Vacuum Cooling Equipment Market Size, Share & COVID-19 Impact Analysis, By Cooling Type (Air Cooled Vacuum Cooling, Water Cooled Vacuum Cooling), By Type (In-line, Pallet), By Application (Fruits & Vegetables, Baked Products, Meats, and Others (Flowers and Others)), Regional Forecast, 2026-2034

Vacuum Cooling Equipment Market Size

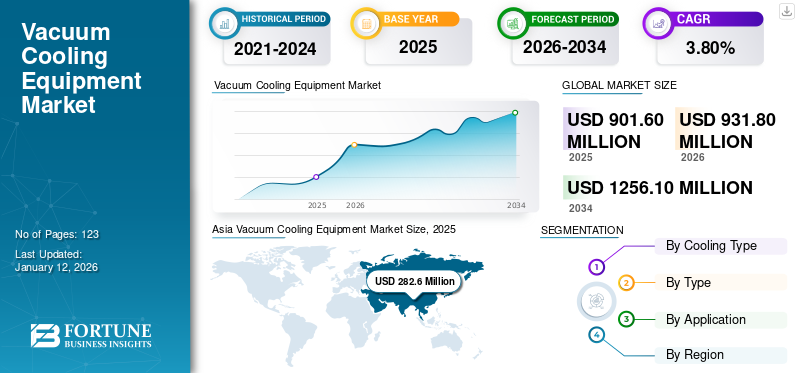

The global vacuum cooling equipment market size was valued at USD 901.6 million in 2025 and is projected to grow from USD 931.8 million in 2026 to USD 1,256.10 million by 2034, exhibiting a CAGR of 3.80% during the forecast period. The Asia Pacific dominated global market with a share of 31.30% in 2025.

Vacuum cooling equipment is an absorption technology used by the cold chain industry to maintain the product's nutritional value by lowering its temperature compared to its surroundings. The equipment operates on two media - air-cooled and water-cooled - that rapidly lower the temperature of fresh produce such as vegetables, fruits, and meat temperature and raises shelf life. Pallet pre-cooling vegetables and fruits and inline production units of bakery food products have broadened their use in the industry.

Global Vacuum Cooling Equipment Market Overview

Market Size:

- 2025 Value: USD 901.6 million

- 2026 Value: USD 931.8 million

- 2034 Forecast Value: USD 1,256.10 million

- CAGR (2026–2034): 3.8%

Market Share:

- Regional Leader: Asia Pacific held approximately 31.30% market share in 2025

- Fastest-Growing Region: Asia Pacific, driven by cold chain investments and fresh produce demand

- Top Application Segment: Fruits & vegetables and baked products are the largest users, with growing adoption in meat and flowers

Industry Trends:

- Cold Chain Expansion: Rising investments in cold chain infrastructure, especially in developing countries

- Health & Wellness Focus: Increased demand for fresh, healthy, and gluten-free foods boosts adoption

- Digital & Agri-Tech Integration: Digital literacy and agri-tech startups drive food safety and traceability

- Energy Efficiency: Shift toward air-cooled systems for rapid, efficient, and moisture-controlled cooling

Driving Factors:

- Government Incentives: Support for cold chain and agri-infrastructure, especially in Asia Pacific

- Consumer Demand: Preference for fresh produce, healthy bakery, and longer shelf life products

- Private Sector Growth: Entry of private players and public-private partnerships in cold chain logistics

- Technological Innovation: New product launches with smart features and improved energy efficiency

Also, diverse applications for increasing the shelf life of fruits and vegetables, baked goods, meat parlors, and flowering for maintaining bloom and freshness and quality of products are expected to fuel market expansion.

The global market has seen steep, steady growth in the past decade. Substantially, the growing adoption of vacuum cooling equipment in the cold chain industry is expected to steadily grow the market in the forecast period. However, lockdown restrictions and a lack of effective supply chain management during the pandemic caused a slight decline in market value. However, the need for fruits and vegetables, medicines, and the ease of government restrictions on essential commodities fueled the market growth. Furthermore, post-pandemic growing investments and supply chain infrastructure expansion projects in developing countries are expected to boost the market in the forecast period.

