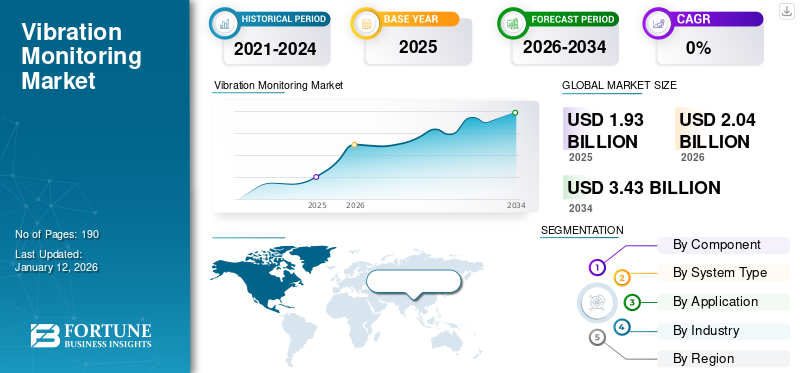

Vibration Monitoring Market Size, Share & Industry Analysis, By Component (Hardware {Accelerometers, Vibration Meters, Vibration Analyzers, Proximity Probes, Velocity Sensors, Vibration Transmitters, Others}, Software {On-Premises and Cloud}, and Services), By System Type (Online and Portable), By Application (Motors and Pumps, Turbines and Compressors, Gearboxes and Bearings, and Fans and Blowers), By Industry (Oil & Gas, Power Generation, Mining & Metals, Automotive, Chemicals, Others {Aerospace, Food & Beverages, etc.}), and Regional Forecast, 2026-2034

VIBRATION MONITORING MARKET SIZE AND FUTURE OUTLOOK

The global vibration monitoring market size was valued at USD 1.93 billion in 2025. The market is projected to grow from USD 2.04 billion in 2026 to USD 3.43 billion by 2034, exhibiting a CAGR of 6.70% during the forecast period.

A vibration monitoring system is a tool that looks for irregularities and other anomalies in a machine's health by measuring its vibration levels. It involves usage of sensors to record vibration signatures, aiding in the identification of faults such as misalignment, unbalance, or loose parts to avoid downtime and expensive repairs. The method is extensively employed in predictive maintenance for optimal operational safety and efficiency.

Growth drivers for the vibration monitoring industry are rising demand for predictive maintenance, swift uptake of Industrial Internet of Things (IIoT) and smart manufacturing, sensor technology advancements (wireless and cloud-based), growing safety concerns across industries, and government-supported smart manufacturing programs. All these drivers are driving market growth, particularly in industries such as oil & gas, power generation, and manufacturing.

The main participants in the market include ABB Ltd., Acoem Group, Emerson Electric Co., Baker Hughes Company, Brüel & Kjær, and Fluke Corporation.

MARKET DYNAMICS

Market Drivers

Cost of Unplanned Downtime & Asset Criticality Driving Market Growth

Unplanned downtime cost and asset criticality are prime drivers driving the expansion of the global vibration monitoring market. Unplanned breakdowns of equipment have the potential to lead to massive cost outlays, particularly in sectors with high-value assets such as power generation, oil & gas, and heavy manufacturing.

A Ponemon Institute study indicates the total cost for unplanned data center outages averages more than USD 1 million per event, with expense levels going higher than USD 5,000 per minute for downtime incidents. ARC has similarly put the aggregate cost of unplanned downtime for process industries globally at USD 1 trillion, highlighting the urgent need for sophisticated monitoring systems to avoid failures.

Vibration monitoring facilitates early fault detection of equipment, enabling firms to transition from reactive to predictive maintenance, hence minimizing downtime expense and preserve asset reliability. Industries with costly failure modes are consequently prime adopters of such technologies.

Market Restraints

Concerns About Data Quality & Sensor Placement Hinder Growth and Limit Market Scalability

Concerns about data quality and sensor placement continue to restrict the scalability of the global vibration monitoring market. Inaccurate mounting, unsuitable sensor selection, and incorrect sampling rates often generate poor-quality or irrelevant data, resulting in false alarms or missed fault detection. This makes users lose trust and spend more on maintenance because of repeated checks or recalibrations. Also, since there are no common standards for installing sensors or verifying data, systems from different industries often don’t work well together, which limits the vibration monitoring market growth.

Market Opportunities

Rising Verticalized Solutions Drive Growth, Creating Opportunities for Innovation

The growing demand for verticalized oriented vibration monitoring solutions is creating robust business and innovation prospects. Wind energy, oil and gas, power generation, and heavy manufacturing industries are driving the demand for customized sensors and top-tier analytics tailored to their specific machinery and operational issues. This specialization makes it possible for providers to offer premium predictive maintenance insights that reduces downtime and operations risks. With digital transformation advancing worldwide, vendors who combine domain expertise with AI-powered analytics have the potential to gain enormous market share by providing accurate, application-specific solutions.

