Wetgas Meters Market Size, Share & Industry Analysis, By Type (Stainless Steel Wetgas Meter and Brass Wetgas Meter), By End-User Industry (Oil & Gas, City Gas Distribution, Chemical, and Others), and Regional Forecast, 2026-2034

WETGAS METERS MARKET SIZE AND FUTURE OUTLOOK

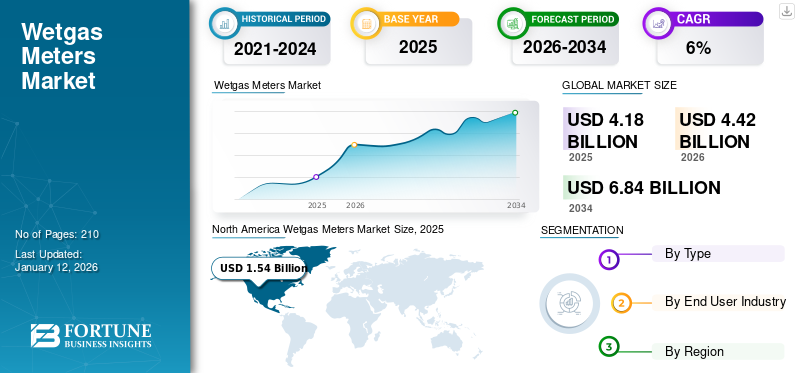

The global wetgas meters market size was valued at USD 4.18 billion in 2025 and is projected to be worth USD 4.42 billion in 2026 and reach USD 6.84 billion by 2032, exhibiting a CAGR of 5.63% during the forecast period. North America dominated the wetgas meters industry with a market share of 36.86% in 2025

The metering of wet gas is becoming an increasingly significant challenge for the oil and gas industry. The Venturi meter is commonly chosen to measure the unprocessed wet natural gas production flow. Wetgas meters are designed to measure the flow rates of gas and liquid phases in a mixed stream. They are crucial in the oil and gas industry for monitoring production, optimizing processes, and ensuring accurate fiscal measurements.

Traditional flow meters often struggle with accuracy in wet gas conditions due to the presence of liquids, making wetgas meters indispensable in such environments. In this context, wet gas refers to a two-phase flow where the liquid phase can comprise up to 50% of the total mass. When using a venturi meter to measure the gas flow rate in a wet gas environment, it is necessary to adjust the meter reading to measure the impact of the liquids.

MARKET DYNAMICS

Market Drivers

Growing Development of High-output Gas Fields to Boost Market Growth

Measuring the flow of wet gas is becoming increasingly significant within the oil and gas sector. Numerous high-output gas fields are being developed, while others are near the end of their productive lifespan. Gas fields that are in their final stages and marginal fields share a common characteristic of producing wet gas, meaning the natural gas pipeline also transports a relatively small volume of free liquid. Furthermore, favorable government policies promoting natural gas as a cleaner energy source have driven investments in gas infrastructure, boosting the demand for wetgas meters.

- Norwegian state-owned energy company Equinor, along with its partners, recently discovered oil and gas in the North Sea, utilizing Odfjell Drilling’s sixth-generation Deepsea Stavanger rig for the drilling process. The application of a wetgas meter to analyze the discovered natural gas presents a significant opportunity. Initial estimations indicate that the discovery could contain 0.1 to 1.2 million standard cubic meters (Sm3) of recoverable oil equivalent in the intra-Draupne Formation and from 0.4 to 1.3 Sm3 of recoverable oil equivalent in the Hugin Formation.

Technological Developments to Support Market Progress

Modern digital technologies and smart metering innovations have played a significant role in the expansion of the market. Contemporary wetgas meters come with cutting-edge sensors, communication technologies, and data analytics features that improve their precision and enable real-time observation and reporting. The increasing focus on energy efficiency, adherence to environmental regulations, and the use of data-informed decision-making across multiple sectors continues to propel the need for advanced wetgas meters.

