Utility Transmission Pole Market Size, Share & Industry Analysis, By Material (Steel, Concrete, Composite, and Wood), By Type (Below 40ft, Between 40ft-70ft, and Above 70ft), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

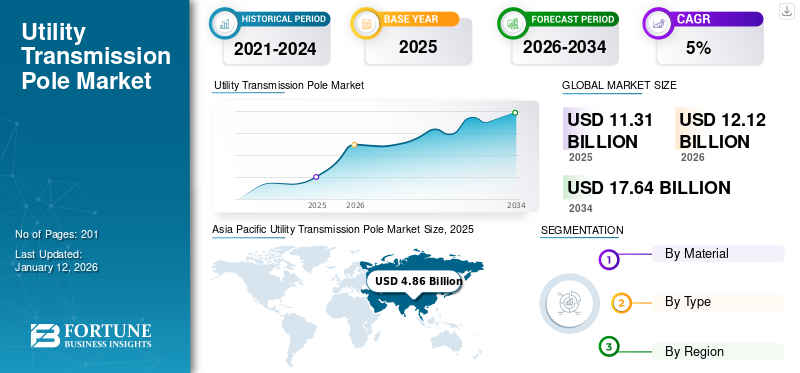

The global utility transmission pole market size was valued at USD 11.31 billion in 2025. The market is projected to grow from USD 12.12 billion in 2026 and is expected to reach USD 17.64 billion by 2034, exhibiting a CAGR of 4.80% during the forecast period. Asia Pacific dominated the global market with a share of 42.98% in 2025.

The rising electricity consumption due to urbanization, population growth, and industrial development is prompting investments in transmission infrastructure to meet growing consumption demands. The integration of wind and solar energy requires modernized and expanded transmission networks to manage the fluctuating nature and distant locations of power generation. This is speeding up grid improvements and the development of new transmission line projects worldwide. These factors are driving market growth in recent years.

Valmont Industries, recognized for its strong engineering solutions, specializes in manufacturing resilient and sustainable transmission poles. Its commitment to grid modernization and eco-friendly products has established it as a frontrunner in the sector. Sabre stands out for delivering high-performance transmission poles suited to various applications. Its capability to manage large-scale projects and its dedication to quality establish it as a favored option among utility companies worldwide.

The increasing demand for dependable, efficient, and contemporary electricity infrastructure prompted by urban development, industrial expansion, renewable energy incorporation, and grid advancement is driving global market expansion.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Adoption of Renewable Energy Projects to Drive Market Growth

The rise in the use of renewable energy, including wind and solar energy, necessitates significant infrastructure to transmit electricity from decentralized generation sites to centralized grids. Utility transmission poles play an essential role in supporting these emerging transmission networks. The total renewable energy capacity that was added to energy systems globally increased by 50% in 2023, reaching nearly 510 gigawatts (GW), with solar PV representing three-quarters of the global additions, as reported by Renewables 2023.

In October 2024, India’s Ministry of Power revealed a strategy to overhaul its power grid to support a significant expansion in renewables by 2032. This initiative, projected to cost 9.15 trillion rupees (USD 109 billion), aims to facilitate the integration of 500 gigawatts of renewable energy, representing more than a two-fold increase from current levels. However, transmission limitations have emerged as a significant barrier to renewable energy deployment globally. The surge in demand for grid access has led to project delays and rising infrastructure costs.

An increase in renewable energy projects is a key factor driving the utility transmission poles market growth. The need to integrate decentralized renewable energy sources into existing grids, coupled with government investments and technological advancements, ensures sustained demand for distribution poles globally.

Development of Smart Cities to Drive Market Growth

The emergence of smart cities requires sophisticated utility poles that support not only power distribution but also telecommunications, internet infrastructure, and smart grid technologies. These multi-functional poles often incorporate sensors and communication devices to allow real-time monitoring and efficient energy management. Currently, 55% of the global population resides in urban regions, a percentage anticipated to rise to 68% by 2050.