VIBRATION MONITORING MARKET TRENDS

Shift from Route-Based to Continuous (Online) Monitoring as a Major Market Trend

A major shift is occurring from route-based inspections toward ongoing online monitoring, reshaping how plants manage asset health. Traditional handheld or intermittent data collection methods are being replaced with systems installed on a permanent basis, delivering real-time vibration information and automated fault indication. These continuous systems enable proactive maintenance decisions, reduce unplanned outages, and improve equipment reliability. The integration of Industrial Internet of Things (IIoT) platforms, cloud-based analytics, and wireless sensor networks is accelerating this trend, pushing industries toward more connected, data-driven maintenance ecosystems.

SEGMENTATION ANALYSIS

By Component

Extensive Use of Advanced Sensors Makes Hardware Segment Lead the Market

Based on the component, the market is segmented into hardware (accelerometers, vibration meters, vibration analyzers, proximity probes, velocity sensors, vibration transmitters, others), software (on-premises and cloud), and services. The Hardware segment is projected to dominate the market with a share of 50.78% in 2026.

The hardware segment held the largest revenue share of USD 0.96 billion in the overall global market in the year 2024. The increase in revenue is due to the extensive use of advanced sensors, transducers, and data acquisition devices that form the foundation of condition monitoring systems. The high upfront investment in these essential components drives its largest market share worldwide.

Of all the segments, software holds the highest CAGR of 8.50% in the global market. The growth of software component is mainly due to the integration of predictive analytics, artificial intelligence, and machine learning, along with the increasing adoption of cloud-based SaaS platforms that enhance scalability, real-time diagnostics, and remote asset performance management.

By System Type

Online Segment Dominates Market Owing to Its Widespread Adoptionin Oil & Gas and Power Generation

Based on channel, the market is divided into online and portable.

The online vibration monitoring led with a market share of USD 1.20 billion in 2024. The segment continues to generate the major revenue due to its widespread adoption across critical rotating machinery in industries such as oil & gas and power generation, where continuous, real time data collection and remote diagnostics are essential for preventing unexpected equipment failures and ensuring operational reliability. The Online segment is expected to lead the market, contributing 63.04% globally in 2026.

The portable system type holds the highest CAGR of 8.60% in the global market. The segment’s growth is mainly due its ability to its cost-effectiveness, ease of deployment, and suitability for retrofitting existing plants and monitoring non-critical assets, enabling flexible and accessible vibration analysis across a wide range of industrial applications.

By Application

Turbines and Compressors Segment Dominates Market Due to Their Critical Role in Energy and Process Industries

Based on the application, the market is divided into motors and pumps, turbines and compressors, gearboxes and bearings, and fans and blowers.

The Turbines and Compressors segment will account for 34.86%market share in 2026. The segment for turbines and compressors accounted for the largest vibration monitoring market share at USD 0.65 billion in the year 2024. The segment continues to generate the highest revenues due to their critical role in energy and process industries. These high-value assets pose major failure risks, thus driving high demand for cutting-edge vibration monitoring to ensure operational reliability, minimize downtime, and reduce costly maintenance interventions.

Fans and blowers represent the largest CAGR of 10.72% in the global market. Fans and blowers are growing faster primarily due to the rising adoption of predictive maintenance and smart factory initiatives, enabling early detection of imbalances, reducing energy losses, and enhancing operational efficiency in HVAC, manufacturing, and industrial process applications.

By Industry

Strict Uptime Demands andPrecision Needs Enhances the Oil & Gas Segment Growth

Based on the industry, the market is divided into oil & gas, power generation, mining & metals, automotive, chemicals, others (aerospace, food & beverages, etc.).

The oil & gas industry led with a notable market share due to equipment uptime being essential for production and safety. Any breakdown would lead to massive economic losses, delayed production, and environmental hazards. Advanced vibration monitoring helps prevent costly breakdowns, ensures continuous operations, and supports strict industry safety and reliability standards.

The automotive segment is growing as Industry 4.0 initiatives transform manufacturing operations. The shift toward smart factories and predictive maintenance allows for real-time machinery health tracking. This factor is driving the demand for cutting-edge sensors and monitoring software to improve production efficiency, reliability, and equipment lifespan.

To know how our report can help streamline your business, Speak to Analyst

VIBRATION MONITORING MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

The North America market was valued at USD 0.58 billion in 2025 and reached USD 0.62 billion in 2026. The region is expected to register the highest CAGR of 7.98%, driven by its advanced industrial infrastructure, early adoption of condition-monitoring technologies, and strict regulatory frameworks emphasizing equipment reliability, operational safety, and predictive maintenance solutions. The U.S. is the leader in the North America market, with an expected revenue of USD 0.46 billion in 2026.

