Vehicle to Infrastructure Communication Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), By Technology (Dedicated Short Range Communication (DSRC), Cellular, Wi-Fi, WiMAX, and Bluetooth), By Application (Traffic Management Systems, Parking Management Systems, Public Transportation, Electronic Toll Collection, and Others), By Component (Hardware, Software, and Service) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

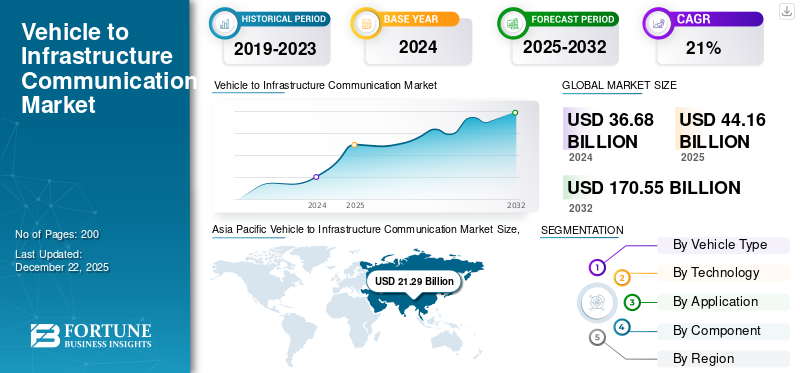

The global vehicle to infrastructure communication market size was valued at USD 36.68 billion in 2024 and is projected to grow from USD 44.16 billion in 2025 to USD 170.55 billion by 2032, exhibiting a CAGR of 21.3% during the forecast period. Asia Pacific dominated the vehicle to infrastructure communication market with a share of 58.04% in 2024.

Vehicle to Infrastructure (V2I) communication refers to the wireless exchange of information between vehicles and road infrastructure, such as traffic signals, lane markings, and road signs. This technology enables vehicles to receive real-time data from infrastructure components, which can enhance traffic management, improve road safety, and reduce accidents. As urban areas become more congested, vehicle to infrastructure communication systems are increasingly recognized for their potential to optimize traffic flow and support the development of smart city initiatives.

Download Free sample to learn more about this report.

VEHICLE-TO-INFRASTRUCTURE (V2I) COMMUNICATION MARKET OVERVIEW

Key Market Trends and Drivers

- AI-driven optimization: Integration of AI/ML in V2I enhances predictive maintenance, traffic control, and hazard alerts.

- EV charging standards: Adoption of ISO 15118 enables seamless vehicle-to-charger communication, boosting smart EV infrastructure.

- ADAS & regulatory push: EU mandates for Intelligent Speed Assistance (ISA) and ADAS are accelerating V2I deployment.

- Smart city initiatives: Governments like the U.S. and Japan invest heavily in V2I-enabled smart mobility projects.

- DSRC & 5G convergence: DSRC remains dominant, but cellular V2I adoption rises with 4G/5G expansion and FCC backing.

Market Size & Share

- 2024 Market Value: USD 36.68 Billion

- 2025 Estimate: USD 44.16 Billion

- 2032 Forecast: USD 170.55 Billion

- CAGR (2025–2032): 21.3%

- Top Region: Asia Pacific (58.04% share in 2024)

- Top Application: Traffic Management Systems

- High-Growth Technology: Cellular V2I (5G-based communication)

Market Challenges

- Data privacy & cybersecurity: Risks from hacking, data breaches, and regulatory constraints (e.g., GDPR) limit adoption.

- Infrastructure gaps: High cost and fragmented rollout of V2I infrastructure across emerging markets.

- Tech standardization: Interoperability issues between DSRC, cellular, and Bluetooth hinder seamless deployment.

