Ultralight and Light Aircraft Market Size, Share, and Industry Analysis, By Type (Light and Ultralight), By Component (Aerostructure, Avionics, Engine, Landing Gears, and Others), By Application (Civil & Commercial and Military), By Operations (CTOL and VTOL), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

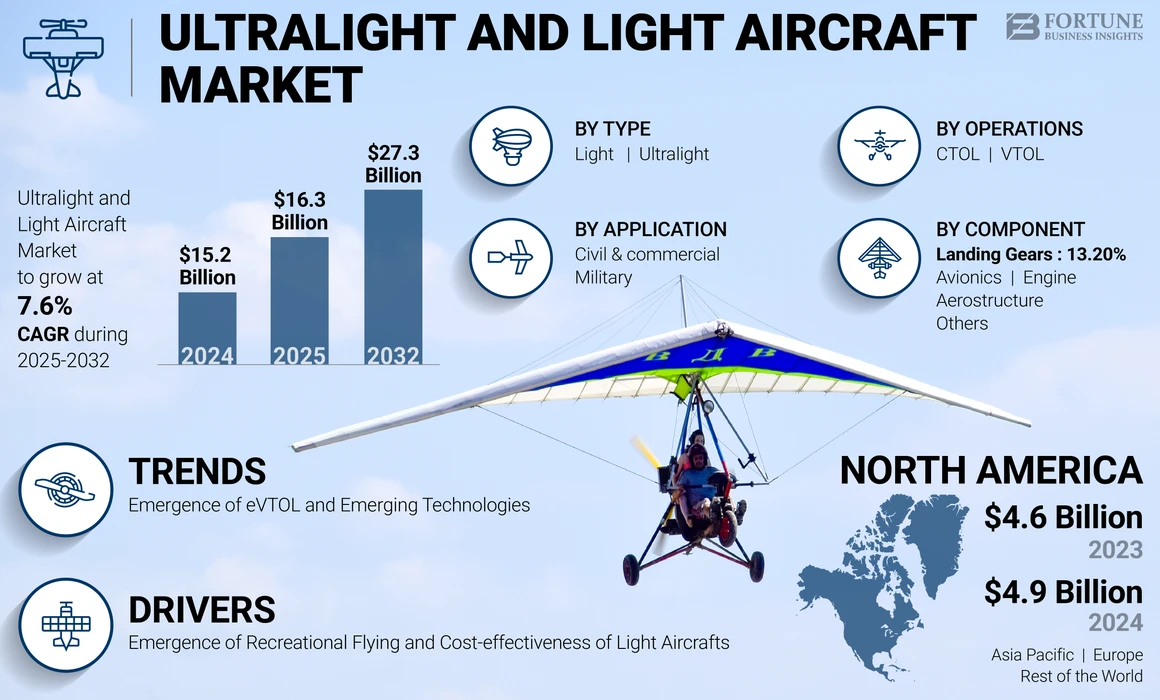

The global ultralight and light aircraft market size was valued at USD 15.21 billion in 2024. The market is projected to grow from USD 16.32 billion in 2025 to USD 27.34 billion by 2032, exhibiting a CAGR of 7.65% during the forecast period. North America dominated the ultralight and light aircraft market with a market share of 32.24% in 2024.

Ultralight aircrafts are very light planes that weigh up to 254 lb (115 kg) and are restricted to 55 knots speeds. They are single-seaters with little regulatory oversight. Light aircraft is a broader category of aircraft, weighing from 1,320 to 12,500 lb and carrying up to two people. They are only flown by licensed pilots and are governed by more stringent regulations. While ultralights emphasize ease of access and simplicity, light aircraft offer greater flexibility for different types of aviation purposes.

The market is set for growth, driven by sustainability initiatives, technological advancements, the increased purchasing power of individuals, and the increasing number of projects and recent developments in various regions. Key players in the market include Cessna Aircraft Company (U.S.), Textron Aviation (U.S.), Airbus SE (Netherlands), and Leonardo S.p.A. (Italy), which compete in the pricing and aircraft provisions in the global ultralight and light aircraft market.