Europe

The European market is substantially growing and is likely to contribute to a revenue share of USD 0.36 billion in 2025. This growth of the region can be attributed to strict equipment maintenance policies, superior manufacturing processes, and higher usage of predictive maintenance technologies in major industries. The U.K., Germany and France are some of the leading contributors to the growth in the market, with the required revenue stake of USD 0.07 billion, USD 0.1 billion and USD 0.04 billion respectively by 2026.

Asia Pacific

Asia Pacific is currently at the forefront of the global market. The market size was valued at USD 0.78 billion in 2025 and is projected to reach USD 0.82 billion by 2026. Rapid industrialization, rising adoption of automation technologies, and increasing emphasis on Industry 4.0 is largely driving the market growth in the region. Moreover, the strong growth of the automotive and manufacturing sectors in China and India further fuels market expansion across the region.

India and China are major contributors to the market growth with an expected revenue share of USD 0.11 billion, and USD 0.3 billion respectively by 2026.

Download Free sample to learn more about this report.

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 0.07 billion and USD 0.14 billion respectively in 2025 due to gradual industrial automation and spending in mining and manufacturing industries. GCC countries are also expected to hold a market value of USD 0.06 billion by 2025 based on oil & gas projects and predictive maintenance implementation.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus On Partnerships and Acquisitions to Lead the Industry

The vibration monitoring market is led by major industrial technology companies and specialized sensor manufacturers with strong global reach and diversified product portfolios. Key players in the market, Honeywell International Inc., PCB Piezotronics, Inc. (IMI Sensors), Kistler Group, Parker Hannifin Corporation, National Instruments Corporation (NI), PRÜFTECHNIK Dieter Busch GmbH, and Rockwell Automation, Inc., focus on IoT integration, AI, and wireless technologies to drive growth through innovation and product diversification. Strategies also include developing comprehensive service offerings, strategic mergers and acquisitions, and partnerships to expand reach.

LIST OF KEY VIBRATION MONITORING COMPANIES PROFILED:

- ABB Ltd. (Switzerland)

- Acoem Group (France)

- Emerson Electric Co. (U.S.)

- Baker Hughes Company (U.S.)

- Brüel & Kjær (Denmark)

- Fluke Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- PCB Piezotronics, Inc. (IMI Sensors) (U.S.)

- Kistler Group (Switzerland)

- Parker Hannifin Corporation (U.S.)

- National Instruments Corporation (NI) (U.S.)

- PRÜFTECHNIK Dieter Busch GmbH (Germany)

- Rockwell Automation, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2025- TDK Corporation announced that its subsidiary, Tronics Microsystems, a leading provider of high-performance inertial MEMS sensor solutions, is expanding its product portfolio to include vibration sensor solutions aimed at process and asset monitoring applications. This strategic development represents a major milestone in the company’s evolution and underscores its dedication to driving the digital transformation across industrial sectors.

- October 2024- Petasense, a leading provider of Industrial IoT solutions for predictive maintenance, announced the launch of the Vibration Mote Model 4 (VM4), the latest advancement in wireless condition monitoring sensors. The VM4 is designed to empower industries with the tools they need to predict and prevent costly machinery failures before they occur.

- November 2023- Worldsensing, a global leader in IoT remote monitoring, launched its newest wireless sensor, The Vibration Meter, which measures vibrations in long-term, continuous vibration monitoring projects. The new product uses a tri-axial MEMS accelerometer with longer battery life, wider communications range and more competitive price point than existing vibration-related technologies on the market, while complying with key regulatory standards.

- March 2023- POLYN Technology introduced VibroSense, a Tiny AI chip solution for vibration monitoring sensor nodes. VibroSense greatly reduces the amount of sensor data transmitted to the cloud, saving on power consumption and enabling energy-harvesting designs.

- July 2021- Fluke Reliability, a world leader in machine monitoring devices and cloud-based maintenance software, introduces the Fluke 3562 Screening Vibration Sensor system. With its revolutionary batteryless technology, long-range sensor-to-gateway communication, and ability to connect up to 1,000 sensors to a single gateway, the Fluke 3562 is a “set it and forget it” solution that can operate continuously, even in hard-to-reach places.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the vibration monitoring market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 6.70% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

| By Component |

|

| By System Type |

|

| By Application |

|

| By Industry |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.93 billion in 2024 and is projected to reach USD 3.43 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 6.70% during the forecast period.

Cost of unplanned downtime & asset criticality is speeding up the market growth.

ABB Ltd., Acoem Group, Emerson Electric Co., Baker Hughes Company, Brüel & Kjær, and Fluke Corporation are some of the top players in the market.

The Asia Pacific region held the largest market share.

Asia Pacific region was valued at USD 0.78 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us