In December 2024, India’s Union Minister for Power declared a total investment of USD 10.53 million to improve the country’s power transmission infrastructure capacity by 2032. The National Electricity Plan (Transmission) details the transmission strategies by 2031-32. According to the scheme, 1,91,474 circuit kilometers (ckm) of transmission lines and 1,274 Giga Volt Ampere (GVA) of transformation capacity would be installed (at 220 kV and above voltage level) during the period from 2022-23 to 2031-32.

MARKET RESTRAINTS

Growing Installation Challenges to Hinder Market Growth

Installing utility poles in remote or difficult terrains, such as mountainous or forested areas, poses significant logistical challenges. These projects often require specialized equipment and skilled labor, leading to increased costs and extended timelines. In densely populated urban areas, limited space for erecting utility poles makes installation challenging. Urban planning considerations and aesthetic concerns drive many municipalities to prefer underground cabling over traditional poles, reducing demand for the product. While advanced materials such as steel and composite poles offer advanced durability and performance, their high initial costs can be prohibitive, especially in regions facing budget constraints, deterring broader adoption.

The increasing deployment of underground power transmission systems represents a significant limitation for the market. Underground cables are regarded as safer, more dependable, and less susceptible to weather-related interruptions than overhead utility poles. These systems also enhance urban appearance, thereby decreasing the need for above-ground poles in particular regions.

Extreme weather conditions caused by climate change, such as storms and hurricanes, pose a threat to utility infrastructure. Frequent damage requires repairs or replacements, leading to increased operational costs for utility companies.

MARKET OPPORTUNITIES

Growth of Smart Grid Technologies to Create Opportunity for Market Growth

Smart grids combine sophisticated communication networks, control systems, and IoT sensors, allowing for real-time surveillance, fault detection, and optimized energy distribution. This update requires the installation of new utility poles to accommodate these advanced systems. Smart grids incorporate sophisticated communication, good electricity distribution, control mechanisms, and IoT sensors, allowing for immediate monitoring, fault identification, and enhancement of energy distribution. This improvement requires the installation of new utility poles to support these advanced systems.

In January 2025, DTE Energy announced the advancements it made in 2024 toward constructing a more intelligent, robust, and resilient electric grid for its clients. Improved operational strategies and heightened investment in the electric grid, along with milder weather conditions, contributed to a nearly 70% enhancement in outage duration for DTE customers from 2023 to 2024. The rise of smart cities and urbanization has amplified the demand for advanced utility poles capable of supporting smart grid infrastructure. These poles are essential for applications such as remote monitoring, data collection, and adaptive energy management.

MARKET CHALLENGES

Aging Infrastructure and Deterioration to Restrain Market Growth

Aging infrastructure and deterioration greatly impact the power transmission and distribution sector by increasing the need for replacements and upgrades. Numerous current utility poles have surpassed their anticipated service life, resulting in heightened safety risks and reliability issues within power and communication networks. This generates a considerable demand for new utility poles to ensure and improve network stability and safety.

However, the installation of new transmission poles, especially those constructed from innovative materials such as steel or composites, entails significant initial costs. This financial challenge hinders swift implementation, particularly in areas with limited budgets. While upkeep expenses are relatively low for long-lasting poles, they still add to the overall cost of ownership, which further limits expansion.

UTILITY TRANSMISSION POLE MARKET TRENDS

Growing Focus on Creating Sustainable Poles to Drive Market Growth

The market is undergoing a notable transition from conventional wood poles to more resilient and eco-friendly materials such as steel, concrete, and composite materials (e.g., fiberglass-reinforced polymers and carbon fiber composites). Composite poles are increasingly popular due to their excellent strength-to-weight ratio, ease of installation, and reduced maintenance expenses.

Manufacturers such as Valmont Industries are leading the way in creating environmentally friendly concrete poles that have lowered CO2 emissions and utilize solar-powered manufacturing facilities, demonstrating a broader shift toward sustainability.

The incorporation of intelligent technologies into utility poles is on the rise, facilitating multifunctional infrastructure that boosts connectivity and efficiency. These advanced poles are increasingly being designed to support 5G small cell technology to enhance telecommunications networks in urban environments.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic resulted in extensive interruptions in global supply chains, especially affecting the availability of raw materials such as wood, steel, and concrete, crucial for producing utility poles. Lockdowns and travel limitations resulted in shortages and production delays, affecting the timelines of projects.