GLOBAL ULTRALIGHT AND LIGHT AIRCRAFT MARKET KEY TAKEAWAYS

Market Size & Forecast:

- 2024 Market Size: USD 15.2 billion

- 2025 Market Size: USD 16.3 billion

- 2032 Forecast Market Size: USD 27.3 billion

- CAGR: 7.6% from 2025–2032

Market Share:

- North America led the market with a 32.24% share in 2024, valued at USD 4.9 billion.

- By type, Light Aircraft held the largest share in 2024 and is projected to grow fastest due to expanding fleets and rising eVTOL adoption.

- By component, Engine had the highest market share in 2024, driven by demand for fuel-efficient designs, while Avionics is expected to grow fastest due to glass cockpit and autonomous flight advancements.

Key Country Highlights:

- U.S.: Largest market globally; supported by FAA’s flexible ultralight flying regulations and strong OEM base (Cessna, Textron, Beechcraft).

- Canada: Presence of Bombardier; robust infrastructure for civil and training operations.

- Brazil: Embraer supports regional growth and export of light aircraft.

- Netherlands & Italy: Airbus SE and Leonardo S.p.A. driving EU innovation and eVTOL R&D.

- China, India, Southeast Asia: Fastest growth due to infrastructure expansion and training demand.

- Middle East & Africa, Latin America: Growth driven by urbanization, regional connectivity efforts, and electric aircraft initiatives.

Market Dynamics

Market Drivers

Emergence of Recreational Flying and Cost-effectiveness of Light Aircrafts to Lead to Substantial Market Growth

Because the recreational flying trend is rising, ultralight and light aircraft are going to witness an increase. More and more individuals in their 30-50 age group have started to take up flying as a hobby and seek experiences not many can have or live to tell, such as being in flight. It has grown mainly due to the rising disposable income and growing interest in leisure time activities such as adventure sports. Ultralight aircraft, which are inexpensive and require minimal training compared to normal planes, have opened the skies to casual enthusiasts who can afford them. Exploring and adrenaline needs are the reasons for ultralight and light aircraft market growth, and ultralight aircraft offer a way for enthusiasts to enter aviation.

Cost-effectiveness is the other essential factor that influences the ultralight and light aircraft markets. These aircraft usually have relatively low acquisition and operating costs compared to the larger commercial planes. The lightweight aircraft consume less fuel and reduce maintenance expenses, making them economically appealing to individual pilots and flight schools. Moreover, technological developments have enhanced the efficiency and safety of these aircraft, further increasing their appeal. This makes flying more accessible to a higher number of people, hence increasing the number of consumers for ultralight as well as light aircraft.

Market Restraints

Airspace Restrictions for Light and Ultralight Aircraft to Restrain Market Growth

Ultralight and light aircraft must observe certain airspace restrictions to be safe and comply. They are not allowed to fly in Class A airspace, which is strictly reserved for IFR flights above 18,000 feet. In Class B airspace, surrounding major airports, and Class C airspace, near busy airports, ultralights need to obtain ATC permission before entry. Class D airspace around airports with control towers also requires prior permission. Although ultralights are allowed to enter Class E airspace with caution, they are unrestricted to enter Class G uncontrolled airspace below 1,200 feet and require no authorization from air traffic control. Moreover, aircraft are prohibited from flying over congested areas and gathering people. In addition, these aircraft should follow the visual flight rules (VFR) and maintain visibility and cloud clearances. Knowledge of these limitations can make aviation operations safer.

Market Opportunities

Urban Air Mobility and Air Taxis to Act as Major Market Expansion Opportunity

Urban Air Mobility (UAM) and air taxis are considered high-growth opportunities for light aircraft, especially with the increase in technological advancements and urban congestion that require innovative transportation solutions. UAM is short-range passenger transportation within cities, using compact VTOL aircraft, mainly electric VTOL vehicles intended to carry 2-5 people.

