Vegan Supplements Market Size, Share & Industry Analysis, By Type (Protein, Vitamin, Minerals, and Others), By Source (Soy, Pea, Wheat, and Others), By Form (Tablets, Chewable, Powder, and Liquid), By Distribution Channel (Mass Merchandisers, Pharmacies/Drugstores, Specialty Stores, Online Retail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

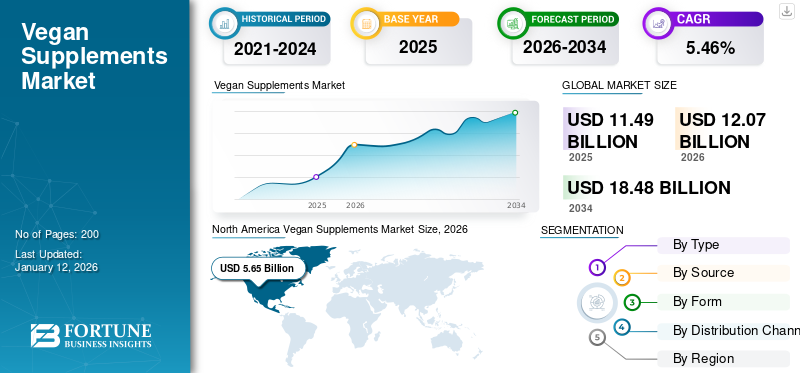

The global vegan supplements market size was valued at USD 11.49 billion in 2025. The market is projected to grow from USD 12.07 billion in 2026 to USD 18.48 billion by 2034, exhibiting a CAGR of 5.46% during the forecast period. North America dominated the vegan supplements market with a market share of 46.82% in 2025.

Vegan or plant-based supplements have witnessed a significant surge in popularity as a large number of consumers are prioritizing holistic approaches to well-being and nutrition. These supplements offer an ethical and sustainable choice for consumers, with a focus on sourcing nutrients from plant-based sources rather than animal-derived ingredients. The prominent players in the market include Roquette Frères, Kerry Group plc, Nestlé S.A., Abbott Laboratories, and Amway Corporation, which focus on market strategies such as new vegan supplement product launches, base expansion, mergers, and acquisition strategies to maintain competition in the global market.

Plant-based supplements are dietary supplements that are manufactured without the inclusion of any ingredients that are sourced from animals. Such supplements are formulated for consumers following a vegan diet, thus ensuring that their nutritional needs are met without the violation of their dietary and ethical needs.

Global Vegan Supplements Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 11.49 billion

- 2026 Market Size: USD 12.07 billion

- 2034 Forecast Market Size: USD 18.48 billion

- CAGR: 5.46% from 2026–2034

Market Share:

- North America dominated the vegan supplements market with a market share of 46.82% in 2025.

Key Country Highlights:

- United States: Rising adoption of plant-based diets, increased demand for clean-label products, and strong presence of key supplement manufacturers like Abbott and Amway drive market leadership.

- Germany: High consumer awareness of sustainable nutrition and health benefits of vegan diets fuel market growth, supported by clean-label trends and regulatory backing.

- Brazil: A shift towards ethical nutrition and increased preference for plant-based proteins such as soy and pea boosts demand for vegan supplements.

- India: Urbanization, rising cases of lactose intolerance, and growing popularity of e-commerce drive demand for plant-based nutritional supplements.

- Japan: Aging population and growing awareness around wellness and healthy aging contribute to the increased consumption of vegan supplements.

Market Dynamics

Market Drivers

Rising Animal Welfare Concerns and Increasing Popularity of Plant-based Diets Drive Market Growth

Rising concerns about animal welfare and animal cruelty have encouraged consumers to shift from animal-based meals to plant-based ones. A vegan lifestyle substantially reduces the number of animals killed and the amount of their suffering. It also assists in reducing the environmental footprint, especially concerning climate change. Therefore, the shift in consumer preference drives the demand for plant-based diets. This constitutes a diverse range of dietary patterns that emphasize foods derived from plant sources and contain lower consumption or exclusion of animal products, fueling the demand for plant-based proteins in supplements. The plant-based diet also has low salts, saturated fats, and added sugars and is therefore recommended as part of a healthy lifestyle. Rising awareness of how lifestyle and diet impact long-term health has further encouraged consumers to seek supplements with plant-based sources, propelling the global vegan supplements market growth.

