U.S. Refrigerator Market Size, Share & Industry Analysis, By Product Type (Top Freezer Refrigerator, Bottom Freezer Refrigerator, Side by Side Refrigerator, French Door Refrigerator), By Distribution Channel (Offline, Online), 2025 - 2032

KEY MARKET INSIGHTS

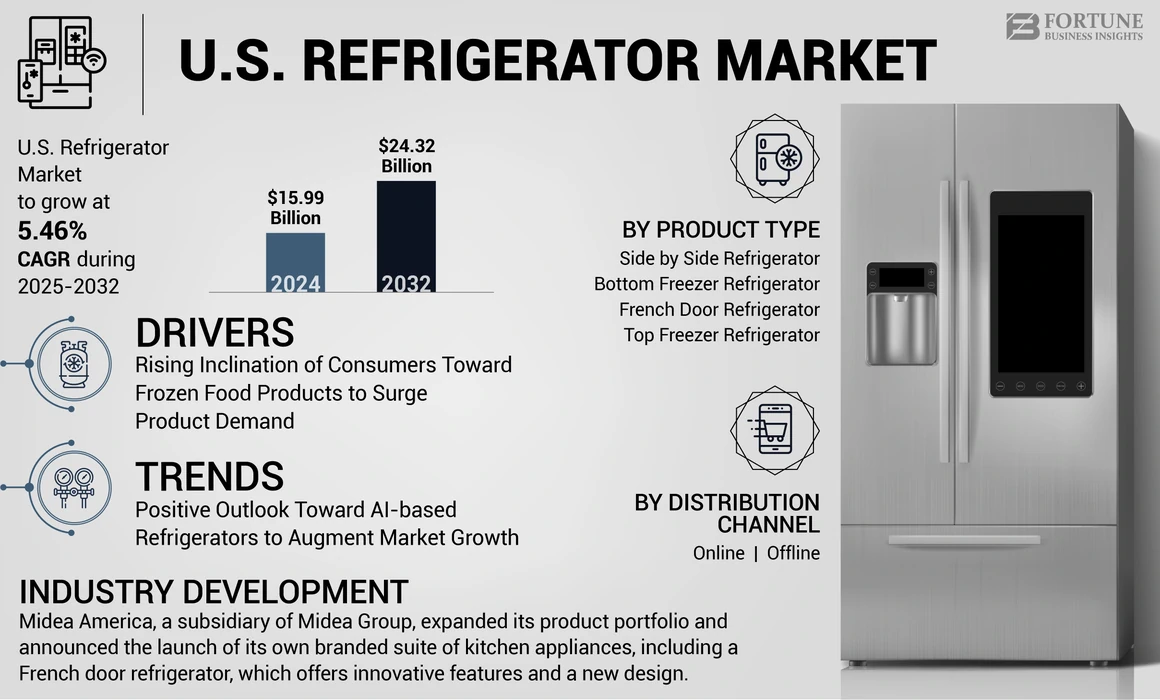

The U.S. is the largest-contributing country in the global refrigerator market. The U.S. refrigerator market size is anticipated to grow at a CAGR of 5.46% during the forecast period. The North America refrigerator market is projected to grow from USD 15.99 billion in 2024 to USD 24.32 billion by 2032.

The growing popularity of smart and intelligent refrigerators in the country and increasing product launches are expected to expand the U.S. market share. Moreover, the consumers of the U.S. mainly consume frozen food. This is due to their busy lifestyle and fast pace of life, which also propels the demand for refrigerators in the country. Companies are constantly launching new products, which can attract consumers in the long run. For instance, in February 2021, Whirlpool Corporation launched connected four-door freezers from the ‘6TH SENSE Live’ connection, combined with customized smart feature management.

U.S REFRIGERATOR MARKET LATEST TRENDS

Positive Outlook Toward AI-based Refrigerators to Augment Market Growth

Smart technologies have been grasping a sizable refrigerator market share. This is on account of their effortless features and multifunctionality options. Intelligent home appliances, including smart refrigerators, have been experiencing high demand in recent times as they provide several benefits such as touchless monitoring, digital temperature control, operations on commands, and others. This provides convenience to consumers and reduces their efforts in directing their appliances, which is expected to drive the U.S. refrigerator market growth.

- For instance, in December 2022, Samsung launched a smart refrigerator equipped with a 32-inch screen, supporting different application types in-built into the freezer screen.