The global vehicle to infrastructure communication market is experiencing significant growth driven by advancements in connected vehicle technology and increasing investments in smart infrastructure. Governments and the private sector are focusing on enhancing transportation safety and efficiency through V2I systems. The integration of V2I with other technologies, such as 5G networks and artificial intelligence, is expected to propel market expansion further. Additionally, the rising demand for autonomous vehicles is creating new opportunities for V2I applications, making them a crucial component of future transportation systems. Key players driving innovation in the V2I market include Robert Bosch, known for smart city and mobility solutions; Qualcomm, a leader in 5G-enabled automotive communication; Infineon Technologies, specializing in semiconductor solutions for vehicle connectivity; and Audi, which has pioneered real-world vehicle to infrastructure communication applications such as Traffic Light Information. These companies are shaping the future of intelligent transportation through advanced hardware, software, and strategic partnerships.

The COVID-19 pandemic had a multifaceted impact on the Vehicle-to-Infrastructure communication sector. Initially, lockdowns and reduced travel led to decreased traffic volumes, which temporarily diminished the urgency for vehicle to infrastructure communication system deployment. However, as cities began to adapt to new norms, there was a renewed focus on enhancing transportation safety and efficiency. The pandemic highlighted vulnerabilities in existing infrastructure, prompting accelerated interest in smart technologies that can improve mobility systems. Consequently, investments in V2I solutions are likely to increase, with governments prioritizing the development of more resilient transportation networks in the post-pandemic era.

Vehicle to Infrastructure Communication Market Trends

Rapid Adoption of Artificial Intelligence (AI) Technology in Vehicles is a Key Market Trend

A significant trend driving the global Vehicle-to-Infrastructure (V2I) communication market growth is the integration of advanced artificial intelligence (AI) and machine learning technologies. These innovations enhance the capabilities of V2I systems by allowing for more efficient traffic management and improved predictive maintenance. For instance, companies such as DENSO have launched solutions that utilize AI to optimize traffic flow and reduce congestion by analyzing real-time data from connected vehicles and infrastructure. Moreover, regulatory bodies are increasingly mandating the adoption of advanced driver assistance systems (ADAS) and intelligent speed assistance systems. The European Union has implemented regulations requiring new vehicles to feature speed-limiting technology, which works in conjunction with V2I systems to ensure compliance with speed limits.

Additionally, developments in electric vehicle (EV) infrastructure are noteworthy. The ISO 15118 standard for EV charging supports direct communication technology between vehicles and charging stations, facilitating seamless transactions without external devices. Furthermore, the U.S. Department of Transportation has introduced initiatives aimed at fostering smart city projects that integrate V2I communication to enhance safety and efficiency on urban roads. This regulatory push complements the growing trend of partnerships between automotive manufacturers and tech firms to accelerate V2I technology deployment.

Market Drivers

Increasing Emphasis on Road Safety and Accident Prevention is Driving Market Growth

As urbanization accelerates and traffic congestion becomes a pressing issue, governments and organizations are prioritizing the deployment of Intelligent Transportation Systems (ITS) that leverage V2I technology to enhance safety measures. Recent developments highlight this growing trend. For instance, the U.S. Department of Transportation has allocated significant funding toward smart city initiatives that integrate V2I systems to improve traffic management and reduce accidents. In 2023, the European Commission proposed regulations mandating that all new vehicles be equipped with advanced safety features, including V2I capabilities, to enhance road safety.

Manufacturers such as Bosch and Continental are actively investing in V2I technologies to meet these regulatory demands. Additionally, companies such as Ford are developing vehicles with integrated V2I communication systems that provide real-time alerts about road conditions and potential hazards. Technological advancements are also playing a crucial role in supporting this shift. The integration of AI in V2I systems allows for predictive analytics, enabling proactive measures to prevent accidents. Moreover, the implementation of Dedicated Short-Range Communications (DSRC) enhances the reliability of vehicle-to-infrastructure interactions, further promoting safety on the roads. This is expected to boost the vehicle to infrastructure communication market growth.