COVID-19 IMPACT

Private Player Penetration and Ease of Government Restrictions Stabilized the Market During the Pandemic Period

The global market observed stagnant growth owing to the peak consumption & growth of the food and vegetables during the pandemic. These low-life products need higher preservation and cooling methods that help them raise shelf life and freshness. In the global level of food produced, around 14% is lost or wasted between harvest and retail and a significant amount is wasted between retail and consumption. However, the ease of government restrictions and incentive-based plans by the government has helped the application of equipment. Additionally, the growing penetration of private players in the cold chain industry has propelled the adoption of vacuum cooling equipment in the market.

For instance, In September 2022, Colman Logistics, a private player in the cold chain industry, began the operations of the Coimbatore unit that aimed to add 6,500 pallets in both phases.

LATEST TRENDS

Download Free sample to learn more about this report.

Shift in Market Trends for Wellness Concerns Due to Digital Literacy to Bolster the Market Demand

Today’s inflation and higher cost of food products directly affect the consumer, significantly raising shopping stress and affecting the revenue and profitability of the food industry. In contrast, prices are overwhelmed by other purchase drivers. Also, digital penetration and literacy and the mushrooming of agri-tech startups have revolutionized the quality of the food industry, ensuring food safety and traceability and enabling changes in the fresh food sector.

For instance, in September 2022, fresh food consumer survey data collated responses for fresh food showing that 84% of consumers still consider health and wellness. Also, 55% of consumers are ready to pay a high premium as they contribute largely to health and wellness.

DRIVING FACTORS

Government Appealing Schemes and Growing Demand for Fresh Produce to Drive the Market Expansion

Nowadays, trends continue to grow when we consider fresh produce due to health concerns. Consumers now put their health first, which comprises making smart food choices and a healthy diet. The trend for gluten-free healthy daily dietary products such as bread, pizza, cookies, and pies is a prime driver for the market growth in western and central countries. While in the Asia Pacific zone, high vegetation and inventive schemes such as the Agro accelerator fund by the Indian government that supplements cold chain players have held a significant share in the pallet vacuum cooling equipment industry. Thus, the international demand for fresh fruits and vegetables and rising government focus on the cold chain infrastructure is driving the demand for vacuum cooling solutions in the market.

For instance, in September 2020, Durrer Spezialmaschinen AG, a leading vacuum pump provider, in collaboration with Zurich University of Applied Sciences (ZHAW), has developed vacuum cooling systems for bakery products.

RESTRAINING FACTORS

Global Power Crisis and Stiff Supply Chain Infrastructure to Impede Product Adoption in the Market

Global awareness about a healthy diet and a stronger immune system has shifted the consumer base to fresh produce in many developing and populated countries, such as fruits and vegetables. But, the prime adoption of vacuum cooling in the pre-cooling operation of the cold chain has put much pressure on the power sector. Also, the challenge the food industry with the cold chain infrastructure in many developing countries such as India, South Africa, and Egypt is in its initial stage and needs strong support from the government. Additionally, weak road networks and stiff supply chain infrastructure are the restraints to equipment adoption and impede the growth of the food industry. One of the major issues is that 71% of freight in the Indian logistics industry relies mostly on road transport.

SEGMENTATION

By Cooling Type Analysis

Increased Capacity and Efficient Cooling Requirement by the End User to Upend the Air Cooled Equipment Use

Manufacturers in the cold chain industry offer coolers of two types: air-cooled and water-cooled. But rough operating conditions and extensive power consumption exempted the use of water-cooled type. In contrast, air-cooled vacuum coolers provide rapid cooling and efficient performance with better moisture control that enables longevity and freshness of the products. Owing to energy efficiency, rapid cooling and optimized cooling rate broadened the use of air-cooled vacuum cooler types, significantly expanding the vacuum cooling equipment market growth.

For instance, In July 2021, The SPRING WEBER COOLING, a vacuum cooling manufacturer in the U.S., installed an efficient vacuum cooler at SQ FLORA, a flower delivery organization in NAALDWIJK. The vacuum cooler offers efficient and fast cooling with temperatures as low as 4-5 degree centigrade.