Construction activities were paused or delayed due to lockdown measures, resulting in considerable delays in utility transmission pole projects. Numerous scheduled installations and maintenance tasks were deferred, contributing to a growing backlog in infrastructure development.

During COVID-19, the global electricity network investment declined by approximately 6%, owing to which various European utility companies reprioritized their grid spending. Nevertheless, as the market recovers and investments in infrastructure rise, there is potential for expansion fueled by modernization initiatives and a transition toward sustainable materials.

SEGMENTATION ANALYSIS

By Material

Lightweight and Easy Installation Characteristics Drive Steel Segment Growth

By material, the market is segmented into steel, concrete, composite, and wood.

The steel segment dominates the global utility transmission pole market share due to its excellent strength-to-weight ratio, which enables the construction of taller and more robust structures that can support heavier cables and endure severe weather conditions. Additionally, the scalability of steel production and its well-established supply chain make it a cost-efficient option for large-scale transmission projects. The segment is expected to dominate the market share of 61.96% in 2026.

The concrete segment is the second leading segment and is becoming popular, particularly in regions prone to severe weather conditions such as hurricanes, tornadoes, and wildfires. Concrete poles’ natural resistance to fire, rotting, and insect damage provides a considerable benefit compared to other materials. Additionally, concrete poles are known for their remarkable durability and low maintenance needs, resulting in savings over the long run. This segment is anticipated to exhibit a CAGR of 9.18% during the forecast period.

By Type

Growing Demand for Long-Range and High-Voltage Transmission Leads Above 70ft Segment Growth

By type, the market is segmented into below 40 ft, between 40 ft- 70 ft, and above 70ft.

The above 70ft segment led the market share by 44.87% in 2026, driven by the long-range, high-voltage transmission and the incorporation of large-scale renewable energy sources. These taller poles are essential for delivering electricity across vast distances with reduced line losses. They are frequently utilized in primary transmission networks that link distant power generation sites to key load centers.

The between 40ft – 70 ft. is the second leading segment and is seeing significant growth, primarily due to the grid modernization efforts and the rising deployment of renewable energy projects. Poles in this height range offer cost-effectiveness and adequate clearance, making them perfect for establishing renewable energy project connections.

To know how our report can help streamline your business, Speak to Analyst

UTILITY TRANSMISSION POLE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific is the most dominating region in the Global Utility Transmission Pole Market

Asia Pacific

Infrastructure Modernization Boosts Market Development in Asia Pacific

Asia-Pacific is the dominating region in the market driven mainly by rapid urbanization and industrialization. The regional market value in 2024 was USD 4.47 billion, and in 2023, the market value led the region by USD 5.25 billion by 2026. China and India are investing in the expansion and enhancement of their grids to meet rising electricity demand, generating considerable opportunities for pole producers. The market value in China is expected to be USD 2.27 billion in 2026.

On the other hand, India is projecting to hit USD 1.41 billion and Japan is likely to hold USD 0.29 billion in 2026.

In January 2025, China's State Grid announced plans to allocate a record of more than USD 88.7 billion to the nation's power grid for 2025, increasing from USD 82 billion in 2024. State Grid is also constructing extensive long-distance ultra-high voltage (UHV) transmission lines to transport electricity from large bases in western China to major urban areas, and launched three new lines in 2024, bringing the total to 38 completed.

China’s national grid operator is expected to begin on an additional UHV line extending from northwestern Shaanxi province to central Henan province. The primary national grid operator of the country stated it will concentrate on enhancing the power grid, bolstering distribution infrastructure, and ensuring the superior growth of renewable energy.

Asia Pacific Utility Transmission Pole Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

Growing Urbanization to Drive Market Growth in North America

North America is anticipated to account for the second-highest market size of USD 3.34 billion in 2026, exhibiting the second-fastest growing CAGR of 27.50% during the forecast period. Rising urbanization and population growth are major factors influencing the market in North America. As cities grow, demand for electricity increases, prompting utilities to enhance and expand their transmission systems to satisfy this rising demand. This expansion necessitates an increase in utility transmission poles to support newly installed and upgraded power lines.