Market Restraints

Data Privacy and Cybersecurity Concerns Restrain Market Expansion

As V2I systems rely on the exchange of sensitive information between vehicles and infrastructure, the risk of data breaches and unauthorized access poses significant challenges. For instance, recent reports have highlighted vulnerabilities in connected vehicle systems that could potentially lead to hacking incidents, raising alarms among consumers and manufacturers alike. To address these concerns, regulatory bodies are implementing stricter data protection regulations. The European Union's General Data Protection Regulation (GDPR) mandates stringent measures for handling personal data, impacting how automotive companies design their V2I systems.

Moreover, manufacturers such as Ford and General Motors are investing in robust cybersecurity measures to safeguard their connected vehicle platforms. Initiatives such as the Automotive Cybersecurity Framework aim to establish industry-wide standards for protecting vehicle data. Additionally, the U.S. Department of Transportation has launched programs to enhance cybersecurity across transportation systems, emphasizing the need for secure communication channels in V2I technologies. These developments indicate that while the potential for V2I is vast, privacy and security concerns remain critical hurdles to its widespread adoption.

Market Opportunities

Integration of V2I Systems into Smart City Infrastructure to Enhance Road Safety, Optimize Traffic Flow, and Support the Rollout of Autonomous Vehicles

V2I enables vehicles to exchange real-time data with traffic signals, road signs, and management systems, allowing for predictive analytics, adaptive signal timing, and early hazard warnings. This technology is increasingly vital as urban congestion and accident rates rise. Government initiatives such as the EU’s C-ITS Directive and the U.S. Department of Transportation’s smart city grants are accelerating deployment by funding pilot projects and mandating interoperability standards. Technological developments include the adoption of 5G and IoT, enabling ultra-low latency communication, and AI-driven traffic management platforms, as demonstrated by Qualcomm’s Snapdragon Auto 5G Modem-RF Gen 2 and Bosch’s intelligent city solutions. Recent news highlights cities such as Detroit and Barcelona integrating V2I to reduce congestion and emissions, while Audi’s Traffic Light Information system optimizes signal timing for improved efficiency. Regulations such as ISO/SAE 21434 ensure cybersecurity in data exchange, and the NHTSA’s V2I guidance promotes nationwide rollout in the U.S.

Segmentation Analysis

By Vehicle Type

SUVs Segment Dominates Due to Their Increasing Adoption in Urban Areas

By vehicle type, the market is divided into hatchbacks/sedan, SUVs, light commercial vehicle (LCV), and heavy commercial vehicle (HCV).

Among these, SUVs dominate the market due to their increasing adoption in urban settings, where V2I technology enhances safety and navigation. For example, manufacturers such as Toyota are integrating V2I capabilities into their SUV models to improve traffic flow and reduce congestion. Government regulations are also playing a crucial role in influencing this segment. In the U.S., the National Highway Traffic Safety Administration (NHTSA) has promoted the integration of V2I technologies in new vehicles to enhance road safety.

Moreover, advancements in connected vehicle technologies are driving growth across all vehicle types. Companies such as Ford are developing models equipped with advanced sensors and communication modules that facilitate real-time data exchange with infrastructure. This trend is further supported by initiatives promoting electric and autonomous vehicles, which often come equipped with V2I capabilities as standard features.

By Technology

Reliable Communication Functionality with Low Latency Makes Dedicated Short Range Communication (DSRC) Dominate Market

By technology, the market is divided into dedicated short range communication (DSRC), cellular, Wi-Fi, WiMAX, and Bluetooth.

Currently, the dedicated short range communication (DSRC) segment leads due to its low latency and high reliability for real-time communication between vehicles and infrastructure. For instance, cities such as New York have begun deploying DSRC systems to improve traffic signal timing based on real-time vehicle data.

However, cellular technology is rapidly gaining ground due to its broader coverage and compatibility with existing mobile networks. Manufacturers such as Qualcomm are pushing for cellular V2I solutions that leverage 4G and 5G networks to enhance connectivity. Regulatory frameworks are evolving to support these technologies; for example, the Federal Communications Commission (FCC) in the U.S. has allocated spectrum for DSRC applications while also exploring opportunities for cellular-based solutions.