Growing Usage of E-commerce Platforms Paves Growth Prospects

The rise of e-commerce has transformed the supplements industry, including the plant-based supplements market. Online shopping offers consumers easy access to a wide product range and allows them to read reviews, compare prices, and make informed decisions. The global shift to digital platforms has further made it easier for both large players and small startups to reach new markets, offering a wide range of vegan supplements at competitive prices. E-commerce platforms such as Healthkart, iHerb, Amazon, Walmart, and others are further seizing the opportunity to launch private-label supplement brands, including vegan supplements, and cater to the rising demand for health and wellness products among consumers preferring online shopping.

Market Restraints

Growing Risks of Allergies to Impede Market Growth

The vegan lifestyle is rising rapidly and becoming a more popular trend, and people are seeking innovative ways to incorporate plant-based eating into their lifestyles. The rising consumer avoidance of animal-based protein propels the demand for plant-based alternatives such as soy, pea, rice, and others. Soy protein is a concentrated form of plant-based protein originating from soybeans and is a perfect substitute for animal proteins. However, rising consumer awareness of soy protein allergies is expected to hinder the demand for vegan supplements. According to the Food and Drug Administration (FDA), there are eight specific food allergens covered by the law. Among them, soy is one of the eight major allergens listed on the packaged foods sold in the U.S., this allergy is most common in young children and infants. According to the National Library of Medicine, approximately 0.4% of infants in the U.S. have a soy allergy. Therefore, rising adverse health effects caused by the presence of soy in various supplements may limit the demand for vegan supplements.

Market Opportunities

Rising Focus on Personalized Nutrition to Leverage Market Growth

With the rising consumer demand for tailor-made dietary plans, personalized nutrition is emerging as a promising trend in the global vegan supplements industry, offering an attractive opportunity for businesses to tap into this burgeoning market. Nowadays, consumers are demanding supplements tailored to their unique requirements rather than opting for generic solutions. Moreover, chronic conditions such as diabetes, obesity, cardiovascular diseases, and an aging population further fueled interest in nutrition-based interventions among consumers. For instance, in February 2025, Dr. Vegan, a nutrition and supplement brand, conducted a 300-person survey, which stated nearly nine in ten, i.e., 86% of respondents, expected general practitioners to be trained in nutrition and offer personalized nutrition advice. Therefore, as the market expands, it offers potential avenues for companies to create cutting-edge solutions that cater to the evolving needs of consumers.

Market Challenges

Distinctive Manufacturing Processes to Pose a Challenge for Market Growth

One of the major challenges for the market is formulation technologies and distinctive manufacturing processes, as plant-based supplements are often less effective in terms of benefits in their final form. Supplement manufacturers have heavily relied on gelatin as it offers a high standard in terms of versatility, quality, and efficiency. However, traditional gelatin is an animal byproduct and cannot be used in manufacturing plant-based supplements, which propels the manufacturers to find new solutions and innovate delivery methods for their supplements. Moreover, several supplement producers often add colors to products or the shell to differentiate themselves from other products, which can be challenging while making an exclusively vegan supplement.

Vegan Supplements Market Trends

Rising Demand for Clean Label Ingredients in Food Products to Propel Market Growth

Amid the growing awareness of the environmental and health impacts arising due to synthetic ingredients, consumers continue to adopt the 'clean label' food trend. Consumers today have become more aware of the substances used in their food items and scrutinize product labels more thoroughly. Furthermore, the trends of healthiness and sustainability have triggered consumers to inculcate such clean-label products in their everyday lives. The governments of various nations are also focusing on appropriate and transparent product labeling due to the increasing use of artificial ingredients in products. For instance, the Food and Drug Administration (FDA) ensures that the food sold in the U.S. is safe, healthy, and properly labeled. Therefore, brands offering non-GMO, cruelty-free, and sustainably sourced ingredients are gaining momentum among consumers, further fueling market growth.

Download Free sample to learn more about this report.

Impact of U.S. Tariff

The U.S. tariff significantly impacted the global supplement industry, including the plant-based supplements market. The tariffs have produced a range of effects on the supplement industry. While some critical ingredients, such as vitamins, have been exempt from tariffs, the overall market remains cautious due to potential price rises and supply chain disruptions for other ingredients, such as botanicals. According to the Kline + Company, in April 2025, many essential vitamins such as A, D, E, K, C, B-complex, biotin, and folic acid have been exempted from tariffs and listed as "strategic security and humanitarian supplies." This acted as a short-term relief for supplement manufacturers who depended on these ingredients, especially those from China.