In particular, the growing population in urban areas results in greater electricity consumption for residential, commercial, and industrial purposes, which in turn requires the addition of more transmission poles to transport electricity over extended distances efficiently. For instance, California's initiative to achieve 100% clean power by 2045 entails upgrading transmission infrastructure to support large-scale solar energy projects, leading to the need for new utility transmission poles.

U.S.

Modernization of Aging Infrastructure to Drive Market Growth in the U.S.

The U.S. market is expected to hit USD 2.95 billion in 2026. A large portion of the current transmission and distribution infrastructure in the U.S. is old, necessitating improvements to guarantee reliability and efficiency. Modernization efforts concentrate on substituting obsolete components, including poles, lines, and substations, with superior materials and technologies.

Government policies such as the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) designate significant funding for grid modernization efforts. These programs are designed to increase energy efficiency, incorporate renewable energy sources, and strengthen resilience to outages. These initiatives, along with the integration of renewable energy and intelligent technologies, are anticipated to drive ongoing growth in the U. S. utility transmission market through 2035.

Europe

Need for Enhanced and Expanding Grid Infrastructure to Support Market Growth

Europe region is to be anticipated as the third-largest market with USD 1.49 billion in 2026. The market in Europe is mainly driven by the increasing need to upgrade aging infrastructure and expand grid infrastructure to support distributed generation and cross-border energy transfers. Aging infrastructure, especially in Central and Eastern Europe, requires replacement initiatives, which, in turn, is boosting demand due to increasing investment in these areas.

For instance, the European Green Deal allocated nearly USD 1.3 billion in funding from the Connecting Europe Facility (CEF) for 41 cross-border energy infrastructure initiatives. Close to almost USD 760 million of the budget supports eight electricity grid initiatives, encompassing offshore and smart electricity networks.

The region is prioritizing electricity infrastructure resilience and digitalization. Initiatives such as the ‘North Seas Energy Cooperation’ involve European countries working together on offshore wind farms and enhancing the transmission grid, which incorporates the deployment of advanced towers to facilitate high-voltage direct current (HVDC) transmission.

China

Rising Demand for Renewable Energy and Infrastructure Expansion to Drive Market Growth

The Asia Pacific region’s high demand for electricity necessitates a robust and expanding transmission infrastructure, with utility transmission poles playing a crucial role. For instance, China's continued infrastructure development, particularly in rural areas, coupled with a national push toward a smart grid, is fueling demand for transmission poles. The market value in China is expected to be USD 2.27 billion in 2026. On the other hand, India is projecting to hit USD 1.41 billion and Japan is likely to hold USD 0.29 billion in 2026.

For instance, according to State Grid Corp. of China, the country’s power sector investments are expected to surpass USD 13.7 trillion between 2020 and 2060. Furthermore, it also plans to source approximately 33% of its energy from renewable energy, an increase from 28.8% in 2020.

Latin America

Rural Electrification to Push Market Growth

The Latin America market is mainly driven by the demand for infrastructure improvements to facilitate rising electrification in rural regions and the expansion of renewable energy integration. The region is to be anticipated as the fourth-largest market with USD 1.16 billion in 2026. Unlike the developed focus on modernizing aging grids, Latin America encounters the dual challenge of expanding access while integrating intermittent energy resources such as solar and wind. This results in high demand for affordable and quickly deployable pole solutions. The GCC market size is estimated to be USD 0.42 billion in 2025.

Governments across regions report that electricity demand is expected to rise at an annual average of 2.3% from 2022 to 2050 due to population growth and economic development. From 2015 to 2022, the region boosted its renewable capacity by 51%, achieving 64% of its generation from renewable sources by 2022.

Middle East & Africa

Increasing Demand for Strong and Specialized Pole Solutions to Boost Market Growth

The Middle East & Africa market is driven by the increasing demand for strong and specialized pole solutions. Numerous Middle East & African countries are swiftly expanding their electricity networks to accommodate growing populations and industrial development. For instance, Saudi Arabia's bold Vision 2030 requires substantial investments in electricity transmission to energize emerging smart cities and industrial areas such as NEOM.

A key trend in the Middle East & Africa market is the increasing focus on localized production and supply networks. Governments across the region are encouraging local pole manufacturing to minimize dependence on imports and generate job openings. Numerous nations are providing incentives and tax reductions to businesses setting up power manufacturing plants in their territories.