U.S REFRIGERATOR MARKET GROWTH FACTORS

Rising Inclination of Consumers Toward Frozen Food Products to Surge Product Demand

Consumers are rapidly inclined toward consuming frozen food items, including frozen vegetables, meat, fruits, and other ready-to-eat snacks, augmenting the demand for refrigerators in the country. Due to their busy lifestyle and hectic work schedule, they are more prone to consume convenience food products that are easy, fast to prepare, and require less time. Moreover, millennials nowadays opt for snack foods and cold beverages, which minimizes their effort for cooking and pulls up the demand.

RESTRAINING FACTORS

Download Free sample to learn more about this report.

High Cost of Smart Refrigerators to Restrain Market Growth

Smart refrigerator generates a huge cost of manufacturing, which soars up the product's price in retail value. Therefore, it becomes difficult for consumers of the lower income group to afford such refrigerators, owing to their low disposable income and less accessibility to advanced infrastructural facilities. Moreover, in rural areas, the penetration of smart appliances is subsequently lower, compared to urban areas, along with a lesser internet penetration level. These factors, in turn, restrict the demand for refrigerators in the country.

KEY INDUSTRY PLAYERS

The leading players in this market include Whirlpool Corporation, GE, LG Electronics, and others. The companies are rapidly undertaking several business strategies, including product launches, marketing and promotion, mergers & acquisitions, and others to acquire a significant share of the overall market. Furthermore, product launches help consumers access a wide variety of products; hence, they can choose from different product ranges, which fosters market growth.

- For instance, in March 2020, Whirlpool Corporation announced the expansion of its new distribution center in Tulsa, Oklahoma to expand its retail presence by investing USD 55 million to create new jobs and increase its manufacturing facilities.

Correspondingly, the booming e-commerce sector, combined with the launch of e-retailing portals by the companies to boost their sales volume, is also projected to drive the market. Different organizations in the home appliance industry also participate in international events and show to capture a significant customer base and provide their unique product solutions.

List of Top U.S. Refrigerator Companies:

- Samsung (South Korea)

- LG Electronics Inc. (South Korea)

- Whirlpool Corporation (U.S.)

- Panasonic Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Electrolux AB (Sweden)

- Godrej Group (India)

- Haier Group Corporation (China)

- Midea Group (China)

- Voltas Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- November 2021: Midea America, a subsidiary of Midea Group, expanded its product portfolio and announced the launch of its own branded suite of kitchen appliances, including a French door refrigerator, which offers innovative features and a new design.

- March 2021: Samsung introduced four-Door Flex Refrigerator in North America. The model range was introduced at the Consumer Electronics Show in January 2021.

- May 2022: Whirlpool Corporation announced the launch of its new marketing organization, WoW Studios (World of Whirlpool Studios), located in Chicago, U.S. The studio comprises a multidisciplinary team working across the company’s North American brand portfolio, including KitchenAid, Whirlpool, Maytag, JennAir, and Amana brands.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the market growth and market size details for all possible segments in the market. The report elaborates on the market dynamics, competitive landscape, and the market forecast. Various key insights presented in the report are an overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.46% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type and Distribution Channel |

|

By Product Type |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Growing at a CAGR of 5.46%, the market will exhibit steady growth in the forecast period (2025-2032).

Major growth factors include the increasing consumption of frozen foods, rapid product innovations, and the rising adoption of smart refrigerators that offer features like remote control, voice command integration, and energy efficiency.

The market is witnessing trends like AI-powered refrigerators, touchless control features, integration with smart home systems, and energy-efficient designs to cater to tech-savvy and sustainability-conscious consumers.

Smart refrigerators are growing in demand due to their automation features, such as inventory tracking, temperature alerts, and mobile app connectivity, making them ideal for the fast-paced American lifestyle.

Leading companies include Whirlpool Corporation, GE Appliances, Samsung, LG Electronics, Haier Group, Electrolux, and Midea Group. These brands dominate the market through product innovations, strong distribution networks, and e-commerce presence.

High costs of smart refrigerator technology, low penetration in rural areas, and limited internet connectivity in some regions act as barriers to broader market adoption, especially among lower-income demographics.

Americans increasingly prefer ready-to-eat meals and frozen snacks due to their busy schedules, which requires reliable cold storage, thereby increasing the demand for high-capacity, feature-rich refrigerators.

The rise of online retail platforms and direct-to-consumer models by major appliance brands has improved product accessibility, price transparency, and delivery options, driving refrigerator sales across the country.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us