However, the tariff may lead to a higher risk of using low-quality or contaminated material entering the supplement market, further hampering the market growth.

Segmentation Analysis

By Type

Vitamin Segment Dominated Market as It Offers Essential Nutritional Value to Individuals

On the basis of the type, the market is segmented into protein, vitamin, minerals, and others.

The vitamin segment captured the largest market share USD 4.72 billion in 2026. Vitamins are essential nutrients that the human body requires to stay healthy. Therefore, vitamin supplements are consumed in regular diets to offer daily essential nutritional value to the individual. The busy lifestyles, changing food habits of consumers, hectic schedules, and rising consumer awareness regarding the health benefits of consuming vitamin supplements are some major factors expected to boost segment growth. However, the reliance on fast food and processed foods among individuals may affect health, and the deficiency of essential nutrients such as omega-3 fatty acids in the body. According to the National Institute of Health (NIH) report 2023, approximately 35% of adults in the U.S. have a vitamin D deficiency. Therefore, the consumption of vitamin supplements has been on the rise among consumers, fueling market growth. The vitamin segment is anticipated to capture 39.11% of the market share in 2026.

The protein segment is expected to grow significantly over the forecast period. Protein supplements are gaining popularity, owing to their perceived health benefits, such as enhancing performance, muscle mass, and recovery. These supplements are commonly available in the form of protein bars, gummies, powders, and ready-to-drink shakes. Furthermore, the ever-increasing trend of plant-based food products has created a demand for plant-based protein supplements, fueling the market growth. Manufacturers are also coming up with innovative product launches to meet the rising demand. For instance, in July 2023, Pulsin, a U.K.-based nutrition specialist, launched a new range of flavors to add to its vegan protein powder collection. It is available in four flavors and formulated to offer a rich source of protein with 20g per serving, helping boost muscle growth and recovery after workouts.

The minerals segment is likely to register a CAGR of 6.29% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Source

Soy Segment Leads Owing to High Protein Content and Affordability

In terms of source, the market is segmented into soy, pea, wheat, and others.

The soy segment is expected to dominate the global market share by 57.75% and with a market size of USD 6.97 billion in 2026. Soy is known to play a significant role in the plant-based protein industry. Soy protein isolates, which are made from soy, are most commonly used in dietary supplements, such as protein powders. They have been experiencing a rising demand owing to their affordability and high protein content, particularly across markets such as North America. According to the Province of Manitoba report, in 2021, North America was the largest market for the consumption of soy protein isolates, reaching almost 82,000 tons, followed by Asia Pacific with 67,000 tons. Moreover, soy is a great alternative for vegans and vegetarians or those with dairy intolerance, as it offers a complete amino acid profile. Soy protein is also highly digestible and contains no saturated fats or cholesterol, making it suitable for meal supplements to make meals protein-rich.

The pea segment is estimated to be the fastest-growing segment with a CAGR of 6.02% over the forecast period. Pea protein is extracted from yellow peas, which are a naturally occurring plant-based protein source. It offers a wide range of health benefits, making it a popular choice for consumers who seek plant-based and clean protein sources, fueling its application in vegan supplements.

By Form

Chewable Segment to Dominate Owing to Pleasant Taste and Ease in Digestion

In terms of form, the market is segmented into tablets, chewable, powder, and liquid.

The chewable segment dominated the global market with 38.36% of revenue share in 2026. These forms offer great flavors, pleasant mouthfeel, various sweetening options, and good stability. The chewable forms are specially formulated to provide a payload of minerals, vitamins, and other nutraceuticals and are easier for digestion and absorption. Consumers who face difficulty in swallowing pills often prefer the chewable form as they are easy to chew and ideal for kids and adults to add to their routines. Moreover, due to the widespread availability of capsules and gummies, this segment is also expected to emerge as the fastest-growing segment in terms of growth rate over the forecast period.

The powder segment is set to grow at a significant rate over the forecast period. The powder form of supplements is known to be shelf-stable compounds that can be mixed with smoothies or water to add extra vitamins, minerals, and proteins. These usually offer a quick and convenient way to supplement nutrients, making them easier to incorporate into daily routines.