These aircraft will relieve urban congestion by offering quick means of transit that go above the ground. Key factors that are driving this growth are electrification technologies, lightweight materials, and automation, which increase the operational efficiency of aircraft while reducing environmental impact. It will also create new markets and job opportunities in manufacturing and infrastructure development.

Market Challenges

Infrastructure Limitations for Light Aircrafts to Challenge Market Development

Infrastructure constraints severely limit the expansion of light aircraft. Most airports do not have facilities such as hangars and maintenance services specifically for light aircraft, which discourages potential operators. The size of existing runways may not be suitable for light aircraft, and environmental regulations may delay new developments or expansions. Moreover, poor transport links between urban areas and airports reduce the attractiveness of light aircraft as an alternative to ground transportation. New infrastructure for charging and maintenance is also needed with the rise of electric and hybrid aircraft, which most airports lack at present. Addressing these challenges is crucial for maximizing the potential of light aviation.

Ultralight and Light Aircraft Market Trends

Download Free sample to learn more about this report.

Emergence of eVTOL and Emerging Technologies to Act as Major Market Trends

There's also the major market trend for light and ultralight aircraft due to the emergence of eVTOL aircraft. eVTOLs are designed specifically for urban air mobility, promoting more effective, sustainable passenger and cargo transportation within quick and eco-friendly modes. Significant growth in battery efficiency, electric propulsion, and autonomous flight capabilities are making up some of the key elements. Improved energy density and fast charging times make eVTOLs more practical, especially for urban applications such as air taxis and emergency services, and greater pressure from regulators on low carbon footprint solutions makes it an added focus.

Impact of COVID-19

The COVID-19 pandemic led to a sharp drop in air travel, with passenger numbers falling by around 60% worldwide. This affected all segments of aviation, including light aircraft used for recreational flying and training, as restrictions and fear of the virus kept would-be pilots on the ground. The cost of running the light aircraft business had, therefore, increased because of enhanced safety protocols and maintenance procedures. The uncertainty surrounding travel restrictions also made planning difficult for flight schools and rental services, further straining their business models. In addition, the pandemic accelerated interest in sustainable aviation solutions, including electric and hybrid aircraft technologies. As manufacturers and operators adapt to changing consumer preferences for greener transportation options, opportunities for innovation within the light aircraft sector arise.

Segmentation Analysis

By Type

Growth in Personal Disposable Income Propelled Light Segment Growth

On the basis of type, the market has been divided into light and ultralight.

The light segment accounted for the largest market share of 74% in 2024. The segment is expected to record the highest CAGR during the forecast period due to the higher number of fleets operating in the world. Additionally, the prevalence of air taxi operations and the emergence of eVTOLs are expected to boost market growth exponentially in the coming years.

The ultralight segment accounted for a significant market share in 2024. Increased recreational flying is giving the ultralight and light aircraft markets a great boost. Increasing interest in aviation as a hobby due to adventure and other experience-related needs also forms the key. Ultralight aircraft are relatively cheap to buy and maintain. Therefore, they make flying accessible to many. The technological improvements that enhance safety and performance makes them attractive features. Besides this, demand for pilot training is growing, and ultralights are an excellent entry point for new pilots. Lastly, post-pandemic recovery has inspired a renewed interest in outdoor activities and travel experiences that will only add to the interest in recreational flying.

By Component

Technological Advancements in Avionics to Augment Segmental Growth

Based on component, the market is segmented into aerostructure, avionics, engine, landing gears, and others.

