Herbal Medicine Market Size, Share & Industry Analysis, By Form (Powder, Liquid & Gel, and Tablets & Capsules), By Application (Pharmaceutical & Nutraceutical, Food & Beverages, and Personal Care & Beauty Products), By Distribution Channel (Hospital Pharmacies, Retail, Pharmacies/Drug Stores, E-Pharmacies & Online Platforms, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

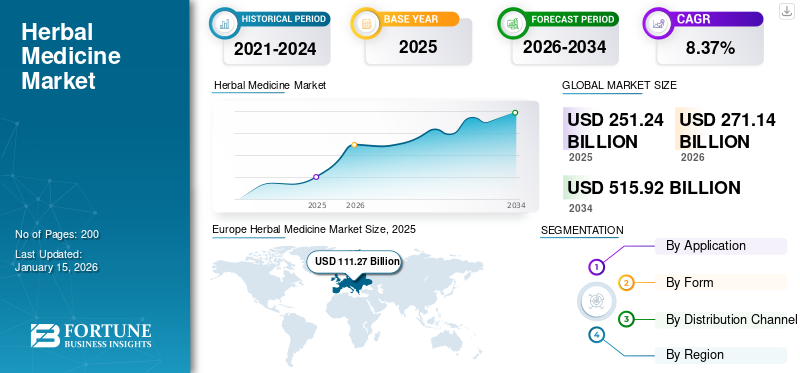

The global herbal medicine market size was valued at USD 251.24 billion in 2025 and is projected to grow from USD 271.14 billion in 2026 to USD 515.92 billion by 2034, exhibiting a CAGR of 8.37% during the forecast period. The Europe region dominated the global market with a share of 44.29% in 2025.

Herbal medicines, derived from plant-based ingredients such as roots, leaves, seeds, bark, and extracts, are increasingly integrated into pharmaceutical formulations, functional foods, dietary supplements, and personal care products. Market expansion is supported by rising consumer preference for natural therapeutics, the increasing burden of chronic diseases, expanding adoption of preventive healthcare, and growing acceptance of traditional medicine systems, such as Ayurveda, Traditional Chinese Medicine (TCM), Kampo, and Unani.

The market is further driven by regulatory recognition of herbal products in major economies, increasing clinical validation of herbal remedies, and expanding distribution through pharmacies, hospitals, and digital health platforms. Asia Pacific remains the core production and consumption hub, while North America and Europe demonstrate strong demand growth driven by nutraceuticals, immunity supplements, and botanical-based wellness products.

The global herbal medicines industry is dominated by major players, including Cultivator Natural Products Pvt. Ltd., ZeinPharma Germany GmbH, Herbalife Nutrition, Blackmores Limited, and others.

Herbal Medicine Market Trends

Heightened Consumption of Herbal Dietary Supplements to Promote Market Growth

The use of alternative antibiotic medicines, such as herbal medicine, has increased over the last decade. These products are gaining popularity among both patients and healthcare professionals. According to the WHO, almost 10-50% of the population in developed countries uses herbal medicine regularly in some form. The major reason for this is that they offer better immunity than synthetic drugs. In developing countries, such as China, Japan, India, Vietnam, South Africa, and Bangladesh, herbal medicines are sometimes the only affordable and available treatment option. Consumers primarily opt for these medicines to treat cough, cold, gastrointestinal disorders, and painful conditions, including joint pain, rheumatic diseases, and stiffness. This ongoing trend of consuming herbal supplements is expected to offer significant global herbal medicine market growth opportunities.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

High Demand for Natural Medicines from Developing Countries Offers Promising Opportunities for Market Growth

Herbal medicines are a vital part of medical treatment in many developing countries. These products are used for almost all minor ailments. In developing and lower-income countries, visits to trained doctors or pharmacists are usually rare and reserved for life-threatening disorders. In developing countries, herbs used for medicinal purposes are unprocessed herbs, plants, or plant parts, dried, and used whole or in cut form. Herbs are also used to make teas (sometimes as capsules or pills) to aid internal healing and as salves and poultices to treat external injuries. As most developing economies have minimal regulations regarding the use of herbs as medicines, the industry size may expand at a robust pace in the coming years.

