin climate. Also, most current EVs have adopted combined integrated thermal management systems through the integration of cabin air filter functionality and battery temperature regulation. Thermal loads are managed through different vehicle systems by the manufacturers for improved energy efficiency and performance. Better controls on cabin temperatures are accompanied with optimized performances and long battery life.

Impact of COVID-19

In the initial stages of the COVID-19 pandemic, production of vehicles was disrupted due to trade restrictions and temporary shutdown of manufacturing facilities, thereby reducing the demand for cabin air filters. In addition, due to stay-at-home orders and decreased travel, fewer automobiles were used, and fewer replacements were needed for cabin air filters in the aftermarkets. During this period, consumers focused their spending on necessary expenses and therefore, reduced spending on discretionary expenditures, such as replacement of air filters in their automobiles.

However, after restrictions were eased and the economy opened up, there was pent-up demand for the maintenance of vehicles, leading to an increase in after-sales. The pandemic increased health and air quality concerns, thus fueling the demand for advanced cabin air filters like HEPA filters that provide better filtration against airborne contamination.

Segmentation Analysis

By Type

Growing Consumer Demand For Comfort Propelled Particulate Filter Segment Growth

On the basis of type, the market has been divided into particulate filters and combination filters.

In 2023, the particulate filters segment dominated the market share. The segment’s growth is attributed to increasing awareness of air quality and its impact on health. This has led consumers to prioritize cleaner air in their vehicles. Particulate cabin air filters help trap allergens, dust, pollen, and other airborne particles, providing a healthier cabin environment for passengers. Environmental regulations are also becoming stricter, necessitating improvements in the air quality systems of vehicles. Manufacturers are more frequently incorporating high-quality air filters to meet these standards.

The combination filters segment is expected to record the highest CAGR in the coming years. With various weather conditions across the U.S., including pollen seasons and increased pollution levels in urban areas, consumers are looking for effective filtration systems to mitigate these issues, driving the demand for quality cabin air filters. There has been a rise in awareness among consumers regarding regular vehicle maintenance, including the importance of changing cabin air filters. This has been supported by educational campaigns by automotive manufacturers and service providers.

By Vehicle Type

Increased Sales Fueled Product Use in Commercial Vehicles

Based on vehicle type, the market has included passenger vehicle and commercial vehicle.

In 2023, the commercial vehicle segment dominated the market. The segment’s growth is attributed to the higher production and sales of commercial vehicles across the U.S. For instance, according to the International Organization of Motor Vehicle Manufacturers, 12.89 million commercial vehicles were produced in 2023 in the U.S. commercial vehicle drivers often spend extended periods in their vehicles. Clean air becomes crucial for their comfort, health, and productivity during these long shifts. Many commercial vehicles operate in urban areas with higher pollution levels, making effective air filtration more important.

The passenger vehicle segment is expected to record the highest growth rate over the forecast period. Americans are becoming increasingly conscious of air quality and its impact on health, leading to a greater demand for air filtration systems in vehicles. Diverse weather patterns across the U.S. can lead to various air quality issues, increasing the need for effective filtration. Air quality regulations and recommendations also indirectly influence consumer preferences for better in-car air filtration.

To know how our report can help streamline your business, Speak to Analyst

By Sales Channel

Regular Maintenance of CAF System is Supporting the Market Demand for Aftermarket Segment

Based on sales channel, the market has included OEM and aftermarket.

The aftermarket segment held the leading U.S. automotive cabin air filter market share in 2023. The need for periodic upkeep and replacement of automotive cabin air filters every six months or as per manufacturer guidelines, will fuel the product’s sales from aftermarkets. Vehicle owners, aiming to preserve peak performance and comfort of their vehicles, regularly seek replacement filters. This consistent replacement cycle will establish a stable market for aftermarket products, particularly as vehicles age and remain in use longer.

The OEM segment is expected to record the highest growth rate over the forecast period. The U.S. government’s environmental policies, like the Clean Air Act have imposed strict regulations on market players. These rules require vehicles to meet specific emissions criteria, heightening the emphasis on highly efficient air filtration systems. Automotive cabin air filters play a crucial role in achieving compliance by reducing in-cabin contaminants, such as particulate matter and volatile organic compounds.

Competitive Landscape

Key Industry Players

Major market players are emphasizing on the development of advance filtering solutions

The U.S. automotive cabin air filter market is characterized by intense competition and strategic innovations among leading players. Major manufacturers like Mann+Hummel, Freudenberg, and Mahle are focusing on advanced filtration technologies, developing multi-layer filters capable of capturing ultra-fine particles and harmful pollutants. Strategic partnerships with original equipment manufacturers (OEMs) and technology companies have become crucial, enabling the development of smart, environmentally friendly filtration solutions that cater to evolving automotive technology and consumer health preferences.

List of Key Companies Profiled In The Report

- Mahle (Germany)

- Mann+ Hummel (Germany)

- Toyota Boshoku (Japan)

- Freudenberg (Germany)

- Robert Bosch (Germany)

- Denso Corporation (Japan)

- APC Filters (U.S.)

- Donaldson Company, Inc. (U.S.)

Key Industry Developments

- September 2023 - K&N Engineering introduced a reusable cabin air filter designed for easy cleaning and long-term use. This eco-friendly product aligns with sustainability trends in the automotive market, offering consumers a cost-effective alternative to traditional disposable filters.

- April 2023 - Tenneco announced a strategic partnership with Toyota to develop next-generation cabin air filters that incorporate smart technology for real-time monitoring of air quality. This collaboration aims to provide drivers with insights into cabin air conditions, promoting better health and safety.

- January 2023 - 3M launched a new series of cabin air filters designed with antimicrobial properties to inhibit the growth of bacteria and mold. This product addresses customers’ health concerns and enhances the overall air quality within vehicles, particularly for those with allergies or respiratory issues.

- October 2022 - Fram, a subsidiary of Honeywell, acquired Fabrico, a manufacturer specializing in advanced filtration materials. This acquisition enhanced Fram's ability to innovate and produce high-quality cabin air filters that meet evolving automotive standards.

- March 2022 - Bosch expanded its portfolio of cabin air filters with the introduction of a new filter that includes an activated carbon layer to reduce odors and harmful gases. This product aims to meet rising consumer demands for cleaner air within vehicles, especially in urban environments.

Report Coverage

The report analyzes the market in depth and highlights crucial aspects, such as prominent companies, market segmentation, competitive landscape, vehicle types, and adoption of advanced technologies. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.3% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Vehicle Type

By Sales Channel

|

Frequently Asked Questions

The was valued at USD 2.64 billion in 2023 and is projected to reach USD 4.48 billion by 2032.

The market is projected to record a CAGR of 6.3% during the forecast period.

By sales channel, the OEM segment accounted for a majority of the market share in 2023.

Rising awareness of air quality is a crucial factor driving the market.

Mahle, Mann+ Hummel, Denso, Freudenbourg, and others are some of the leading players in market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us