The avionics segment accounted for a substantial market share in 2024 and is expected to grow at the highest CAGR during the forecast period. Technological advancements in avionics are changing light aircraft, increasing safety and efficiency, and improving pilots' ability. Major innovations include glass cockpits, in which traditional analog gauges are replaced by integrated digital displays that allow pilots to know real-time data about the flight parameters. Autonomous systems are also being implemented. Artificial intelligence and machine learning make strategic decisions for pilots with reduced workloads. Another advance is navigation technologies, for example, satellite-based systems and Automatic Dependent Surveillance-Broadcast (ADS-B), which enhances situational awareness and optimization of route, and avionics compact computing platforms to make possible more efficient processing and integration of functions paving the way towards innovation in light aviation. Such advancements all add up to a safer and more efficient flying experience. This segment is likely to grow with a considerable CAGR of 9.16% during the forecast period (2025-2032).

The engine segment accounted for the largest market share in 2024. One of the most important growth drivers for engine components in light and ultralight aircraft is the increasing demand for fuel efficiency. In addition to saving aircraft owners money on the cost of operation, this, in turn, enhances fuel efficiency and reduces the environmental impact of flying. With the ongoing increase in fuel prices and growing environmental concerns, OEMs are focusing their efforts on the development of light and fuel-efficient engines. These engines are designed considering factors such as advanced materials, aerodynamics, and optimized combustion processes. Innovations in these directions have been contributing to the trend. Focusing on fuel-efficient engines can help meet regulatory requirements and consumer expectations and improve the overall appeal and sustainability of light aircraft in the aviation market. The segment is set to acquire 35% of the market share in 2025.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Civil & Commercial Applications on Pilot Training to Grow Segmental Growth

Based on application, the market is segmented into civil & commercial and military.

The civil & commercial segment accounted for the largest market share in 2024 and is expected to grow at the highest CAGR in the forecast period. Pilot training using light aircraft is the core of all aviation education, offering an aspiring pilot hands-on exposure in a manageable and cost-effective environment. Light aircraft are suitable for training due to their simplicity and low operating costs. They can be managed easily and, therefore, are perfect for novices. The flight schools, therefore, use these aircraft to impart essential skills such as navigation, communication, and emergency procedures. The training usually covers both ground school instruction and practical flight time, which gradually helps the students gain confidence and proficiency. Students can gradually be moved to more complex aircraft as they progress in their aviation careers. The segment is expected to gain 52% of the market share in 2025.

The military accounted for a significant market share in 2024 and is expected to record a significant CAGR of 6.96% during the forecast period. Surveillance in military operations is a vital element for gathering intelligence and situational awareness. Surveillance means constant observation of a target area to understand activities and track movements over time, creating a comprehensive picture of the operational environment. Reconnaissance, on the other hand, is a more specific mission aimed at collecting certain information in order to answer defined military questions, such as enemy positions or terrain features. These purposes are often fulfilled by light aircraft because they can fly at lower altitudes, enabling detailed visual and electronic observations. This capability supports strategic decision-making by providing timely and relevant data to commanders, thereby enhancing mission effectiveness.

By Operation

Growth in eVTOLs and Air Taxis to Augment Growth of VTOL Segment

Based on operations, the market is divided into CTOL and VTOL.

The Conventional Take Off and Landing (CTOL) accounted for the dominating market share in 2024. Conventional aircraft designs are often less complicated and more rugged than advanced ones, thus making them easier to maintain and operate. This makes them appealing to private pilots and flight schools alike. Additionally, acquisition and operational costs for CTOL aircraft tend to be lower than those for more complex types of aircraft. This makes it more appealing to a wider range of users, from private owners to small commercial operators. Many pilots appreciate the handling characteristics of conventional aircraft, which can provide a more engaging flying experience. This preference contributes to the continued popularity of CTOL designs in pilot training programs. The segment is expected to attain 63% of the market share in 2025.