Market Restraints

Higher Installation Costs and Technical Challenges in Measurement Accuracy May Hinder Market Growth

Concerns such as elevated installation and upkeep expenses, the necessity for calibration, and the intricacy of managing different types of wet gases can influence market trends. Nonetheless, the wetgas meters market is projected to maintain its growth as sectors progressively embrace advanced measurement technologies. The deployment of advanced wetgas meters involves substantial initial investment, which can be a barrier for small and medium-sized enterprises. Accurately measuring wet gas flow is technically challenging due to the varying compositions and flow regimes of gas-liquid mixtures. Developing meters that can handle these complexities without compromising accuracy remains a significant challenge, which creates a hurdle for the wetgas meters market growth.

Market Opportunities

Rising Movements in Subsea Are Creating New Opportunities for Market Players

Operators aiming to develop a subsea wet gas field encounter various challenges as the complexities of development and operational conditions escalate. To adapt to shifting operating conditions and diverse fluid compositions, they require real-time, precise data on water, gas, and condensate, as this data greatly influences flow assurance and hydrocarbon allocation strategies. Advanced meters provide unmatched water sensitivity, precision, and rapid response, ensuring dependable production measurement. These meters include the industry's first integrated salinity-measurement system, offering crucial information essential for safeguarding subsea well and pipeline integrity while supporting metering and allocation strategies in gas and gas condensate fields.

Market Challenges

Cost-Effective and Accurate Device Making With Online Device Measuring System Could Deter Market Growth

The development of accurate and cost-efficient online devices for measuring flow rates of wet gas and liquids has gained significant interest in the research community. In commercial applications, the prevalent type of wet gas meter is the ‘hybrid type wet gas meter, which integrates two or more single-phase meters arranged in series. Most of these wetgas meters incorporate differential pressure meters (such as Venturi, cone meters, and orifice meters) along with various other flow measurement devices and sensors, including velocity flowmeters, volumetric flowmeters, mass flowmeters, γ-ray sensors, microwave sensors, infrared sensors. While these current measurement tools can accurately predict wet gas behavior, they are often hindered by inherent drawbacks such as intricate designs and considerable size.

WETGAS METER MARKET TRENDS

Advancements in Measurement Technologies Is a Key Market Trend

By creating solutions that enhance energy management, lower emissions, and ensure adherence to environmental regulations, businesses can align with industry developments and fulfill the changing needs of their clients. Measuring wet gas flow is significantly more complex than measuring single-phase flow. Continuous research and development efforts are leading to the introduction of more accurate and reliable wetgas meters. Innovations include the integration of digital connectivity and advanced sensor technologies, enhancing measurement precision and operational efficiency. Additionally, integrating wetgas meters with Industrial Internet of Things (IioT) solutions enable real-time monitoring and data analysis, improving decision-making processes and operational efficiency.

Fortunately, the technical difficulties associated with net zero wet gas flow metering can be addressed using existing technologies. The hydrocarbon production sector has been developing various techniques for wet gas metering for a long time, and these methods can be applied to emerging net-zero industries. Ongoing research is crucial for addressing the technical challenges associated with wet gas measurement. Recent studies have focused on improving the accuracy and reliability of wetgas meters under varying flow conditions. For instance, a comprehensive review of recent developments in wet gas flow metering highlights advancements in measurement methods and technologies.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The reduced global energy demand due to the COVID-19 pandemic negatively impacted the market. Wetgas meters are majorly used in the oil & gas industry, and the industry witnessed a decline in oil and gas demand, resulting in less spending, consequently resulting in less demand for wetgas meters.

SEGMENTATION ANALYSIS

By Type

Stainless Steel Wetgas meters Segment to Dominate due to Rise in Demand for Wetgas meters Accurate Wet Gas Flow Measurement

According to type, the market is categorized into stainless steel wetgas meter and brass wetgas meter. The stainless-steel wetgas meter segment is expected to lead throughout the forecast period. These meters are used to measure the flow rate of wet gases, such as natural gas, that contain liquid droplets. Typically, they feature a steel body and a measuring chamber filled with liquid, often glycerin, to minimize friction and stabilize the measurement. As gas flows through the meter, it generates a pressure drop that correlates with the flow rate, which is then recorded and measured. This segment is set to attain 67.21% of the market share in 2026.