Furthermore, advancements in Wi-Fi and Bluetooth technologies are enabling specific applications such as smart parking management and automated toll collection systems.

By Application

Increasing Vehicular Conjunction Makes Traffic Management Systems Dominate the Market

By application, the market is fragmented into traffic management systems, parking management systems, public transportation, electronic toll collection, and others. Traffic management systems are particularly dominant as cities aim to optimize flow and reduce congestion. For instance, Los Angeles has implemented smart traffic signals that communicate with vehicles to adjust timing based on real-time traffic conditions.

Parking management systems are also gaining traction as urban areas face increased demand for efficient parking solutions. Companies such as ParkMobile are integrating V2I technologies into their platforms, allowing drivers to find available spaces quickly. Government initiatives play a crucial role in this segment, with many municipalities adopting smart city strategies that include V2I solutions to improve public transportation. Additionally, regulations promoting electronic toll collection systems further drive adoption by streamlining payment processes and reducing wait times at toll booths.

By Component

Hardware Components are Essential Components Installed for Communication, Making it Dominate the Market

By component, the market is segregated into hardware, software, and service. Hardware components such as onboard units (OBUs) and roadside units (RSUs) are critical for establishing effective communication channels between vehicles and infrastructure, generating the largest revenue share, and dominating the market. Companies such as Siemens are developing advanced RSUs that incorporate sensors and communication modules for enhanced data exchange.

Software solutions also play a vital role in processing the data collected through V2I systems. For instance, companies such as Cisco are offering cloud-based software platforms that analyze traffic data to provide actionable insights for urban planners. Service offerings related to the installation and maintenance of V2I systems are increasingly important as cities upgrade their infrastructure. Government regulations often mandate specific service standards to ensure reliability and security in V2I communications. As cities invest in smart infrastructure projects undertaken by the government, the demand for comprehensive service packages that include consulting and integration services is expected to grow significantly.

Vehicle to Infrastructure Communication Market Regional Outlook

The global vehicle to infrastructure communication market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Vehicle to Infrastructure Communication Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Urbanization and Significant Investments in Smart Transportation Solutions Drive the Market Growth in Asia Pacific

Asia Pacific leads the vehicle to infrastructure communication market share due to rapid urbanization and significant investments in smart transportation solutions. Countries such as Japan and South Korea are leading the way with government initiatives aimed at modernizing their transportation infrastructures. For instance, Japan's Smart Mobility Challenge encourages local governments to adopt advanced transportation technologies, including V2I systems. In South Korea, major automotive manufacturers such as Hyundai are integrating V2I capabilities into their vehicles to enhance connectivity with urban infrastructure. The country has also implemented smart traffic management systems that utilize V2I technology to optimize traffic flow and reduce congestion in major cities such as Seoul.

North America

North America's V2I communication market is driven by robust technological infrastructure and significant government support for advanced vehicle technologies. The U.S. Department of Transportation has been proactive in promoting V2I systems, implementing initiatives that encourage the integration of these technologies into new vehicles. For example, the Connected Vehicle Pilot Deployment Program aims to test V2I applications in real-world scenarios across multiple cities, enhancing traffic management and safety.

Europe

Europe is witnessing the fastest growth in the V2I communication market, primarily due to stringent safety regulations and a strong focus on integrating intelligent transportation systems. The European Union has implemented regulations that mandate the adoption of connected vehicle technologies to enhance road safety and reduce emissions. For instance, the EU's ITS Directive encourages member states to deploy intelligent transport systems, including V2I applications. Countries such as Germany are at the forefront of this trend, with significant investments in smart automotive projects.

Rest of the World

The market in the Rest of the World is gradually gaining traction. Countries in Latin America and parts of the Middle East & Africa are increasingly recognizing the importance of modernizing their transportation infrastructures to improve road safety and efficiency. For instance, Brazil has initiated projects aimed at implementing smart traffic management systems that incorporate V2I technology to address urban congestion issues in major cities such as São Paulo. The Brazilian government is also exploring partnerships with technology providers to enhance its public transportation systems through connectivity solutions.