By Distribution Channel

Mass Merchandisers Segment Dominates Owing to Easy Accessibility and Wide Product Selection

In terms of distribution channel, the market is segmented into mass merchandisers, pharmacies/drugstores, specialty stores, online retail, and others.

The mass merchandisers segment is predicted to dominate the global market share by 30.16% and size of USD 3.64 billion in 2026. Mass merchandisers such as supermarkets possess a significant number of outlets across large geographic areas and stock a wide variety of products, such as health supplements, making them a preferred choice for consumers. These establishments also carefully sort health and wellness products, enabling consumers to easily compare and choose the required product from a wide variety of supplements.

On the other hand, the online retail segment is estimated to be the fastest-growing segment with a CAGR of 6.49% during the forecast period. The COVID-19 pandemic accelerated interest in immune-boosting supplements, which has fueled the demand for digital platforms to purchase supplements owing to travel restrictions and lockdowns. The rise of online stores allowed consumers greater product exposure, subscription-based supplement models, and AI-driven personalized nutrition. E-commerce platforms such as Walmart and other specialized health and wellness websites gained popularity owing to a wide range of products with competitive pricing and convenience.

Vegan Supplements Market Regional Outlook

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Vegan Supplements Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market with a USD 5.56 billion in 2026. North America, which includes the U.S. and Canada, is the leading market for plant-based supplements owing to factors such as increasing health awareness and food preferences, ethics, and sustainability. The number of people consuming vegan and plant-based diets has increased tremendously in the region. According to the Multidisciplinary Digital Publishing Institute (MDPI), in 2020, around 6% of adults in the U.S. followed a vegetarian diet, and half of them were vegan. Consumers in the region have become more conscious of the health advantages of vegan diets and supplements, including a low risk of chronic diseases such as diabetes and obesity, and improved quality of nutrition, influencing the plant-based supplements market. Moreover, the region is also dominated by a large number of big multinational and local supplement firms, including Nestlé S.A., MusclePharm Corporation, Amway Corporation, Abbott Laboratories, and others that spend heavily on new product development, mergers, and partnerships to access new markets and increase their market share. The U.S. market is estimated to reach USD 4.41 billion in 2026.

Europe

Europe held the second-largest share, with a market size of USD 3.47 billion in 2025, expanding to USD 3.62 billion in 2026 and capturing 30.19% of the global market. is increased demand for preventive healthcare and wellness in Europe, which has resulted in demand for supplements to overcome common deficiencies such as vitamins B12, D, and iron. Food supplements are becoming popular as they are considered a healthier and safer option than synthetic ones. The region is also witnessing a rising trend toward veganism, which is influencing the supplement market. According to the Center for the Promotion of Imports, in Europe, about 61% of supplement users reported that they are concerned about the natural origin, and about 46% of them do not want their supplements to be made from animal origin. This trend is a future potential for plant-based products in the European market, with exceptional growth in the demand for plant-based ingredients in food supplements, such as immune-boosting botanicals and plant-based probiotics. The U.K. market is projected to reach USD 0.64 billion, while the German market is estimated to be USD 0.74 billion and France is likely to hit USD 0.53 billion in 2025.

Asia Pacific

Asia Pacific is expected to be the third-fastest growing region in the global market with USD 2.52 billion in 2026. Factors such as the region’s large population, rapid urbanization, rising middle-class disposable incomes, and increased health awareness, especially in emerging economies such as China and India, contribute to market growth. The rising aging population of countries such as Japan has further increased the demand for nutritional supplements, including plant-based ones, for wellness and healthy aging. According to the Economic and Social Commission for Asia and the Pacific report, in 2023, about 44,483 (thousands) people in Japan were above 60+ age. Moreover, increased awareness and participation in fitness and sports activities in Asia Pacific is likely to drive protein and other nutritional supplements consumption. Consumers based in urban areas are, therefore, more subject to fitness and wellness trends that are encouraging the use of supplements, including vegan ones. The Japan market is projected to reach USD 0.63 billion, while the Indian market is estimated to be USD 0.19 billion and China is likely to hit USD USD 1.33 billion in 2026.