- In November 2024, Turbines, Inc. launched the Integrated Turbine Meter (ITM) series, designed to offer measurement solutions for agriculture, water, oil, and chemical applications. The ITM combines precision, dependability, and affordability. Made from stainless steel, the ITM provides +/-1% linearity, can withstand operating pressures of up to 5,000 psi, and accommodates flow rates ranging from 3 gpm to 50 gpm, delivering a comprehensive measurement solution.

Brass wetgas meters are recognized for their corrosion resistance and long-lasting performance in different environmental conditions, which makes them suitable for residential and light industrial uses where affordability and strength are essential. These meters are typically preferred in regions with milder gas compositions and lower pressure needs. This segment is likely to grow with a CAGR of 5.36% during the forecast period (2025-2032).

By End-User Industry

To know how our report can help streamline your business, Speak to Analyst

Oil & gas Segment Captures the Key Market Share due to Expansion in the Oil & Gas Sector

Based on end-user industry, the market is divided into oil & gas, city gas distribution, chemical, and others. Oil & gas dominates the market due to exploration and extraction activities in subsea and the rising global demand for oil and gas. Furthermore, the wet gas flow technology has developed and is now employed in fiscal production allocation and financial transactions between host governments and operating companies. Additionally, the growing investment in the exploration of unconventional oil and gas resources, along with offshore exploration efforts, will boost the need for wet gas flow meters to achieve optimal performance. The segment dominated the market with a share of 84.39% in 2025.

Chemical industry is also one of the leading industries after oil & gas. Wetgas meters are used in many chemical applications, including biogas recovery, chemical reactions, and others. Wet gas is used in chemical processes such as Wet Gas Sulfuric Acid (WSA) process, Wet gas sulfuric acid recovery plants, and others. These numerous applications of wet gas consequently spur the adoption of wetgas meters.

WETGAS METERS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Wetgas Meters Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Technological Advancement in the Region to Boost Market Growth

North America held a significant wetgas meters market share valued at USD 1.54 billion in 2025 and USD 1.64 billion in 2026, driven by extensive oil and gas exploration activities and the adoption of advanced measurement technologies. This is primarily attributed to the rising energy demand and the growing use of gas-powered vehicles within the region. Furthermore, the trend of replacing liquid-fueled vehicles with gas-powered alternatives, along with stringent government regulations on carbon emissions, is anticipated to fuel market growth during the forecast period. Market growth will also be bolstered by increasing offshore oil and gas drilling activities, heightened investment levels, enhanced research and development efforts, and a surge in digitization. Additionally, the presence of numerous major companies in the region and the expanded exploration of shale gas present attractive investment opportunities across the continent. For example, according to the World Energy Council, the U.S. is particularly influential in this growth, with the country possessing 1161 trillion cubic feet of recoverable unconventional gas, the largest globally. Moreover, technological innovations such as the integration of IoT, AI, and the necessity for horizontal drilling to achieve optimized output are driving momentum in the wetgas meters market.

U.S.

Swift Expansion of the Natural Gas Sector is set to Increase Need for Wetgas meters

The U.S. proved reserves of natural gas have risen almost every year since the year 2000. Significant advancements in natural gas exploration and production technologies, such as horizontal drilling and hydraulic fracturing in shale, sandstone, carbonate, and other tight geological formations, have led to growth in both natural gas production and reserves. The U.S. market is expected to gain USD 1.37 billion in 2026.

As reported in U.S. Crude Oil and Natural Gas Proved Reserves, by December 31, 2022, the total proved reserves of natural gas in the U.S. as wet gas amounted to approximately 691 trillion cubic feet (Tcf). Wet gas represents the amount of natural gas left after lease condensate has been removed at lease and field separation sites, excluding non-hydrocarbon gases when present in sufficient quantities to make the gas unmarketable. The wet gas volume for 2022 represented a 10.5% increase compared to the estimated 625 Tcf of proved reserves at the end of 2021. The portion of these reserves that was dry natural gas was around 653 Tcf, marking a 10.8% rise from the 589 Tcf recorded in 2021.

