U.S. Renewable Energy Market Size, Share & Industry Analysis, By Type (Wind, Solar, Bioenergy, Geothermal, Ocean Energy, and Hydropower) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

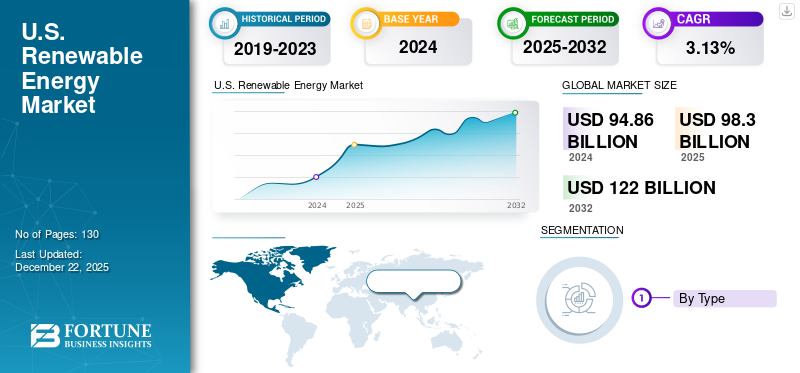

The U.S. Renewable Energy Market size was worth USD 94.86 billion in 2024. It is estimated to grow to USD 98.30 billion in 2025 and reach USD 122.0 billion by 2032. The market is projected to grow at a CAGR of 3.13% during the forecast period.

The renewable energy market in U.S. is expected to grow significantly owing to the declining costs of solar and wind technologies, government policies such as tax credits and subsidies, electrification of transportation sector (driven by EV adoption), growing electricity demand from data centers and other industrial uses, and increasing public and corporate awareness about the need for sustainability to combat climate change.

The U.S. renewable energy market is growing as governments and businesses push for clean, reliable, and affordable large-scale power generation to meet decarbonization and energy security goals. The renewable energy market within the energy industry is about shifting the global energy landscape away from fossil fuels and embracing cleaner, sustainable power sources. This comprises options such as solar, wind, hydropower, bioenergy, and geothermal energy. Solar capacity in the renewable energy sector is increasing due to the declining technology costs, strong policy support, and growing demand for clean power across the U.S. The market is seeing a surge in generation sources, due to encouraging government policies, ambitious decarbonization targets, and the demand for energy security.

- In August 2024, the U.S. Department of Energy announced an investment of USD 31 million to support geothermal energy projects across the country to reduce emissions and boost the growth of clean energy sector. Government inclination toward the adoption of renewable energy is expected to fuel the market growth over the next few years.

U.S. Renewable Energy Market Trends

Increasing Focus on Hybrid Renewable Projects Combining Solar, Wind, and Storage is expected to Boost Market Growth

The focus on hybrid renewable projects combining solar, wind, and storage is reshaping the energy market by enhancing reliability and overcoming intermittency through optimized energy generation and storage. Key trends include the rise of hybrid systems and microgrids for localized energy independence, advancements in storage technologies, smart grid integration, and increasing government support for renewable deployment. In the U.S., strong federal investment, technological innovation, and rising solar adoption are driving growth, with future potential for enhanced grid resilience and flexibility through technologies such as V2G and AI-driven controls.

- In December 2024, ContourGlobal announced the expansion of its hybrid renewable energy portfolio by acquiring a solar-plus-storage project in the western U.S. Strategically located in a competitive market with rising demand from data centers and commercial customers, the project is positioned to deliver premium value and attract high-quality long-term buyers.

Key takeaways· In the by type segmentation, Solar accounted for around 77.1% of the U.S. Renewable Energy Market in 2024. · In the by type segmentation, geothermal is projected to grow at a CAGR of 6.41% in the forecast period. · By type segmentation, wind energy accounted for around 14.6% of the U.S. Renewable Energy Market in 2024. |

U.S. Renewable Energy Market Growth Factors

Supportive Government Policies and Incentives to Accelerate Renewable Deployment, Driving the Market Growth

Supportive government policies and incentives are significant drivers of the U.S. renewable energy market as it reduces costs, stimulates investment, and encourages technological innovation, leading to increased deployment and market growth. Key U.S. federal incentives include tax credits such as the Renewable Electricity Production Tax Credit (PTC) and Investment Tax Credit (ITC), which are crucial for accelerating the adoption of renewable energy technologies.

- According to the U.S. Department of Energy, the U.S. government aims to decarbonize the electricity grid by 100% by 2035 across energy-intensive industries.