- According to the World Health Organization (WHO), over 80% of the global population relies partly on traditional medicine, reinforcing sustained baseline demand across regions.

Market Restraints

Strict Guidelines Related to Use of Herbal Ingredients as Raw Material in Cosmetic Industry to Restrain Market Growth

The global herbal medicine and botanical ingredients market faces regulatory headwinds due to increasingly stringent guidelines governing the use of herbal raw materials in cosmetic formulations, particularly in developed economies. Regulatory authorities emphasize consumer safety, toxicological validation, traceability, and sustainability, which raises compliance costs and lengthens product approval timelines, thereby restraining market growth.

- As of 2023, the EU had restricted or prohibited over 1,600 cosmetic ingredients, including multiple plant-derived substances such as certain essential oils and botanicals containing coumarins, furocoumarins, or pyrrolizidine alkaloids, which are naturally occurring in herbs.

Market Opportunities

Increasing Demand for Herbal Ingredients in Cosmetic Industry to Unlock New Growth Opportunities

The cosmetics industry offers promising prospects for exporters of natural ingredients from developing countries looking to expand into developed nations. There is a rising demand for natural ingredients within the cosmetics sector, driven by consumers’ increased awareness of natural cosmetic products and the efforts of cosmetics companies to integrate natural herbal alternatives instead of synthetic ingredients. This rising demand for natural ingredients in toiletries and cosmetics is estimated to persist in the foreseeable future. Herbal medicine manufacturers are actively substituting synthetic chemicals with natural remedies to align with consumer preferences and the shift toward sustainable sourcing of raw materials. The strong demand for beauty products, personal care, and toiletries that do not contain harmful chemicals is expected to drive the global herbal medicine market growth over the forecast period.

SEGMENTATION ANALYSIS

By Application

Pharmaceutical & Nutraceutical Segment Held Major Market Share Owing to Increasing Demand for Herbal Raw Materials

By application, the market is divided into pharmaceutical & nutraceutical, food & beverages, and personal care & beauty products.

The pharmaceutical & nutraceutical segment held the largest herbal medicine market share. This is attributed to the high demand for herbal ingredients from dietary supplement manufacturers. Consumers are shifting their preference from synthetic or chemical-based medicines to herbal-based medicines, considering their impact on health in the long term. Herbal protein powders and anti-aging products are popular product categories in the dietary supplement and nutraceutical industry. This factor will boost the dominance of the pharmaceutical & nutraceutical segment in the global market during the forecast period.

The personal care & beauty products segment is expected to register the fastest growth, expanding at a CAGR of 9.16%, supported by rising demand for botanical cosmetics, herbal skincare, and clean-label beauty products. The segment accounted for 24.53% of the total market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

By Form

Tablets & Capsules Led Market Owing to Their Wide Availability in Pharmaceutical Industry

Based on form, the market is segmented into powder, liquid & gel, and tablets & capsules.

The powder segment led the global market and was valued at USD 118.6 billion in 2025, accounting for 47.2% of total global market demand. Dominance is driven by traditional consumption practices in Asia, ease of formulation, and widespread use in decoctions and herbal blends. The segment is projected to grow at a CAGR of 8.44% in the coming years.

The liquid & gel segment is expected to rise at a CAGR of 8.86%, supported by faster absorption rates, pediatric and geriatric suitability, and increasing use in syrups, tinctures, and topical formulations. The segment accounted for 35.11% of the total market share in 2026.

By Distribution Channel

Retail Pharmacies/Drug Stores to Retain Dominance Owing to OTC Availability and Consumer Familiarity

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies/drug stores, e-pharmacies & online platforms, and others.