Europe

Established Chemical and Oil & Gas Industry in Europe Drives Demand for Wetgas Meters

Europe is the second largest market expected to hit USD 0.98 billion in 2025, exhibiting a CAGR of 5.57% during the forecast period (2025-2032). One of the largest oil & gas producers in Europe and the world is Russia, which consequently makes Europe one of the lucrative markets for wetgas meters. The U.K. market is expanding, estimated to be worth USD 0.103 billion in 2026. In addition, according to The European Chemical Industry Council, chemical sales in Europe is around USD 700 to 800 billion in 2022. In Europe, Germany and France are the largest producers of the chemicals. Norway is set to reach a value of USD 0.14 billion in 2025, while Russia is poised to be valued at USD 0.55 billion in the same year.

Asia Pacific

Rapid Industrialization and Energy Demand to Boost Product Demand

Asia Pacific is the third largest market anticipated to grow with a value of USD 0.84 billion in 2026. The Asia Pacific market is marked by a variety of meter types tailored for different industrial and commercial uses. Ultrasonic meters are gaining traction due to their non-invasive measurement capabilities and ability to provide accurate readings across a broad spectrum of flow conditions. Each category of wet gas meter offers distinct advantages that influence its use across the varied industrial landscape of the region. China is projected to reach USD 0.33 billion in 2026. The selection of meter types in this market is determined by factors such as the characteristics of the gas being measured, the level of accuracy needed, and the specific application setting. With the increasing need for dependable and precise wet gas measurement options, ongoing technological innovations are spurring the advancement and uptake of these meter types to address the region’s evolving needs. Rapid industrialization and growing energy needs are propelling the demand for wetgas meters in China and India. Southeast Asia is poised to gain USD 0.20 billion in 2025, while Australia is expected to hit USD 0.17 billion in the same year.

Latin America

Accelerating Government Support for Exploration of Oil & Gas Drives Product Demand

Latin America is projected to experience gradual growth throughout the forecast period. The market’s growth is linked to the rising need for precise measurement of gas flow across several industries, including oil and gas, chemicals, and power generation. Additionally, government regulations on gas flow measurement are also contributing to the market's expansion.

- In September 2024, TotalEnergies announced that production had commenced at the Fenix gas field, situated 60 kilometers off the coast of Tierra del Fuego in Southern Argentina. The Fenix field is part of the Cuenca Marina Austral 1 (CMA-1) concession, where TotalEnergies holds a 37.5% operating stake, along with partners Harbour Energy (37.5%) and Pan American Energy (25%). With the capacity to produce 10 million cubic meters of gas per day (70,000 boe/d), the Fenix development features a new unmanned platform placed in 70 meters of water depth. This platform is linked to the current CMA-1 infrastructure, with the installation of a wetgas meter. Gas extracted from the Fenix field is transported via a 35-kilometer subsea pipeline to the Véga Pléyade platform operated by TotalEnergies.

Middle East & Africa

Advanced Use of Wetgas Meters in Oil & Gas Field is Driving the Market Growth

The Middle East & Africa is the fourth leading region poised to grow with a value of USD 0.8 billion in 2026. Extensive research is currently being conducted in the area of wet gas flow metering to enhance the accuracy, precision, reliability, and level of confidence within the subsea sector in the region. While currently available wet gas flowmeters offer an acceptable degree of accuracy, they are limited to specific operational ranges. Modern wetgas metering systems are integrated with advanced sensors and data processing capabilities that facilitate real-time monitoring and accurate measurement in difficult conditions. This capability is vital in deep-sea exploration and remote sites in the Middle East & Africa, where traditional measurement techniques may not be practical or reliable.

Strict environmental regulations and the increasing emphasis on sustainable practices in the oil and gas sector have accelerated the use of wetgas meters. These devices assist operators in reducing emissions and enhancing production processes by delivering precise data regarding gas and liquid hydrocarbon flow rates. Iran is likely to gain USD 0.32 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Industrial Participants Ability to Cater Numerous Industries is Reinforcing Their Position in Market

The global market is mostly fragmented, with key players operating across the industry, including Tek Tol, AMETEK, Emerson, Kronhe, and others. Emerson is a global technology and software company that offers innovative solutions for customers across various end markets globally, including chemical, power & renewables and energy, life sciences, metals & mining, food & beverage, pulp & paper, automotive, medical, packaging and semiconductor, and more. The company also offers a range of servo motors used in industrial robots, machine tools, textile/packing machinery, and other dynamic motion control applications.