Competitive Landscape

Key Market Players

Key Players Focus on Integrating V2I Technology into Their Vehicles to Gain a Competitive Edge

The leading player in the global Vehicle to Infrastructure (V2I) communication market is Audi AG. Audi has established itself as a pioneer in integrating advanced communication technologies into its vehicles, positioning itself at the forefront of the V2I landscape. The company's commitment to innovation is evident in its development of the Traffic Light Information (TLI) system, which allows vehicles to communicate with traffic signals. This system provides real-time data on signal status, enabling drivers to optimize their speed and reduce waiting times at intersections. Audi's proactive approach to V2I technology aligns with its broader strategy of enhancing vehicle connectivity and safety, making it a leader in this sector. Audi's offerings also extend to Vehicle to Vehicle (V2V) communication, where the company focuses on enhancing safety and traffic efficiency. The company has been involved in developing systems that allow vehicles to share critical information about road conditions and potential hazards, thereby improving overall road safety. This integration of V2V communication complements its V2I initiatives, creating a comprehensive ecosystem that enhances the driving experience.

Qualcomm is known for its contributions to wireless communication technologies. Qualcomm's C-V2X (Cellular Vehicle-to-Everything) technology enables vehicles to communicate with each other and with infrastructure and network services. This technology supports both direct communication between vehicles and infrastructure-based communication, facilitating applications such as traffic signal priority and collision avoidance. Qualcomm's focus on robust connectivity solutions positions it as a key player in the V2V segment, driving advancements that enhance vehicle safety and efficiency on the roads.

KEY INDUSTRY DEVELOPMENTS

- February 2025- AUTOCRYPT launched a Security Fuzzer in Japan through a Distributor Agreement with Hitachi Solutions. This launch adds to the existing partnership between the two companies, as AUTOCRYPT currently offers its V2X security solution, with the option of integrating its security library with Hitachi Solutions' Vehicle-to-Everything (V2X) Middleware Platform.

- October 2024- South Africa launched a credit-guarantee facility to boost private sector involvement in the country’s ambitious infrastructure investment plans, reducing the need for public spending. The facility is being deployed with the International Finance Corp; Eskom will pilot the private-sector lending arm of the World Bank and the program as part of its aggressive expansion of the national grid over the next decade.

- August 2024- The U.S. DOT launched a framework to deploy vehicle-to-everything technology nationwide.

- January 2023- Integrity Security Services and SAESOL Tech announced a strategic partnership to deliver connected and autonomous vehicle (CAV) security solutions. The collaboration aimed to provide comprehensive security measures to protect CAVs from cyber threats, ensuring the safety and reliability of V2I and V2V communications.

- January 2022- Honda Motors signed a partnership with the V2X Suisse consortium and Switzerland’s car-sharing operator, Mobility, to work on the V2G trial project. Under this project, Honda supplied 50 electric vehicles to Mobility to perform the trial. The company also provided 35 power managers that deliver V2G energy recovery capability.

REPORT COVERAGE

The global vehicle to infrastructure communication market report analysis report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology advances. Besides this, the report offers insights into the latest market trends and highlights key automotive industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Technology

By Application

By Component

By Geography

|

Frequently Asked Questions

Fortune Business Insights says the market was valued at USD 36.68 billion in 2024 and is projected to reach USD 170.55 billion by 2032.

The market is expected to register a CAGR of 21.3% during the forecast period of 2025-2032.

Increasing emphasis on road safety and accident prevention is likely to drive market growth.

Asia Pacific leads the market.

Qualcomm, LG Electronics, Huawei, Hyundai Motor Company, and Toyota are among the leading key players in the market.

Integration of vehicle to infrastructure communication systems into smart city infrastructure to enhance road safety, optimize traffic flow, and support the rollout of autonomous vehicles is the key opportunity of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us