South America

South America is the fourth-largest region with a market value of USD 0.17 billion in 2025, also known to be a land of opportunity for many emerging markets, and vegan food supplements are rapidly becoming popular in the region. Rising urbanization, growing middle class with disposable incomes, rising health awareness, and increased elderly population are the factors that are contributing to the growth of the market. Consequently, consumer demand for food supplements is expected to increase further, which could help consumers meet their optimum health goals, such as weight management, immunity boosting, and digestive health. Consumers in the region are also embracing plant-based protein sources such as soy, pea, and lentils, owing to rising allergies and the growing popularity of cleaner, more ethical nutrition. According to a DuPont Nutrition & Health survey conducted in 2019, Brazil, Argentina, and Colombia are leading countries in South America, with 67%, 65%, and 78% of consumers, respectively, showing interest in plant proteins. Moreover, Brazil and Argentina are leading the vegan supplement market owing to the evolving regulatory landscape, large population, and cultural trends.

Middle East & Africa

The alternative and plant-based protein market has been growing steadily in the Middle East & Africa region due to rising health awareness among consumers, urbanization, sustainability, and ethical consumption. These factors have been the key drivers for the increasing demand for plant-based health supplements in the region. Further, health consciousness among consumers has grown since the outbreak of the COVID-19 pandemic, driving high-protein and low-fat products for healthier consumption, which, in turn, is driving demand for plant-based supplements as these align with these preferences. The UAE market is likely to reach 0.12 billion in 2026.

Competitive Landscape

Key Market Players

Get comprehensive study about this report by, Download free sample copy

The global vegan supplements market is moderately consolidated, with the presence of large players as well as small active players, creating a dynamic landscape offering potential growth opportunities. The prominent players in the market include Roquette Frères, Kerry Group plc, Nestlé S.A., Abbott Laboratories, and Amway Corporation. These players are focusing on adopting development strategies such as innovative product launches, investing in research and development, base expansion, and partnerships in order to strengthen their business and gain a competitive edge in the global market. For instance, in October 2024, Fortifeye Vitamins, one of the leaders in nutritional supplements, introduced a new line of 100% Vegan protein powders. The new line is a soy-free and plant-based protein blend available in vanilla, chocolate, and salted caramel mocha flavors.

List of Key Vegan Supplement Companies Profiled:

- Danone S.A. (France)

- Roquette Frères (France)

- Glanbia plc (Ireland)

- Kerry Group plc (Ireland)

- Nutrazee (India)

- Amway Corporation (U.S.)

- MusclePharm Corporation (U.S.)

- Nestlé S.A. (Switzerland)

- Abbott Laboratories (U.S.)

- Plant Fusion (U.S.)

Key Industry Developments

May 2025 – Eat Just launched a new product, Just One, which is a single-ingredient vegan protein powder made from mung beans. The new product is available at US Whole Foods Market stores and online from Purple Carrot.

January 2025 – West Family Ventures LLC., a U.S.-based company, launched Zyra Protein Powder. It is a plant-based nutritional supplement made from pea protein, strawberry powder, date sugar, and salt.

September 2024 – FoodFutureCo, a sustainable and health-forward food company, launched a product range named Smart Eats. It is a sugar-free Iron Lift protein powder, which is designed for runners and athletes to accelerate recovery and fuel workouts.

June 2024 – Nutriburst collaborated with Universal Products & Experiences and launched its latest range of new Nutriburst Kids’ Minions Vitamins gummies, which are sugar-free, vegan, and made from plants.

October 2023 – Sirio Pharma, one of the leading contract manufacturers for the dietary supplement industry, expanded its product offering by launching a range of herbal gummies for trending consumer health categories. The new range is vegan (pectin-based) and contains low-to-no sugar.

Report Coverage

The global vegan supplements market report analyzes the market in depth. It highlights crucial aspects such as prominent companies, market trends, research, analysis, segmentation, competitive landscape, type, source, distribution channel, and form. Besides this, it provides insights into the market demand and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.46% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Source

By Form

By Distribution Channel

By Region

|

Frequently Asked Questions

The global vegan supplements market size was valued at USD 11.49 billion in 2025. The market is projected to grow from USD 12.07 billion in 2026 to USD 18.48 billion by 2034, exhibiting a CAGR of 5.46% during the forecast period.

Fortune Business Insights says that the global market value for 2025 is anticipated to touch USD 12.07 billion.

The global market is projected to grow at a significant CAGR of 5.46% during the forecast period of 2026-2034.

By source, the soy segment dominates the market.

Rising demand for clean-label ingredients in food products is likely to drive the demand in the market.

Roquette Freres, Kerry Group plc, Nestle S.A., Abbott Laboratories, Amway Corporation, and others are some of the leading players globally.

North America dominates the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us