AMETEK is a global front-runner in designing and producing sophisticated analytical, testing, and measurement instruments for various sectors, including energy, aerospace, power, research, medical, and industrial markets.

Some of the Key Companies Profiled in the Report:

- Tek Tol (U.S.)

- AMETEK (U.S.)

- DP Diagnostics (U.S.)

- EMCO Controls (Denmark)

- Emerson (U.S.)

- Expro (U.S.)

- Force Technology (Denmark)

- Krohne (Germany)

- Shinagawa Co. Ltd. (Japan)

- Rosen-nxt (Switzerland)

- MaxiFlo (U.K.)

- SLB (U.S.)

- CX Instrument (Austria)

- Shanghai Cixi Instrument Co. Ltd (China)

- Fluid Components LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

May 2024: OneSubsea, a joint venture supported by SLB, Aker Solutions, and Subsea7, secured a contract for a Troll Phase 3 project designed to enhance gas infrastructure at a major oil and natural gas field located in the northern North Sea, operated by the Norwegian state-owned energy company, Equinor.

May 2023: SLB launched the Vx Spectra™ surface Multiphase Flowmeter (MPFM), utilizing robust Vx™ multiphase well-testing technology. The Vx Spectra flowmeter provides continuous, precise, and reliable measurements across diverse production settings, including high-rate oil and wet gas wells.

September 2020: Krohne launched Bluetooth Low Energy (BLE) functionality for all Optimass x400 Coriolis flowmeters that come with the MFC 400 converter. When paired with the Opticheck Flow Mobile app (accessible on both iOS and Android), this enables commissioning, validation, diagnostics, and monitoring of the device through a smartphone or tablet using secure wireless communication. Optimass flowmeters equipped with BLE are currently the only SIL-certified mass flowmeters available that support Bluetooth communication.

October 2019: Emerson Automation Solutions launched the Roxar MPFM 2600 M multiphase flow meter. The Roxar MPFM 2600 M serves as a versatile and cost-effective solution for wellhead measurement applications, addressing the requirements of demanding tasks while providing an option for tighter budgets.

March 2019: With the introduction of its advanced ST80 Series Thermal Mass Flow Meter, featuring revolutionary Adaptive Sensor Technology (AST), Fluid Components International (FCI) raised the standard for air and gas flow measurement in the process industry. FCI’s pioneering AST thermal mass flow technology for the ST80 Flow Meters includes a novel hybrid sensor drive system.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Norway's total investment in oil and gas activities was projected to reach USD 23.91 billion as of August 15, 2024, reflecting a 4.1 percent increase from the previous quarter, according to the Norway Government Agency. This growth in investment shows the rising interest of investors in the wet gas meters market expansion. This total investment includes funding for pipeline transport, as stated by the agency. In 2023, Norway reserves amounted to 44.2 trillion standard cubic meters of fossil fuels, with Iran and Qatar holding reserves exceeding 30 and 20 trillion cubic meters, respectively. Significant discoveries have been made since 1960, when reserves were much lower. The U.S. ranks as the leading producer of natural gas globally, though its proven reserves are about one-third of Russia’s. In 2023, the U.S. produced nearly one trillion cubic meters of natural gas, whereas Russia's output was around 580 billion cubic meters.

In India, foreign direct investment in the petroleum and natural gas sector was around USD 800 million in the financial year 2020. The natural gas output from public sector companies in India for fiscal year 2020 reached approximately 31 billion cubic meters.

REPORT COVERAGE

The global wetgas meters market research report delivers a detailed insight into the market sizing. It focuses on key aspects such as leading companies and their operations in drilling and producing wetgas meters. Besides, the report offers insights into the market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.63% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-User Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size stood at USD 4.18 billion in 2025.

The market is likely to grow at a CAGR of 5.63% over the forecast period (2026-2034).

The oil & gas segment leads the market.

The market size of North America stood at USD 1.54 billion in 2025.

Growing requirements for dependable measurement of wet gas across different applications are key factors boosting market growth.

Some of the top players in the market are Tek Tol, AMETEK, Emerson, Kronhe, and others.

The global market size is expected to reach USD 6.84 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us