The retail pharmacies/drug stores segment dominated the market, valued at USD 99.3 billion in 2025, representing 39.5% of global sales. Strong physician trust, OTC availability, and consumer familiarity support its leadership. The segment is projected to grow at a CAGR of 7.19% in the coming years.

The e-pharmacies & online platforms segment is witnessing the fastest expansion, driven by digital health adoption, home delivery, and cross-border herbal product sales, significantly outpacing traditional channels during the forecast period.

Herbal Medicine Market Regional Outlook

Regionally, the report covers the global market analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Herbal Medicine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe accounted for USD 111.27 billion in 2025, representing 44.29% of the global market value, and is projected to grow at a CAGR of 7.79%. Growth is supported by strong herbal supplement penetration, regulatory approvals for traditional herbal medicinal products (THMPs), and demand from an aging population. Europe boasts the world's largest cosmetics market, and it presents promising opportunities for newcomers from developing countries. The personal care and beauty product segment is witnessing a growing demand for natural ingredients, a trend expected to persist. Europe is expected to make a significant contribution to future market growth by meeting this demand.

Germany Herbal Medicine Market

Germany leads Europe, valued at USD 21.16 billion in 2026, driven by the adoption of phytopharmaceuticals and physician-prescribed herbal medicines.

U.K. Herbal Medicine Market

The U.K. market was valued at approximately USD 16.02 billion in 2026, driven by demand for retail supplements and the growing acceptance of botanical wellness products.

North America

North America was valued at USD 35.2 billion in 2025, accounting for 13.99% of the global market share, and is projected to register the fastest regional CAGR of 8.18% from 2026 to 2034.

U.S. Herbal Medicine Market

The U.S. accounted for 63.15% of regional demand, valued at approximately USD 23.91 billion in 2026, supported by dietary supplement consumption and integrative medicine practices.

Asia Pacific

Asia Pacific is expected to grow significantly in the global market, valued at USD 84.4 billion in 2025, accounting for 33.6% of the global market share. The region is projected to grow at a CAGR of 9.36% (2026–2034), driven by strong cultural integration of traditional medicine systems, a large population base, and extensive raw material availability. The Japan market is projected to reach USD 25 billion by 2026.

China Herbal Medicine Market

China represented the largest market globally, valued at approximately USD 19.5 billion in 2025, supported by institutionalized TCM usage, government backing, and hospital integrations. The China market is projected to reach USD 21.16 billion by 2026

India Herbal Medicine Market

India’s market was valued at approximately USD 7.55 billion in 2026, driven by Ayurveda, rising nutraceutical exports, and increasing demand for preventive healthcare.

South America and Middle East & Africa

The South America and Middle East & Africa regions are expected to witness moderate growth in this market space during the forecast period. South America represented USD 12.5 billion in 2025, accounting for 5.0% of the global market share, and is projected to grow at a CAGR of 7.92%, driven by traditional plant-based remedies and increasing awareness of herbal supplements. The Middle East & Africa market was valued at USD 7.9 billion in 2025, accounting for 3.1% of global demand, and is projected to grow at a CAGR of 5.28%. The increasing use of traditional medicine drives growth, as does the rising prevalence of chronic diseases and the expansion of retail healthcare infrastructure.

UAE Herbal Medicine Market

The UAE market was valued at approximately USD 1.1 billion in 2025, driven by premium wellness imports, expatriate demand, and regulated sales of herbal supplements.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Adopting Innovative Product Packaging Designs to Attract New Consumers and Increase Product Sales

The major companies operating in the market are Cultivator Natural Products Pvt. Ltd., ZeinPharma Germany GmbH, Herbalife Nutrition, Blackmores Limited, and others. The companies are working on expanding their presence in untapped markets by collaborating with local distributors in a particular region. Some companies are also focusing on launching new products to attract more customers from a particular region or country.