The Vertical Take Off and Landing (VTOL) segment is expected to record the highest CAGR over the forecast period. Urban air spaces are best suited by VTOL aircraft because, under restricted areas such as rooftops or parking lots, they require no traditional runways. They will address the issues caused by the urban congestion space, along with increasing accessibility to deprived areas, making air transportation much more efficient. The majority of VTOL designs emphasize green technology, wherein the electric propulsion system produced reduces levels of noise and emissions generated compared to that of a traditionally flown aircraft. This makes them more acceptable to communities and aligns with global sustainability goals. VTOL aircraft typically require less extensive infrastructure than traditional fixed-wing aircraft, and this reduces operational costs. It is possible to integrate smaller landing pads into urban settings, so large airports are not necessary. This segment is set to expand with a significant CAGR of 8.32% during the forecast period (2025-2032).

Ultralight and Light Aircraft Market Regional Outlook

North America

North America Ultralight and Light Aircraft Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.57 billion in 2023 and USD 4.87 billion in 2024. North America led the ultralight and light aircraft market share in 2024. The positive regulatory atmosphere for ultralight aircraft in North America, especially through FAA FAR Part 103, allows individuals to fly these planes without needing a pilot's certificate, thereby making it easier to get access to recreational flying. This lax structure encourages people to participate in it by relying on personal accountability for their safety and adherence. Moreover, though formal certification is not mandatory, many flight schools offer structured programs that are customized for ultralight flying. These programs offer ground instruction and practical flight experience that impart essential skills to pilots, thus enhancing safety and competence. All these factors combined are expected to greatly enhance the growth of ultralight aircraft in the region. The U.S. market is poised to hold USD 4.63 billion in 2025.

Europe

Europe is the second largest market estimated to be valued at USD 4.59 billion in 2025, registering a CAGR of 8.02% during the forecast period (2025-2032). The European market is forecasted to achieve a higher growth rate in the coming years. Huge investments are being made in the development and expansion of eVTOL technologies in the region. The growing interest in Urban Air Mobility (UAM) is primarily driven by the growing rate of urbanization and the need to reduce traffic congestion in major cities. UAM offers a promising solution by utilizing airspace for efficient, direct routes, significantly reducing commute times. The U.K. market continues to grow, projected to reach a market value of USD 0.89 billion in 2025. This sustainability focus, indeed, is aligned with international environmental goals because UAM vehicles will be zero-emission quieter than conventional aircraft, especially the electric vertical takeoff and landing (eVTOL) aircraft, which will dominate many UAM operations. As the urban populations grow, traditional transportation methods become strained, leading to longer travel times and decreased quality of life. Altogether, efficiency combined with environmental responsibility drives the growth of UAM in urban transport. Germany is expected to stand at USD 1.78 billion in 2025, while France is poised to gain USD 0.51 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market expected to gain USD 4.16 billion in 2025. The Asia Pacific market is forecasted to achieve the highest growth rate in the coming years. The development of infrastructure and a supportive regulatory environment are critical for the growth of ultralight and light aircraft in the region. Governments are investing in aviation infrastructure, including the construction of airstrips and flying clubs, which facilitates easier access to flying opportunities and training programs. China is foreseen to grow with a value of USD 1.64 billion in 2025. This investment enhances connectivity and also promotes recreational flying and pilot training. Good laws make the process of certifying and operating ultralight aircraft less cumbersome, encouraging more people to take to the skies. These factors collectively form a good environment in which the ultralight and light aircraft market is expected to expand in the region. India is predicted to stand at USD 0.81 billion in 2025, while Japan is set to reach USD 0.89 billion in the same year.

Rest of the World

The rest of the world is anticipated to stand at USD 2.37 billion in 2025. The Rest of the World market is forecasted to achieve a higher growth rate in the coming years. Key developments in infrastructure, rising income, and urbanization are predicted to drive the development of light and ultralight aircraft within the Middle East & Africa and Latin America. The development is also due to increased applications and the emergence of small electric aircraft and UAV-type light and ultralight aircraft.