By Type Analysis

Changing Consumer Preference for Healthy Fresh Goods to Propel the Demand for Inline Vacuum Coolers

Vacuum coolers are segmented into inline and pallet types based on their cooling type. Vacuum coolers are the lifeline of fresh produce and bakery products. Post COVID, consumer trends have changed a lot from junk foods to healthy fiber-rich bakeries. Furthermore, the increased adoption of inline bakery units is expected to fulfil the product demand. At the same time, the ample growth of fresh fruits and vegetables is expected to hold a substantial vacuum cooling equipment market share during the forecast period.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Preference for Gluten-Free Bakeries to Propel the Demand for Baked Goods

This market by application is segmented into fruits and vegetables, baked goods, meats, and others.

The rising demand for baked goods product demand in the regions such as North America, Europe and the Middle East is expected to propel industry expansion. As consumers shifted their focus to healthy and gluten-free bread, pizzas gained a prominent market size. Also another trend is the application of vacuum cooling in plant-based bread that contains 60% protein and 28% dietary fiber, pushing exponential growth to the market.

Additionally, substantial rise in product usage in the fruit and vegetables application keeps the produce alive and fresh till it reaches the consumer. This is elevating market expansion over the forecast period. Furthermore, applying a vacuum cooler to keep the meat moist and tender and for flowers and grass to keep fresh and refreshing is helping the market gain substantial growth.

For instance, in December 2020, Dekker vacuum technologies, a leading vacuum solution provider, launched its new Duravane series, engineered to provide a constant and reliable vacuum solution.

REGIONAL INSIGHTS

The market report covers a detailed scope and thorough analysis of five main regions: North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific

Asia Vacuum Cooling Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 282.6 billion in 2025 and USD 292.7 billion in 2026. Asia Pacific is projected to hold a major share of the global market owing to government industry-focused initiatives and schemes. The exponential growth of road and supply chain infrastructure. Investments in the agro sector have helped public-private partnerships that focus on implementing vacuum solutions in pack houses. The presence of geographical vegetation is expected to help solve the cold chain gap and raise the global market share in the Asia Pacific region in the forthcoming years.

China is set to dominate in the Asia Pacific region as of the high population count and vegetation dominance in the country. The country’s fresh produce is only about 71% in 62% consumed in the same region. In contrast, prime crops such as grains and veggies contribute largely to the vacuum cooling equipment to keep the produce fresh. Additionally, large exports of special fruits such as mangoes and kiwi grow the substantial market share of countries such as India and Australia. Also, the significant use of vacuum coolers in the meat and flowers to keep them fresh and moist holds a substantial share in South Korea, Japan, and the rest of Asia Pacific during the forecast period. The Japan market is projected to reach USD 55.7 million by 2026, the China market is projected to reach USD 86.9 million by 2026, and the India market is projected to reach USD 62.5 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

Demand across North America is projected to grow exponentially during the forecast period owing to increased health awareness among the general population. In addition, the preference for gluten-free, and plant-based bakery products for daily consumption will promote the use of vacuum cooling devices in the bakery industry. Furthermore, extensive imports from neighboring countries such as Mexico and Canada and heavy reliance on cold chain logistics in Canada are expected to expand the vacuum cooling application in the bakery, meat industry, and fruits and vegetables in the cold chain industry. The U.S. market is projected to reach USD 106.4 million by 2026.

Europe

Europe’s vacuum cooling demand is projected to grow steadily due to its prime application in the bakery sector owing to appealing capabilities and enhancement in dough properties through air-cooled vacuum coolers. Also, vacuum cooling solutions enable extra tenderness and moisture in the bread loaves, which has intensified its application in the bakery industry through an inline vacuum cooler. Also, exports of essential commodities such as tomatoes to other countries helped the adoption of vacuum cooling in the region. The UK market is projected to reach USD 40.2 million by 2026, while the Germany market is projected to reach USD 48.3 million by 2026.

South America

South America has a significant presence with ample steady growth in the market. South America, at the global level, contributes largely to America's fresh produce needs for its green leafy vegetables such as spinach, cauliflower, radish, and other fruits. According to the USDA (United States Department of Agriculture) data, Brazil contributes largely to the fresh fruit needs that amplify the use of air-cooled pallet-type vacuum coolers in the market.