Key Players in the Herbal Medicine Market

|

Rank |

Company Name |

|

1 |

Cultivator Natural Products Pvt. Ltd. |

|

2 |

ZeinPharma Germany GmbH |

|

3 |

Herbalife Nutrition |

|

4 |

Blackmores Limited |

|

5 |

Patanjali Ayurved Limited |

List of Key Herbal Medicine Companies Profiled

- Cultivator Natural Products Pvt. Ltd. (India)

- 21ST Century HealthCare, Inc. (U.S.)

- Herbalife Nutrition (U.S.)

- ZeinPharma Germany GmbH (Germany)

- Blackmores Limited (Australia)

- Himalaya Global Holdings Ltd. (India)

- Nutraceutical Corporation (U.S.)

- Emami Limited (India)

- Nature's Answer, LLC. (U.S.)

- Patanjali Ayurved Limited (India)

KEY INDUSTRY DEVELOPMENTS

- November 2025: SS Herbal India scaled up its Ayurvedic treatment and herbal wellness business across India, positioning itself as a digitally driven, non‑surgical alternative solutions brand in the Ayurvedic healthcare space. The brand expanded its national footprint through pan‑India direct‑to‑consumer reach, using e‑commerce platforms and digital channels to ship products and offer consultation‑linked treatments across multiple states.

- August 2025: Greenspace Herbs launched “Quantum Ayurveda,” a physics‑driven technology platform that aims to make Ayurvedic botanicals more consistent, more bioavailable, and easier to target specific organs and health outcomes.

- June 2024: BLC (Bangkok Lab and Cosmetics Public Company Limited) utilized CPHI South East Asia 2024 as a platform to showcase new Thai herbal innovations and launch a portfolio of generics targeting aging and NCD patients, while signaling a scale-up of its manufacturing and CDMO ambitions.

- June 2023: Traditional Medicinals, one of the leading botanical wellness companies operating in North America, launched its newest product in Canada, Organic Lemon Ginger tea. The newly launched refreshing blend is a combination of organic herbal ingredients, including lemon peel, ginger, hibiscus, and lemongrass. The herbal tea offers a zesty, sweet, and slightly spicy taste, and can be consumed either hot or cold.

- January 2023: Handard, an Indian traditional medicine manufacturer, diversified its product offerings. The new offerings include face washes, shampoos, and oral hygiene products.

REPORT COVERAGE

The global herbal medicine market industry report analyzes the market in depth and highlights crucial aspects such as global market trends, supply chain, market dynamics, prominent companies, investment in research and development, and end-use. Besides this, the report also provides insights into the global market analysis and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Form · Powder · Liquid & Gel · Tablets & Capsules |

|

|

By Distribution Channel · Hospital Pharmacies · Retail Pharmacies/Drug Stores · E-Pharmacies & Online Platforms · Others |

|

|

By Region · North America (By Application, Form, Distribution Channel, and Country) • U.S. (By Application) • Canada (By Application) • Mexico (By Application) · Europe (By Application, Form, Distribution Channel, and Country) • Germany (By Application) • Spain (By Application) • Italy (By Application) • France (By Application) • U.K. (By Application) • Rest of Europe (By Application) · Asia Pacific (By Application, Form, Distribution Channel, and Country) • China (By Application) • Japan (By Application) • India (By Application) • South Korea (By Application) • Australia (By Application) • Rest of Asia Pacific (By Application) · South America (By Application, Form, Distribution Channel, and Country) • Brazil (By Application) • Argentina (By Application) • Rest of South America (By Application) · Middle East & Africa (By Application, Form, Distribution Channel, and Country) • South Africa (By Application) • UAE (By Application) • Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 251.24 billion in 2025 and is anticipated to reach USD 515.92 billion by 2034.

At a CAGR of 8.37%, the global market will exhibit steady growth over the forecast period.

By form, the powder segment led the market.

Europe held the largest market share in 2025.

High demand for natural medicines from developing countries drives the market growth.

Cultivator Natural Products Pvt. Ltd., ZeinPharma Germany GmbH, Herbalife Nutrition, Blackmores Limited, and others are the leading companies in the market.

Heightened consumption of herbal dietary supplements is shaping the industry.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us