U.S. Renewable Energy Market Restraints

High Upfront Capital Costs to Limit Small-Scale Adoption, Restraining Market Growth

High initial investment is a significant market restraint for small-scale deployment in the U.S. renewable energy market, as it requires substantial upfront costs for hardware, specialized equipment, installation, and infrastructure development, making it difficult for Small and Medium-sized Enterprises (SMEs) to secure funding despite potential long-term savings. This financial barrier, combined with competition from established fossil fuel industries and the need for large-scale solutions, hinders the rapid adoption of new renewable technologies.

U.S. Renewable Energy Market Segmentation Analysis

By Type

Based on type, the market is divided into wind, solar, bioenergy, geothermal, ocean energy, and hydropower.

In 2024, Solar accounted for the largest U.S. renewable energy market share owing to factors such as favorable policies including the Inflation Reduction Act (IRA), a robust domestic manufacturing base, and strong corporate and residential demand for clean power.

- In September 2024, TotalEnergies announced the start-up of largest utility-scale solar farms with batteries located in southeast Texas, U.S. The project consists of two utility-scale solar farms with a combined capacity of 1.2 GW as part of the renewable assets portfolio, summing up to 4 GW in operation and under construction in Texas.

Moreover, geothermal emerged as the fastest segment supported by favorable federal and state policies, corporate commitments to clean energy, and the need for stable, renewable power sources. The market is expanding due to increasing adoption for both electricity generation and heating/cooling through geothermal heat pumps in residential, commercial, and industrial sectors.

List of Key Companies in the U.S. Renewable Energy Market

NextEra Energy holds a prominent position in the U.S. renewable energy market as the world's largest generator of wind and solar energy, a leading investor in clean energy infrastructure, and a global leader in battery storage. Through subsidiaries such as NextEra Energy Resources, it develops and operates large-scale projects, while Florida Power & Light (FPL) provides rate-regulated electricity to millions of customers, making NextEra Energy one of the largest electric utility holding companies across the U.S.

The competitive landscape of the U.S. renewable energy market is characterized by large incumbent companies such as NextEra Energy and Iberdrola, a rise in innovative startups, and intensified competition in segments including solar and wind. Key factors driving competition include technological advancements in energy storage and smart grids, supportive government policies, strategic partnerships, and consolidation within the industry, creating a dynamic environment for both established players and new entrants.

LIST OF KEY COMPANIES PROFILED

- NextEra Energy Inc. (U.S.)

- Vestas Wind Systems AS (U.S.)

- Invenergy (U.S.)

- Constellation Energy (U.S.)

- Duke Energy (U.S.)

- Clearway Energy (U.S.)

- First Solar (U.S.)

- Enphase Energy (U.S.)

- Sunrun (S.)

- Brookfield Renewable Partners (U.S.)

- GE Vernova (U.S.)

- One Power Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: U.S. Wind Inc. announced its plan to start largest renewable energy project in Maryland, U.S. The project is expected to have wind energy capacity of more than 600 MW with a total of 1,719 MW.

- September 2024: TotalEnergies announced the start-up of the largest utility-scale solar farms with batteries located in southeast Texas, U.S. The project consists of two utility-scale solar farms with a combined capacity of 1.2 GW as part of the renewable assets portfolio, summing up to 4 GW in operation and under construction in Texas.

- September 2024: Grew Energy announced the launch of next-generation solar PV modules for the North American market. The company showcased its P-type (Mono-Perc) and N-type (Topcon) solar modules at RE+ 2024.

- August 2024: Pivot Energy collaborated with Microsoft for the development community solar energy project to deliver sustainable energy to local communities. The projects will have a capacity of 500 MW located across the S. between 2025 and 2029.

REPORT COVERAGE

The U.S. Renewable Energy Market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the U.S. Renewable Energy Market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.13% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Wind o Onshore o Offshore · Solar o PV o CSP o Thermal · Bioenergy o Solid o Liquid o Gas · Geothermal o Shallow (30 to 400 meters) o Deep (from 400 meters depth) o Great depth (above 4,000 meters) · Ocean Energy o Wave o Tidal · Hydropower o Small o Large |

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 94.86 billion in 2024.

The market is likely to grow at a CAGR of 3.13% over the forecast period (2025-2032).

Supportive Government Policies and Incentives to Accelerate Renewable Deployment Drives the Market Growth in the Country.

Some of the top players in the market are NextEra Energy Inc., Vestas Wind Systems AS, Mitsubishi Heavy Industries Ltd, Siemens Gamesa Renewable Energy SA, and others.

The U.S. market size is expected to reach USD 122 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us