Middle East and Africa

The Middle East and Africa is expected to showcase a steady growth during the forecast period. This is driven by the sustainable import needs for fresh produce and fruits. Also, exporting essential commodities such as potatoes to the European region intensifies the use of air-cooled vacuum coolers. Furthermore, pallet type is set to grow steadily owing to large exports of fresh seasonal fruits to the neighboring countries and will provide substantial growth to the market.

KEY INDUSTRY PLAYERS

New Active Products and Smart Efficient Products to Gain Strong Market Footing

Key industry players have adopted product diversification and application through new product offerings. Products in the market are getting more efficient in terms of energy usage and optimal vacuum insulation methods. Also, optimizing the performance of vacuum pumps with air-cooled technology to help prominent players acquire a significant market share. Along with this, healthy competition in the market among Chinese players is estimated to drive industry expansion over the forecast period.

- May 2021: Edwards Vacuum, a leading screw vacuum pump manufacturer and a part of Atlas Copco group, launched three compact dry vacuum pump models. A smart choice for the R&D and industrial companies seamlessly offers 40% smaller footprints and integration to analytical systems.

- February 2020: Edwards Vacuum, a leading vacuum solution provider, launched its new nXRi range of vacuum pumps. Due to its wide spectrum of applications and compact size, it offers low power, reliable performance, and reduced cost of operation.

LIST OF TOP VACUUM COOLING EQUIPMENT COMPANIES:

- Atlas Copco (Sweden)

- Verhoeven Family of Companies (Netherlands)

- Coldmaxx (China)

- ULVAC (Japan)

- Pfeiffer Vacuum (Germany)

- Focusun Refrigeration Corporation (China)

- Airtech, Inc. (New Jersey)

- ProXes Gmbh (Germany)

- WEC Group (U.K.)

- Durrer Spezialmaschinen AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- May 2022: Pfeiffer Vacuum inaugurated new leak detection and vacuum technology facility in the Indianapolis region. The company is one of the world’s leading vacuum and leak detection solutions providers for the semiconductor industry.

- January 2021: Osaka Vacuum, a Japanese-based manufacturer, launched a new series of Direct Drive Oil Sealed Rotary Vane Pumps VSV series. The series was more performance and reliable due to competitive pricing.

- July 2021: Pfeiffer Vacuum GmbH, a German-based manufacturer, launched its new HiScroll, ATEX Scroll pump specially designed for the European market. The pumps offer an efficient drive system with higher efficiency at low temperatures and easier, cost-effective cooling.

- September 2020: Durrer Spezialmaschinen AG, a leading provider of vacuum coolers, launched its new customized version of vacuum cooling. The products are equipped with the latest pump technology COBRANX developed by BUSCH.

- September 2020: BVT, a unit of the Verhoeven Family of Companies, a leading vacuum industry solution provider, launched a new generation vacuum cooling and baking solution, VACTORR.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report covers a thorough analysis of the cooling type, type, and application. The companies profiled in this report provide information about leading players in the market and their business overview, product offerings, investments (R&D, expansions, and investments), revenue analysis, types, competition analysis, and leading applications of the product. Besides, the report offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.8% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Cooling Type, By Type, By Application, By Region |

|

By Cooling Type |

|

|

By Type |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 901.6 million in 2025.

According to our insights from report, the market is expected to be valued at USD 1,256.10 million in 2034.

The global market is estimated to have a remarkable CAGR of 3.8% during the forecast period.

Asia Pacific is expected to hold a major market share in the market. The region stood at USD 282.6 million in 2025.

Within the application segment, bakery products are expected to be the leading segment in the market during the forecast period.

Government appealing schemes and the growing demand for fresh produce are expected to drive the market growth.

Atlas Copco (Sweden), Verhoeven Family of Companies (Netherlands), Coldmaxx (China), ULVAC (Japan), Pfeiffer Vacuum (Germany), Focusun Refrigeration Corporation (China), Airtech, Inc. (New Jersey), ProXes Gmbh (Germany), WEC Group (U.K.), and Durrer Spezialmaschinen AG (Switzerland) are the top players in the market.

Bakery product applications is expected to drive the market.

The major players in the market constitute approximately 60%-67% of the market which is majorly owed to their presence in multiple regions and diverse product portfolios.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us