Competitive Landscape

KEY INDUSTRY PLAYERS

Major players Focus on Collaborations to Expand Their Businesses

The global market is mostly fragmented, comprising many players operating in the industry. Globally, Valmont Utility stands out as a major player in the market owing to its extensive product portfolio, technological advancements, and strong global presence. In March 2023, ClearWorld, is leading provider of solar LED lighting and smart pole solutions, announced a partnership with Valmont. The collaboration is aimed at enhancing ClearWorld’s ability to deliver sustainable and resource-efficient solutions while expanding ClearWorld's smart infrastructure offerings. This partnership supports the lasting impact on communities' resilience and provides scalable, innovative infrastructure for a broad range of clients.

List of Key Utility Transmission Pole Companies Profiled:

- Valmont Utility (U.S.)

- Sabre Industries, Inc. (U.S.)

- Creative Composites Group (U.S.)

- FUCHS Europoles (Germany)

- Pelco Structural (U.S.)

- Skipper Limited (India)

- KEC International Ltd. (India)

- Nova Pole (Canada)

- Bell Lumber & Pole (U.S.)

- RS Technologies Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- August 2023- KEC International Ltd., a worldwide infrastructure EPC major under the RPG Group Company, obtained new orders of USD 13.54 million across several businesses. The business secured orders for T&D projects in India, Africa, and the Americas, such as the 400 kV Transmission line and GIS Substation order in India from a PSU subsidiary in the renewable power generation segment, 400/220 kV AIS substation order from a leading private developer, the supply of towers in Africa, and the supply of towers, hardware, and poles in Americas, through its subsidiary, SAE Towers.

- October 2022- RS Technologies and Energy Impact Partners announced a strategic equity investment of more than USD 107.60 million. The investment aimed to expand RS Technologies’ composite utility structure manufacturing capabilities in North America with an aim to cater to the enormous demand from electric utilities working to update their systems.

- September 2022- Bell Lumber and Pole Company purchased the assets of The Oeser Company, a manufacturer and supplier of utility poles situated in Bellingham, Wash. The acquisition allows Bell to further position itself as a top supplier of utility poles in North America, enhancing Bell's footprint in the Pacific Northwest.

- September 2022- Creative Composites Group introduced StormStrong technology, an upgrade option for utility, waterfront, cooling tower, and light pole products. This offering provides added resiliency for extreme weather conditions such as hurricane-force winds, blizzards, and deep freezes. The products available for the StormStrong upgrade include pultruded utility poles, utility cross arms, light poles, waterfront sheet piles, waterfront pipe piles, and FRP cooling towers.

- January 2020- Locweld, the North American leader in steel transmission tower manufacturing, announced an exclusive partnership with Valmont Utility to deliver the best solution to North American utilities and EPC firms by designing and supplying lattice transmission structures for large-scale projects.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Infrastructure upgrades and the need for reliable power transmission generally drive an investment in utility transmission poles. Governments and utilities worldwide are investing heavily in upgrading aging infrastructure, which requires replacing older poles and installing new ones to meet modern efficiency and reliability standards.

- In July 2023, RS Technologies Inc., a division of Werklund Growth Fund L. P. and Energy Impact Partners L. P., announced that it has entered into credit agreements with J. P. Morgan, Bank of Montreal, The Toronto-Dominion Bank, and Export Development Canada totaling USD 148.5 million. The financing would aid the company’s rapid expansion to meet the growing need for the Company’s composite solutions.

REPORT COVERAGE

The global utility transmission pole market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering utility transmission poles. Besides, the report provides insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material, By Type, and By Region |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 12.12 billion in 2026.

The market is likely to grow at a CAGR of 4.80% over the forecast period (2026-2034).

By material, the steel segment leads the market.

The market size of Asia Pacific stood at USD 4.86 billion in 2025.

The rapid adoption of renewable energy projects and the development of smart cities are the key factors driving market growth.

Valmont Industries, Inc., Sabre Industries, FUCHS Europoles, and NOVA Pole are some of the markets top players.

The global market size is expected to reach USD 17.64 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us