Competitive Landscape

Key Market Players

Key Market Players are Adopting Various Strategies to Gain Edge in the Market

The competitive landscape of the global ultralight and light aircraft market offers insights into various competitors. This includes an overview of each company, their financial performance, revenue generation, market potential, investments in research and development, new initiatives, strengths and weaknesses, product and brand portfolios, product launches, mergers and acquisitions, and their applications. The data provided focuses specifically on the companies' engagement within the market.

List of Key Companies Profiled In The Report

- Cessna Aircraft Company (U.S.)

- Textron Aviation (U.S.)

- Airbus SE (Netherlands)

- Leonardo S.p.A. (Italy)

- Beechcraft Corporation (U.S.)

- Cirrus Design Corporation (U.S.)

- Piper Aircraft, Inc. (U.S.)

- Bombardier, Inc. (Canada)

- Embraer S.A. (Brazil)

- Honda Aircraft Company (U.S.)

Key Industry Developments

- November 2024 – In efforts aimed at bettering regional connectivity, Meghalaya announced the implementation of Udan 5.5, under which seaplanes and helicopters will be used more to extend connectivity to remote regions in the country. This new scheme aims to improve remote areas' connectivity throughout the nation.

- October 2024, AIRPLANE Africa Limited (AAL) made history by launching Tanzania's first domestically manufactured ultralight aircraft, the Skyleader 600, with three units already produced and successfully tested at Julius Nyerere International Airport. The aircraft, which can accommodate two passengers and runs on petrol fuel, represents a significant milestone for Tanzania's manufacturing sector, employing both local and Czech expertise while offering a cost-effective transportation solution for business travelers across Africa.

- September 2024 - Vantage Robotics, a leading provider of small UAVs and an innovator in drone technology, said that it launched a new nano drone called Trace, which is designed to fulfill the urgent needs of national security, law enforcement, and critical infrastructure management for trusted and affordable American-made nano UAVs. It will bring the capabilities of large drones into a dramatically smaller form factor, enabling gains in safety, detectability, cost, and scope of use.

- September 2024 – Joby Aviation, a startup in the light aviation industry, unveiled its plans to bring air taxis for the Olympics in Los Angeles. Joby is just one of the many emerging players in an industry that is trying to make flying cars a reality by bringing electric aircraft into cities and integrating them into transportation systems, such as Uber. The aircraft blends technology from airplanes and helicopters and can take off and land vertically.

- January 2024 – Pivotal Aero, the showcase pioneer in light electric vertical takeoff and landing (eVTOL) air ship, is excited to report the official dispatch of online deals for its profoundly expected flying vehicle, the Helix. The beginning cost for a Helix air ship is USD 190,000 USD some time recently charges, conveyance, or other expenses, as pertinent. Clients can put orders for conveyance within the Joined together States on Pivotal's site at pivotal.aero.

- In September 2023, Erickson Incorporated and Helicopter Express, Inc. announced a strategic alliance aimed at expanding S-64 air crane helicopter operations. This partnership includes Helicopter Express acquiring additional S-64 helicopters to enhance its fleet, with deliveries expected throughout the year to support increasing demand for heavy-lift operations in construction and firefighting sectors.

Report Coverage

The report analyzes the market in-depth and highlights crucial aspects, such as prominent companies, market segmentation, competitive landscape, airport types, and technology adoption. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over the years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.65% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Component

By Application

By Operations

By Country

|

Frequently Asked Questions

The market was valued at USD 15.2 billion in 2024 and is projected to record a valuation of USD 27.3 billion by 2032.

The market is projected to record a CAGR of 7.6% during the 2025-2032 forecast period.

Based on operation, the CTOL segment accounted for a majority of the market share in 2024.

The emergence of recreational flying and the cost-effectiveness of light aircraft is expected to lead to substantial market growth.

Cessna Aircraft Company (U.S.), Textron Aviation (U.S.), Airbus SE (Netherlands), Leonardo S.p.A. (Italy), and others are some of the leading players in the market.

The U.S. dominated the global market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us